1099 & W-2 Filing Guide for Trucking Companies

Order the right 1099 & W2 forms, choose the right filing method, and get everything done on time.

Learn about 1099 & W2 requirements for 2023 and your options for filing with the IRS or SSA, printing recipient forms and how to make sure everything is correct and compliant!

NEW! Major e-Filing requirement changes in 2023. You must efile if you have 10+ W2 and 1099 forms, combined, per EIN. Learn more below.

1099 Form Due Dates for 2023.

1099NEC forms must be mailed to recipients and e-filed or mailed to the IRS on or before January 31, 2024.

For other 1099s, file by February 28, 2023, if you file on paper, or by March 31, 2024, if you file electronically.

The due dates for furnishing payee statements remain the same.

New E-Filing Requirements

For the 2023 tax year, businesses with 10+ W2 and 1099 forms, combined, per EIN, are required to electronically file Copy A forms with the IRS or SSA. Learn More >

DiscountEfile.com helps you get it all done, easily!

E-Filing Requirement Changes

The new e-file threshold for the 2023 tax year is only ten (10) W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

Dateless 1099 Forms

Many 1099 Forms Now Require You to Fill in the Year

The dateless format introduced in 2022 requires you to fill in the year on each form. A software update is required. The new dateless 1099 forms are:

- 1098

- 1099A

- 1099C

- 1099CAP

- 1099DIV

- 1099G

- 1099INT

- 1099K

- 1099LTC

- 10999MISC

- 1099NEC

- 1099OID

- 1099Q

- 1099S

- 1099SA

These forms have minor formatting changes to accommodate the new format.

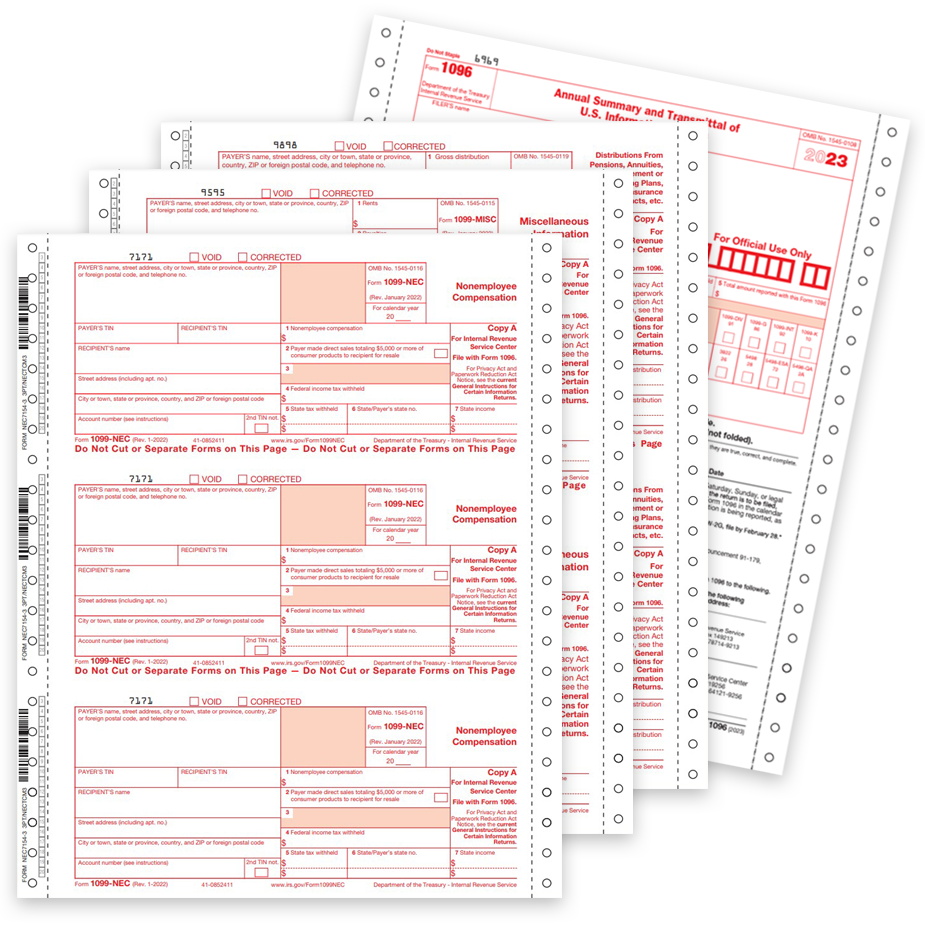

1099-NEC Form Changes

1099-NEC are used when business taxpayers to report payments of nonemployee compensation.

You must must complete this form to report any payment of $600 or more to a payee such as a contractor, freelancer, attorney and others.

1099-NEC forms are dateless

Starting last year, you must fill in the year on each 1099NEC form. If you use software to print forms, you need to update your system to accommodate this important change.

Other 1099-NEC Form Changes for 2023

There were no changes to the 1099NEC form for 2023.

Generally, this form is due by January 31st - to be mailed to the recipient and mailed or e-filed with the IRS.

There is no automatic extension for this form but may be available under certain hardships.

Nonemployee compensation may be subject to backup withholding if a payee has not provided a taxpayer identification number to the payer or the IRS notifies the payer that the TIN provided was incorrect.

More information about this form can be found here: Form 1099-NEC, Nonemployee Compensation

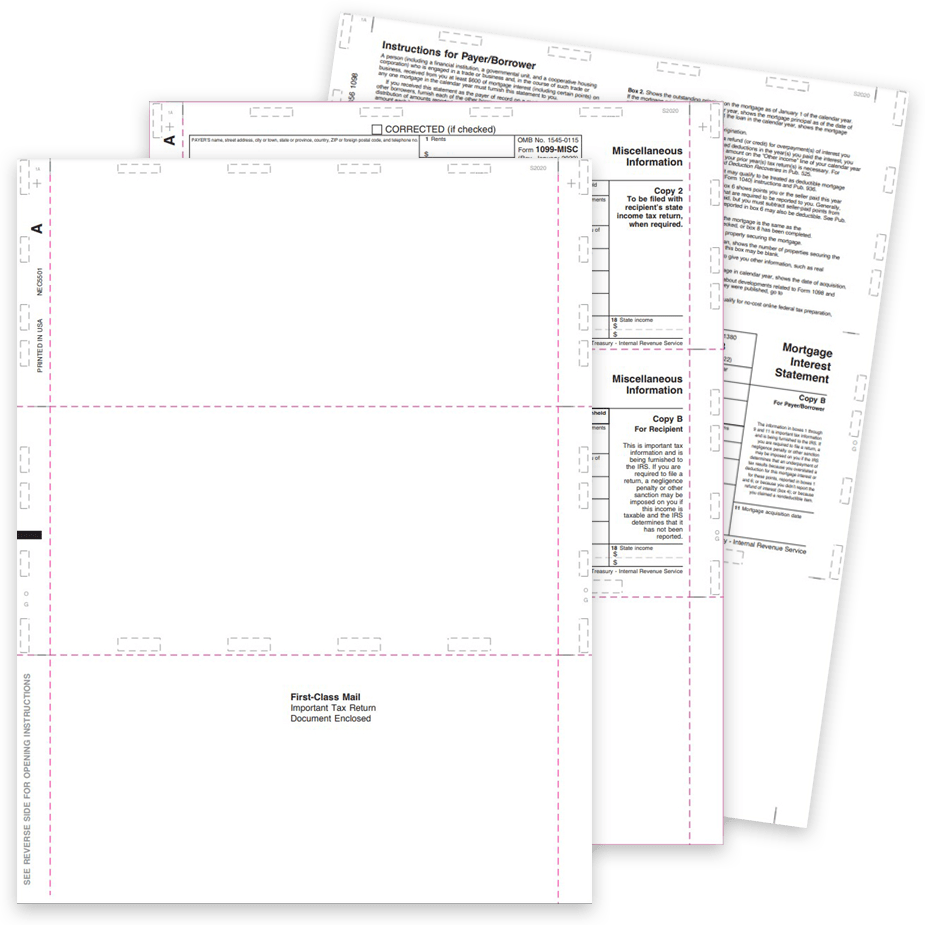

1099-MISC Form Changes

Changes to 1099-MISC Forms

There are no changes to 1099MISC forms for 2023.

1099 Rules that can make or break you

Due Date for W2 Copy A

January 31, 2024 is the deadline for W-2 Forms for tax year 2023.

This includes: W-2, W-2AS, W-2CM, W-2GU, W-2VI, W-3 and W-3SS with the SSA. The due date is now January 31 whether you file using paper forms or electronically.

You no longer get more time to e-file or print and mail copies to the SSA.

New E-Filing Requirements

The IRS is considering changing the e-filing threshold to 100+ total 1099 & W2 forms per payer. They will make this decision by November. Stay tuned to Discount Tax Forms for details...

DiscountEfile.com helps you get it all done, easily!

W2 Efiling Requirement Changes

The new e-file threshold for the 2023 tax year is only ten (10) W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

Good News!

There were no major changes to W2 forms for 2023.

Deadlines for 2023 1099 & W-2 Filing

January 31, 2024

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *NEW E-FILE RULES FOR 2023 << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

February 28, 2024 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2024 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

Let Us Do the Work for You This Year!

Instantly print, mail and e-file your 1099 and W-2 forms.

Simply enter your data, or import it from QuickBooks®, then click a few buttons and you're done.

We print and mail recipient copies, plus e-file with the government, for around $4 per form.

Easy 1099 & W-2 Starts with Your Software System

Your accounting software is the first step to filing 1099 & W-2 Forms the easiest way.

You have 3 main options.

Your Accounting Software

If your accounting software prints 1099 & W-2 Forms, you can purchase compatible forms and envelopes.

The program will summarize all of the wage data for the year, then print recipient and government copies.

Important: Forms must the layout used in your software.

Specialized 1099 & W-2 Software

If your accounting software does NOT print the forms, specialized 1099 & W-2 software is ready to help!

Import wage data, or manually enter it into the system. Then, print the 1099 or W-2 forms you need. E-filing is also typically available.

Be sure that forms are compatible with the layouts programmed into the software.

Online 1099 & W-2 Filing

The easiest way to file less than 50 forms is online! Discount E-file takes care of printing and mailing recipient copies for you, plus e-files with government agencies.

You simply import or type in data and we do the rest!

E-Filing is required for 100+ forms, but you can e-file as few as one!

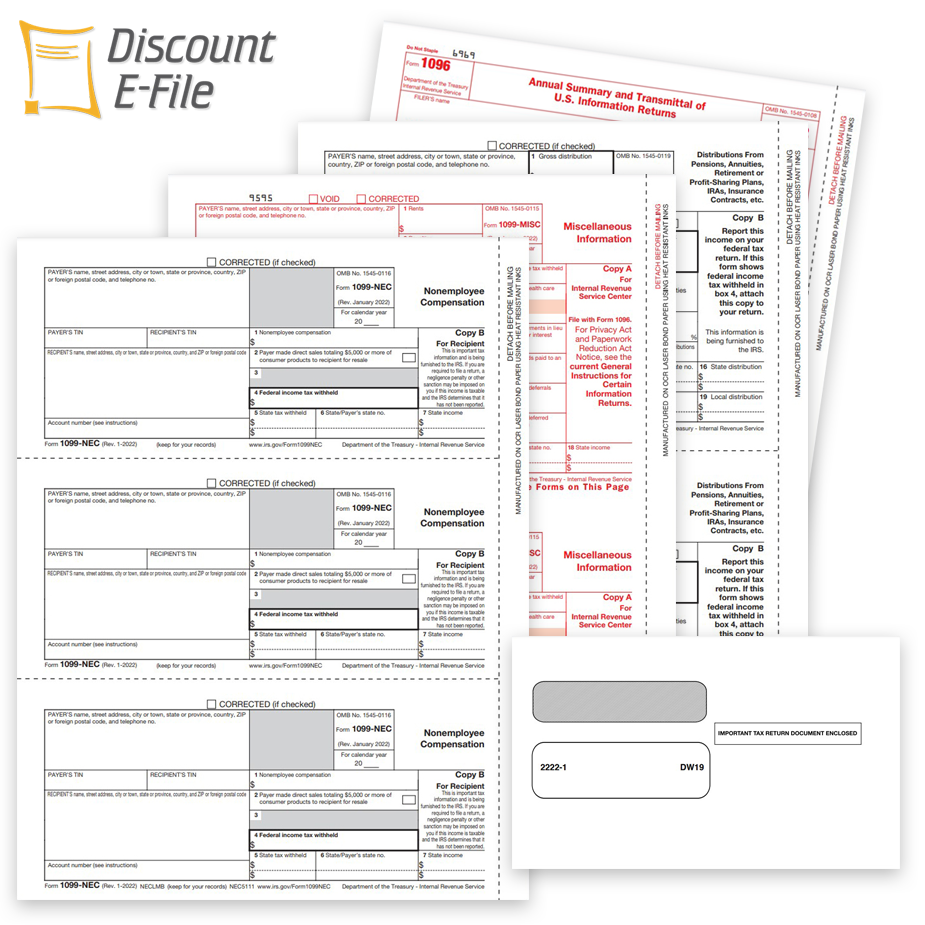

1099 - Choosing the Right Forms

Select the right type of 1099, in the right format, for easy printing and mailing.

1] Which 1099 Form to Use

1099-NEC forms have replaced 1099-MISC

You must file a 1099NEC if you've paid $600+ to an individual who is not an employee during the tax year.

There are many other types of 1099 forms used for other purposes. Here is a list.

2] Number of 1099 Parts

The number of parts you need is based on which government agencies you need to file with - Federal, State, and/or City.

Typical 1099 Parts:

- Copy A: Federal Government (Red Copy)

- Copy B: Recipient Copy

- Copy C/2: Payer or State Copy

3-Part States

AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WY

4-Part States

AL, AR, AZ, CA, CO, CT, DE, DC, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MS, MT, NE, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, UT, VT, VA, WV, WI

5-Part States

AL, AZ, CO, CT, DE, HI, ID, ME, MA, MN, MS, MT, NE, NC, ND, OH, OK, PA, SC, UT, WI

Decoding 1099-MISC Requirements

Get the details on your options and regulations on our blog post "Decoding 1099-MISC Requirements"

3] Type of Paper

Preprinted 1099 Forms are for software that only prints the data. Boxes are preprinted on the form and recipient instructions are preprinted on the back.

Blank 1099 form paper is for software that prints form boxes and data. Recipient instructions can be printed on the back. If they aren't, you must supply them per IRS regulations.

Continuous, pin-fed 1099 forms can be used with typewriters or dot-matrix printers.

Pressure Seal 1099 Forms

Ideal for printing a large volume of 1099 forms with pressure seal systems.

Don't Forget 1099 Envelopes

Use compatible envelopes to ensure the recipient and return addresses show through the windows correctly.

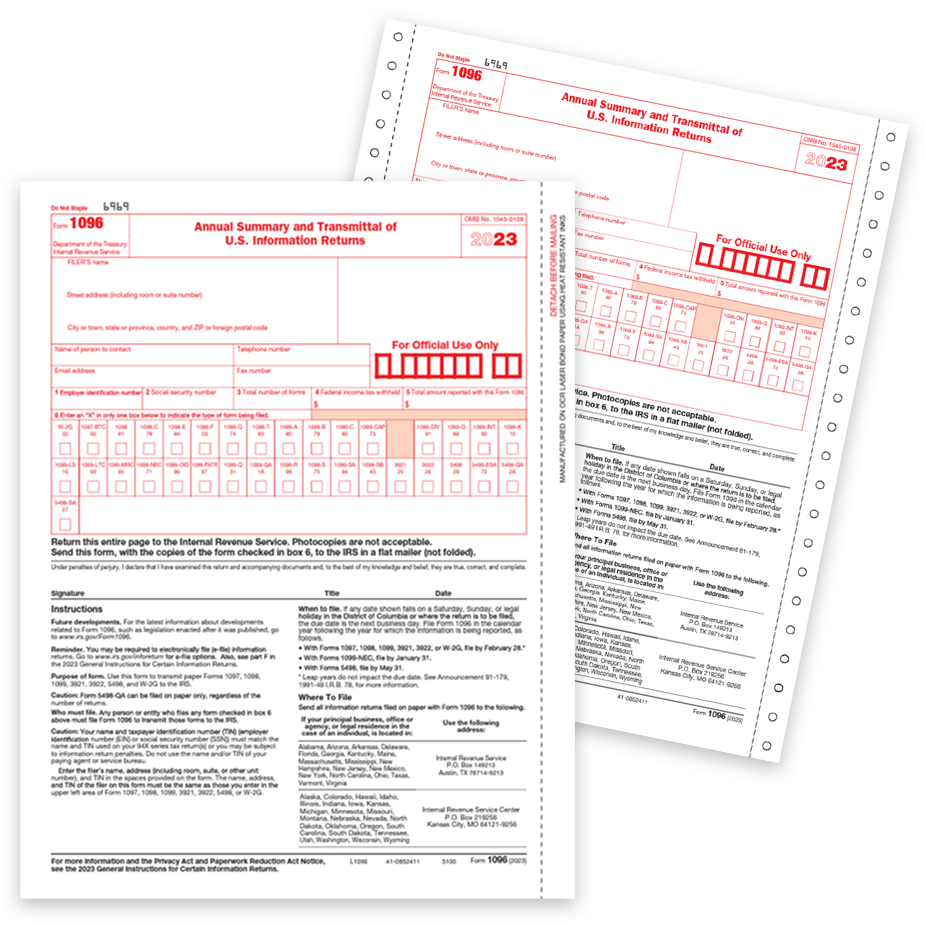

1096 Transmittal Forms

When mailing 1099 Copy A forms to the IRS, include one 1096 form for each payer. This form summarizes all of the 1099-MISC submitted by the payer.

Use QuickBooks?

Check out our blog post "How to Print 1099-MISC with QuickBooks"

Instantly Print, Mail & E-file Online

Let us do the work for you this year!

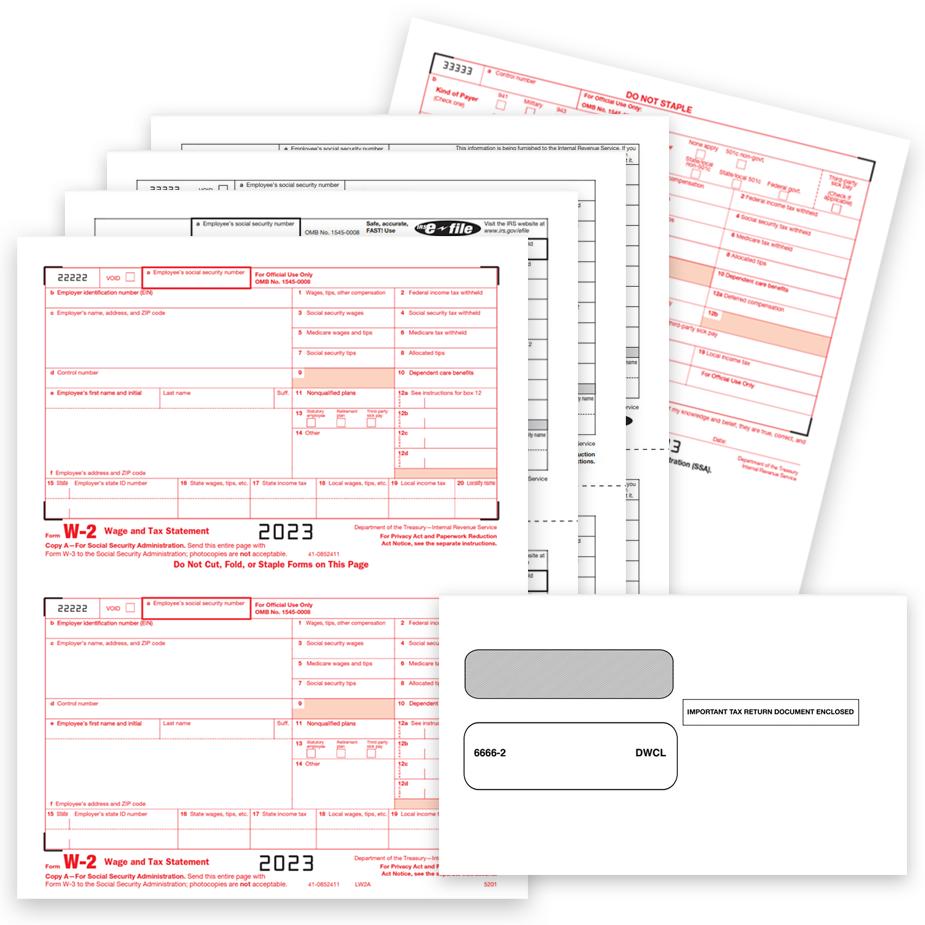

W-2 - Choosing the Right W2 Forms

Select the right type of W-2, in the right format, for easy printing and mailing.

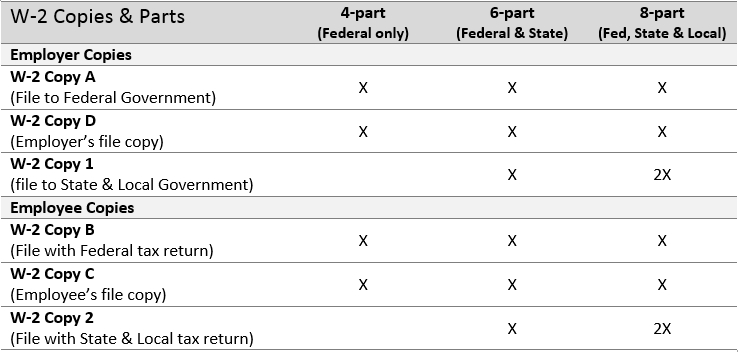

1] Government Requirements

The number of W2 parts needed depends on which government agencies you must report to.

Federal Only = 4 Parts

Federal & State = 6 Parts

Federal, State & City/Local = 8 Parts

4-Part States

AK, FL, NV, NH, SD, TN, TX, WA, WY

6-Part States

AL, AZ, AK, CA, CO, CT, DC, DE, GA, HI, ID, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, NE, ND, NJ, NM, NY, OH, OK, OR, PA, RI, SC, UT, VA, VT, WI, WV (add extra parts for city withholding taxes)

8-Part States

AL, DE, KY, MD, MI, MO, NY, OH, PA

Decoding W2 Requirements

Get the details on your options and regulations on our blog post "Decoding W-2 Requirements"

2] Software Functionality

Your W-2 Software will determine which forms to use.

Each software supports different tW-2 layouts. First, check to see if you should use blank W-2 paper or preprinted forms, then determine which layout you need. Many systems support Official W2 Forms, as well as 2up, 3up or 4up condensed formats.

The best way to ensure compatibility is to print a sample form and use it to compare when shopping.

Preprinted W2 Forms are for software that prints the only the employee data. Boxes are preprinted on the form and employee instructions are preprinted on the back.

Blank W2 paper is for software that prints the boxes and data. Employee instructions are often printed on the back. If they aren't, you must supply them per IRS regulations.

Don't Forget W2 Envelopes

Use compatible envelopes to ensure the employee and return addresses show through the windows correctly.

W-3 Transmittal Forms

When mailing W2 Copy A forms to the SSA, include one W3 form for each payer. This form summarizes all of the W-2 forms submitted by the employer.

2up W-2 Forms

2 Forms per page; ideal for 4pt forms

Print 1 sheet for each employee: Copies B & C

NOTE** All Government Copies MUST be printed in 2up layout.

Blog

Expert insights to

easy 1099 & W2 filing.

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.