Blog

Expert insights to

easy 1099 & W2 filing.

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Why Order Business Checks with a Hologram Icon?

Premium security and peace of mind come with the top-level fraud protection offered by business checks with a foil hologram icon. Hear a customer’s story and learn why they made the switch after battling check fraud that could have cost them thousands.

Business Check Reorders are Easy with The Tax Form Gals

Need business checks fast? The Tax Form Gals at Discount Tax Forms have you covered! Not only do we ship out your first order of business checks within about 48 hours, we make it super simple to reorder them every time you need them, with the same quick delivery.

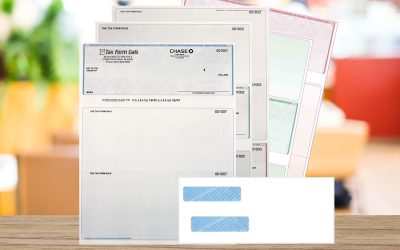

How Do We Keep Prices so Low on Business Checks?

There are a few key reasons why we can keep our prices on business checks so low. As a small, women-owned business we have low overhead, connections with top suppliers who share our values focused on helping our fellow small businesses and use efficient technology.

You Don’t Need a Coupon Code to Save on Business Checks

Are you searching online for a coupon code to save money on your next order of checks for your business? Look no further! We sell business checks for lower prices everyday – no coupon code required.

Business Check Supplier Alternatives to The Big Guys

The Big Name Check Suppliers Prioritize Profits and Minimize Service. But Not the Tax Form Gals – an Alternative Supplier Who Puts Our Customers First!

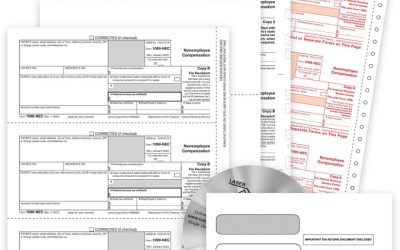

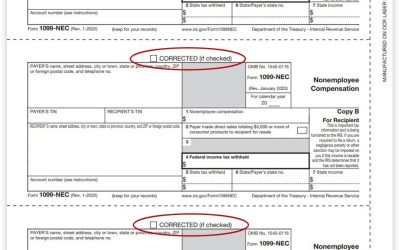

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

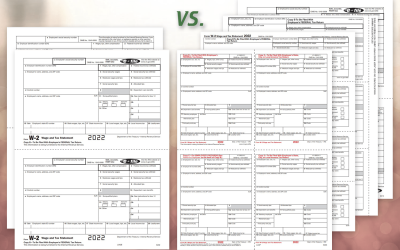

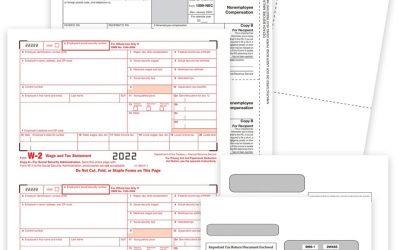

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.

Where to Buy 1099 & W2 Forms?

Buy 1099 & W2 forms from a fellow small business for discount prices and expert service – The Tax Form Gals at Discount Tax Forms!

Why Spend Money on Tax Return Folders?

Making an investment in a business brand and professional image pays dividends! Here’s why you should invest in client tax return presentation folders.

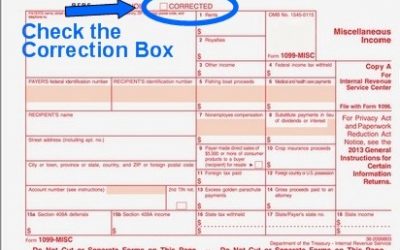

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

How to Correct W2 Forms

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

The Myth of the QuickBooks Coupon Code

Good luck getting your hands on a QuickBooks coupon code! If you need to file 1099 and W2 tax forms, your bank account isn’t going to like the prices charge by Intuit. Look to Discount Tax Forms for lower prices every day!

1099 & W-2 Filing Deadlines for 2022

A list of official 1099 and W2 due dates for e-filing or mailing paper copies to recipients and the IRS or SSA.

Decoding W-2 Copy Requirements

There are various ‘Copies’, or parts, of a W-2 form, each with a different name. Although they will have the same information about the employer and employee, earnings and withholdings, each copy is given to a different entity. This ensures correct reporting during the income tax filing process. W-2 Forms are filled out by the employer and provided to the employee or a government agency.

Decoding 1099-MISC Copy Requirements

1099-MISC ‘Copies’, or parts, report income to recipients and government agencies and help ensure accuracy of income tax filing. 1099-MISC Forms are filled out by the payer and provided to the recipient and government agency.

How to File a W2 or 1099 TODAY

The Deadline to Mail 1099s & W2s to Recipients is January 31. You can get them out the door without having to go to the office store and buy forms.

Why You Should NOT Buy W-2 Forms from the Office Store

Simply stated, it’s not efficient. They only have 1 style of form, the Traditional 2up W-2, for employee copies. This is the SLOWEST way to print W-2 forms.

Construction Company Guide to Filing 1099 and W-2 Forms

An overview of your options for 1099-MISC filing, how to choose the right forms, filing deadlines and more.

Small Business Guide to Filing 1099 & W-2 Forms

An overview of the options for small business 1099 and W2 filing, how to choose the right forms, filing deadlines and more.

How to File 1099-NEC for Contractors

An overview of your options for filing 1099 forms for non-employee compensation, how to choose the right forms, filing deadlines and more.

Landscaping Company’s Guide to Filing 1099 & W-2 Forms

An overview of your options for 1099 and W2 filing, how to choose the right forms, filing deadlines and more.

Trucking Company Guide to Filing 1099 & W-2 Forms

An overview of options for trucking companies to file 1099 and W2 forms, how to choose the right forms, filing deadlines and more.

New ACA Reporting with 1095 Forms

Beginning in January 2016, most employers must file information returns for the Affordable Care Act (ACA) on new 1095 and 1094 Forms. Here is an overview of the requirements.

How to File1099-MISC Forms with QuickBooks®

Instructions for printing 1099 forms from QuickBooks® software.

How to File W-2 Forms with QuickBooks®

Instructions for printing W2 forms from QuickBooks® software.

How to Correct 1099 Forms You Already Filed

You do not need to correct a 1099 the same way you filed it, so if you mailed a paper copy, you can e-file a correction, or vice versa. However, if you have 250 or more corrections that need to be filed, they MUST be e-filed with the IRS.

How to Correct W2 Forms You Already Filed

If you need to correct W2 forms that have already been mailed or e-filed with the SSA, you must file a W-2C Correction Form, with a W-3C form to summarize corrections by a single employer. There is no deadline, simply file the form as soon as you discover the error.

File 1099 & W2 Forms Yourself and Save Money

As a small business, we’re always looking for ways to save money by doing things ourselves. Many of our colleagues can say the same. One of the ways you can do this is filing 1099 and W2 forms yourself, instead of paying an accountant. It’s easier than you think!!

How to E-file 1099 & W-2 Forms

E-filing 1099 and W2 forms to the Federal Government is not only faster, but you get more time to get it done! It’s enough of a hassle to print and mail recipient copies, you don’t need to spend time repeating the process for the government copies. Here is how to electronically file quickly and easily.

Don’t Get 1099 & W-2 Forms from the IRS!

Why not? They’re free, right? Sure, they’re free. But this is definitely a case of ‘you get what you pay for’. Here is a list of things that regularly go wrong when you order 1099 and W2 Forms from the IRS.

The Fastest Ways to Get 1099 and W2 Forms Done

It’s that time of year again. Tax season. And if you’re a business, it starts NOW with 1099 and W-2 form filing. But it doesn’t have to be a hassle. There are ways to make it faster and easier.

Online 1099 & W-2 Filing – Efile, Print & Mail Service – DiscountEfile.com

Technology, no doubt, makes filing 1099 and W-2 forms easier – typewriters are almost completely out of business. There are software programs and accounting software will print the forms. As long as you buy the right forms, stock up on printer ink, and are prepared to make a few mistakes and stuff a few envelopes, you’ll get it all done. Eventually. Hopefully by the deadline. But yet again, technology brings you a better way! With online filing systems like DiscountEfile.com, you no longer need to hassle with software, forms or stuffing envelopes.

It’s May. W-2s and 1099s are the Last Thing on Your Mind

Congratulations on finishing up another year-end reporting cycle. Hopefully everything went well, forms mailed on time, taxes paid and now it’s time to relax a little and enjoy the summer. But know that we’re STILL working on 1099 and W-2 filing! No, not because we didn’t send out our forms on time, but because we’re working to make filing easier for you at the end of this year!

How to Get W2s and 1099s Done 3 Days Before the Deadline, Without Leaving Your Office

There are online systems ready and waiting to help you get things done easily. You don’t have to buy software or forms, all you need is Discountefile.com

3 Ways to Make Printing 1099 & W2 Easier

First, error check data before printing, always select the right 1099 & W-2 forms and choose the best filing method for the number of employees or recipients you have.

1099 & W2 Efile Options

Blog Expert insights to easy 1099 & W2 filing. 1099 & W2 Efile Options E-filing W-2 and 1099 info, instead of printing Copy A forms is encouraged for all businesses. It’s easy to do and will save you time and printing expenses....

Types of W-2 Forms

Blog Expert insights to easy 1099 & W2 filing. Types of W-2 Forms Types of Paper for W-2s W-2 Preprinted Laser Forms: These forms are for laser and inkjet printers and have the boxes and government information preprinted on the front, and...

Penalties for Business that Don’t File 1099 Forms Correctly

If a business doesn’t file 1099-MISC Forms with the correct information, by the due date, and cannot show reasonable cause, it is subject to penalties from the IRS. This applies to electronic and paper filers. Penalties can be assessed if a business fails to do any of the tasks in this article.

1099 Form Definitions

A simple list of all the 1099 forms and what they are used for. From 1099-MISC to 5498 forms, they’re all covered here.

How to File 1099 & W-2 Forms: Different Filing Methods

From typing forms on a typewriter to printing them using your accounting software or specialized 1099 & W2 software, to filing them online and never touching a form, we help you understand your options and make the most efficient choice for getting this annual talk done quickly and efficiently.

Welcome to the Discount Tax Forms Blog about 1099s and W-2s

Blog Expert insights to easy 1099 & W2 filing. Welcome to the Discount Tax Forms Blog about 1099s and W-2s Since we’ve been helping you get the right 1099 and W2 forms for years, we figured it’s about time that we give you even more resources on a...