Blog

Expert insights to

easy 1099 & W2 filing.

Guide to Filing 1099 Forms for Contractors

Instructions and information for business that need to file 1099 forms for non-employee compensation for contractors, attorneys and others.

Get the basic run-down on how to choose the right forms for your software or how to file everything online in this blog post, or read the full guide to 1099 filing for contractors.

Options for Filing 1099-NEC for Non-Employee Compensation

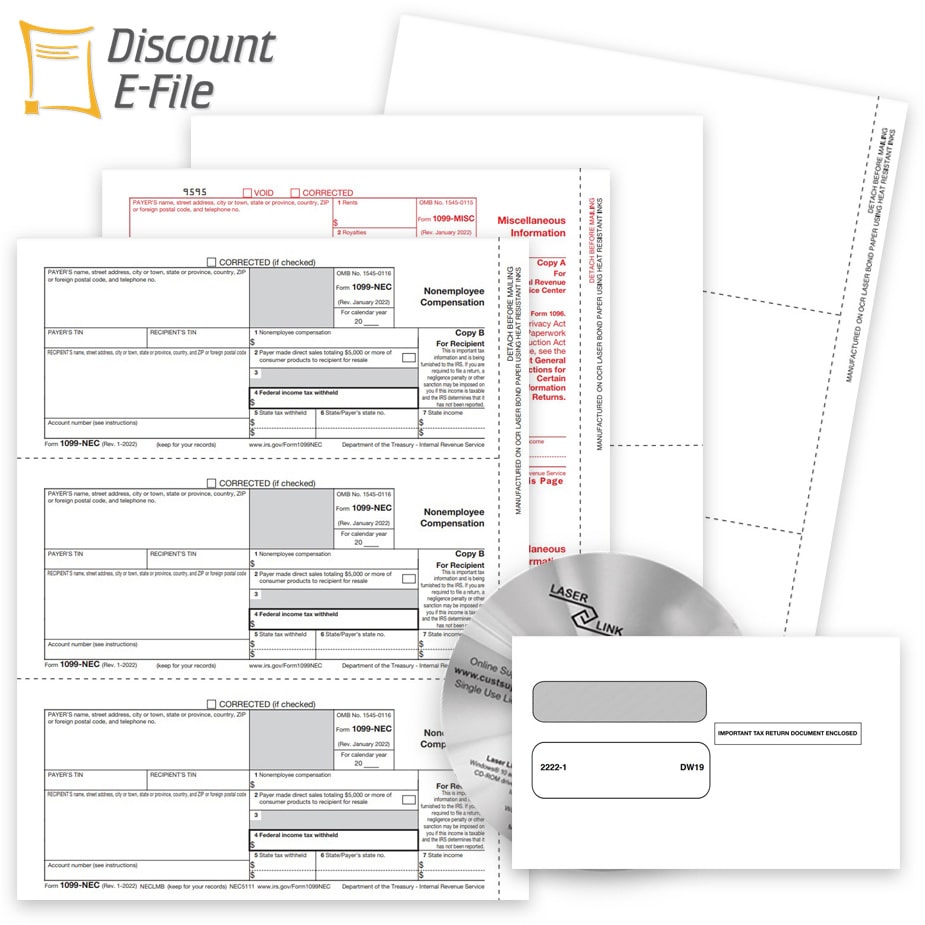

Your Accounting Software: Many types of accounting software will print 1099 and W-2 forms. Some will e-file payer copies. To print payer and recipient copies, purchase forms compatible with the software as there are many layouts available. Print copies, stuff envelopes and mail. Purchase forms for your Software >

Specialized 1099 & W-2 Software: Prints all 1099 and W-2 forms. Will e-file payer copies. To print payer and recipient copies, purchase forms compatible with the software as there are many layouts available. Print copies, stuff envelopes and mail. Purchase Specialized 1099 & W-2 Software >

Online Filing: The newest, and easiest way to file one or hundreds of 1099 & W-2 forms! Online filing takes care of printing and mailing to recipients, as well as e-filing with Federal and State Governments. You simply type in the data or import it from your accounting software. The online filing system will do the rest! Learn more about Online Filing of 1099 and W2 >

Choosing the Right 1099 Forms

1] Which 1099 Form to Use

1099-NEC is the appropriate form for reporting non-employee compensation (replacing the 1099MISC in 2020). It is used for subcontractors and consultants who you have paid $600+ during the tax year. Other 1099 Forms are available. Shop for 1099 Forms>

2] Number of Parts Needed

The number of parts you need for a 1099-NEC is based on where you need to file government copies: Federal only, State or City:

Copy A: Federal Copy for the IRS

Copy B: Recipient Copy

Copy C/2: Payer Copy for State, Local or File

3] Type of Forms

Your software will print on either:

Pre-printed 1099 forms – software will print only the recipient and payer data

Blank perforated 1099 paper – software will print the entire form at once, including boxes and labels with the recipient and payer data.

Don’t forget 1099 Envelopes or 1096 Forms if you’re printing and mailing your own forms!

If you use QuickBooks, read our blog post: How to Print 1099 Forms from QuickBooks >

1099 Filing Deadlines

January 31 – Recipient copies for all 1099 forms; 1099-NEC Copy A mailed or e-filed to IRS

February 28 – Paper Copy A and Transmittals mailed to the IRS (all 1099s except 1099NEC and MISC)

March 3 – E-file Copy A to IRS or SSA (all 1099s except 1099NEC and MISC)

Most states have the same deadlines as the Federal government.

More Insights for 1099 & W2 Filing

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

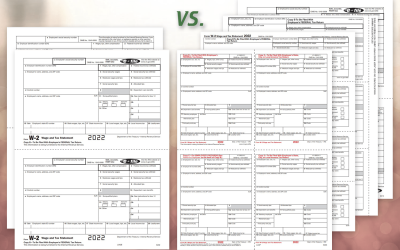

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.