Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

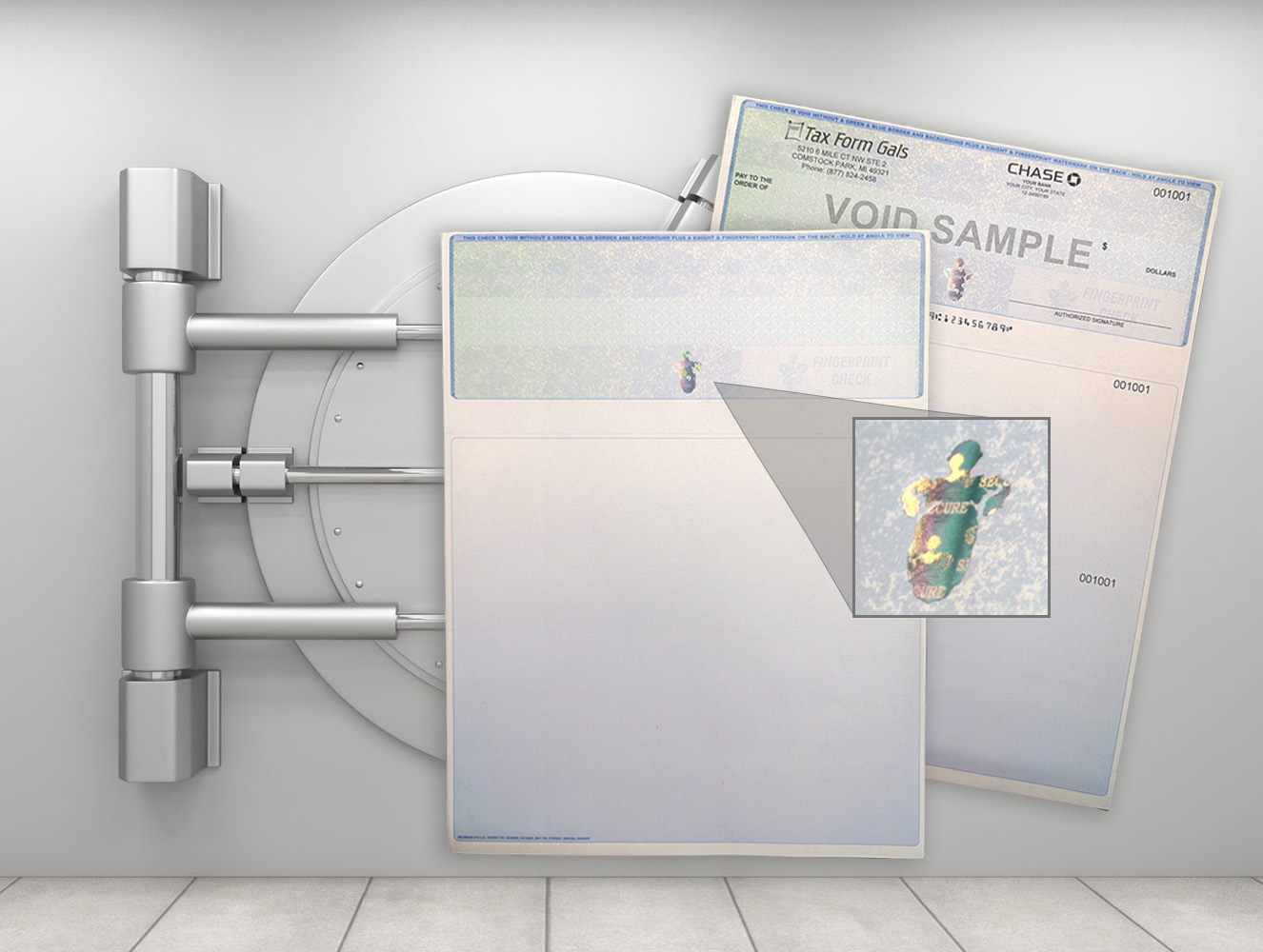

Premium security and peace of mind come with the top-level fraud protection offered by business checks with a foil hologram icon. Hear a customer’s story and learn why they made the switch after battling check fraud that could have cost them thousands.

Need business checks fast? The Tax Form Gals at Discount Tax Forms have you covered! Not only do we ship out your first order of business checks within about 48 hours, we make it super simple to reorder them every time you need them, with the same quick delivery.

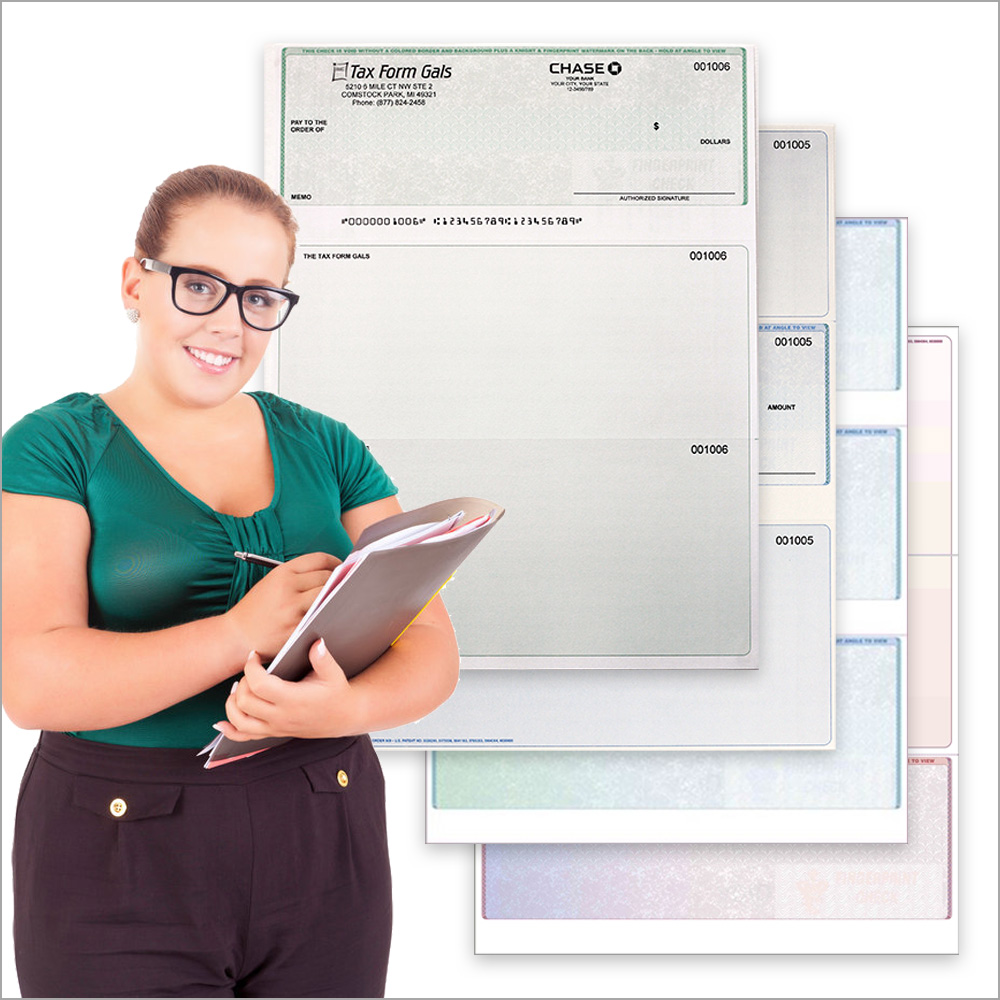

There are a few key reasons why we can keep our prices on business checks so low. As a small, women-owned business we have low overhead, connections with top suppliers who share our values focused on helping our fellow small businesses and use efficient technology.

Are you searching online for a coupon code to save money on your next order of checks for your business? Look no further! We sell business checks for lower prices everyday – no coupon code required.

The Big Name Check Suppliers Prioritize Profits and Minimize Service. But Not the Tax Form Gals – an Alternative Supplier Who Puts Our Customers First!

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.