2022 1099 & W-2 Guides for Small Business

Order the right 1099 & W2 forms, choose the best filing method, and get everything done on time, easily.

Easy-to-use 1099 & W2 Guides help small business alleviate the confusion, reduce errors, file faster and understand the process better. Let the experts at Discount Tax Forms help you!

Call our friendly reps with any questions!

Want an easier way to file 1099 & W2 forms? Let us do it for you! We'll e-file with the IRS or SSA and can even mail recipient copies. Learn more and get started for free at DiscountEfile.com.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2023.

Use DiscountEfile.com to enter or upload data and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

Industry-Specific Guides to Filing 1099 and W2 Forms

Filing Requirements Overview

Deadlines for 2022 1099 & W-2 Filing

January 31, 2024

1099-NEC Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099-NEC & W2 Copy A forms to IRS (e-file if you have 10+ W2 & all 1099 forms, combined for a single payer; mail paper Copy A for 9 or less recipients)

February 28, 2024 – Mail Other 1099 Copy A Forms to IRS

For all 1099 Form Copy A’s, along with 1096 Transmittals, for which you print and mail paper copies (only if there are 9 or fewer recipients for a single payer for all types 1099 & W2 forms)

March 31, 2023 – E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, if a single payer has 10+ recipients for all types of 1099 form.

Let Us Take Care of It All for You!

Instantly E-file and/or print and mail 1099 and W-2 forms.

Simply enter or import your data, click a few buttons and you’re done!

We e-file with the IRS or SSA and can even print and mail recipient copies, for around $4 per form.

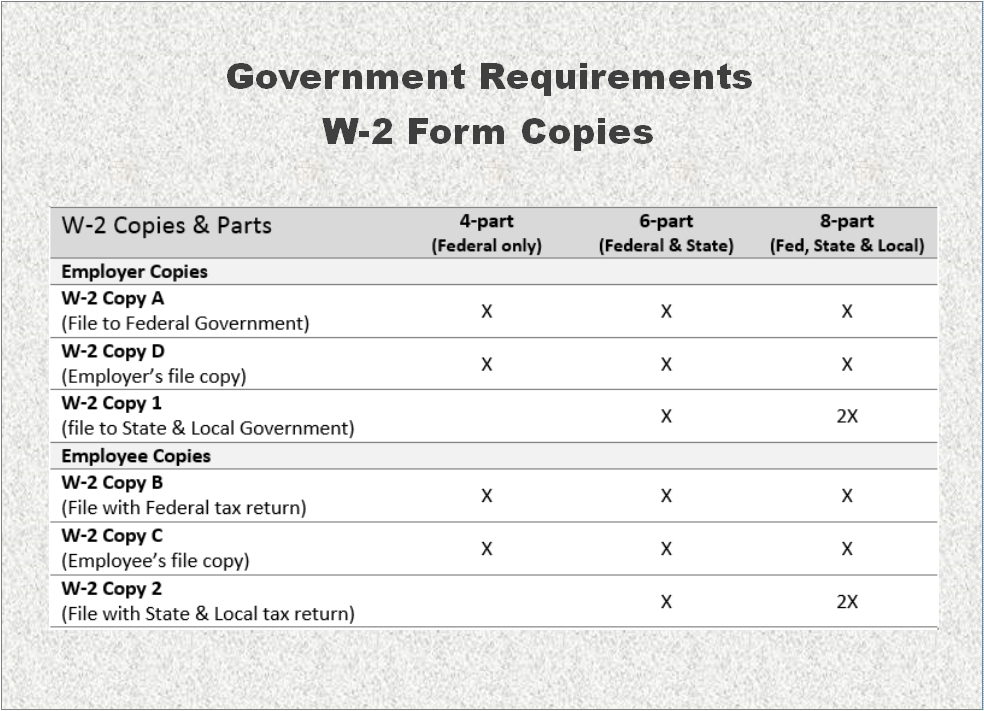

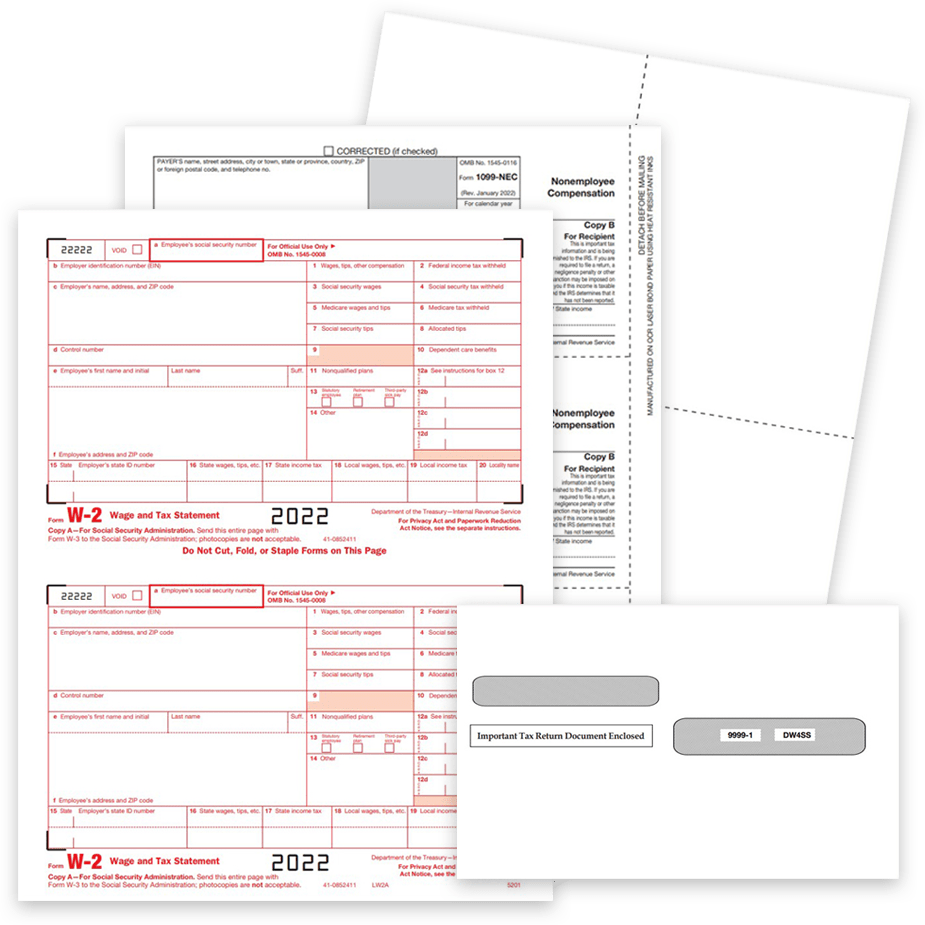

Decoding W-2 Formats

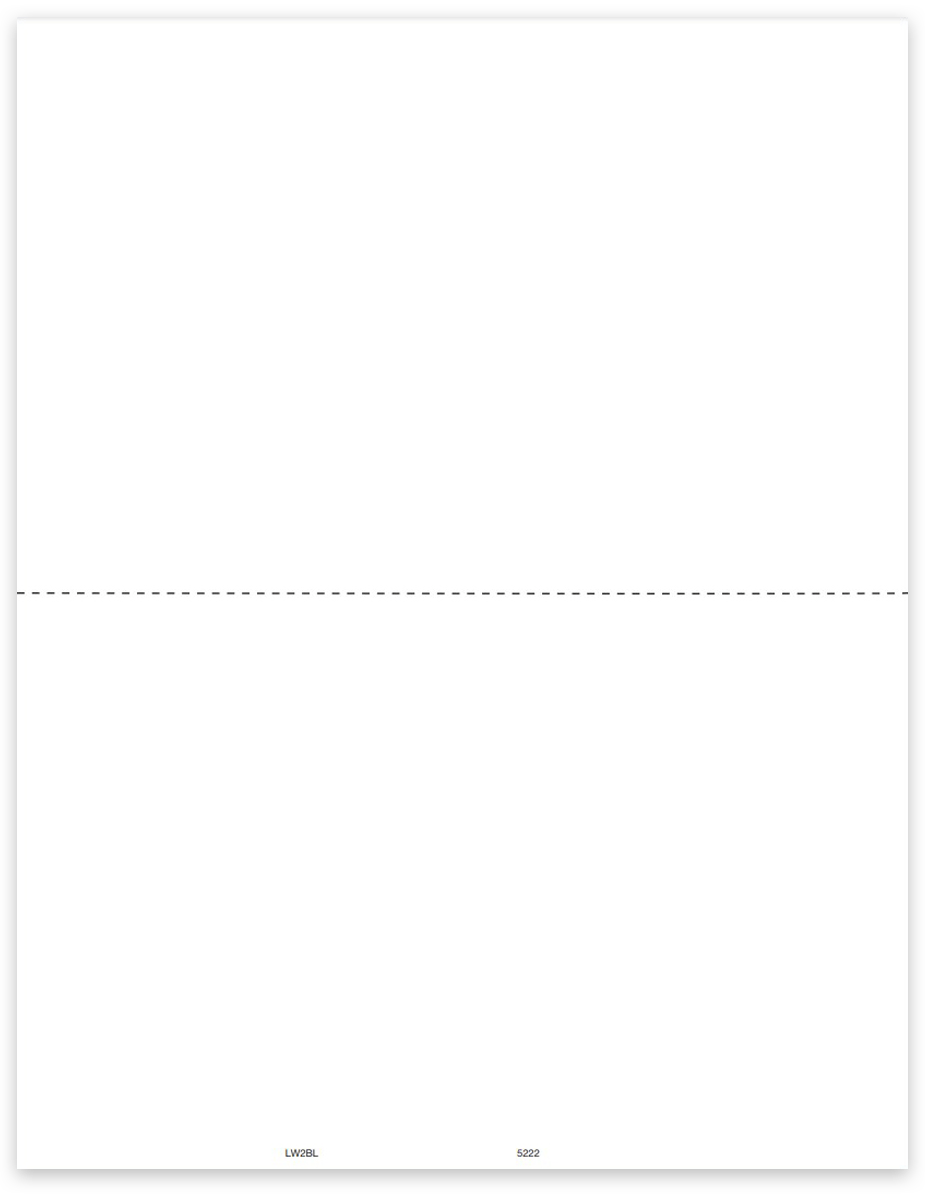

2up W2 Forms

2 forms on a sheet, with one center perforation to create 2 forms.

Use for traditional or condensed 2up W2 forms for employees, 4-pt Copies B and/or C for federal filing and the employee record copy.

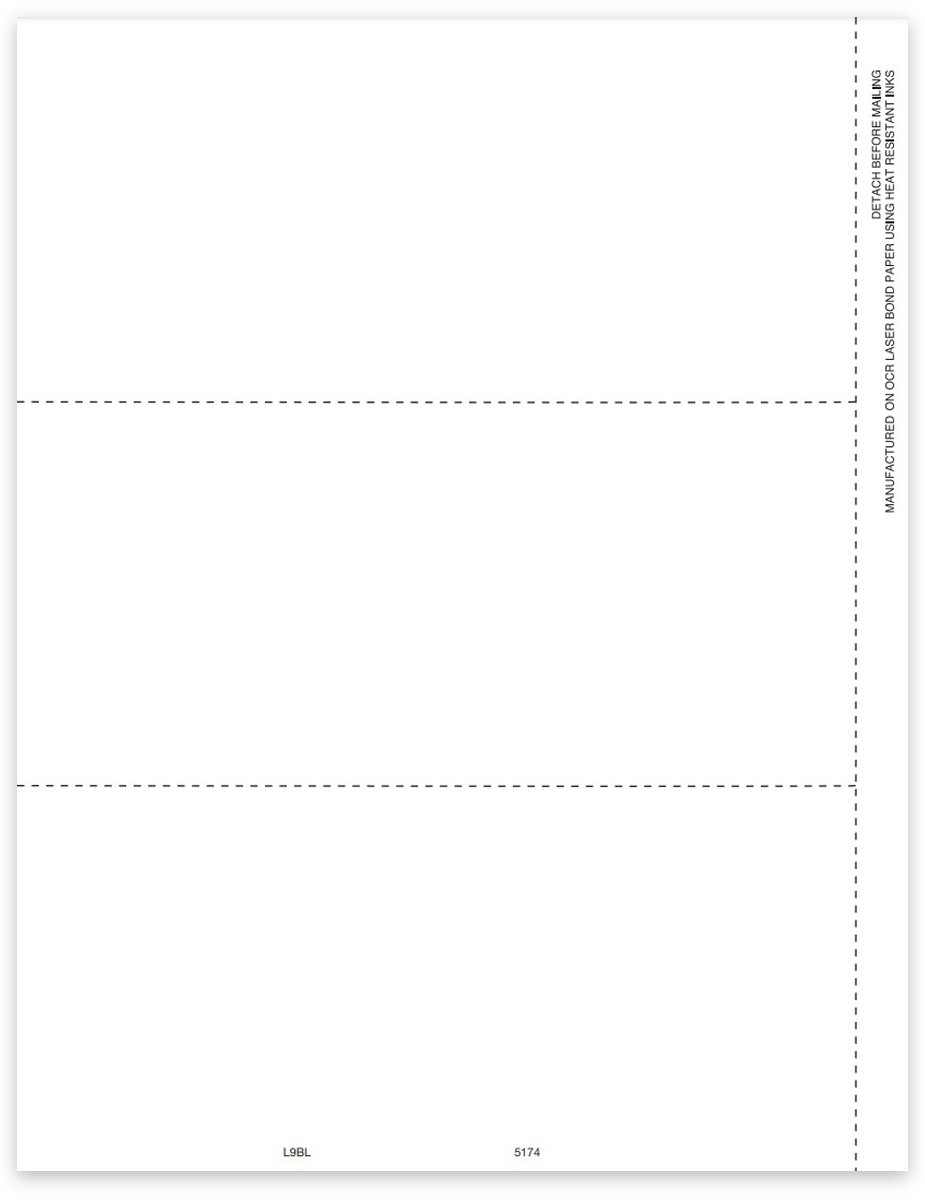

3up W2 Forms

3 forms on a sheet, typically with a vertical side strip to remove before mailing.

Use for condensed 3up W2 forms for employees, 6-part Copies B/C/2 for federal and state filing.

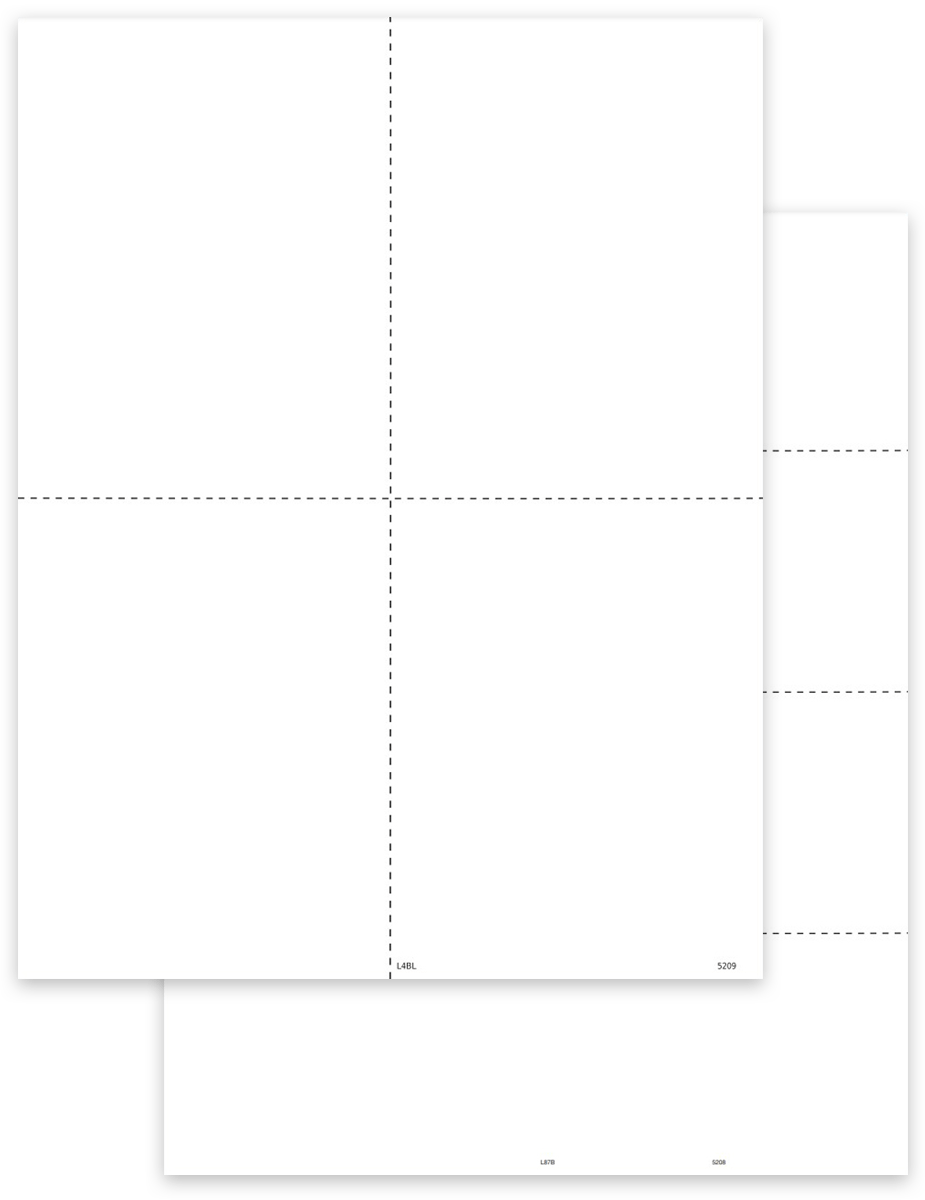

4up W2 Forms

4 forms on a single sheet, perforated into quadrants or horizontal sections depending on your software.

Use for 8pt W2 printing of employee Copies B/C/2/2 for federal, state and local filing.

Tips for Easier W2 Filing

Check your software for supported formats:

- Preprinted forms (prints data on a pre-made form) or

- Blank paper (prints data and boxes on a perforated sheet)

- 2up, 3up or 4up forms

- Be sure your envelope windows match!

W3 Transmittal forms must be mailed with Red Copy A forms. We include a couple FREE W3 forms with each W2 order.

Online filing is an option! DiscountEfile.com lets you enter or import data, and then takes care of the rest. Your forms are e-filed with the IRS/SSA and mailed to employees automatically. With a few clicks, you're done! Learn more.

Blog

Expert insights to

easy 1099 & W2 filing.

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

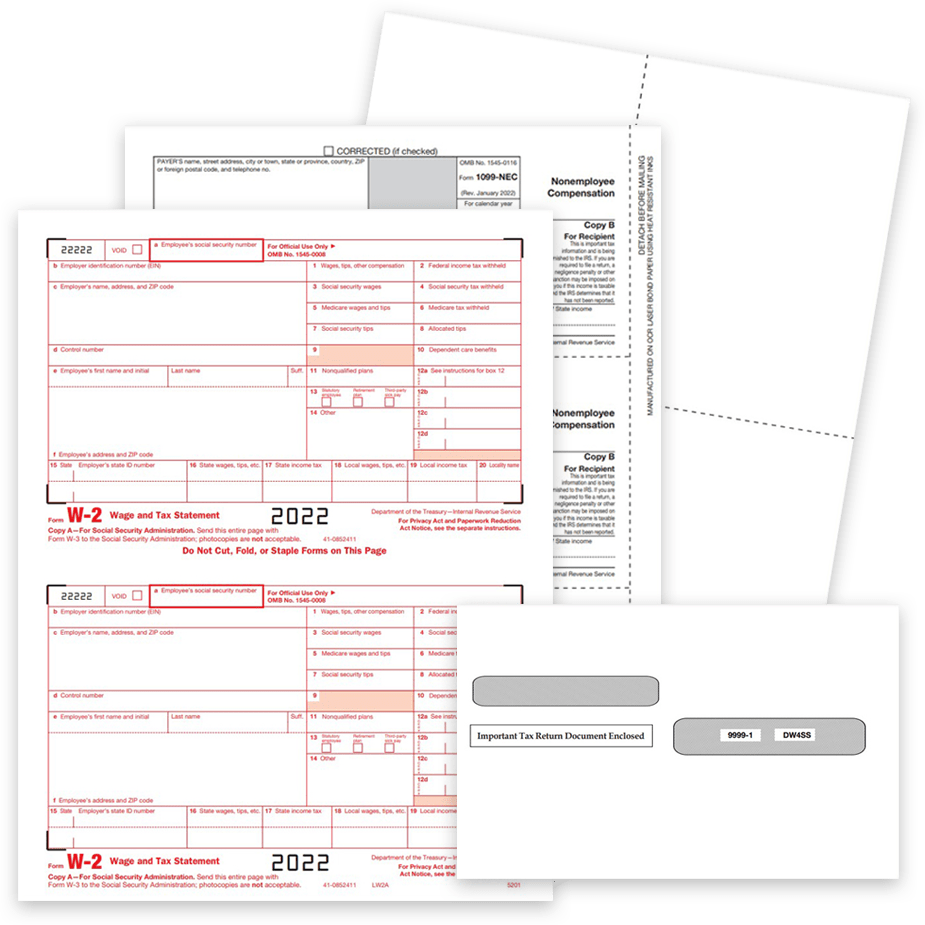

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.