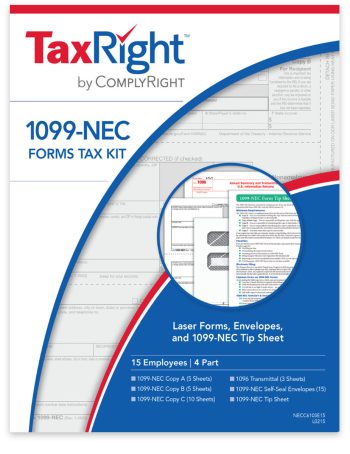

1099NEC Tax Forms

Report non-employee compensation with 1099-NEC forms for 2023.

- 1099NEC forms at discount prices – no coupon needed!

- Small minimum quantities of 1099-NEC forms

- Compatible with most accounting software systems

**NEW** 1099 E-filing requirements — e-file Copy A if you have 10+ W2 and 1099 forms combined for 2023

1099NEC tax forms & e-filing made easy with the right options at discount prices – no coupon code needed.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The required threshold for e-filing is 10+ W2 and 1099 forms, combined, per EIN.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2025.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

1099NEC Tax Forms

for reporting non-employee compensation

-

1099 Envelope – 3up

-

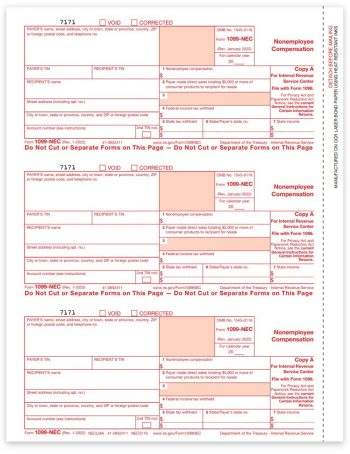

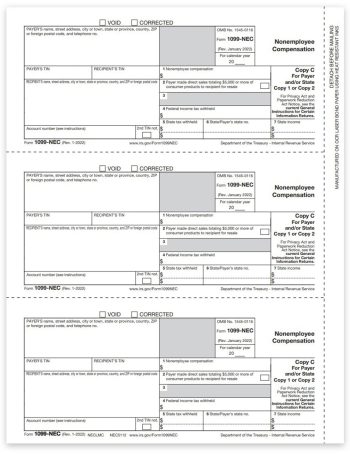

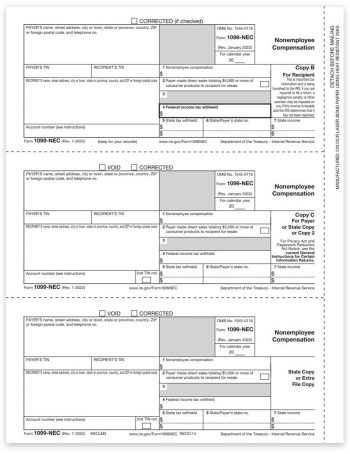

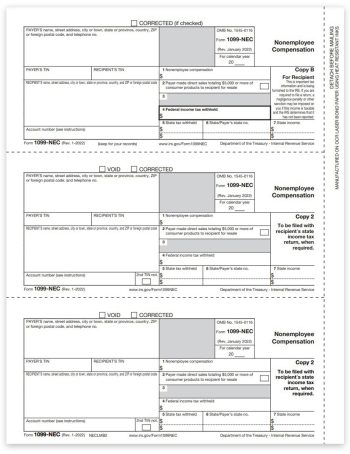

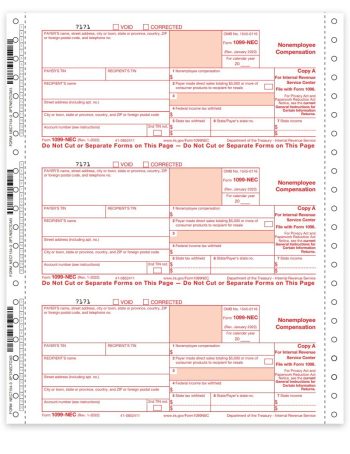

1099-NEC Form – Copy A, Payer Federal

-

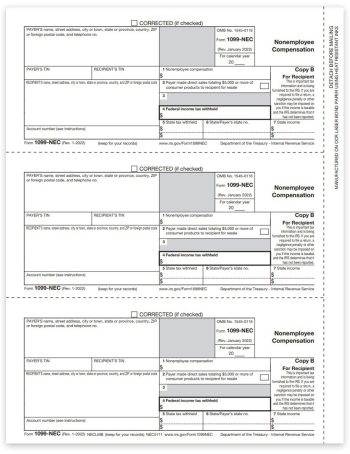

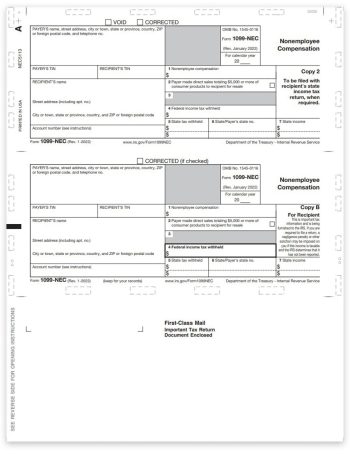

1099-NEC Form – Copy B Recipient

-

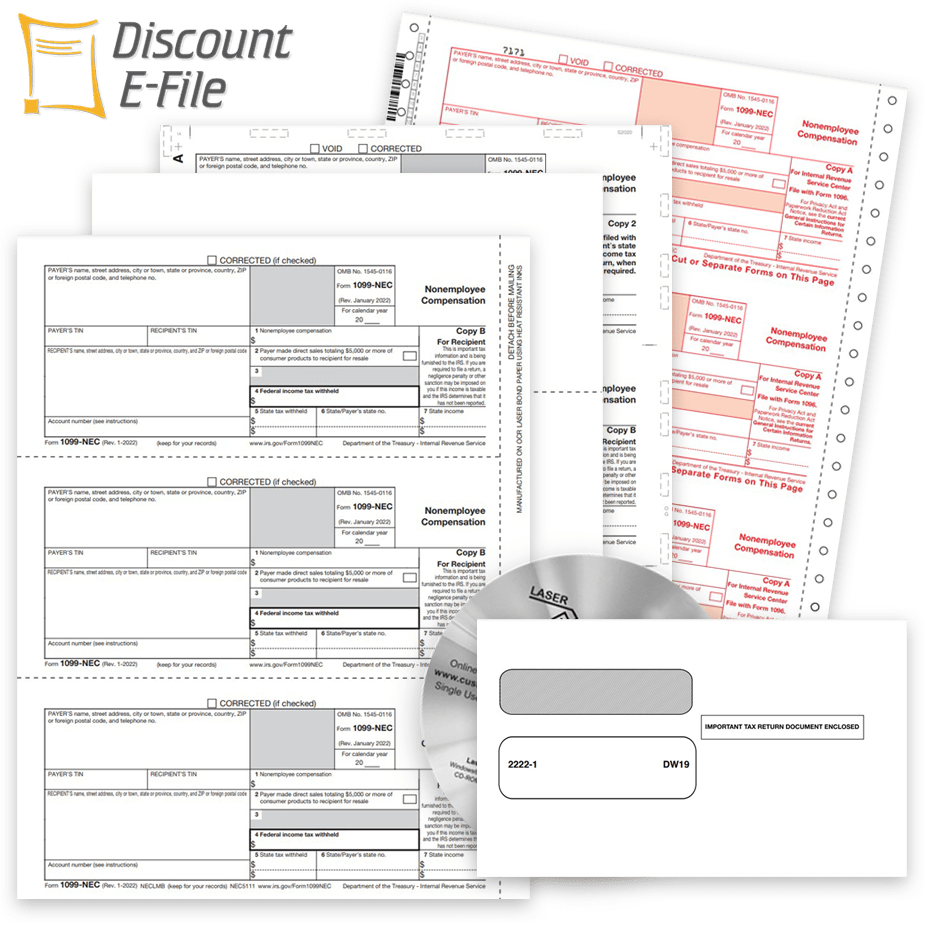

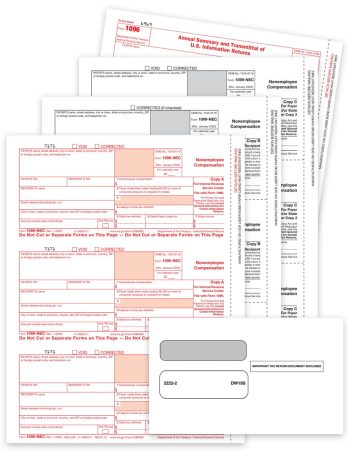

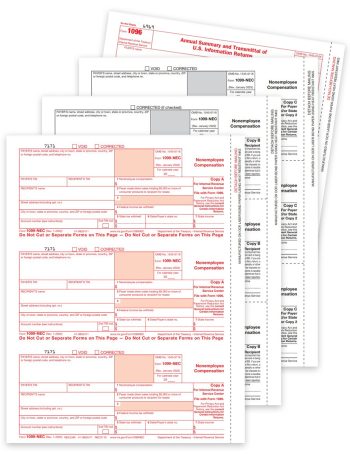

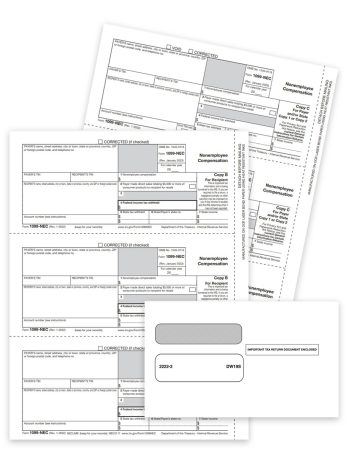

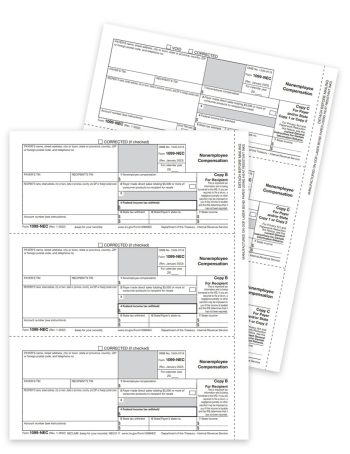

1099-NEC Forms Set with Envelopes

-

1099-NEC Form – Copy C-2 Payer

-

1099-NEC Forms Set

-

1099-NEC Forms Sets with Envelopes for E-filers – 3-part

-

1099-NEC Form – Combined Copy B-C-Extra Recipient & Payer

-

1099-NEC Form – Combined Copy B-2-2 for Recipient

-

1099-NEC Forms Sets for E-filers – 3-part

-

1099NEC Blank Paper – 3up for 1 Recipient – With Recipient and Payer Instructions

-

1099NEC Blank Paper – 3up for 3 Recipients – With Recipient Instructions

-

1099-NEC Carbonless Continuous Forms

-

1099-NEC Pressure Seal Forms Copy B-2 – 11″ Z-Fold

-

1099-NEC Blank Pressure Seal Forms 11″ Z-Fold

-

W2 & 1099 Universal Forms – Blank

1099 Correction Forms

Print & Mail Forms

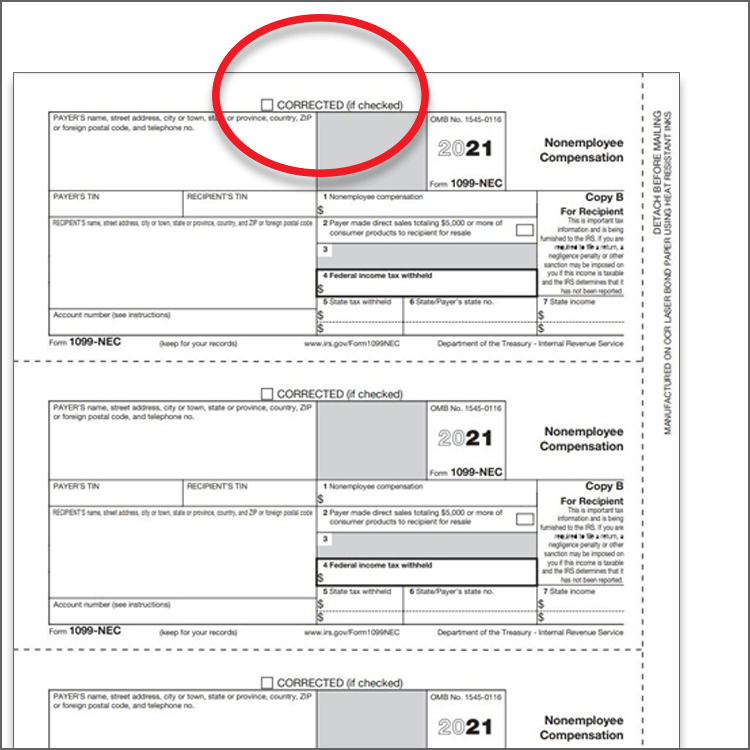

Simply use the same type of 1099 form as the original, and check the 'Corrected' box at the top.

Easy Online Correction Filing

Simply enter the corrected data and we'll automatically e-file with the IRS and mail recipient copies! Avoid the hassle of printing forms and let us do the work for you.

How to File 1099 Corrections

Read our latest blog post on how to correct 1099 forms.

The process is similar to filing standard 1099 forms. You'll need to provide the corrected information and check the Corrected box.

But the big question... "is there an easier way?"

Online Filing Eliminates the Forms!

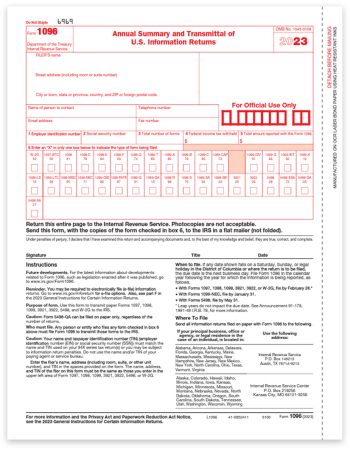

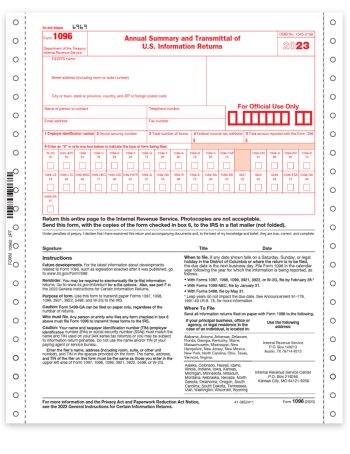

Instructions for Form 1099-NEC

To use the 1099-NEC properly, you need to understand what is considered non-employee compensation.

Previously reported on Box 7 of the 1099-MISC, the new 1099-NEC will report any payments of $600 or more to nonemployee service providers, such as independent contractors, freelancers, vendors, consultants and other self-employed individuals (commonly referred to as 1099 workers).

According to the IRS, a combination of these four conditions makes a payment reportable on the 1099NEC:

- It is made to someone who is not your employee.

- It is made for services in the course of your trade or business.

- It was made to an individual, partnership, estate, or, in some cases, a corporation.

- Payments were $600 or more for the calendar year.

Examples of when to use 1099NEC forms:

- Professional service fees to attorneys, accountants or architects

- Fees paid by one professional to another

- Payments for services, including those for parts or materials used to perform the services, even if they were incidental

- Commissions paid to nonemployee salespeople, not repaid during the year

Exceptions:

- Payments for merchandise, phone, freight, storage or similar items.

- Payments to a tax-exempt organization, including tax-exempt trusts or governments.

Dos and Don’ts for 1099-NEC

✓ Do verify that the recipient’s taxpayer ID is correct. You must have Form W-9 from each recipient with the current taxpayer ID before you complete Form 1099-NEC.

✘ Don’t use Form 1099-NEC to report personal payments.

✘ Don’t use Form 1099-NEC to report employee wages; use Form W-2 instead.

✘ Don’t report gross proceeds to an attorney (not fees) on Form 1099-NEC; use Form 1099-MISC instead.

✘ Don’t use Form 1099-NEC to report payments of rent to real estate agents or property managers; use Form 1099-MISC instead.

Please note: You must also file Form 1099-NEC (report in box 4) for anyone from whom you withheld federal income tax under the backup withholding rules, regardless of the amount.

Filing Form 1099NEC

- Distribute to recipients by January 31.

- File with the IRS by Jan. 31 through paper or electronic filing.

- As part of the Taxpayer First Act, many businesses will no longer be able to submit paper forms. For tax year 2021, the electronic filing threshold is 10 forms. Which means any business with 10 forms or more are required to e-file. For an easy efiling solution, check out DiscountEfile.com!

1099 Filing Guides

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

1099 Filing Blog

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.

Where to Buy 1099 & W2 Forms?

Buy 1099 & W2 forms from a fellow small business for discount prices and expert service – The Tax Form Gals at Discount Tax Forms!

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

How to Correct W2 Forms

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

The Myth of the QuickBooks Coupon Code

Good luck getting your hands on a QuickBooks coupon code! If you need to file 1099 and W2 tax forms, your bank account isn’t going to like the prices charge by Intuit. Look to Discount Tax Forms for lower prices every day!

1099 & W-2 Filing Deadlines for 2022

A list of official 1099 and W2 due dates for e-filing or mailing paper copies to recipients and the IRS or SSA.