1099 Software

Easy 1099 software for simple printing, mailing and e-filing.

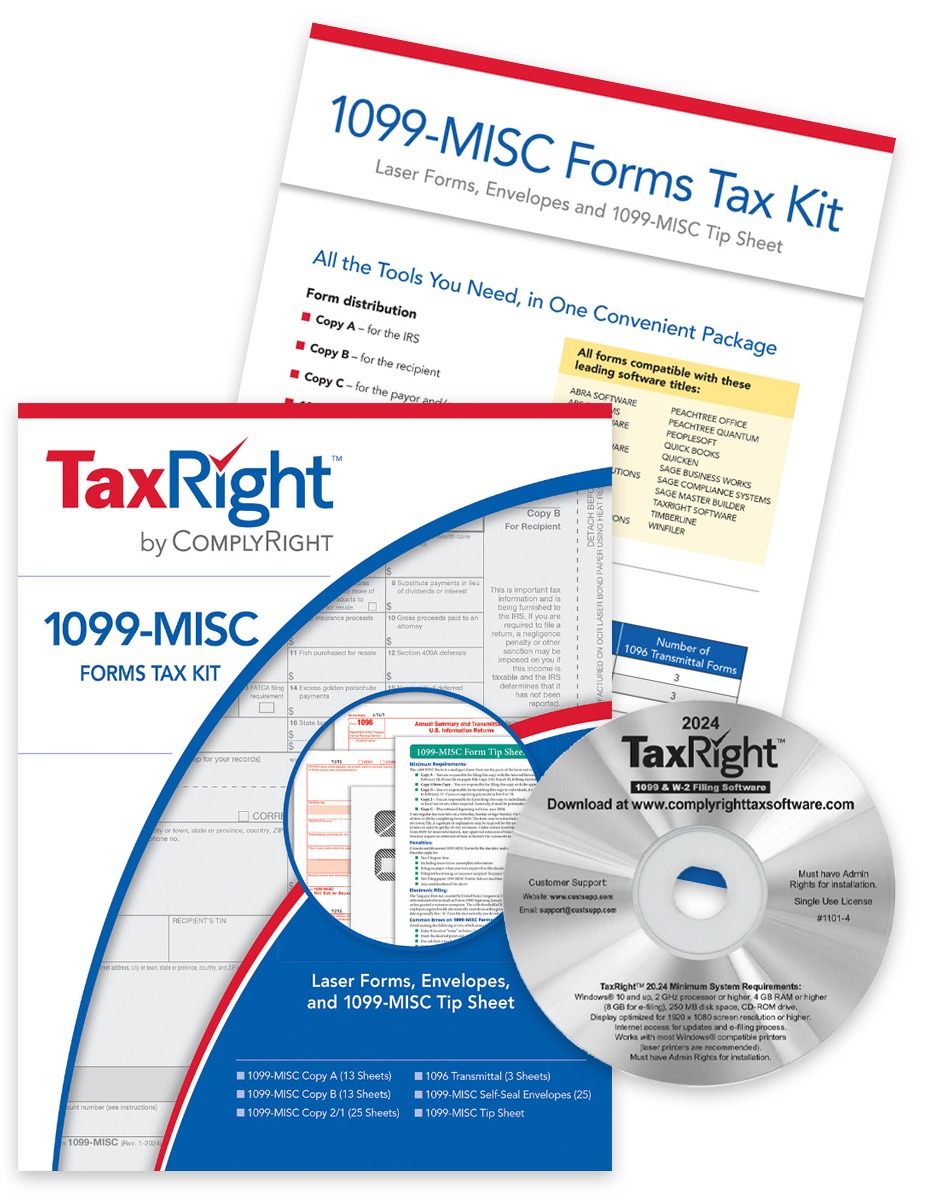

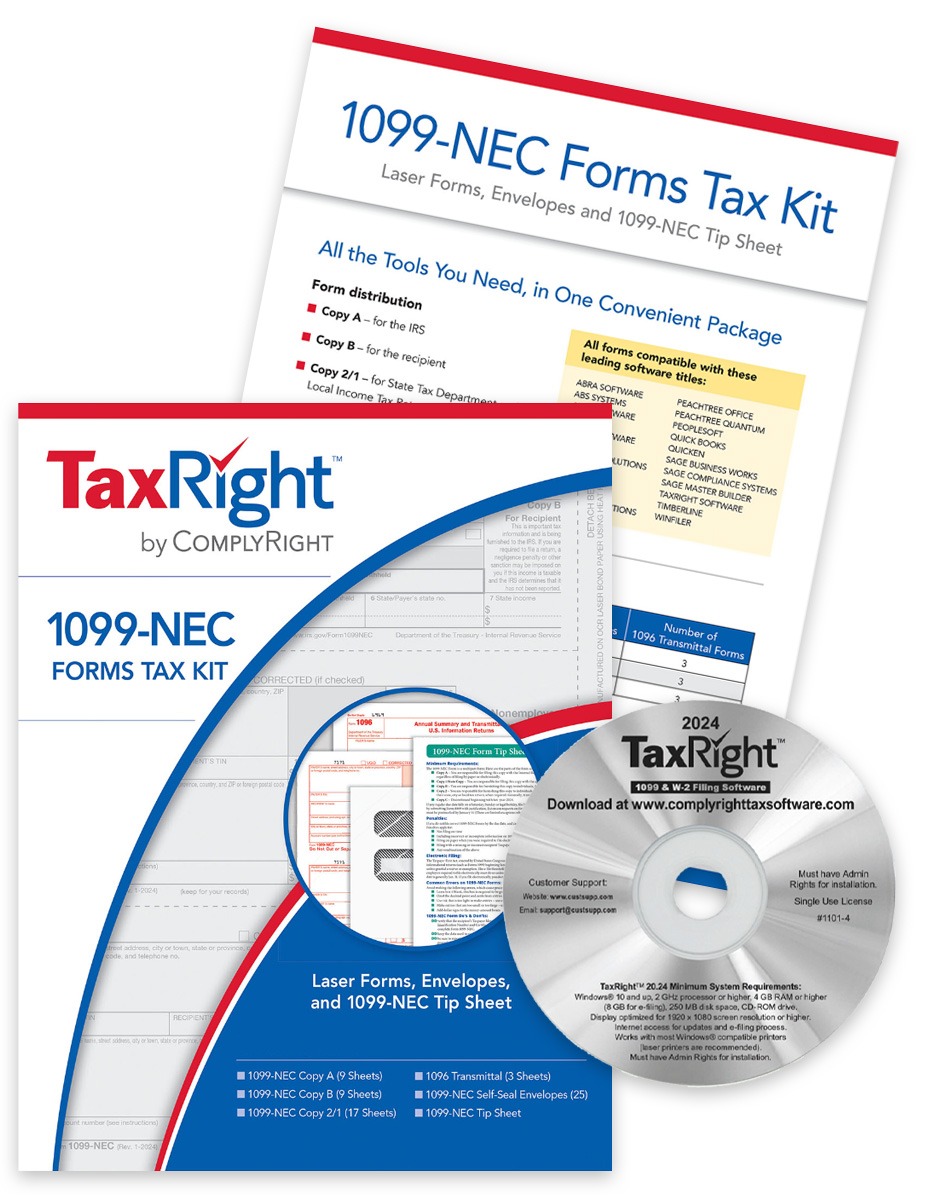

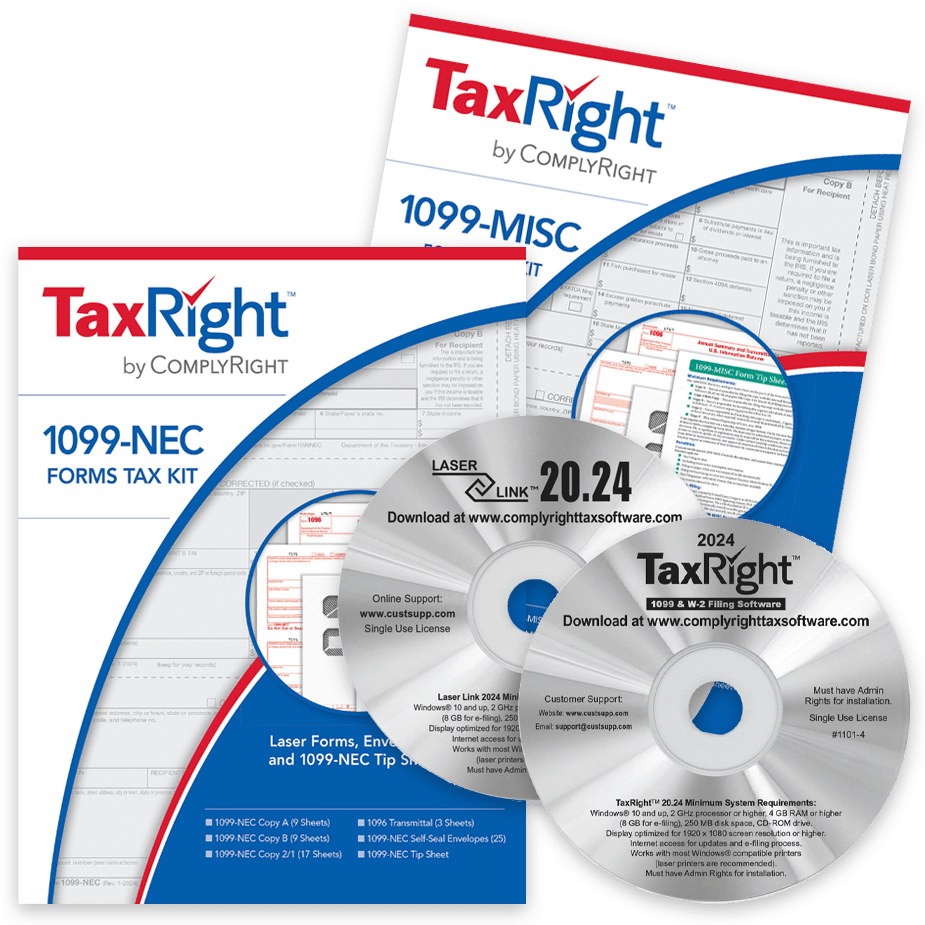

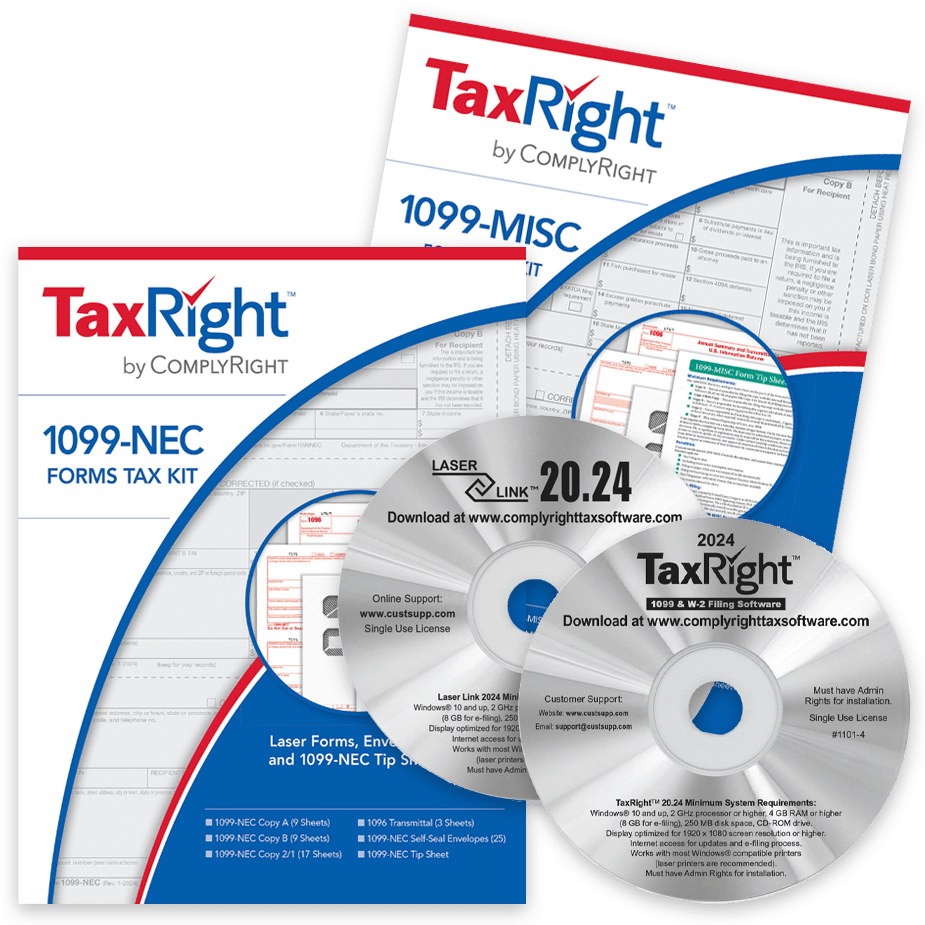

If your accounting software doesn’t print 1099 and W2 forms, or is simply clumsy and hard to use, LaserLink™ or TaxRight™ 1099 software by ComplyRight® is a great alternative!

- Software for printing any type of 1099 form

- Stand-alone 1099 software

- Optional kits with compatible forms and envelopes

- Import data from accounting systems

- Easy E-file Options

Easily print, mail and e-file any type of 1099 form with the simple software solutions at everyday discount prices.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

Order 1099 Software and E-Filing for 2024

Rely on The Tax Form Gals for personal, friendly service and fast shipping.

As a women-owned and operated business in Michigan, the friendly Tax Form Gals at Discount Tax Forms work hard for you, and have fun every day – even on Mondays!

With the goal of delivering the best value and best service for essential business supplies that you rely on every day to make your small business run like a well oiled machine.

Give us a call at 877.824.2458 or email hello@taxformsgals.com.

Skip the Software – File 1099 Forms Online!

ONLINE E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no printing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2024.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

1099 & W2 Filing Deadlines

Deadlines for 2024 1099 & W-2 Filing

January 31, 2025

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *E-FILE REQUIREMENTS << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

February 28, 2025 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2025 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

Let Us Do the Work for You This Year!

Instantly e-file, print and mail 1099 and W-2 forms.

DiscountEfile.com makes year end reporting easier than ever!

Simply enter your data, or import it from QuickBooks®, then click a few buttons and you're done.

We e-file with the IRS or SSA, and can optionally print and mail recipient copies, starting at about $4 per form and going down from there.

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.