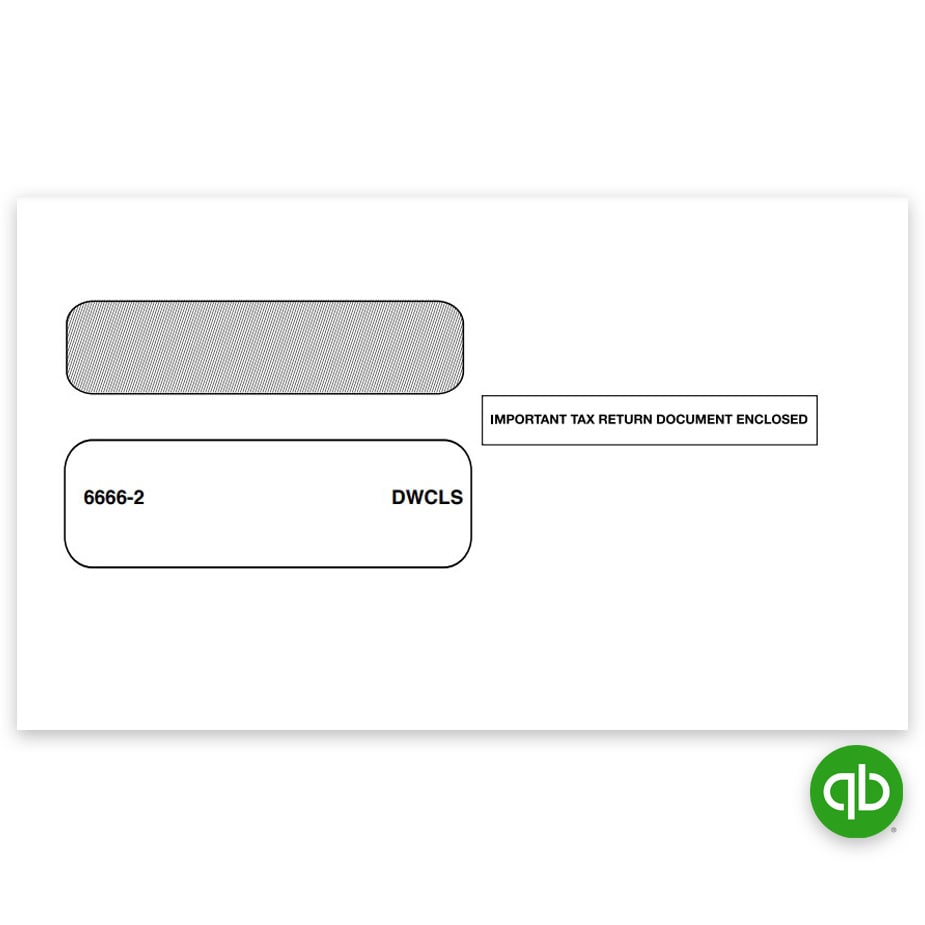

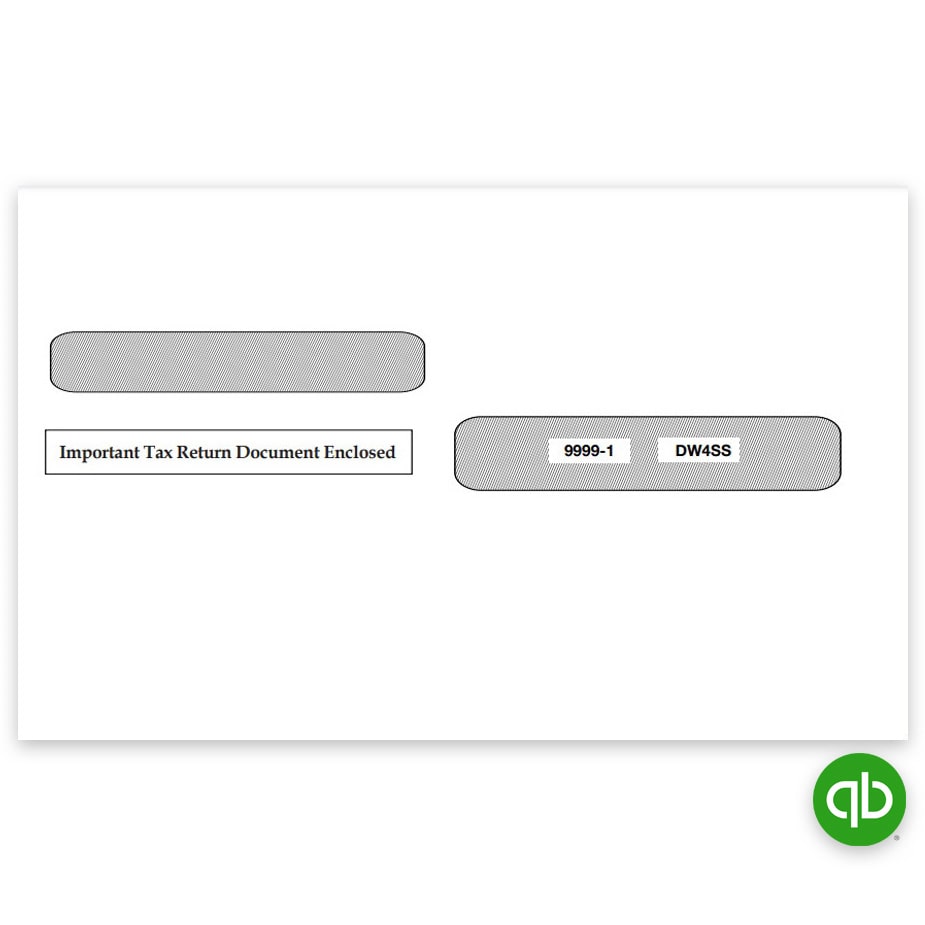

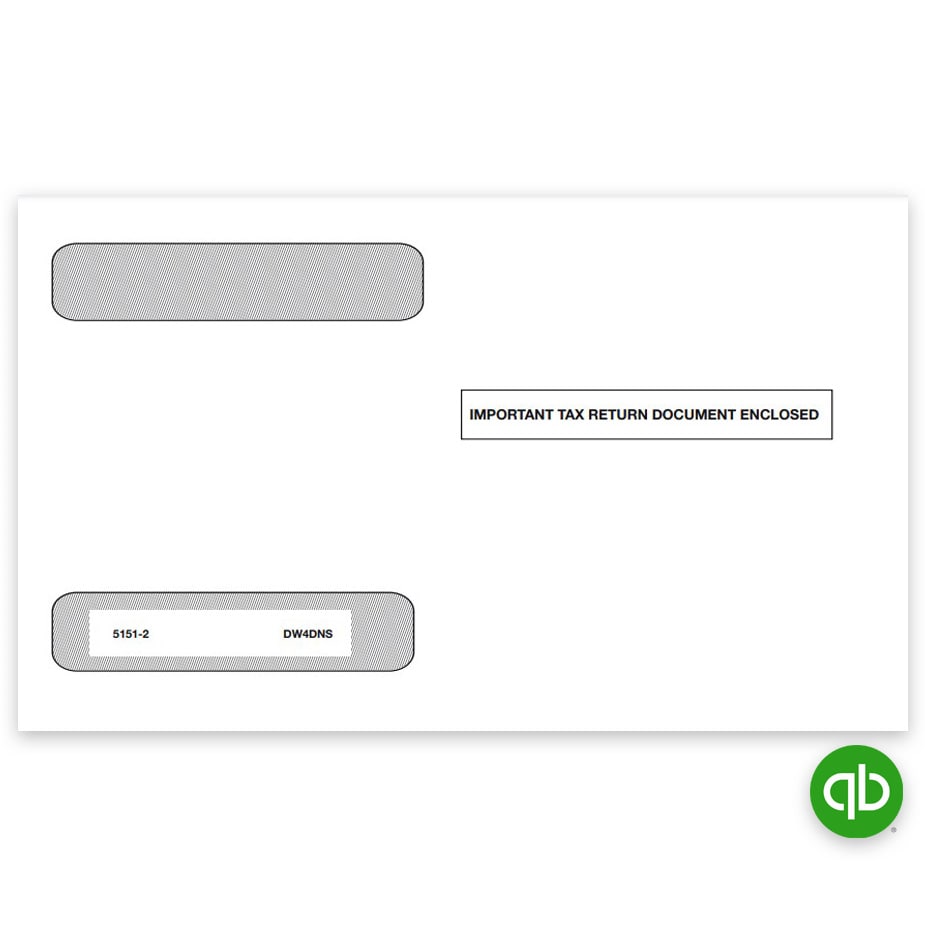

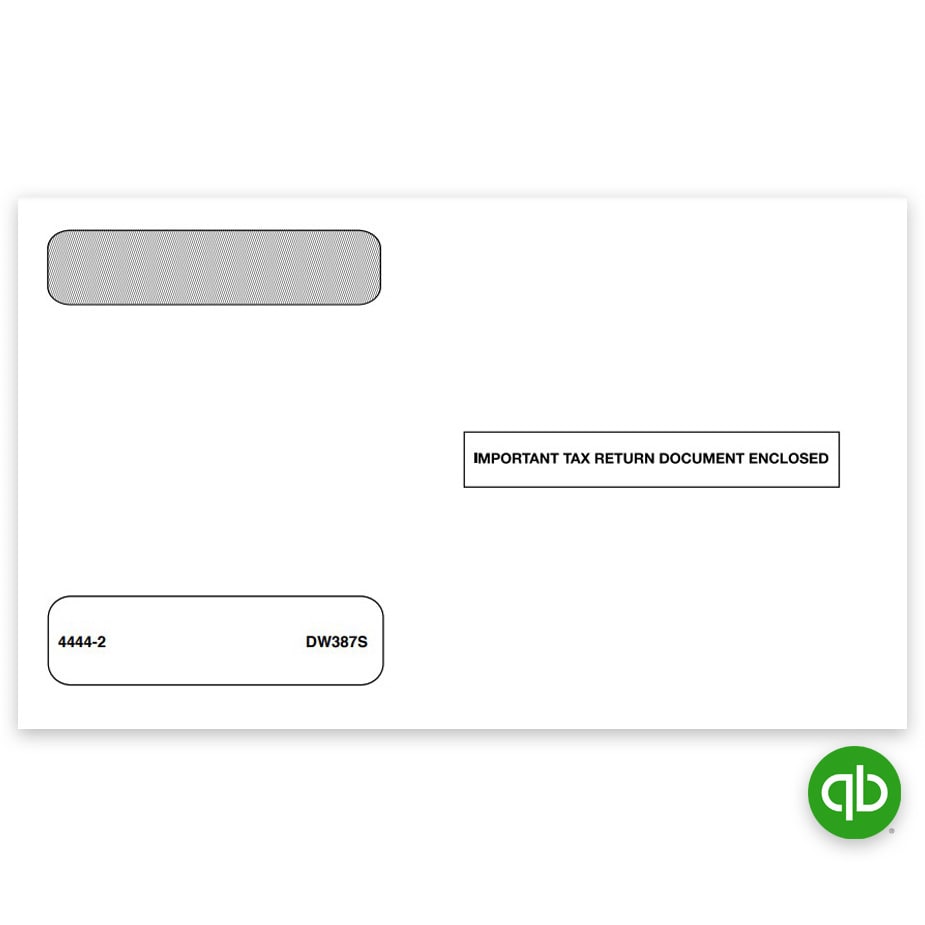

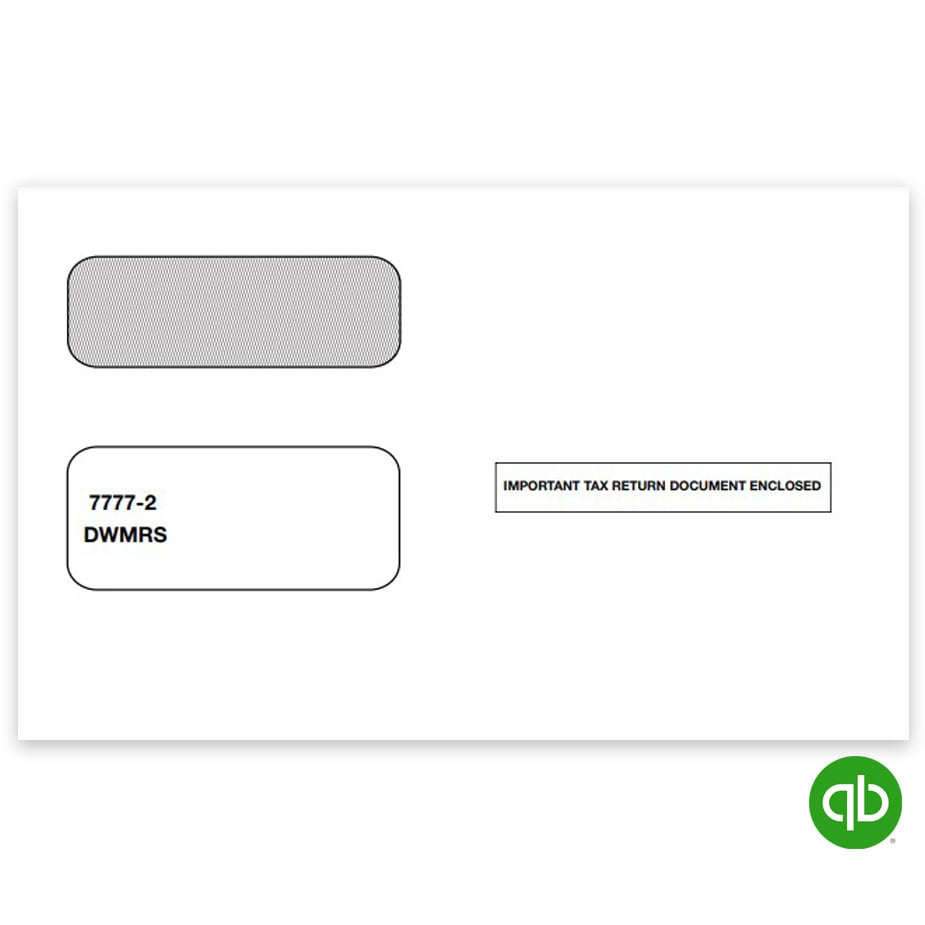

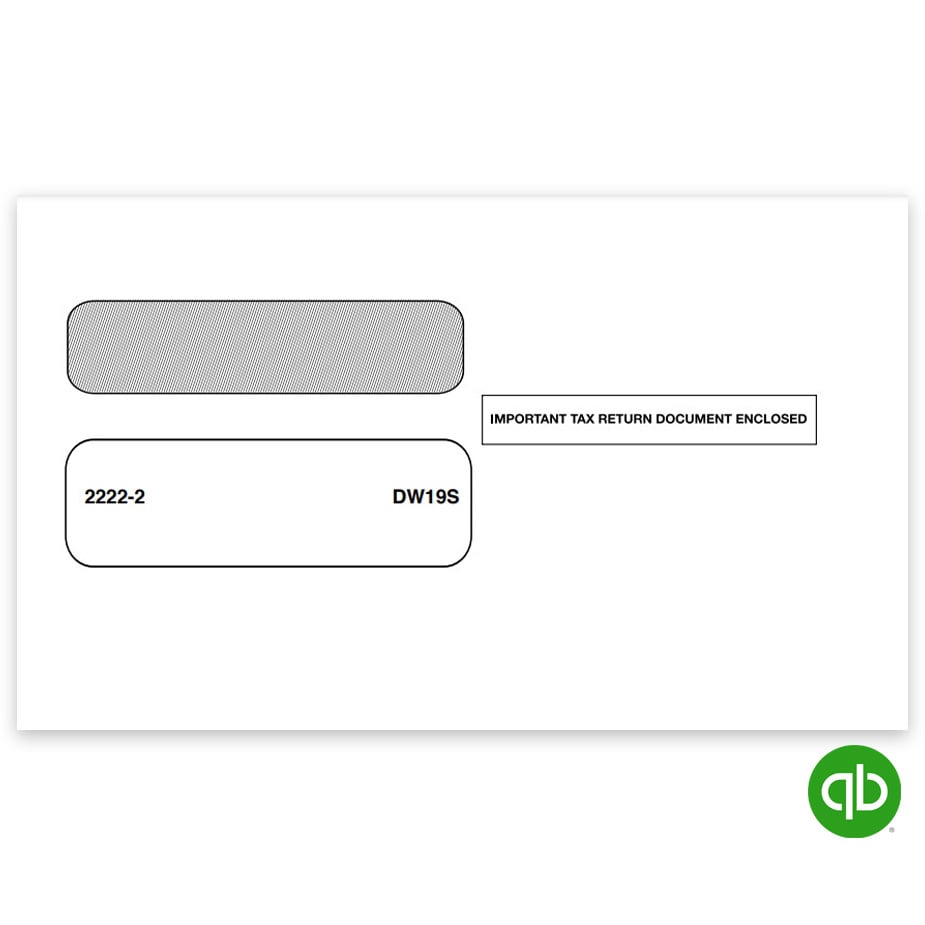

QuickBooks® Envelopes

Compatible envelopes for checks and 1099 & W2 tax forms printed with Intuit® QuickBooks® software

- Everyday discounts – no coupon code required!

- Save big over Intuit® Marketplace

- Small minimum quantities

- Guaranteed 100% compatible

Compatible QuickBooks Envelopes for Checks and Tax Forms at Discount Prices – No Coupon Needed.

Shop Easy with The Tax Form Gals!

Envelopes Compatible with QuickBooks Software

W2 & 1099 E-filing Eliminates the Forms!

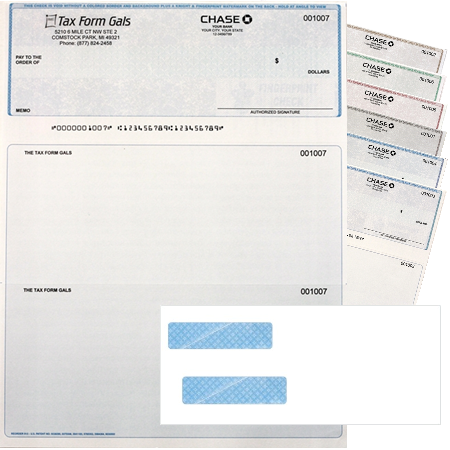

Save on Business Checks for QuickBooks

QuickBooks Compatible Business Checks at Discount Prices

Laser checks for QuickBooks software have the highest security features at significantly lower prices.

- Plus, we print your logo for free!.

- Most checks ship within 48 hours from our local, secure facility.

- Fast, friendly service from the Tax Form Gals

Compare prices and save more with Discount Tax Forms everyday!

QuickBooks® Resources

Learn about efficient filing of tax forms and more with Intuit® QuickBooks software.

- How to set up a contractor

- How to e-file 1099s and W2s

- Check writing and printing

- Setting up and paying payroll taxes

- Find a QuickBooks advisor

More Information on QuickBooks Forms

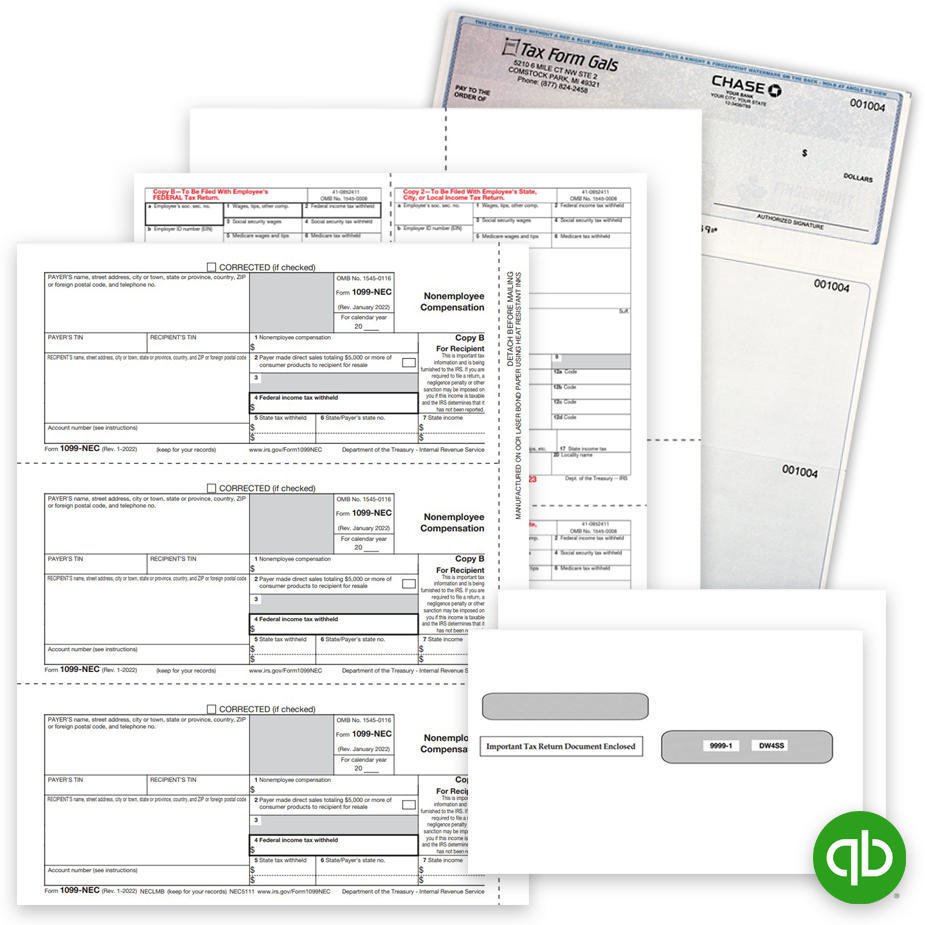

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.