Resources for QuickBooks® 1099 & W2 Filing

Videos and information to efficiently, and affordably file 1099 & W2 Forms with QuickBooks.

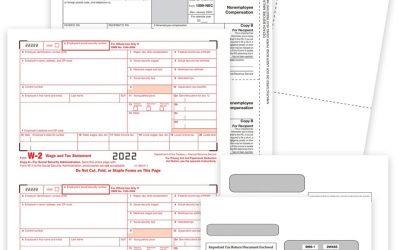

How to Set up a 1099 Contractor in QuickBooks

- Create a vendor with a Tax ID

- Create an account for 1099 payments for each vendor

- Assign account as Non-Employee Compensation

- Review list of vendors and add if needed

- Review information

- Print 1099 forms or import to DiscountEfile.com for easier online filing

How to E-file 1099 & W2 Forms in QuickBooks

- Use DiscountEfile.com for an easier way!

- Affordable! $3.95 per form or less

- Absolutely secure

- Complete e-file and/or mail service

- All the popular 1099 forms and corrections

- W-2 forms and corrections

- W3 & 1096 Transmittals included

How to Write Checks in QuickBooks

- Open a check

- Enter payee info

- Choose an account, date and category

- Enter the check amount and check number

- Print individually or as a batch (see below)

How to Print Checks in QuickBooks

- Choose print checks from the main menu

- Select type of check and preview a sample

- Load QuickBooks check stock and print!

How to Set Up Payroll Taxes

- Gather necessary tax information about your business

- Set up employees

- Enter Federal and State tax details

- Set up e-file and e-pay, or manually pay

- Set up verification and security information

How to Pay Payroll Taxes

- Click Pay Taxes in your activities area

- Click e-pay to submit electronically

- Approve tax payments as needed

Find a Certified QuickBooks ProAdvisor in Your Area

A ProAdvisor is a QuickBooks-Certified accounting professional who provides strategic insight and support to drive small business success.

A ProAdvisor pushes more than numbers—they push you to make your business the best it can be.

Blog Posts about QuickBooks 1099 & W2 Filing

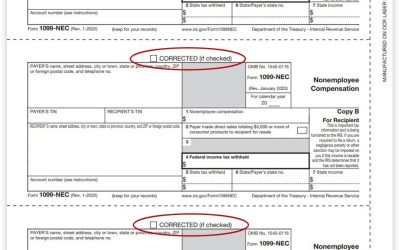

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

How to Correct W2 Forms

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

The Myth of the QuickBooks Coupon Code

Good luck getting your hands on a QuickBooks coupon code! If you need to file 1099 and W2 tax forms, your bank account isn’t going to like the prices charge by Intuit. Look to Discount Tax Forms for lower prices every day!