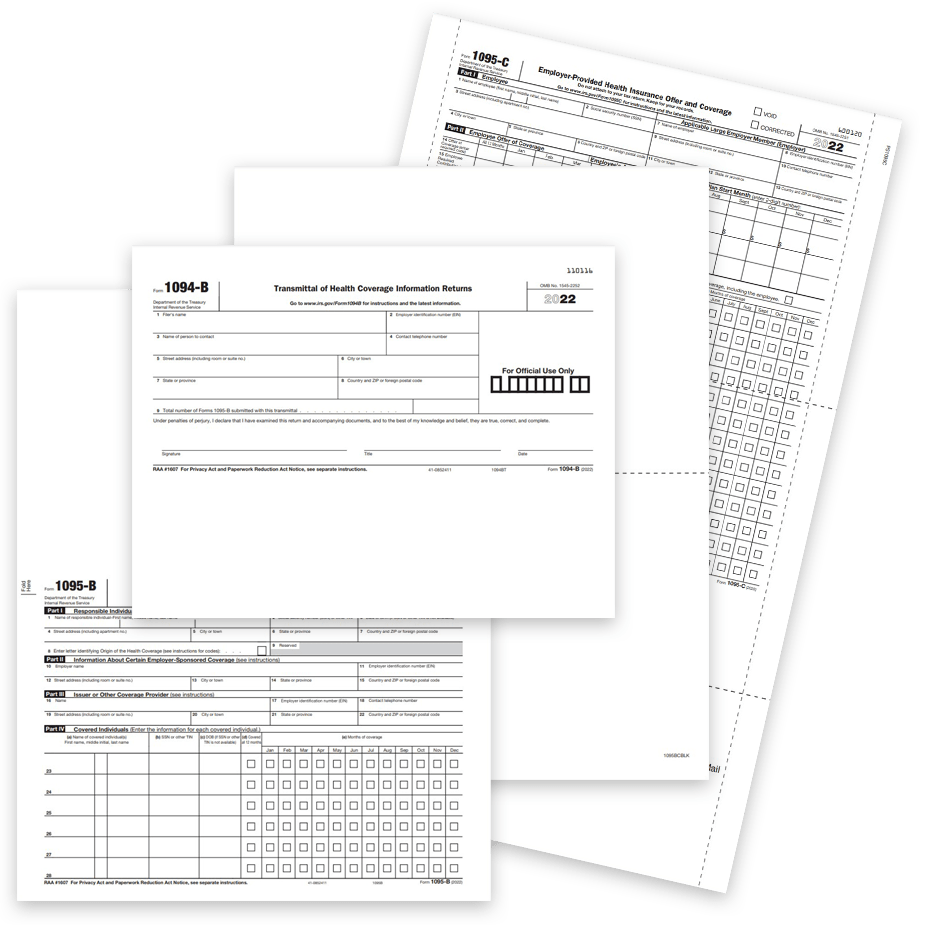

ACA 1095 Filing

1094 & 1095 forms, envelopes, software and online filing.

- ComplyRight® software compatible forms

- Official IRS 1095 forms

- Small minimum quantities

- Easy, affordable 1095 software

- Online filing with DiscountEfile.com

ACA-compliant 1095 filing to report on Healthcare Insurance status for employees. Employers with 50+ employees are required to file these forms.

Easy ACA 1095 form filing with the right options for printing, mailing and e-filing at discount prices.

Shop easy with The Tax Form Gals!

-

Blank Pressure Seal 1095 Forms – 14″ EZ Fold

-

1095 Envelopes for ComplyRight Format Forms Only

-

1095 Blank Paper with Instructions

-

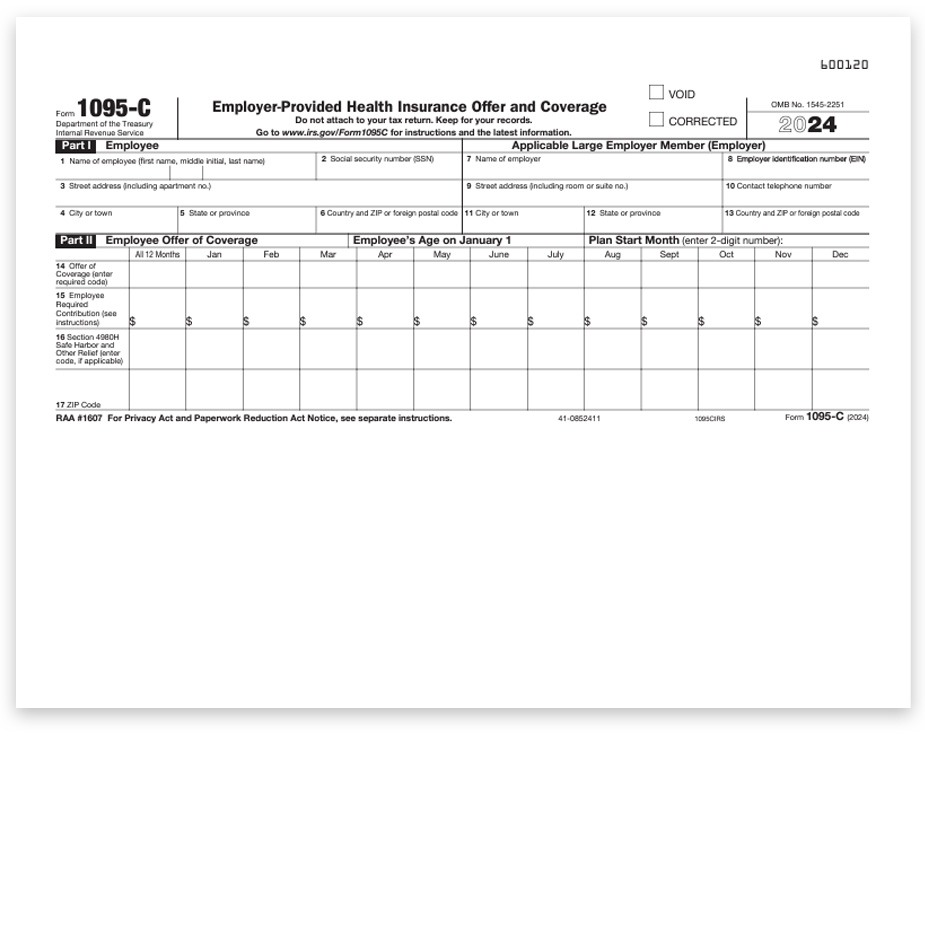

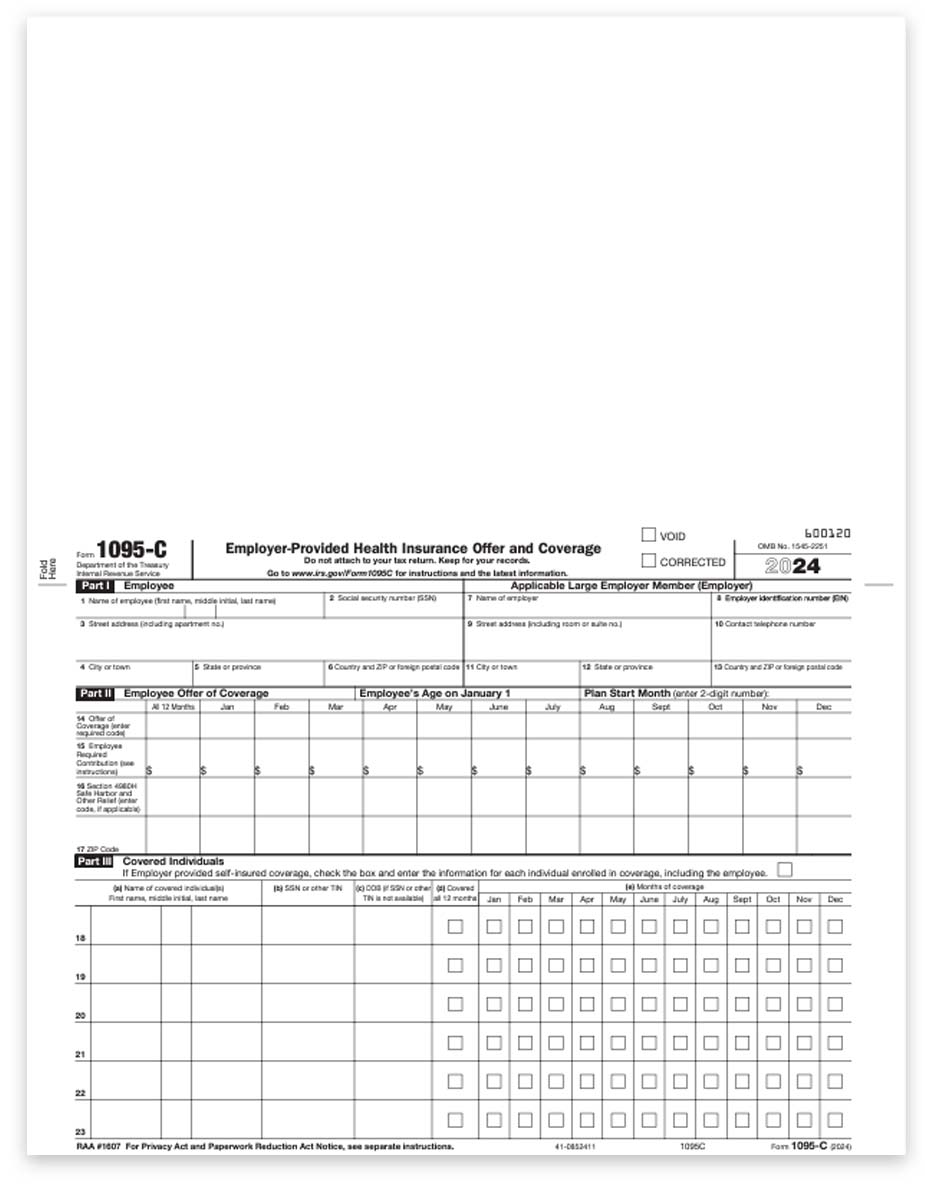

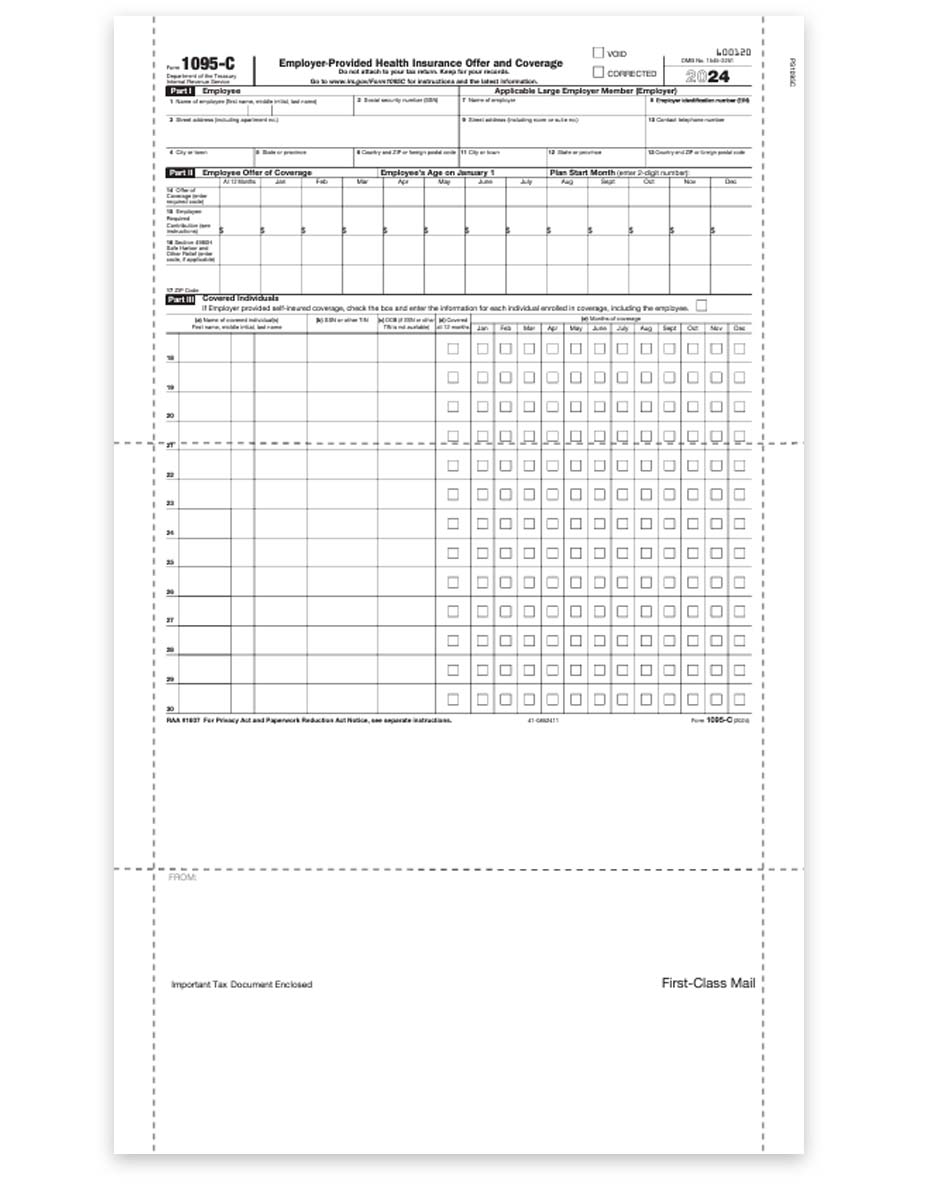

1095-C Form – IRS Half Sheet Format

-

1095-C Forms – ComplyRight Format

-

Pressure Seal 1095-C Form – 14″ EZ Fold

-

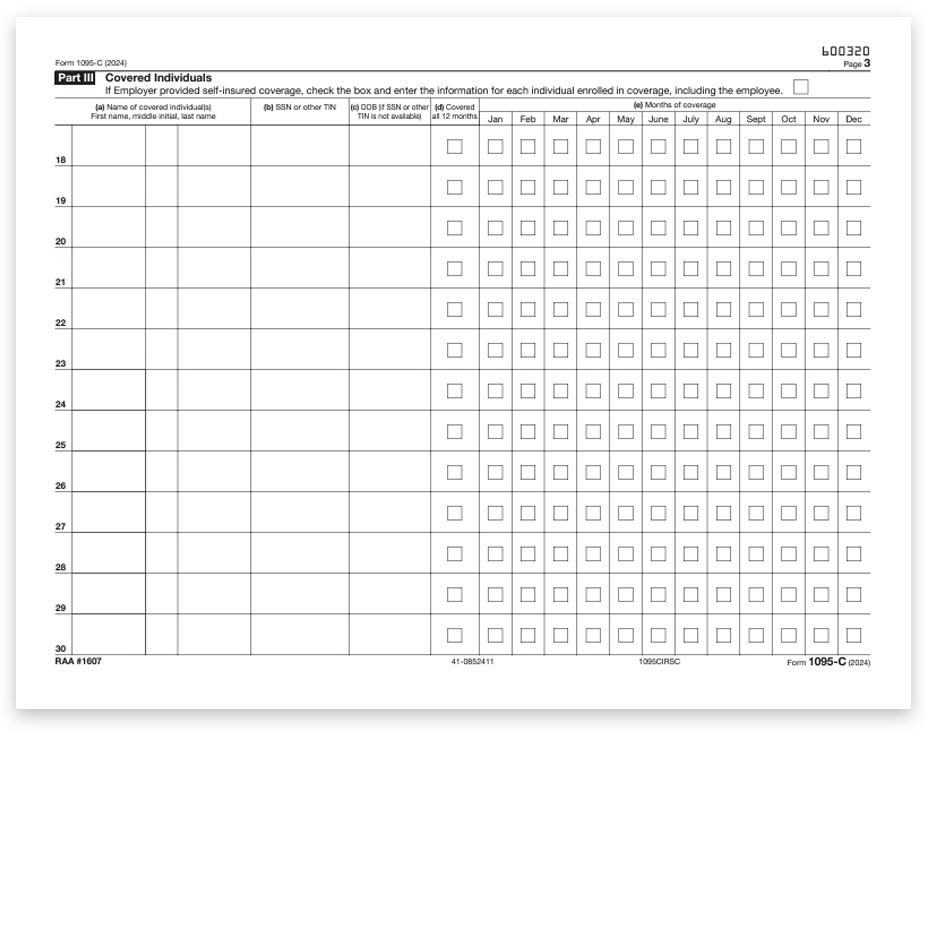

1095-C Dependent Continuation Forms – IRS Half Sheet Format

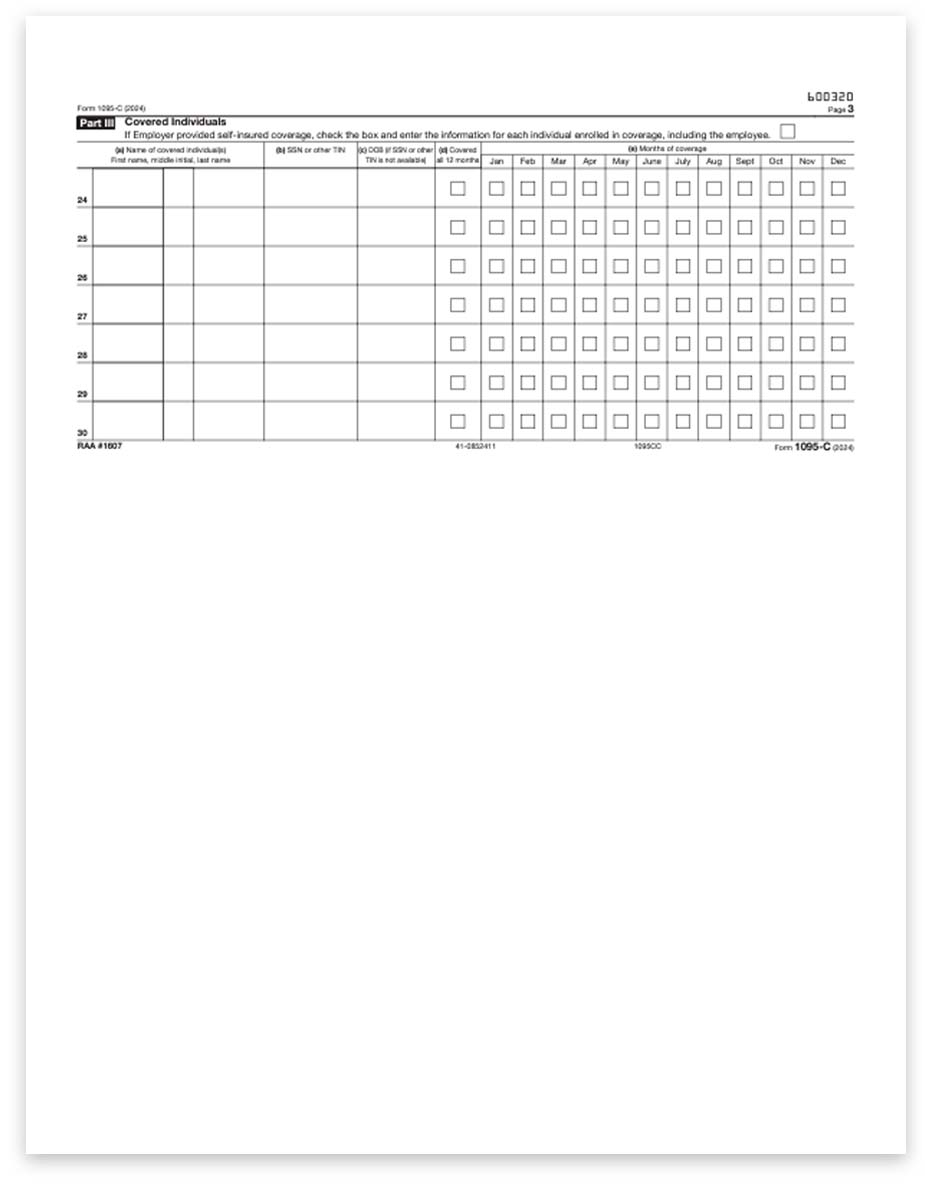

-

1095 Envelopes – Standard

-

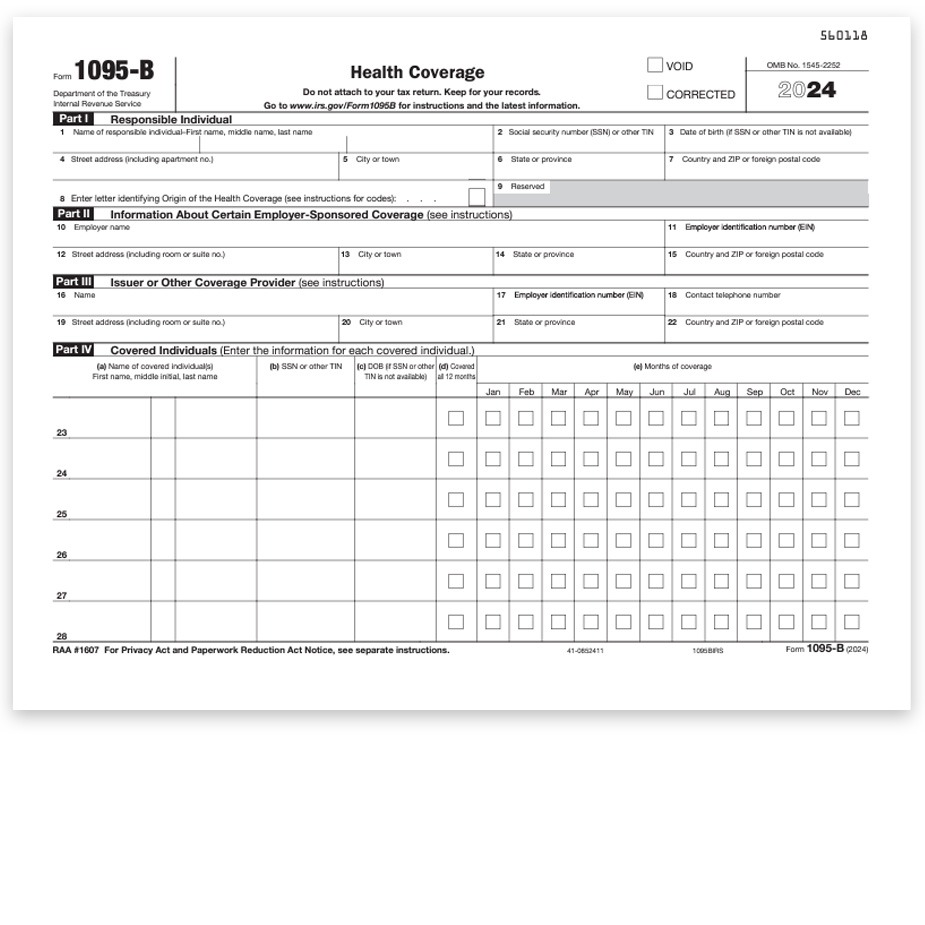

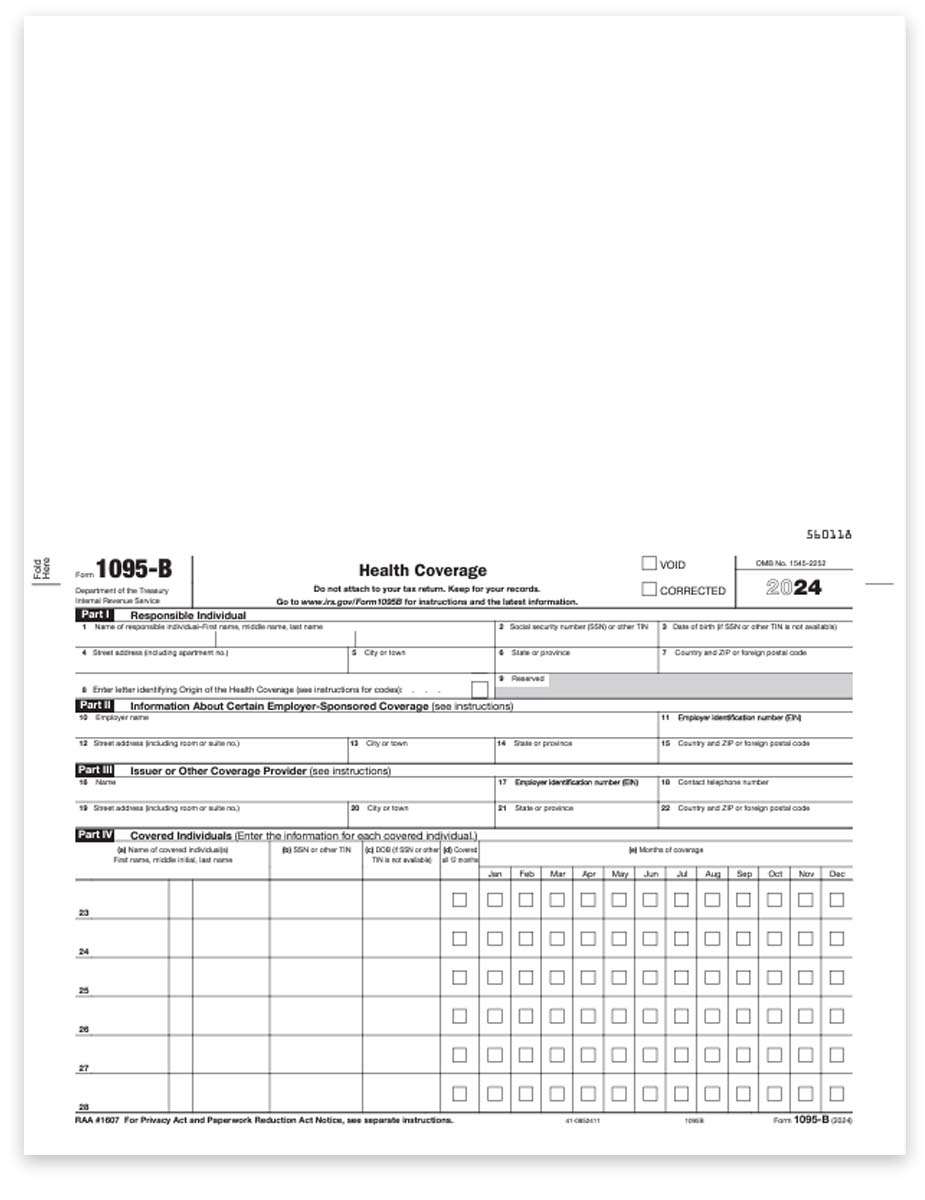

1095-B Forms – IRS Half Sheet Format

-

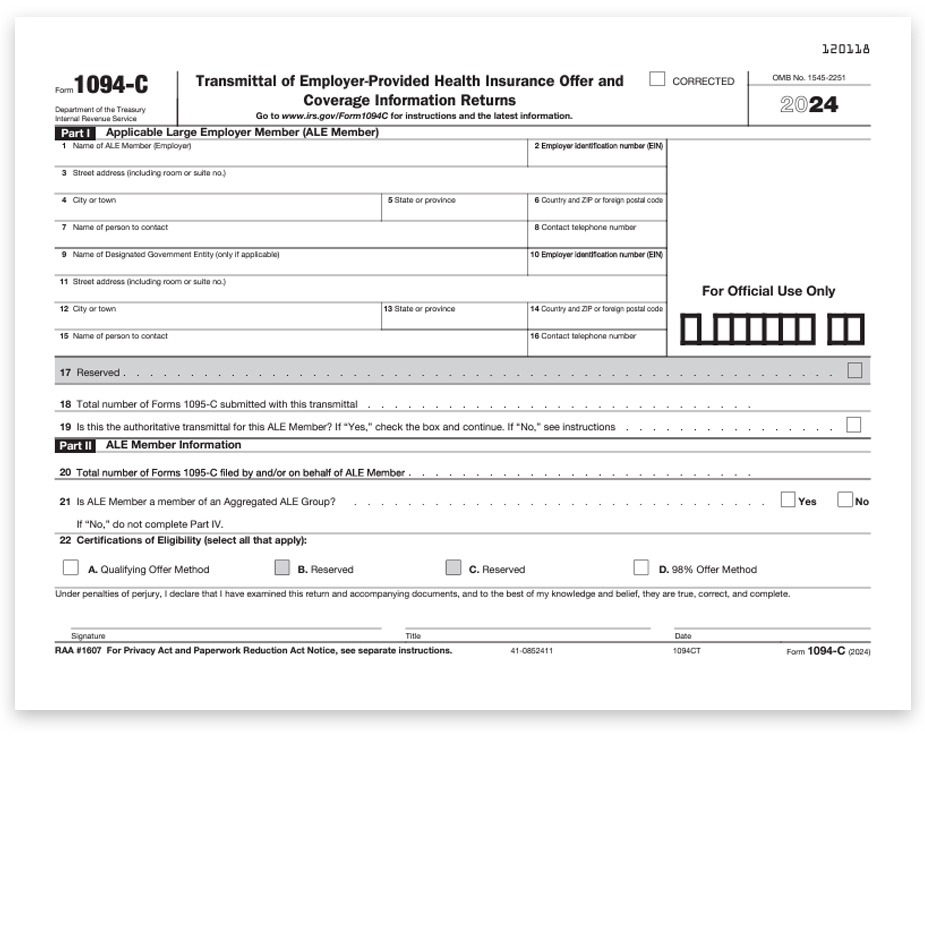

1094-C Form – Transmittal

-

1095-B Forms – ComplyRight Format

-

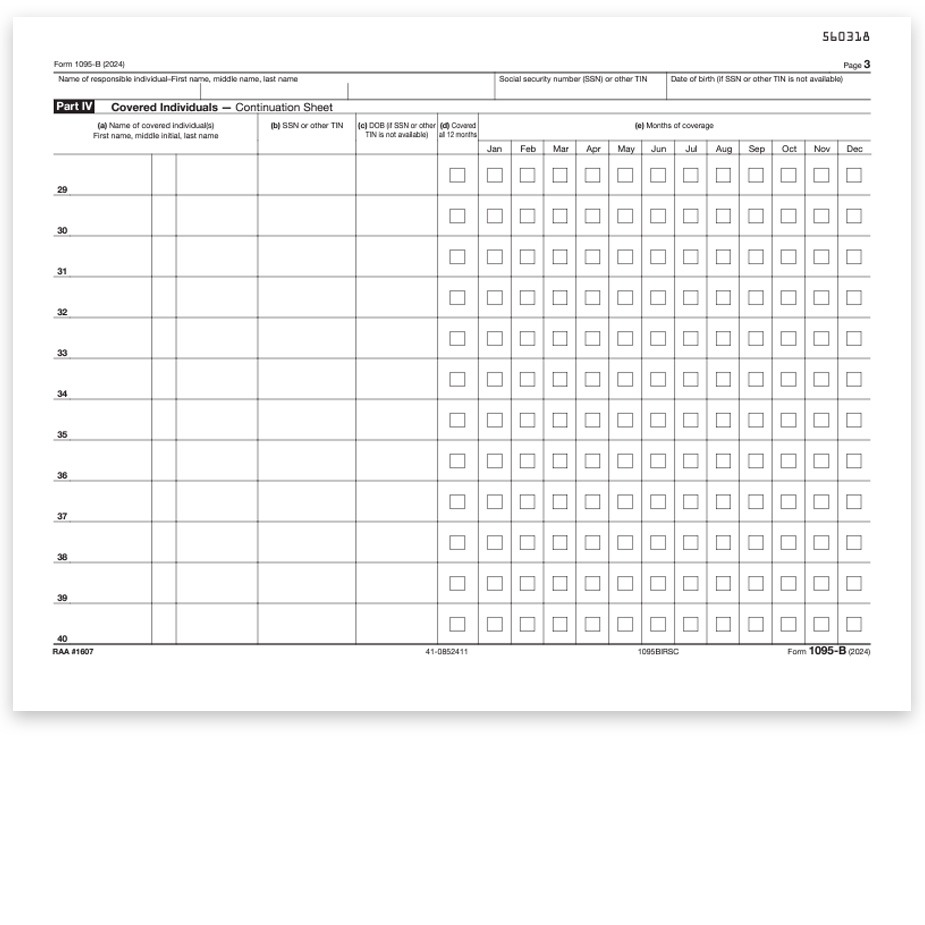

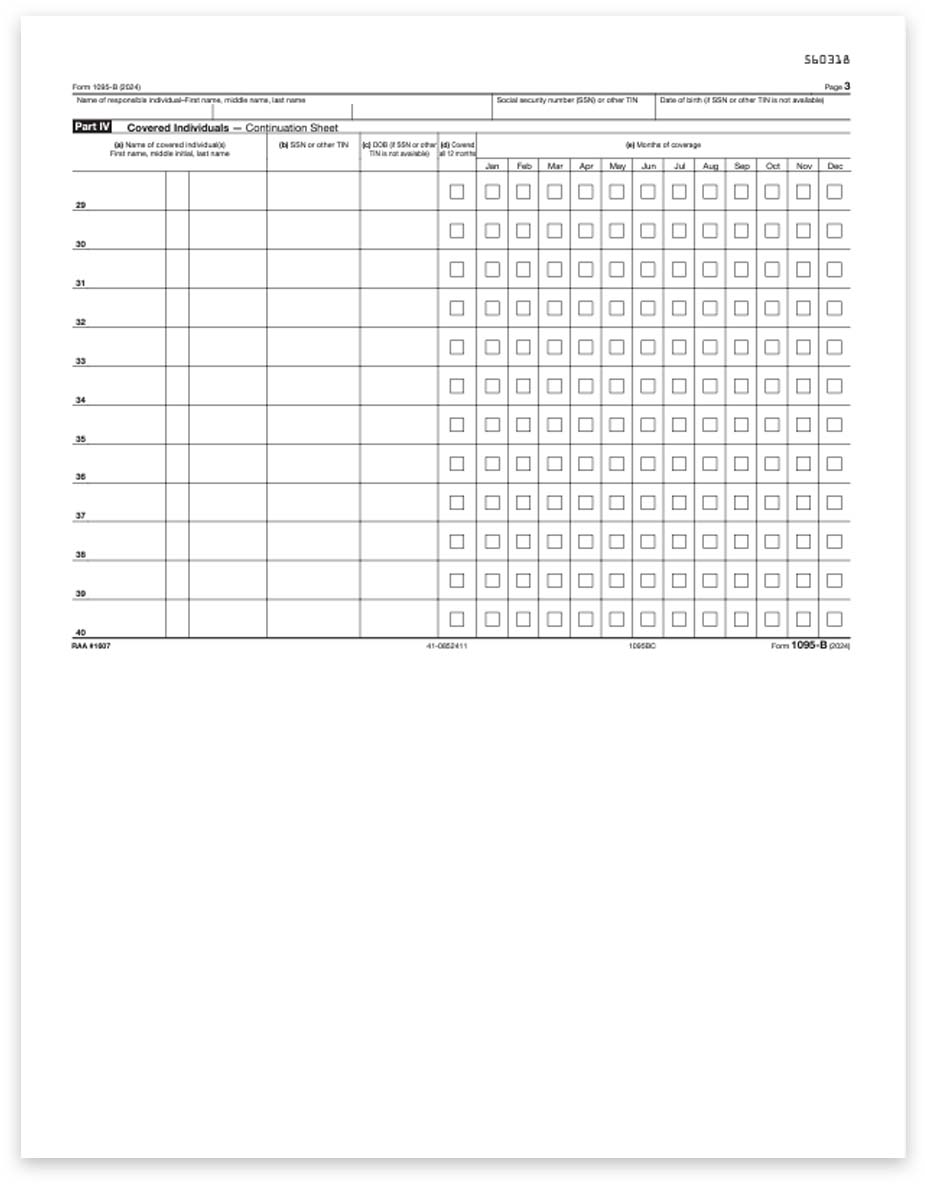

1095-B Continuation Forms – IRS Half Sheet Format

-

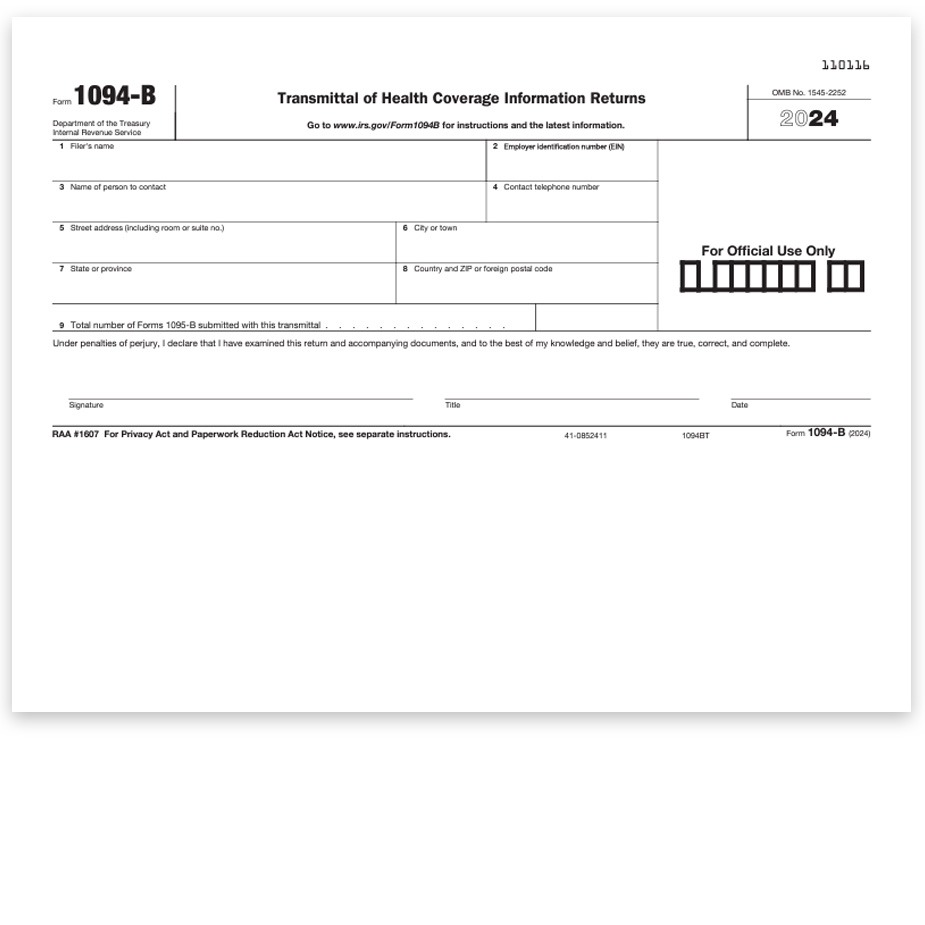

1094-B Form – Transmittal

-

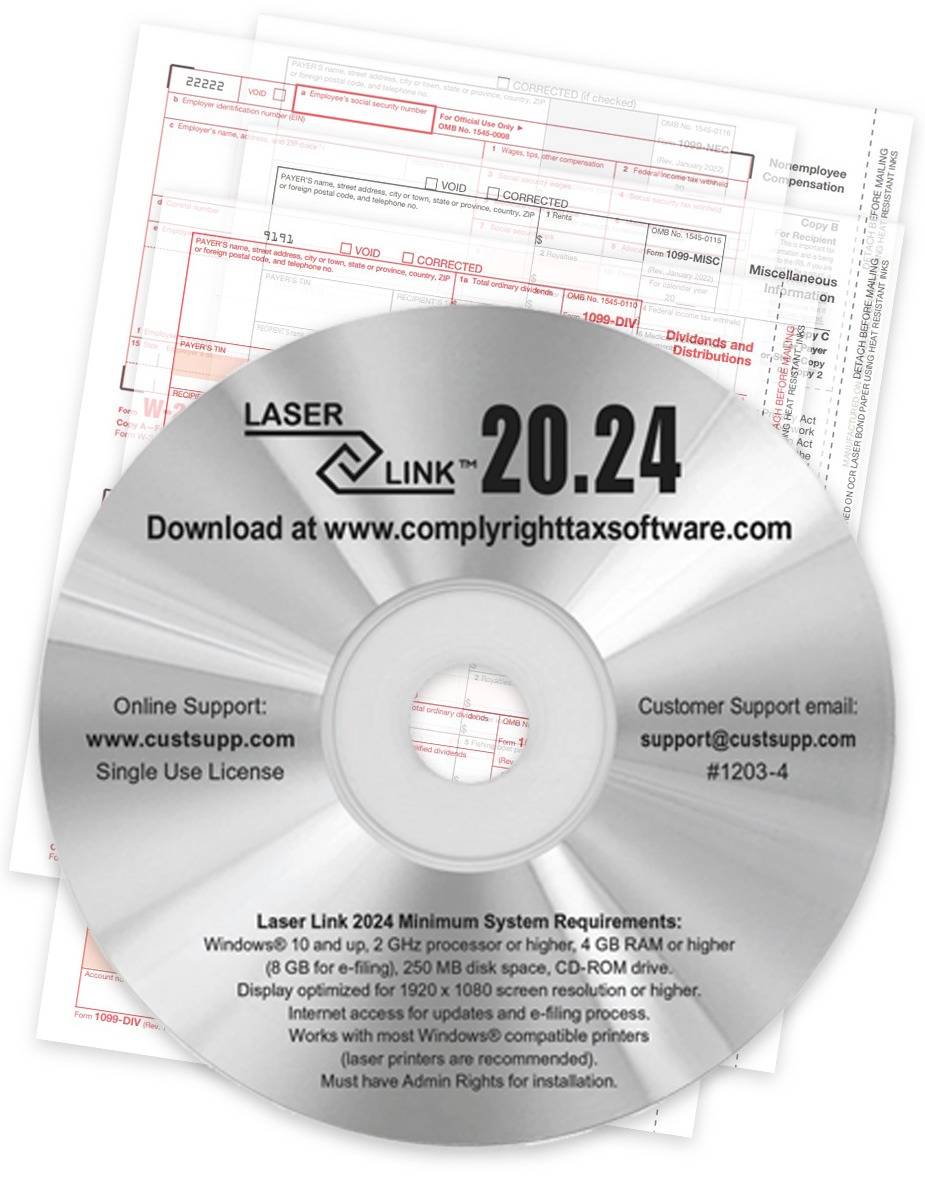

Laser Link 1099, W2 & 1095 Software + E-filing

$165.000 -

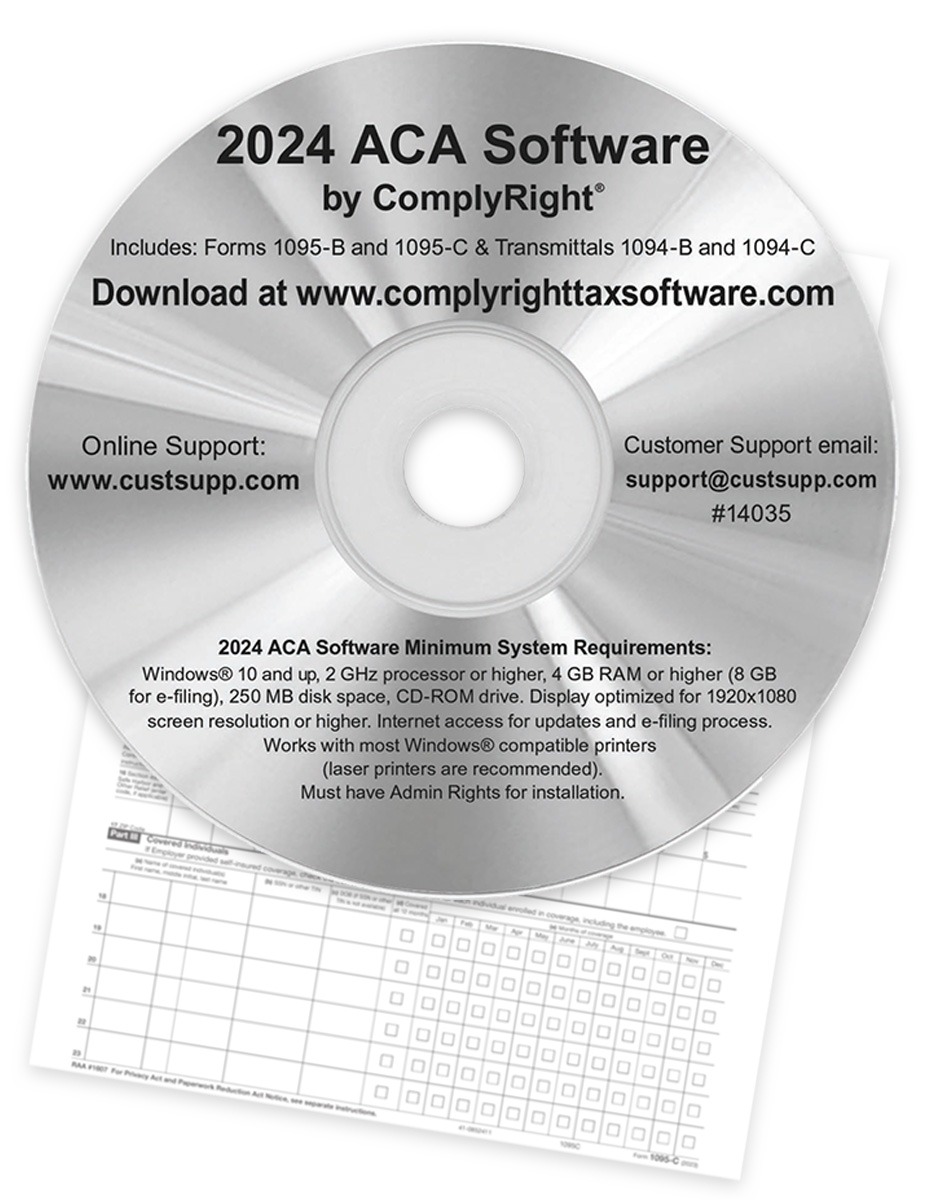

1095 Software for ACA Health Insurance Reporting

$165.000 -

1095-B Continuation Forms – ComplyRight Format

-

1095-C Continuation Forms – ComplyRight Format

Online 1095 Filing Eliminates the Hassle!

ACA 1095 Filing Requirements for Healthcare Insurance Coverage Reporting

As part of the Employer Shared Responsibility Rule of the Affordable Care Act (ACA), 1095 forms are required to be filed by employers and insurance companies to report individual health care coverage during a tax year.

Medium-to-large size businesses and health insurance companies need to file 1095 forms.

Who exactly needs to file:

- Employers with 50+ full-time employees (or full-time equivalent)

- Self-insured employers with fewer than 50 employees (a very small number of businesses)

- Health insurance companies

- Businesses can file these forms themselves, or outsource to a payroll company.

Forms 1095-B and 1095-C are used to report coverage information to the IRS and employees.

1095 forms include the following information:

- Enrolled employees and former employees

- Details of employees’ health insurance coverage

- Verification that the minimum essential coverage (MEC) requirement has been met.

Employees and their dependents will use this information to complete their personal tax returns – and those who do not have minimum essential coverage may receive a penalty on their tax returns.

1095-C is for applicable large employers with 50+ full time employees

1095-B is for self-insured employers and health insurance companies

1094-C and 1094-B are the summary transmittal forms

1095 forms must be filed with the IRS on paper or efile, and also provided to the employee.

[wptb id=627304]