Product Details

Software Compatible 1095 Envelopes

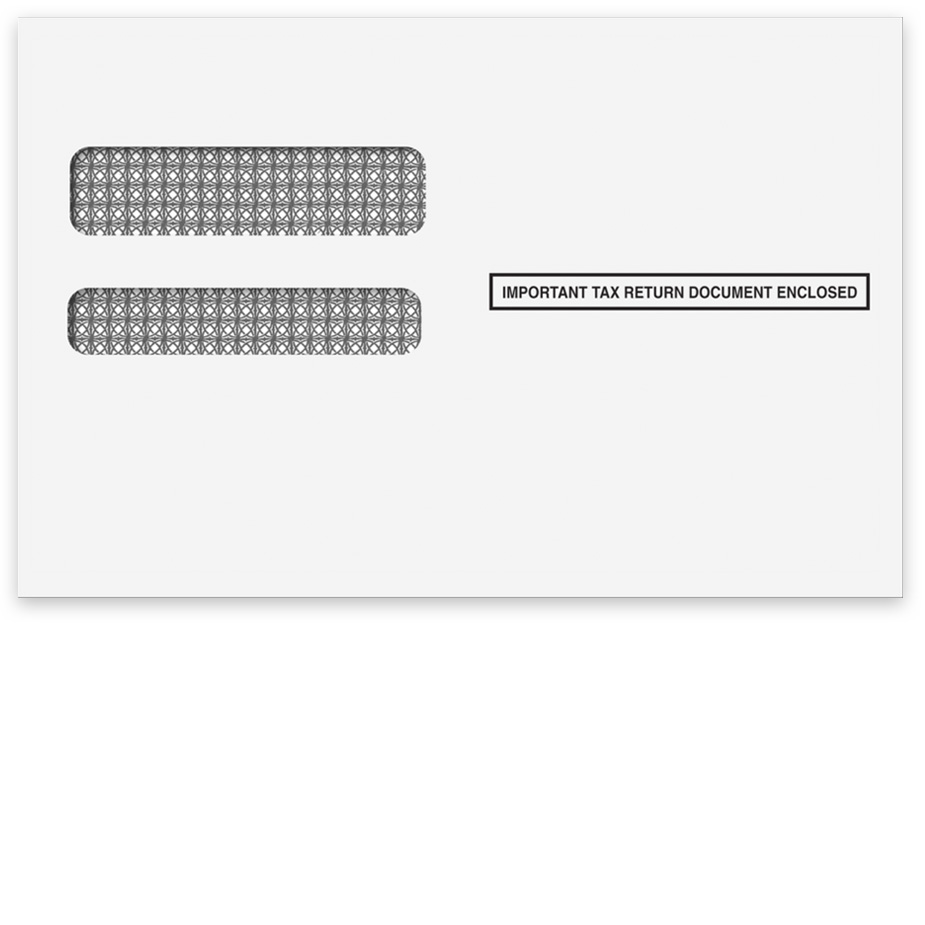

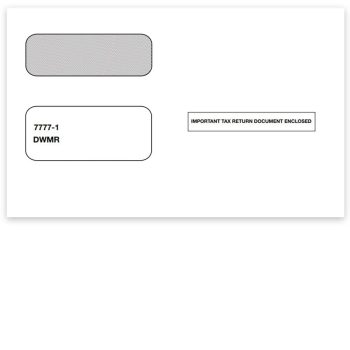

A 1095 envelope for most software systems. Use these envelopes to mail recipient copies of 1095C and 1095B ACA health care reporting forms to recipients when printed with many different software systems.

Tinted envelopes have 2 windows that ensure that no sensitive information is revealed.

Choose a moisture seal or self-sealing flap.

These envelopes ARE NOT COMPATIBLE with ComplyRight or IRS format forms.

1095 Envelope Specs:

- 5-3/4″ x 8-3/4″

- Security tint and cellophane windows ensure the privacy of information

- 28# envelope stock

- Printed with “Important Tax Information Enclosed”

- Flap opening: long

- Seal: moisture or self-sealing

- WINDOWS:

- Top Window Size: 3/4″ x 4-1/16″

- Top Window From Left Side: 3/8″

- Top Window From Bottom: 3-11/16″

- Bottom Window Size: 11/16″ x 3-7/8″

- Bottom Window From Left Side: 4-1/2″

- Bottom Window From Bottom: 2-5/8″

ACA Forms 1095 and 1094

New Forms 1095 &1094 for the Affordable Care Act

These new forms are required to report on employee health care coverage during the previous year. This is part of the Employer Shared Responsibility Rule of the Affordable Care Act.

The majority of businesses will need to file these forms!! Who needs to file:

- Employers with 50 or more full-time employees (or full-time equivalent)

- Self-insured employers with fewer than 50 employees (a very small number of businesses)

- Health insurance companies

Businesses can file these forms themselves, or outsource to a payroll company, just like W-2 forms.

Forms 1095-B and 1095-C are used to report to the IRS, and include the following information:

- Enrolled employees and former employees

- Details of employees’ health insurance coverage

- Verification that the minimum essential coverage (MEC) requirement has been met.

Employees and their dependents will use this information to complete their personal tax returns – and those who do not have minimum essential coverage may receive a penalty on their tax returns.

1095-C is for applicable large employers

1095-B is for self-insured employers and health insurance companies

1094-C and 1094-B are the summary transmittal forms

| | | | |

| Which months the insured and their family was covered under the plan. | Self-Insured Employers, with fewer than 50 full-time employees, that provides health insurance plans.

Insurance Carrier, for businesses with employer-sponsored group health insurance plans.

| Feb. 28 paper;

Mar. 31 e-file

| |

1094-B

Transmittal of Health Coverage | Summary transmittal record of

1095-B forms | Accompanies 1095-B forms when mailed to the IRS. | Feb. 28 paper;

Mar. 31 e-file | |

1095-C

Employer-Provided Insurance Offer and Coverage | Whether or not the employer offered health insurance coverage to employees. | Employers with 50 or More Full-Time Employees (applicable large employers). Both insured and self-insured issue 1095-C | Feb. 28 paper;

Mar. 31 e-file | |

1094-C

Transmittal of Employer-Provided Insurance Offer and Coverage | Summary transmittal record of

1095-C forms | Accompanies 1095-C forms when mailed to the IRS. | Feb. 28 paper;

Mar. 31 e-file | |

Applicable Large Employers are those with 50 or more full-time employees, including full-time equivalent employees.

These employers must file information returns with the IRS and also provide statements to full-time employees about health coverage the employer offered or to show the employer didn’t offer coverage.

Use the HealthCare.gov FTE Employee Calculator for more information.

To be prepared to report this information to the IRS and issue the new Form 1095C to employees, you’ll need to:

- Determine if your organization is an applicable large employer.

- Determine the kind of health insurance coverage you offered to full-time employees and their dependents, if any.

- Identify who your full-time employees are for each month and track health coverage information in 2015 to help complete new IRS forms.

Are you an applicable large employer?

Your organization is an applicable large employer if you or other entities that must be combined together with your organization (for instance, other members of an aggregated group) employed an average of at least 50 full-time employees, including full-time equivalent employees, on business days during the preceding calendar year.

To determine if your organization is an applicable large employer for a year, count your organization’s full-time employees, full-time equivalent employees and, if you are a member of a combined group, the full-time employees and full-time equivalent employees of all members of the group for each month of the prior year and then average the numbers for the year.

An aggregated group is commonly owned or otherwise related or affiliated employers, which must combine their employees to determine their workforce size.

Which employees count?

Employers average the number of employees across the months in the year to see whether they will be an applicable large employer for the next year.

In general: A full-time employee is an employee who is employed on average, per month, at least 30 hours of service per week (or at least 130 hours of service in a calendar month).

A full-time equivalent employee is a combination of employees, each of whom individually is not a full-time employee (has fewer than 30 hours of service per week), but who, in combination, are equivalent to a full-time employee.

Getting Ready: Monthly Tracking

To prepare for 1095 reporting, applicable large employers need to track information each month, including:

- Whether you offered full-time employees and their dependents minimum essential coverage that meets the minimum value requirements and is affordable.

- Whether your employees enrolled in the self-insured minimum essential coverage you offered.

You need to track this information because you could be subject to an employer shared responsibility payment if either:

- You offered coverage to fewer than 95% of your full-time employees and their dependents and at least one full-time employee enrolled in coverage through the Health Insurance Marketplace and receives a premium tax credit, or

- You offered coverage to at least 70% of your full-time employees and their dependents, but at least one full-time employee receives a premium tax credit (because coverage offered was not affordable, did not provide minimum value or the full-time employee was not offered coverage).

Tips for Completing the Forms

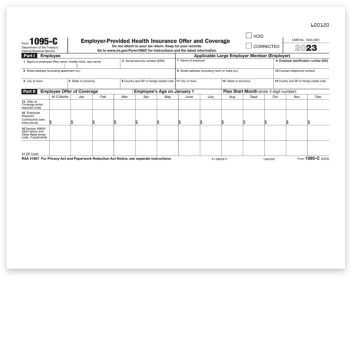

Form 1095-C: Employer Provided Health Insurance Offer and Coverage

What You Need to Do:

- Provide to full-time employees to use when filing their tax returns.

- File with the IRS as an information return.

What Form 1095-C Reports:

- Information about health insurance coverage offered and any safe harbors or other relief available to the employer, or reports that no offer of coverage was made.

- Enrollment information from employers who offer self-insured plans and information about employees and individuals who enrolled in minimum essential coverage.

How Form 1095-C Is Used:

- Helps the IRS determine if your organization potentially owes an employer shared responsibility payment to the IRS.

- Helps the IRS determine whether your full-time employees and their dependents are eligible for the premium tax credit.

What You Need for Form 1095-C:

- Who is a full-time employee for each month.

- Identifying information for employer and employee, such as name and address. Information about the health coverage offered by month, if any.

- The employees share of the monthly premium for lowest-cost self-only minimum value coverage.

- Months the employee was enrolled in your coverage.

- Months the employer met an affordability safe harbor with respect to an employee and whether other relief applies for an employee for a month.

- If the employer offers a self-insured plan, information about the covered individuals enrolled in the plan, by month.

Form 1094-C: Transmittal of Employer Provided Health Insurance Offer and Coverage Information Returns

What You Need to Do:

File with the IRS as a transmittal document for Forms 1095-C, Employer Provided Health Insurance Offer and Coverage.

What Form 1094-C Reports:

Provides a summary to the IRS of aggregate employer-level data.

How Form-1094-C Is Used:

Helps the IRS determine whether an employer is subject to an employer shared responsibility payment and the proposed payment amount.

What You Need for Form 1094-C

- Identifying information for your organization.

- Information about whether you offered coverage to 95% of your full-time employees and their dependents.

- For the authoritative transmittal Total number of Forms 1095-C you issued to employees.

- Information about members of the aggregated applicable large employer group, if any.

- Full-time employee counts by month.

- Total employee counts by month.

- Whether you are eligible for certain transition relief.

Reviews

There are no reviews yet.