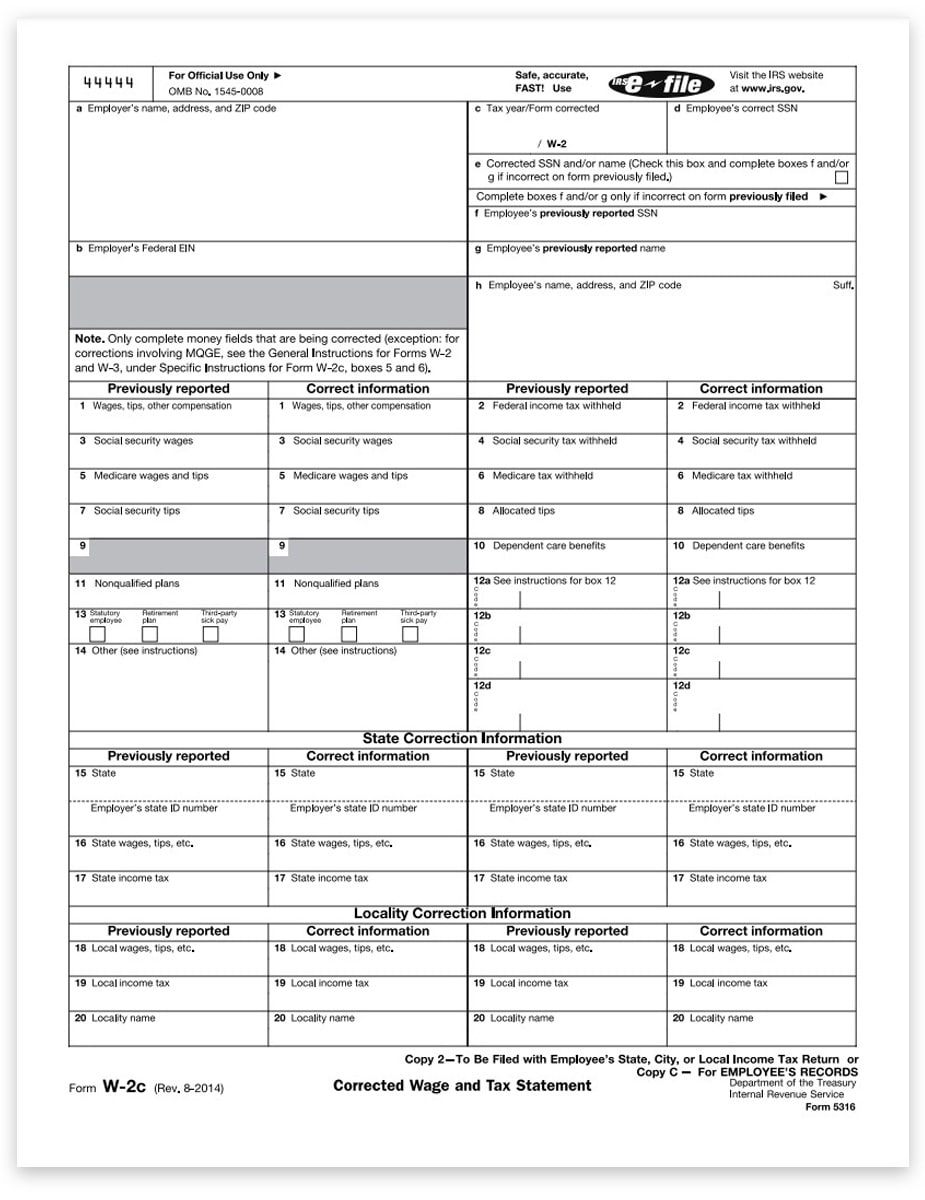

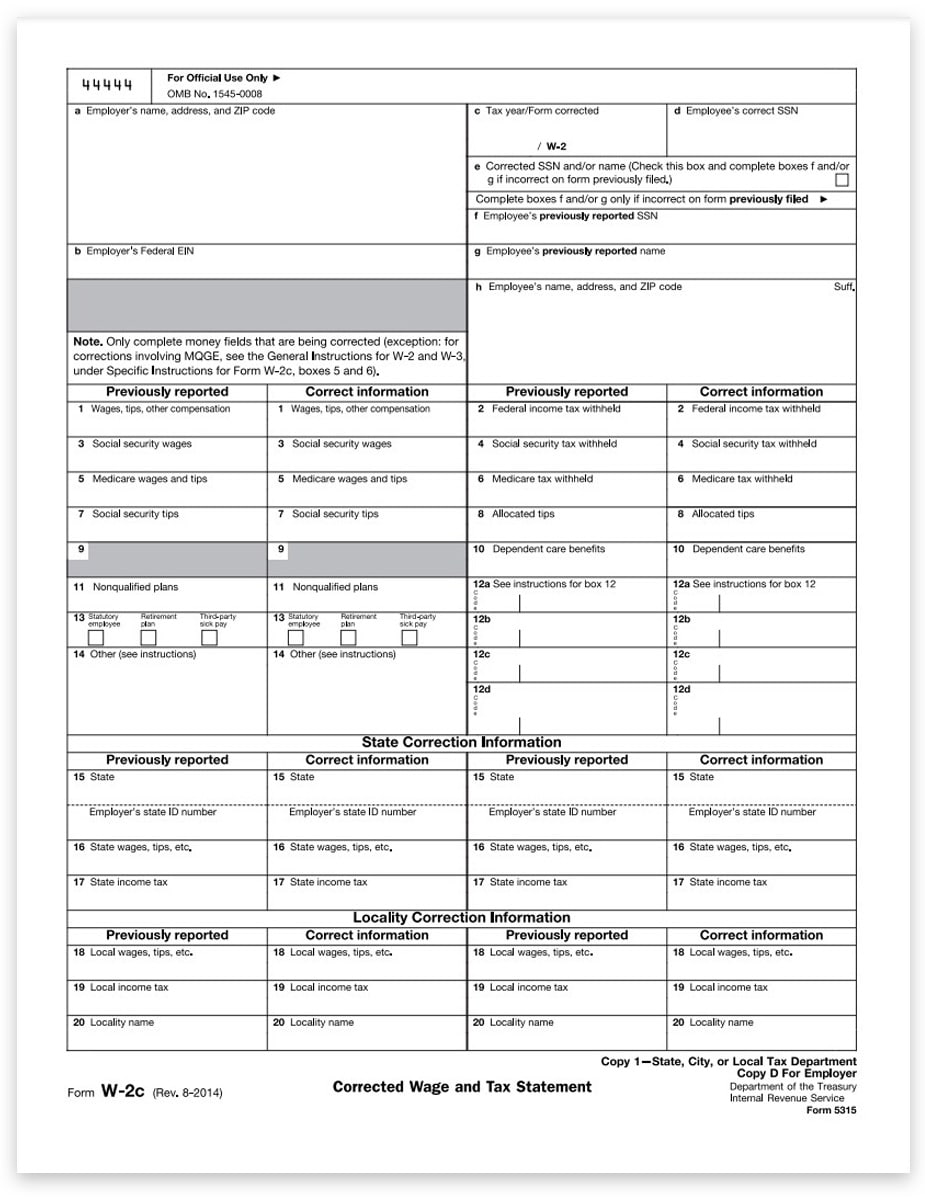

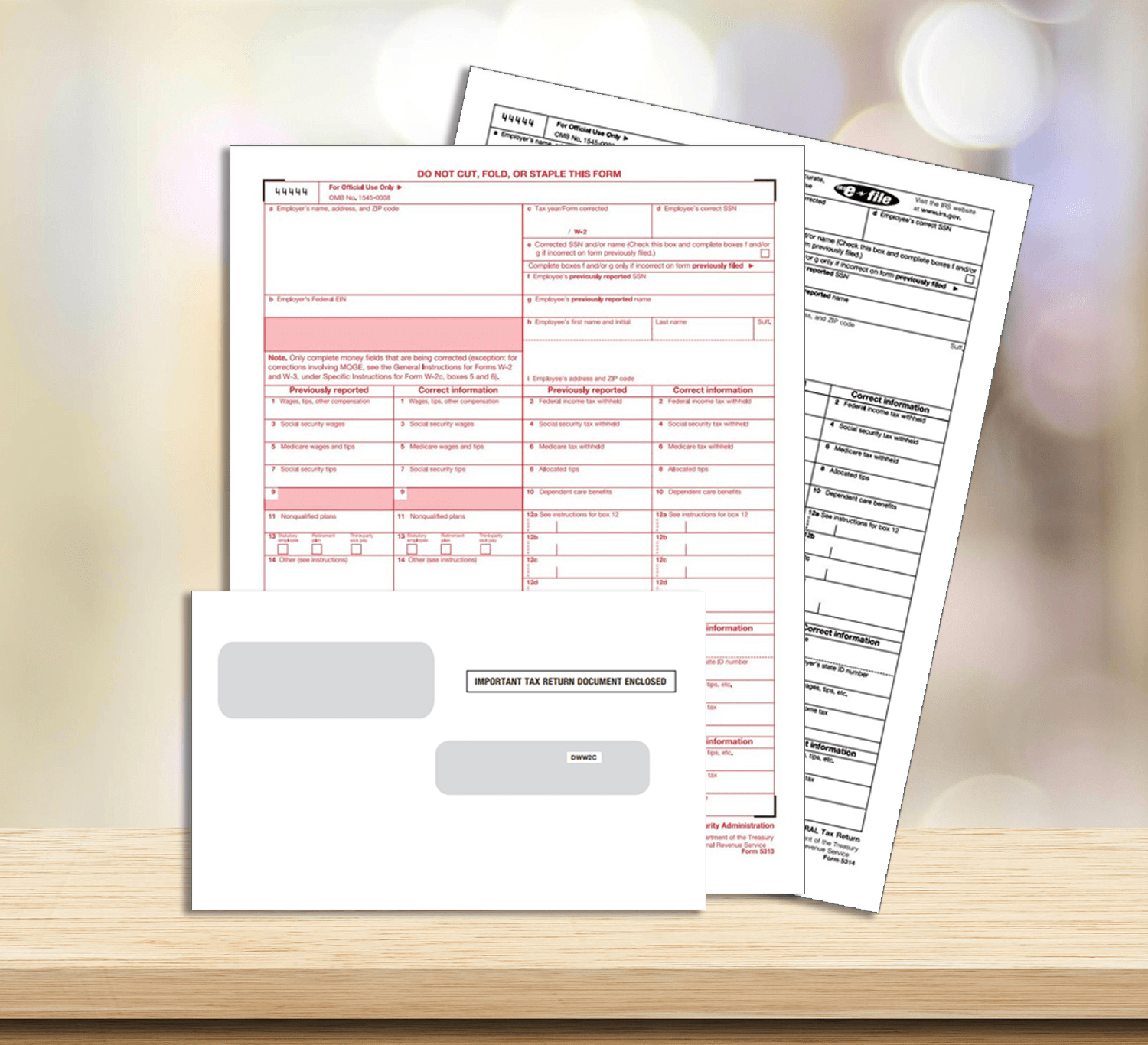

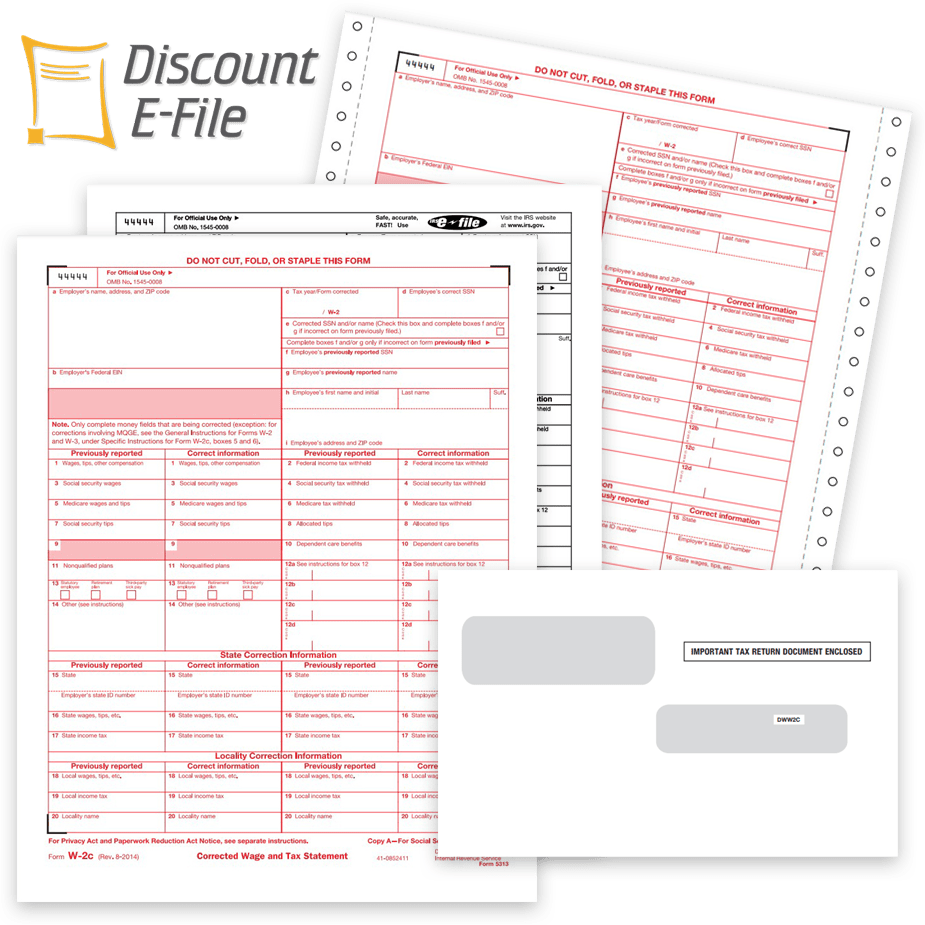

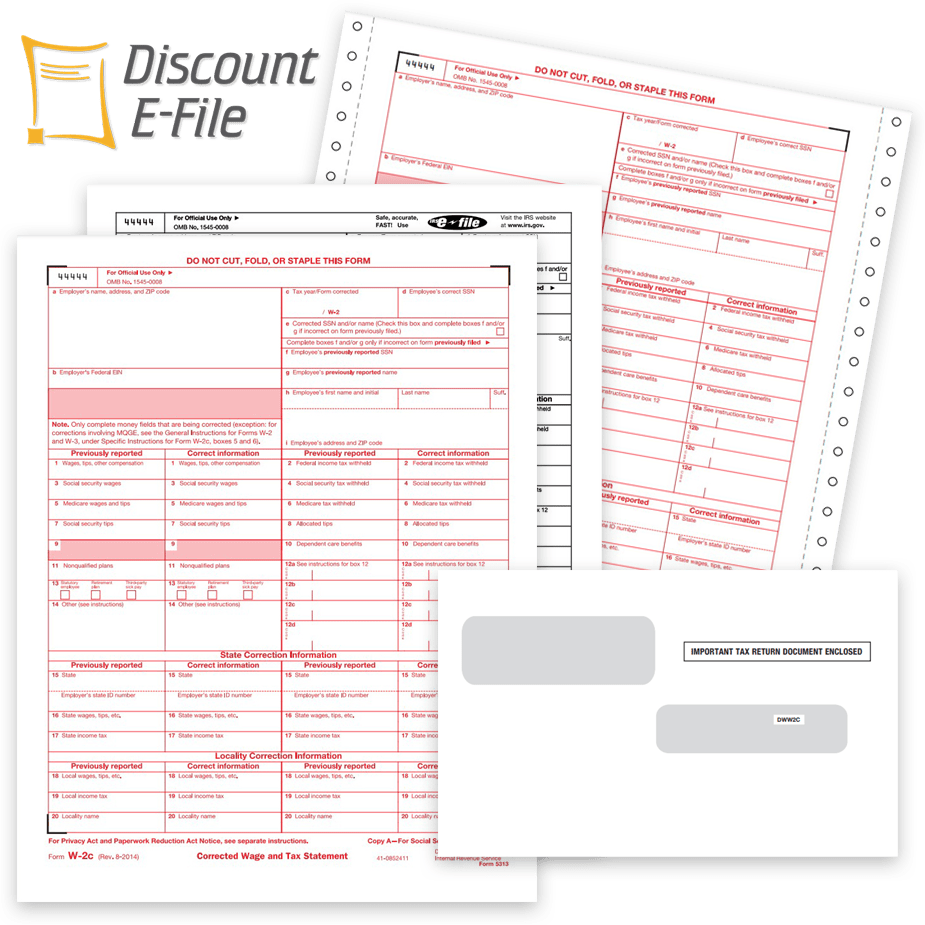

W-2C Correction Forms

Order W2C forms and envelopes for filing corrected W2 tax forms.

Need to correct a W2 form for an employee? We have everything you need!

Buy W2C forms and envelopes, or use our easy online W2C filing system and we’ll take care of everything for you.

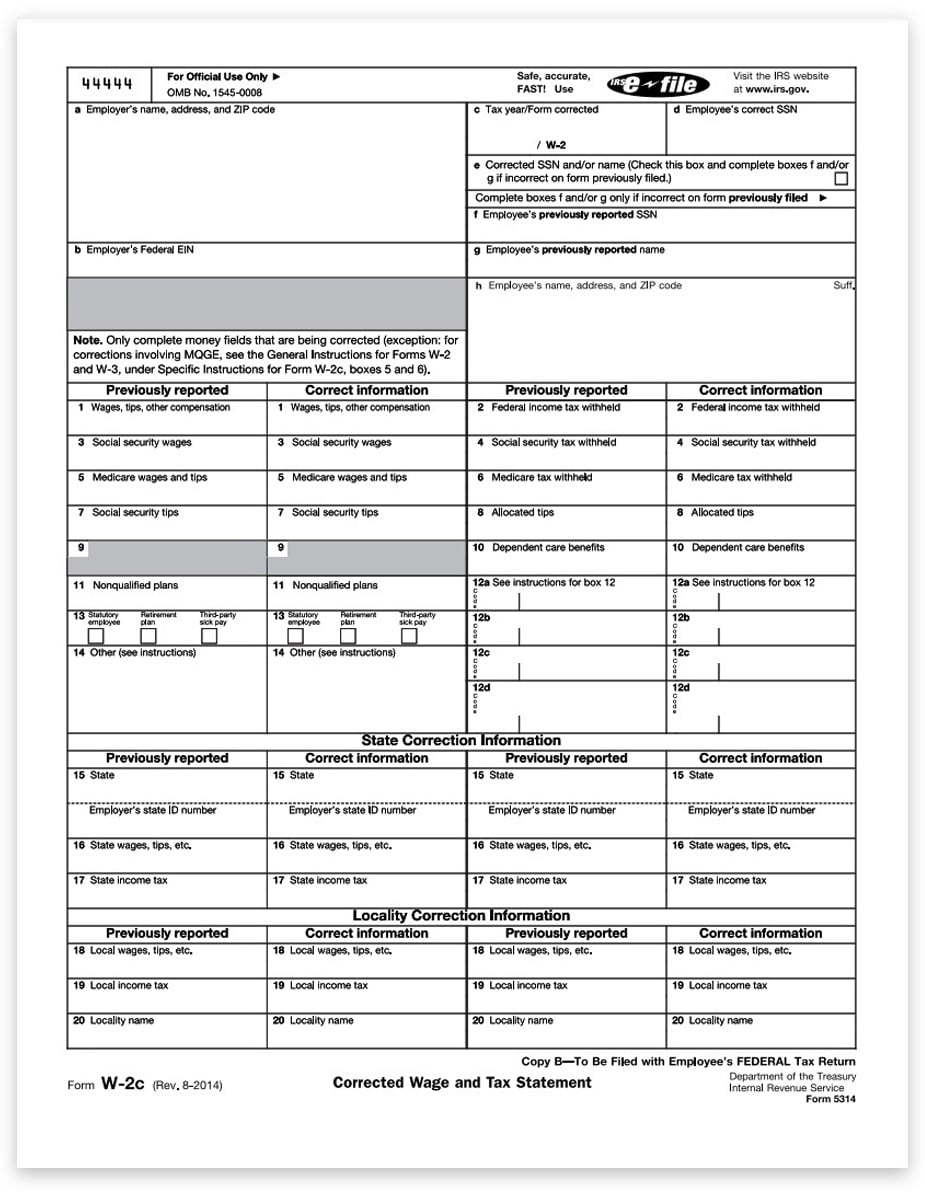

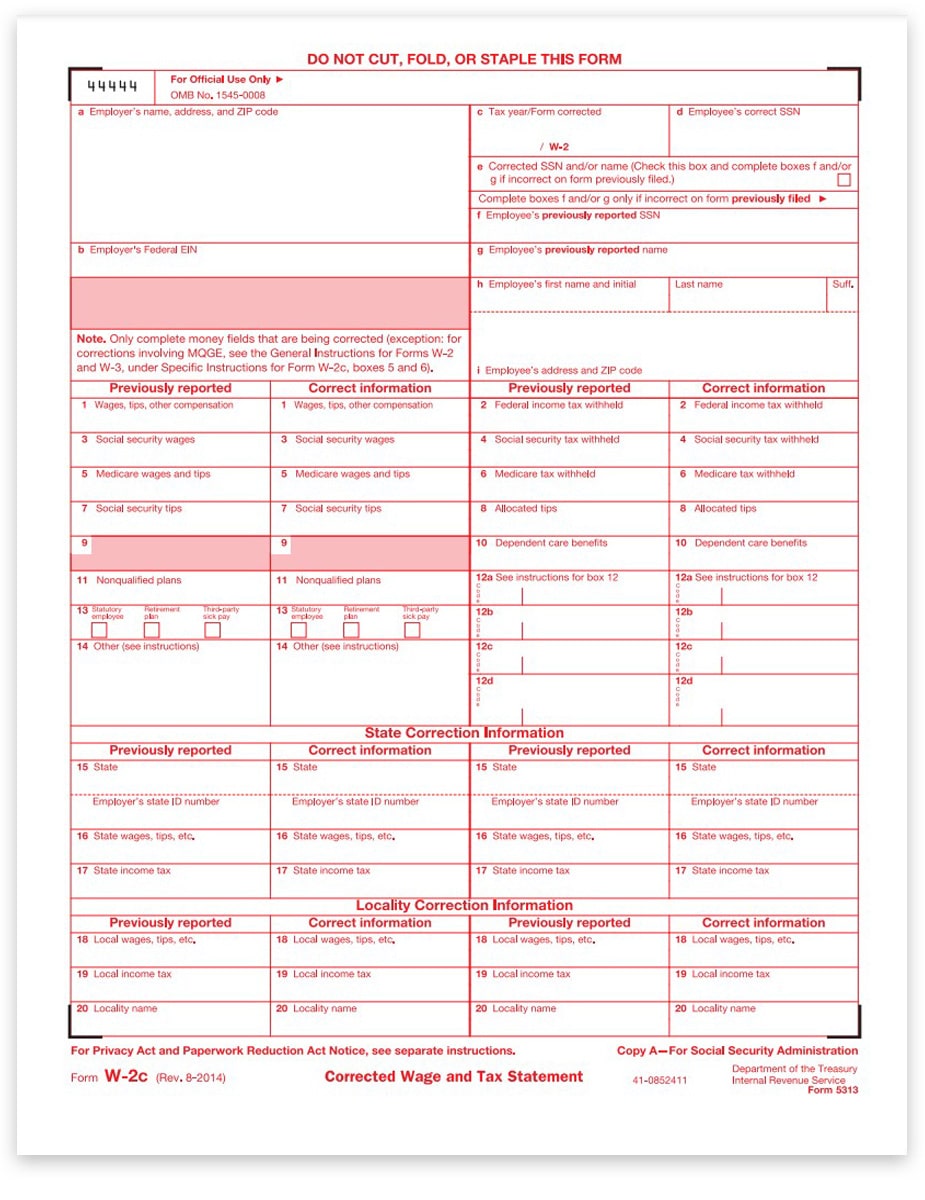

- Buy W2C correction tax forms at discount prices – no coupon needed

- Laser or continuous W2-C forms available

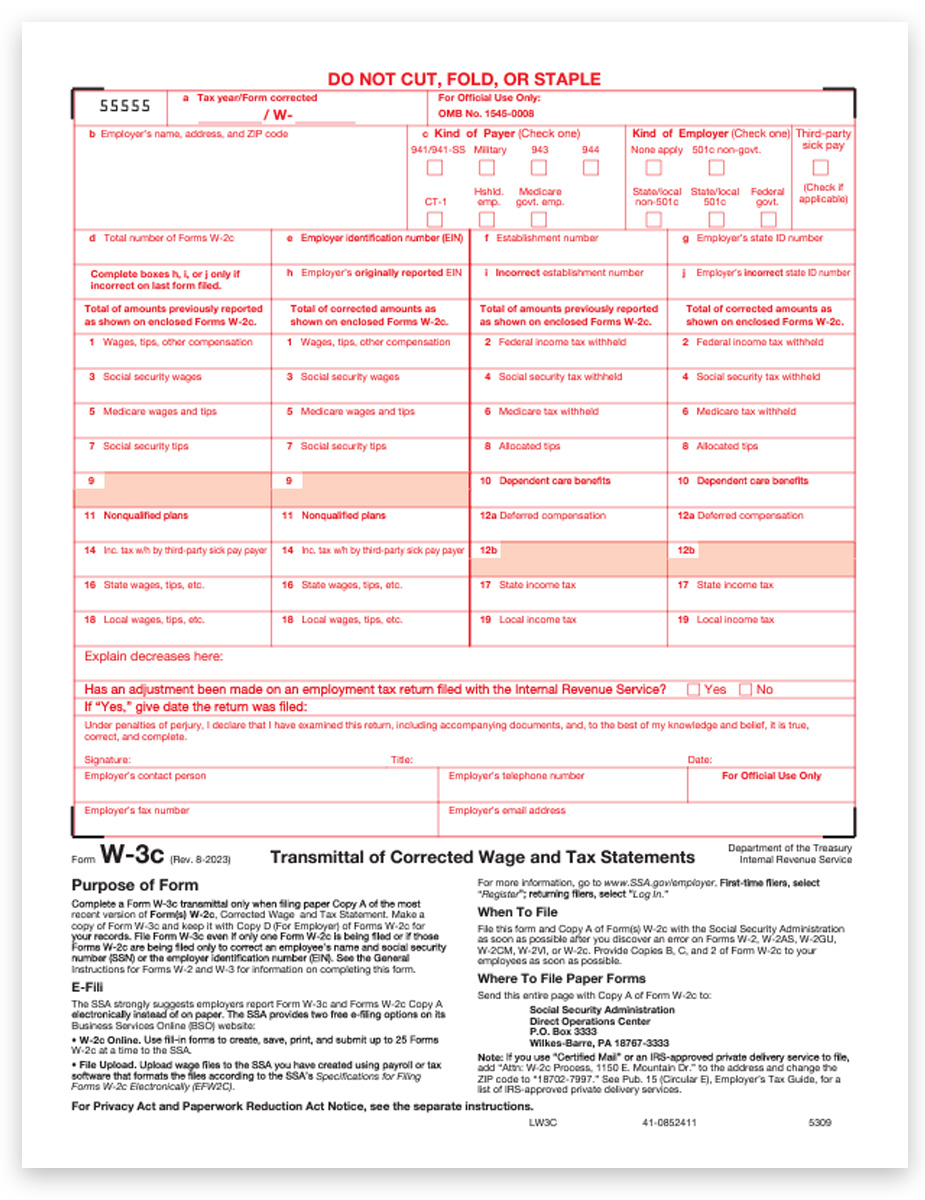

W2C filing requirements — you must file Correction forms in the same manner as the original W2 via paper or e-file

Correcting W2 forms is easy with official W2C forms and envelopes, or an option to file everything online and save time.

Shop easy with The Tax Form Gals!

Have W2C Filing Questions?

Read our latest blog post about filing W2C correction forms.

The process is similar to filing standard W2 forms. You’ll need the employer and employee information from the original, and enter it, along with the corrected data.

The first question to ask is “have you already filed the W2 with the SSA?”

W2C Online Filing Eliminates the Forms!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.

Where to Buy 1099 & W2 Forms?

Buy 1099 & W2 forms from a fellow small business for discount prices and expert service – The Tax Form Gals at Discount Tax Forms!