Blog

Expert insights to

easy 1099 & W2 filing.

How to Correct a W2 Form

Easy W2C Filing Methods and Instructions for correcting W2 forms.

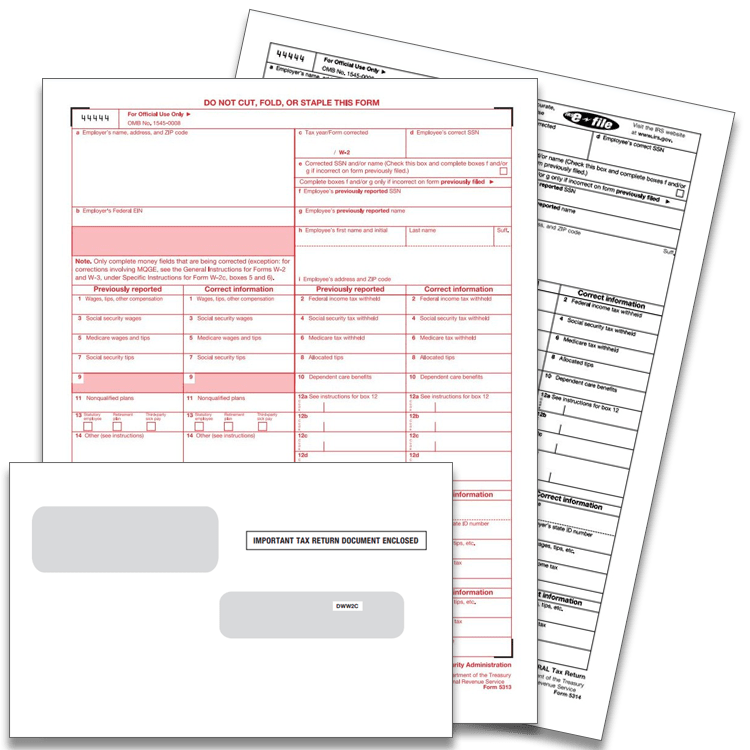

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form).

This is different than a standard W2 form, and requires a few additional steps. You’ll need to fill in all of the fields, once for the information originally filed, and once for the correct information (if applicable).

But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

Correcting a W2 form that has already been filed with the SSA

If you have already mailed W2 Copy A to the SSA, or e-filed is using any W2 e-filing system, you will need to complete and file W2C forms for the SSA, employer and employee.

Use Form W-2 C to:

- Correct errors on Form W-2 or W-2 C filed with the Social Security Administration (SSA).

- Provide a corrected Form W-2 to employees.

BUT WAIT!!! There is an easier way to file W2C Correction forms…

Instead of ordering forms, printing and mailing them, you can do it all online! Our DiscountEfile.com system allows you to file W2C forms easily, even if you didn’t use it to file the original forms.

Simply enter data for the employer (payer) and the employee (recipient) information, the original and corrected data, then we’ll do the rest!

DiscountEfile will automatically and securely e-file with the SSA and mail recipient copies.

Set up a free account today, try it out and only pay for the forms you actually submit online.

Online W2C filing is available all year long!

Correcting a W2 form that has NOT yet been filed with the SSA

If you discover a mistake on an employee’s W2 form, but have NOT mailed Copy A to the SSA or efiled it, you DO NOT need a W2C form! Only use W2C if the SSA copy has already been filed.

To correct a W2 form in this instance, simply reprint the W2 with the corrected information and provide that to the employee and when filing it with the SSA.

Helpful Hints for W2C Filing from the SSA

It’s important to correct a W2 form as soon as possible after you discover an error!

File Forms W-2c (Corrected Wage and Tax Statement) and W-3c (Transmittal of Corrected Wage and Tax Statement) with the SSA as soon as possible after you discover the error. Also provide a W-2c Form to the employee.

- To correct a Form W-2 you have already submitted to the SSA, file a Form W-2c with a separate Form W-3c for each year needing correction.

- File a Form W-3c whenever you file a Form W-2c, even if you are only filing a Form W-2c to correct an employee’s name or Social Security number (SSN).

Follow the General Instructions for Forms W-2c/W-3c.

If you expect to file 250 or more W-2cs during a calendar year, you are required to file them electronically with SSA.

If any item shows a dollar amount change and one of the amounts is zero, enter “-0-“. Do not leave the box blank.

If you reported your EIN incorrectly, please file a W-3c to correct it. Make sure you use the Employer Identification Number (EIN) issued by IRS on all Forms W-2c/W-3c.

Use our DiscountEfile.com system to easily file W2 & W2C forms – whether its a few or hundreds!