Blog

Expert insights to

easy 1099 & W2 filing.

Blog Posts on QuickBooks® 1099 & W2 Forms & Filing

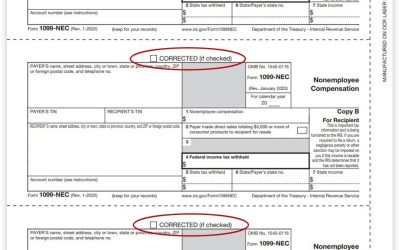

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

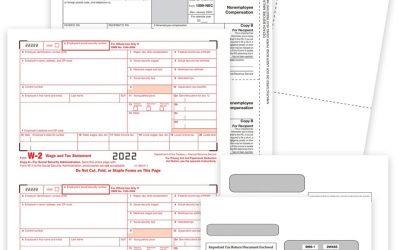

How to Correct W2 Forms

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

The Myth of the QuickBooks Coupon Code

Good luck getting your hands on a QuickBooks coupon code! If you need to file 1099 and W2 tax forms, your bank account isn’t going to like the prices charge by Intuit. Look to Discount Tax Forms for lower prices every day!

How to File1099-MISC Forms with QuickBooks®

Instructions for printing 1099 forms from QuickBooks® software.

How to File W-2 Forms with QuickBooks®

Instructions for printing W2 forms from QuickBooks® software.