Blog

Expert insights to

easy 1099 & W2 filing.

How to Correct a 1099 Form

Easily File a Correction for Any Type of 1099 Form!

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

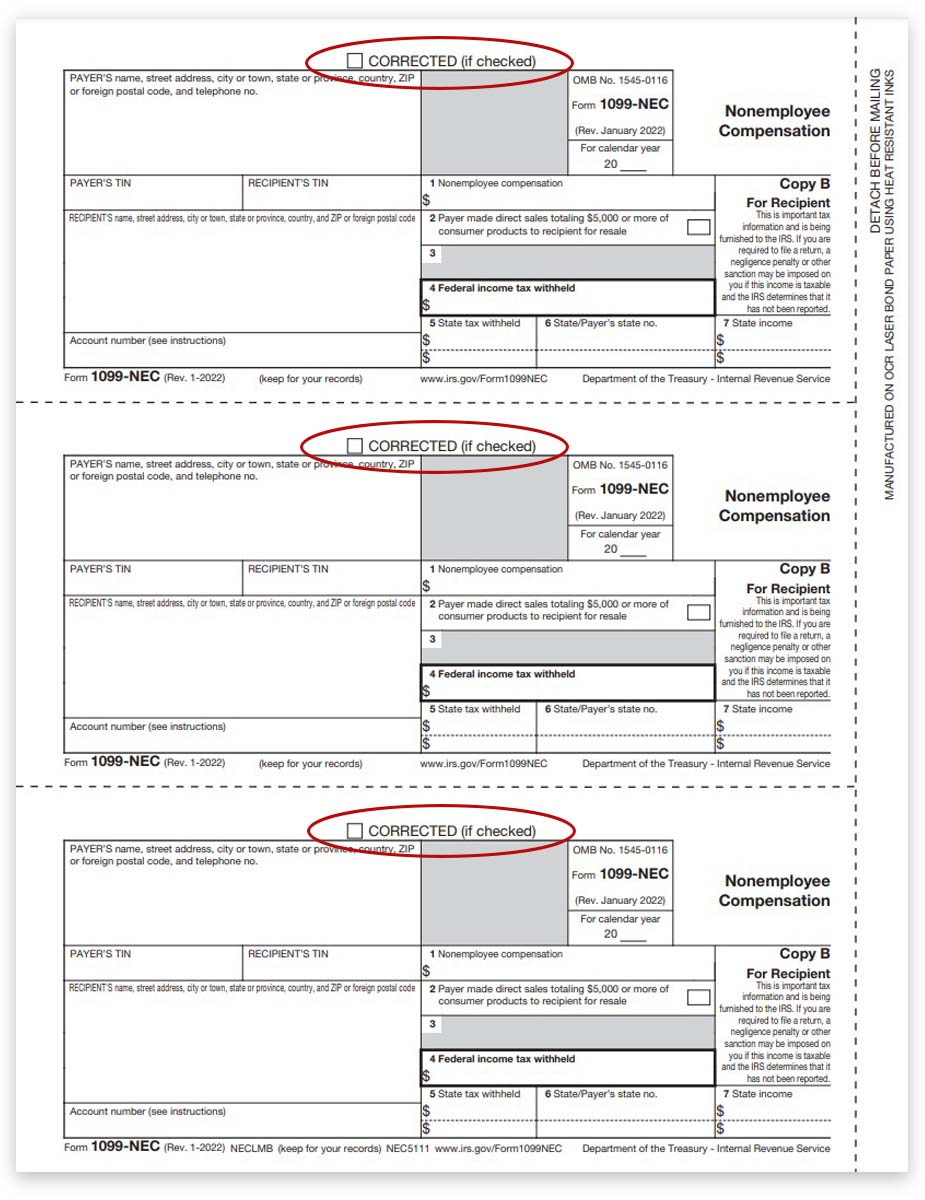

The only difference is a simple “Corrected” checkbox at the very top of the 1099.

Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to obscure types of 1099 forms too.

You can print and mail the corrected 1099 forms yourself, or file them all online to save time!

Filing 1099 Correction Forms

The process for correcting a 1099 form is the same for all types of 1099s. There are over a dozen types, but filing corrections doesn’t change based on the type of 1099 form.

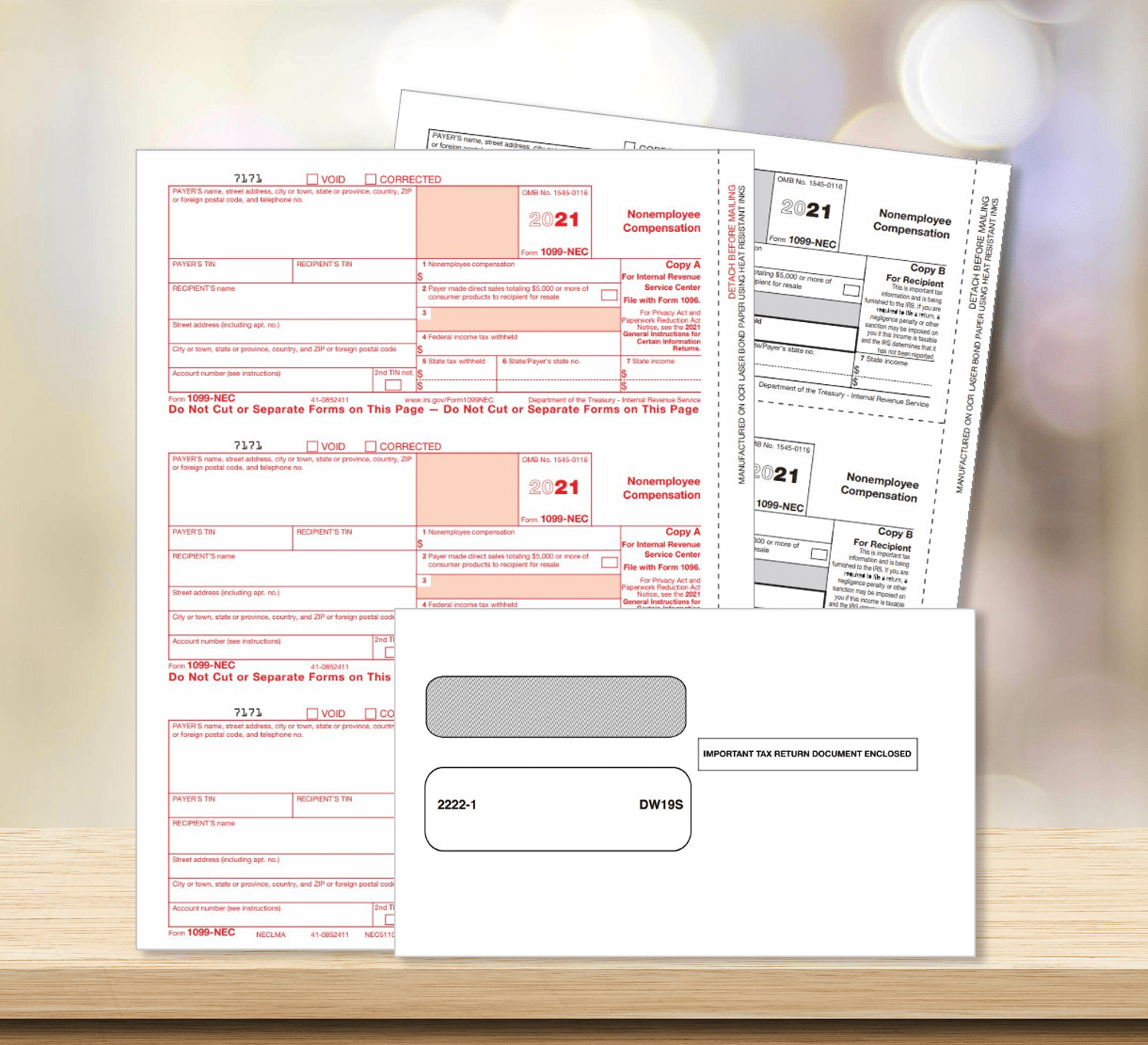

You will need to complete and file new 1099 forms with the IRS, plus mail a copy to the recipient and provide a copy for the payer files.

Since the recipient needs correct 1099 information to file their federal, state and local tax returns, getting them corrected copies right away is very important!

Depending on the original due dates for the forms, you’ll first need to know if you have already mailed Copy A to the IRS or e-filed it using any type of 1099 e-filing system. And also if the recipient copy has already been mailed.

IRS Copies of 1099 Corrections

If you have already e-filed or mailed Copy A of a 1099 form to the IRS, you will need to refile it.

Paper 1099 Forms: You can purchase new 1099 Copy A forms or use any leftovers you have, and check the box at the top to note that it is ‘CORRECTED (if checked)’.

E-Filing 1099 Corrections: If you e-filed the 1099 form with the IRS, you can e-file a corrected 1099 form using our DiscountEfile.com system! We’ll e-file the correction, mail a recipient copy and provide one for the payer too – even if you didn’t use it to file the originals.

If you have NOT already filed your 1099 with the IRS, you can simply discard the incorrect form and print a new one.

Recipient Copies of Corrected 1099 Forms

If you have already delivered a 1099 to a recipient, you will need to provide them with a corrected version.

You can purchase new 1099 Recipient forms or use any leftovers you have, and check the box at the top to note that it is ‘CORRECTED (if checked)’. Then, mail it to the recipient, or deliver it in person, etc. Just make sure they get one!

But it may be easier to use an online system to correct 1099 forms! Especially if you don’t have any leftover forms and would need to purchase a whole pack just to do a few corrections. Check out our DiscountEfile.com system and file 1099 corrections easily – even if you didn’t use it to file the original! We mail recipient corrections, e-file with the IRS and provide a payer copy too.

If you have not yet delivered the original 1099 form to the recipient, simply discard the old one and print a new one. You will not need to check the Corrected box if this is the case.

Payer Copies of 1099 Corrections

Also be sure that the payer has an updated 1099 copy for their records!

Every business needs to have accurate tax records in case of audit, so be sure to print a 1099 correction for the payer too, using the correct payer copy of the 1099 form and checking the box at the top. You can order 1099 forms online, use leftovers you have from the tax year, or file 1099 corrections online.

BUT WAIT!!! There is an easier way to file 1099 Correction forms…

Instead of ordering forms, printing and mailing them, you can do it all online! Our DiscountEfile.com system allows you to file 1099 correction forms easily, even if you didn’t use it to file the original forms.

Simply enter data for the employer (payer) and the employee (recipient) information, the original and corrected data, then we’ll do the rest!

DiscountEfile will automatically and securely e-file with the IRS and mail recipient copies.

Set up a free account today, try it out and only pay for the forms you actually submit online.

Online 1099 correction filing is available all year long!