Product Details

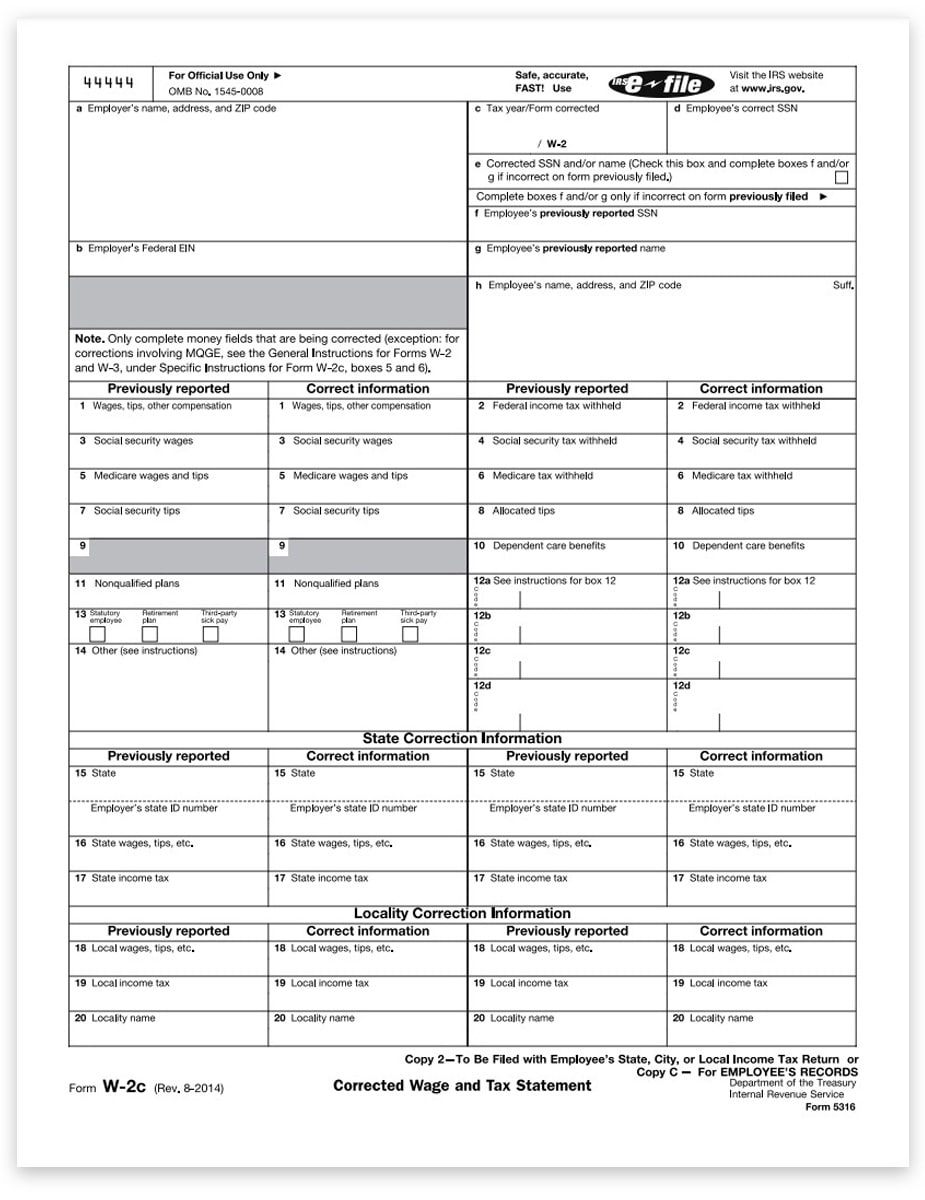

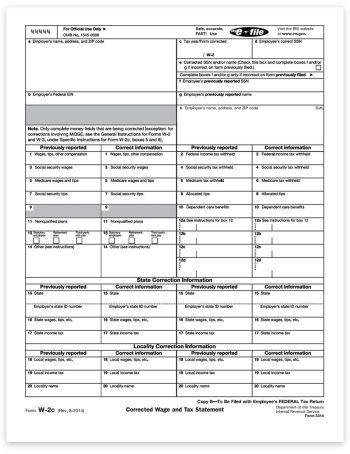

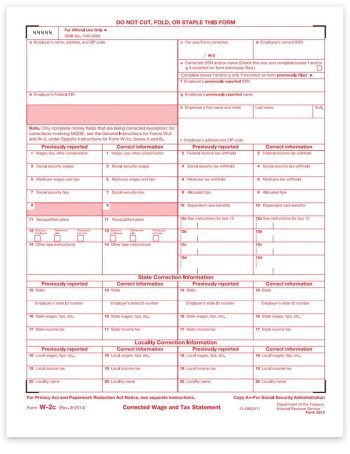

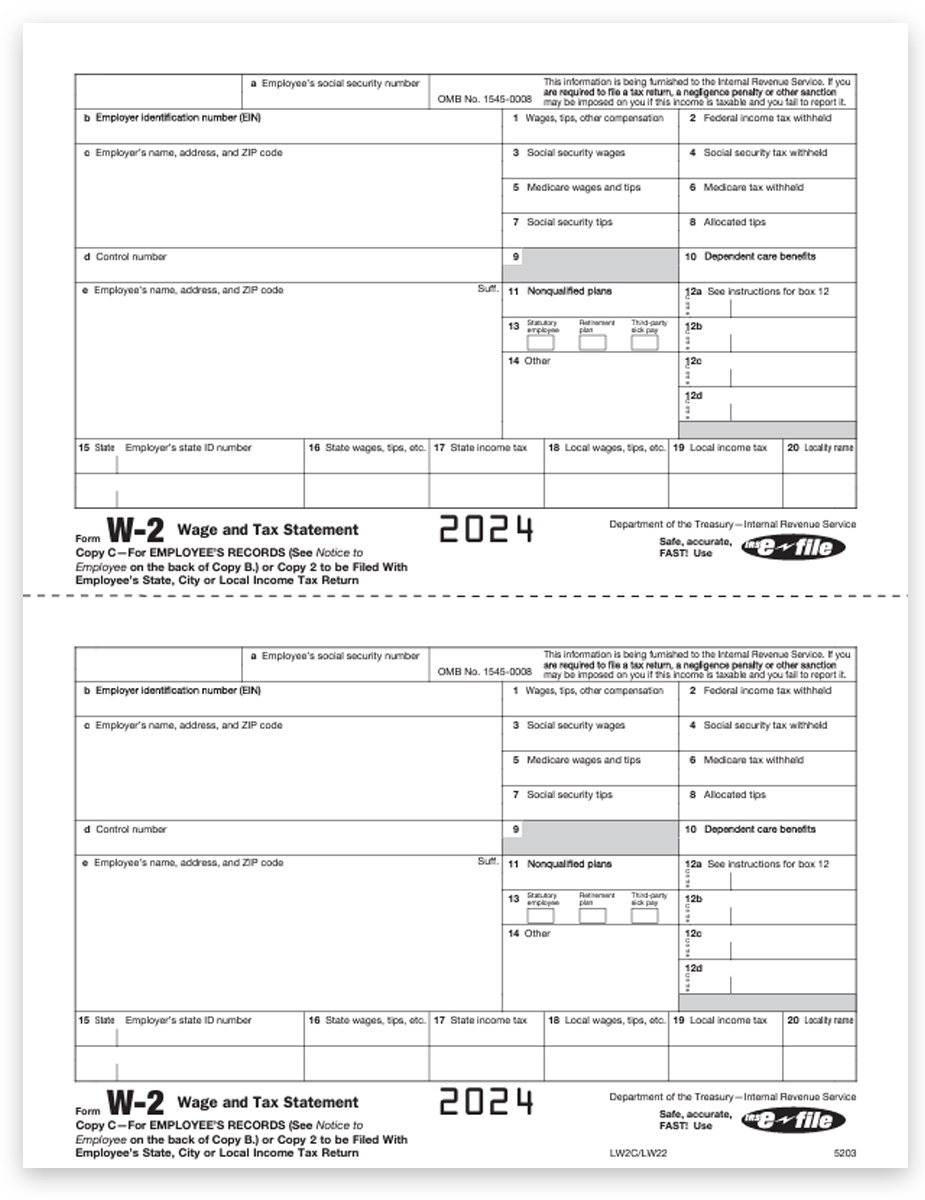

W2c Correction Forms – Copy C-2 for Employee State, City or File Copy

Form W2C used to provide corrections to information filed on an original W2 form.

Get big discounts on W2 forms – no coupon needed with The Tax Form Gals!

Mail this W2c Correction Form to the employee in a compatible W2c envelope. The employee uses this W2c Copy C-2 to send to the state, or for their files. The form copies are interchangeable, however there is only one form per sheet to use as either Copy C or Copy 2. If you need to file with the state, and also need an employee file copy, order 2 forms for each employee.

W2C Correction Copy C-2 Form Specs:

Order a quantity equal to the number of employees for which you need to file corrected W2 forms.

- 1up forms (1 form per page – if you need both Copy 1 and Copy D, order two forms)

- 8.5″ x 11″ sheet

- No side perforations

- Preprinted with black ink

This form was combined with W2C Copy 2, item# LW2CC and that SKU has been discontinued.

Compatible W2C Envelopes

Simplify W2C Correction form filing!

Instantly file W2C forms online with DiscountTaxForms.com – no forms needed! Simply enter your corrected data and we’ll e-file with the SSA, and mail employee copies too.

Online W2C Filing

How to Choose the Right W-2 Forms

NEW E-FILE THRESHOLDS FOR 2023

The IRS has made a MAJOR change to e-filing requirements for the 2023 tax year. If a payer has 10+ 1099 & W2 forms combined, per EIN, they MUST efile Copy A forms with the IRS or SSA. Learn More >>

We make it easy! Set up a free account on DiscountEfile.com and you can e-file, plus print and mail recipient copies in one easy step. Learn More >>

OPTIONS FOR FILING W-2 FORMS

- Your Accounting Software: Print W-2 forms compatible with your software, such as QuickBooks®.

- Specialized W-2 Software: Print and e-file W-2 forms if your accounting software does not.

- Online W-2 Filing: Enter or import data and we print, mail and e-file for you!

TYPES OF W-2 FORMS

All government copies must be printed in a 2up format (2 forms per page)

Employee copies may be printed in a 2up, 3up or 4up format (2, 3 or 4 forms per page; also called ‘condensed forms). All of the copies for a single employee will print on one page. You simply fold and mail – no need to separate and collate forms! Your software may support these formats, be sure to check its functionality before ordering.

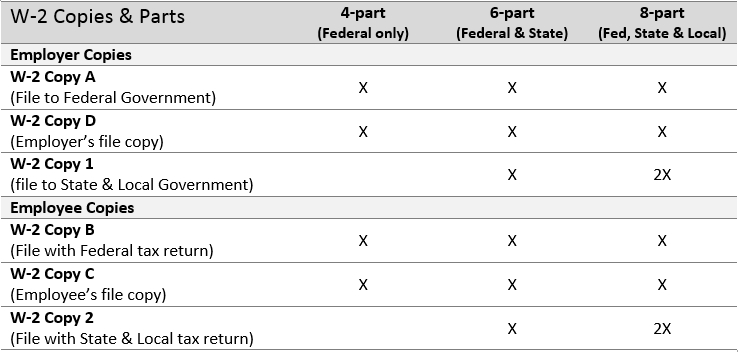

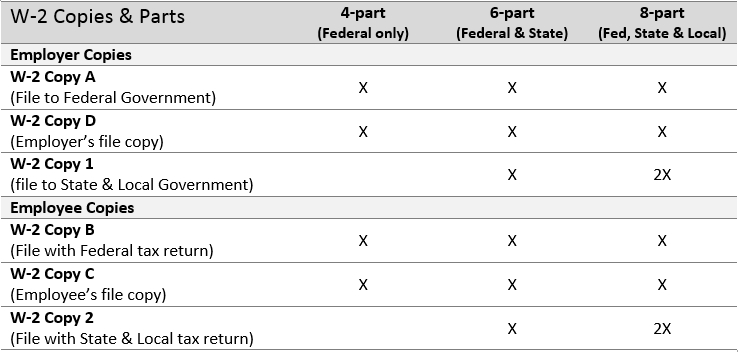

NUMBER OF W2 PARTS

The number of parts you need is determined by which government agencies you are reporting to.

- Federal Only – 4 parts

- Federal and State – 6 parts

- Federal, State and City – 8 parts

When using condensed 2up, 3up or 4up forms, you can print all employee copies on a single sheet to save time.

- For a 4-part form, use 2up paper.

- For a 6-part form, use 3up paper.

- For an 8-part form, use 4up paper.

4-Part States: AK, FL, NV, NH, SD, TN, TX, WA, WY

6-Part States: AL, AZ, AK, CA, CO, CT, DC, DE, GA, HI, ID, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, NE, ND, NJ, NM, NY, OH, OK, OR, PA, RI, SC, UT, VA, VT, WI, WV (add extra parts for city withholding taxes)

8-Part States: AL, DE, KY, MD, MI, MO, NY, OH, PA

Read More: Decoding W2 Copy Requirements >

EASY ONLINE FILING FOR W2 FORMS

File W2 forms online and save time! Skip the hassle of buying and printing forms, stuffing envelopes and paying for postage with DiscountEfile.com

With our online W2 filing system, simply enter or import your data and we’ll efile with the SSA and can even print and mail employee copies for you, for $4.50 or less per form.

Visit DiscountEfile.com for more information.

W3 TRANSMITTAL FORMS

Transmittal W-3 Forms are required only if you are printing and mailing W2 Copy A to the Federal Government.

One W3 is required to summarize all W2s for one employer. Order W-3 Forms.

W2 ENVELOPES

Order compatible W-2 Envelopes to ensure mailing information aligns correctly in the windows. Order W-2 Envelopes

W-2 FILING DEADLINE

- January 31 – Recipient copies postmarked, Copy A mailed or efiled with IRS

These are federal deadlines. Most states follow the same dates.

W-2C CORRECTION FORMS

If you need to correct a W2 form that has already been filed with the SSA because the original has errors, you will need to file a W2C form (W-2 Correction Form).

This is different than a standard W2 form, and requires a few additional steps. You’ll need to fill in all of the fields, once for the information originally filed, and once for the correct information (if applicable).

NEW for 2023… you must file the W2C form with the SSA in the same manner as the original W2.

- If you e-filed, you must e-file the correction.

- If you printed and mailed the original Copy A, you must also print and mail the W2C.

You can also file W2C forms online and let us do the work for you!

More on W2C Filing

The IRS & SSA have changed the rules for W-2C Correction filing in 2023

The IRS & SSA have changed the rules for W-2C Correction filing in 2023

You must now file W2C Copy A in the same manner as the original W2 Copy A was submitted.

This means that if you e-filed the original W2 Copy A, you must also e-file W2C Copy A.

If you printed and mailed the original W2 Copy A, you are required to print and mail the W2C Copy A.

We can take care of e-filing for you with our online DiscountEfile.com system!

Online W2C Filing

Ordering 1099 & W2 Forms

Official preprinted 1099 & W2 forms are sold by the form (not sheets).

Order a quantity equal to the number of recipients you have. For example, if you have 25 recipients, order 25 forms.

- If your W2 or 1099 forms are 2up (2 per page) you will receive 13 sheets

- If your 1099 forms are 3up (3 per page) you will receive 7 sheets

Condensed preprinted W2 forms are sold by the recipient (not the number of forms on it).

Order a quantity equal to the number of employees you have. For example, if you have 50 employees, order a quantity of 50.

Blank 1099 & W2 forms are sold by the sheet (not the number of forms on it).

Order a quantity equal to the number of recipients you have. For example, if you have 100 recipients, order 100 sheets.

Packaging Information

When you receive your order, please open it right away to review the contents and ensure you have exactly what you need. The information below will help you to understand how it’s packaged.

Each shrink-wrapped package may contain several different forms. If there are multiple forms in a package, they will be separated by a colored sheet of paper.

Be sure to open the entire package to determine if items are missing.

Packaging of Kits and Sets

1099 & W2 kits or sets can be packaged in one of two ways.

Example 1: Pre-packaged in specific quantities, which may mean there are multiple shrink-wrapped packs to fulfill your entire order.

Example 2: One shrink-wrapped package, which includes all the forms together.

Free Transmittals

Your order was likely shipped with free 1096 or W3 transmittal forms. They will likely be at the bottom of your packs of forms.

Getting Help with Your Order

If you discover a discrepancy, please contact us right away and we’ll make it right.

- Email: hello@taxformgals.com

- Call: 877-824-2458

Our small business appreciates yours!

Need to File Some Forms at the Last Minute?

There’s no need to order additional forms and wait for shipping – file them online at DiscountEfile.com! You enter or import data and we’ll e-file the Copy As, plus print and mail recipient copies. Learn More >>

Reviews

There are no reviews yet.