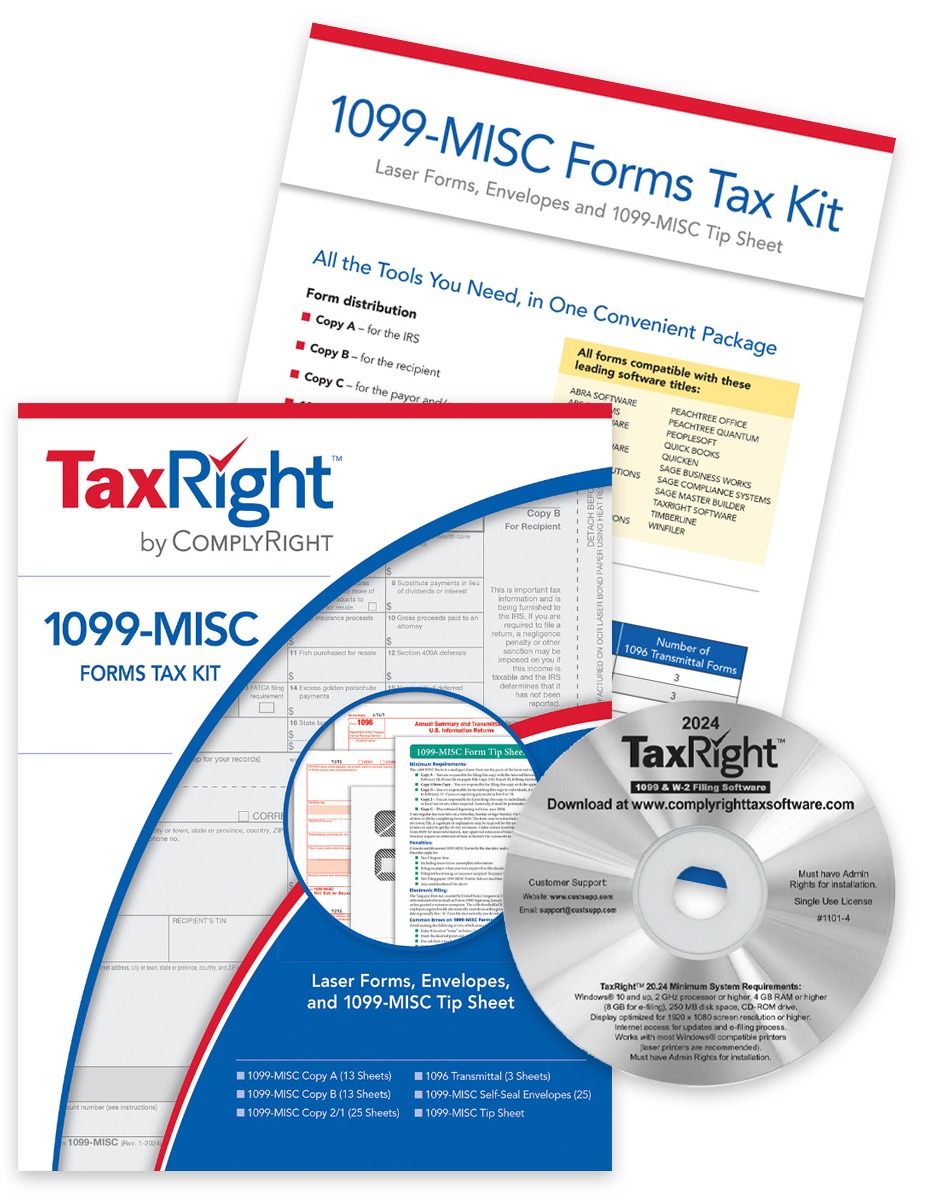

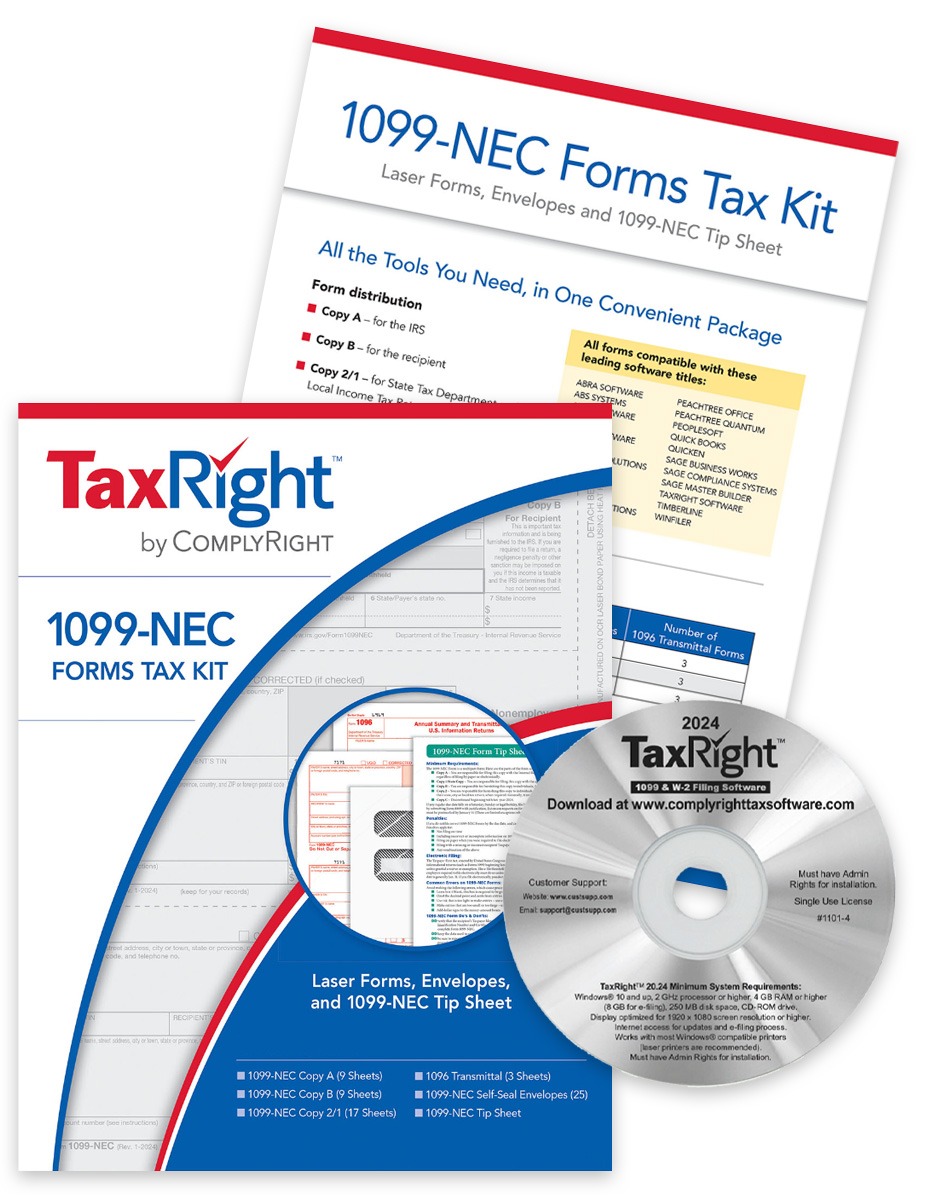

1099 & W2 Software + E-Filing Kit with 1099-MISC Forms and Envelopes

A kit with 1099MISC forms, envelopes and software for easy small business filing for the 2023 tax year. Plus e-filing capabilities for IRS and SSA electronic filing of Copy A forms – which is now required for 10+ forms.

1099 Software & 1099MISC Form Kits Make Filing Easy!

TaxRight software will easily print recipient copies on preprinted 1099 and W2 forms.

Simple functionality with step-by-step user guides, templates for importing data from TFP and other systems, plus enhanced reporting to see payer and recipient summary information.

E-Filing is simple, with a quick and easy process to upload files and send to the IRS and/or SSA and costs just $1.65 per form.

Secure filing with password protection and SSN masking to show only the last 4 digits of recipient SSN.

Official 1099-MISC forms (4-part) and self-sealing envelopes are included in this kit, along with software and a 1099 filing tip sheet.

Major W2 & 1099 Efiling Requirement Changes in 2023

If your business has 10+ W2 and 1099 forms, combined, pre EIN, you must e-file Copy A forms with the IRS and SSA for the 2023 tax year. This software makes it easy! Learn More About the Changes >

Switching from TFP Software?

An easy conversion integration is available from within Tax Right software! No need to switch to Winfiler® or other expensive 1099 & W2 software, TaxRight does it all at a more affordable price. And the functionality, workflow and printing is so similar, you’ll feel right at home.

1099 Software and 1099MISC Form Kit Includes:

- TaxRight 1099 & W2 Software

- 4-pt 1099-MISC Forms: Payer Copy A (Federal), Recipient Copy B (Federal), Payer Copy C-2 (Payer State, File)

- Compatible 1099MISC Envelopes: Double cellophane windows, self-seal flaps and security tint; printed with the required text, “Important Tax Return Document Enclosed”

- Three 1096 Transmittal Forms

- 1099 Filing tip sheet

1099MISC Software & Form Kit Specs:

- Efiling capabilities – additional $1.65 per form

- Includes 4-part 1099MISC forms and compatible envelopes (choose a pack of 10, 25 or 50 additional forms can be ordered separately)

- Access e-filing information for up to 4 years

- E-mail notifications when forms are efiled and accepted by the IRS or SSA

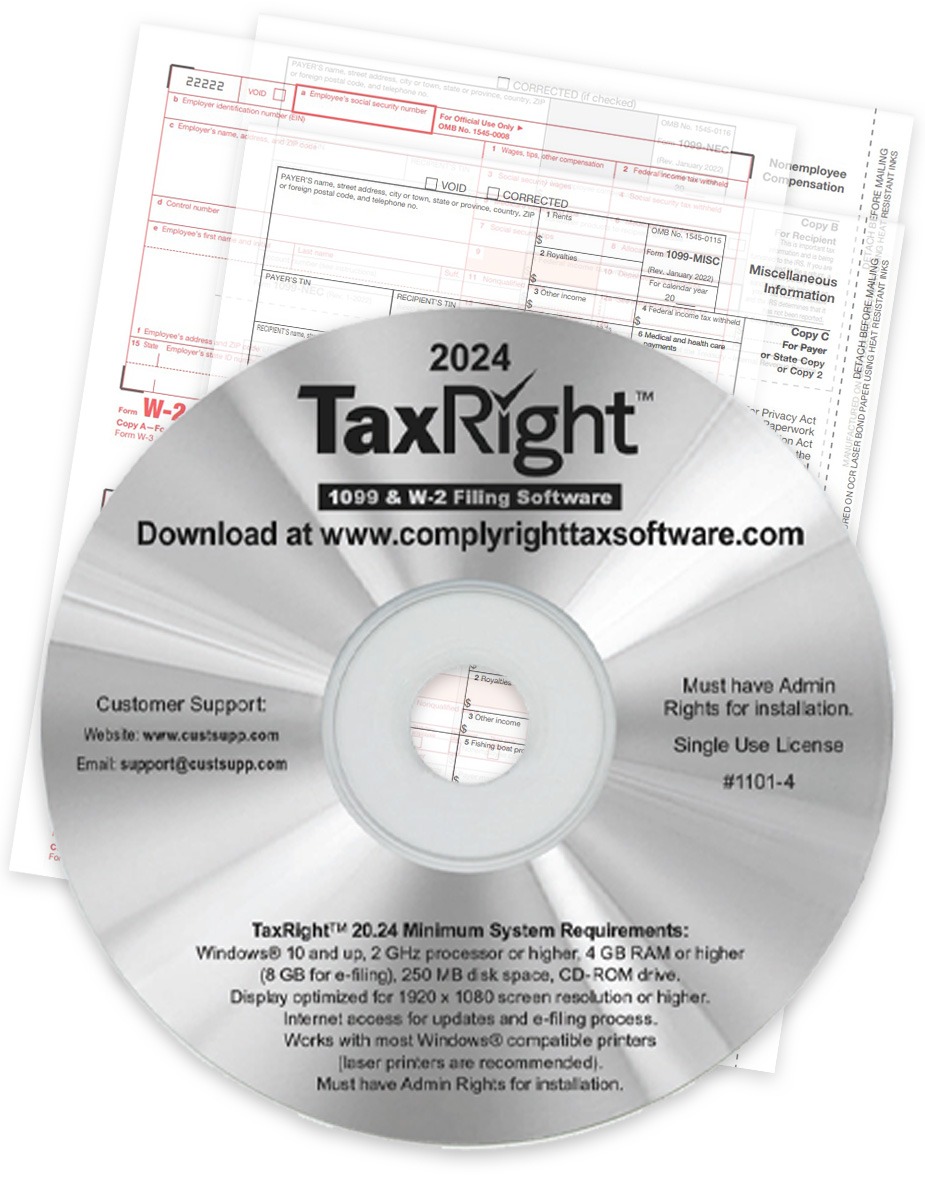

- Software can print the following 1099 & W2 forms:

- 1099-NEC

- 1099-MISC

- 1099-DIV

- 1099-INT

- 1099-B

- 1099-C

- 1099-R

- 1099-S

- 1098

- 1098-T

- W-2

- 1096 and W-3 transmittals

Click to order additional W2 forms and envelopes, or other 1099 forms and envelopes. You can use most of the other preprinted formats we offer.

Want to skip the software?

You can file everything online at DiscountEfile.com! We take the hassle out of filing 1099 & W2 forms by doing it for you. Simply enter or import your data and we’ll e-file with the IRS or SSA, print recipient copies and provide them electronically, and keep everything on file for you. Learn More >>

Reviews

There are no reviews yet.