Why Spend Money on Tax Return Folders?

Making an investment in a business brand and professional image pays dividends! Here’s why you should invest in client tax return presentation folders.

Making an investment in a business brand and professional image pays dividends! Here’s why you should invest in client tax return presentation folders.

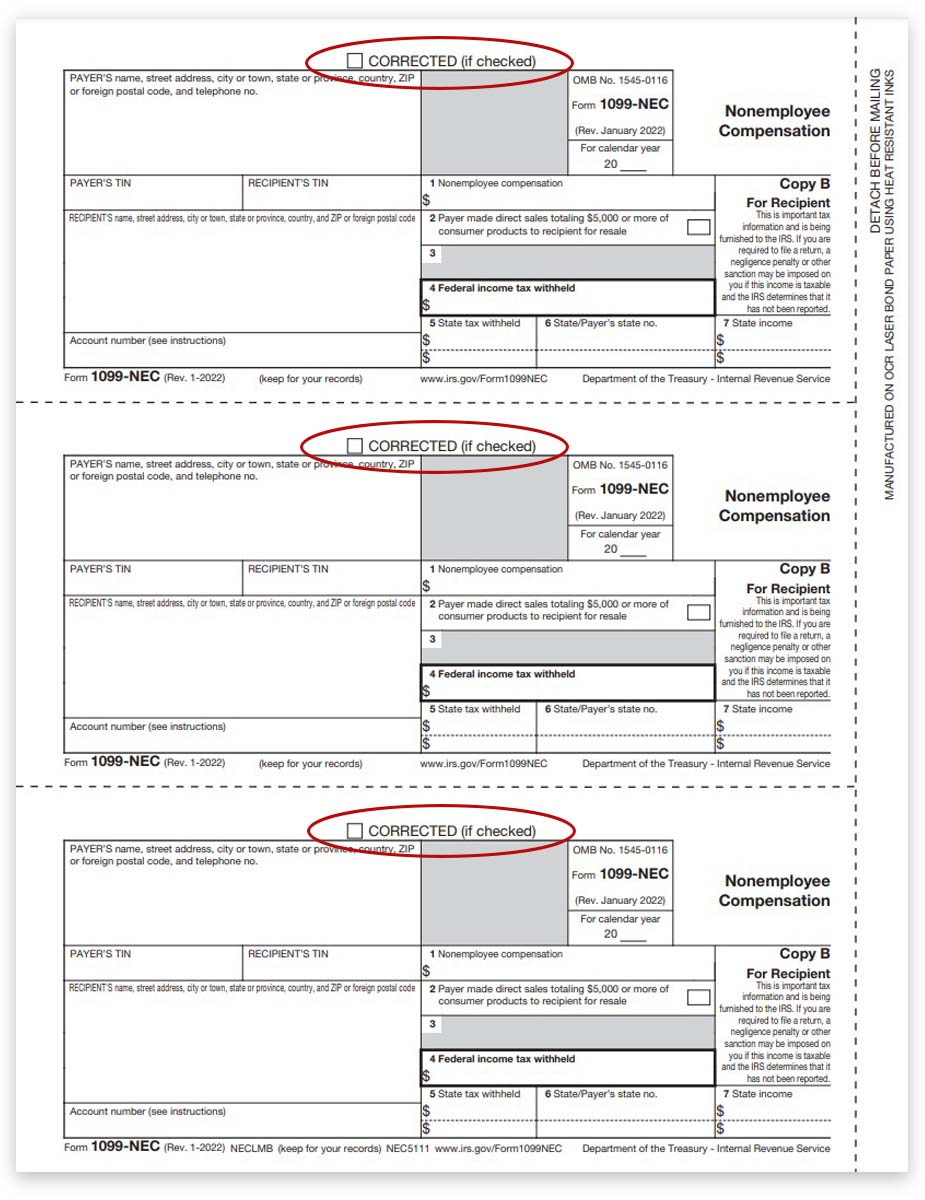

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

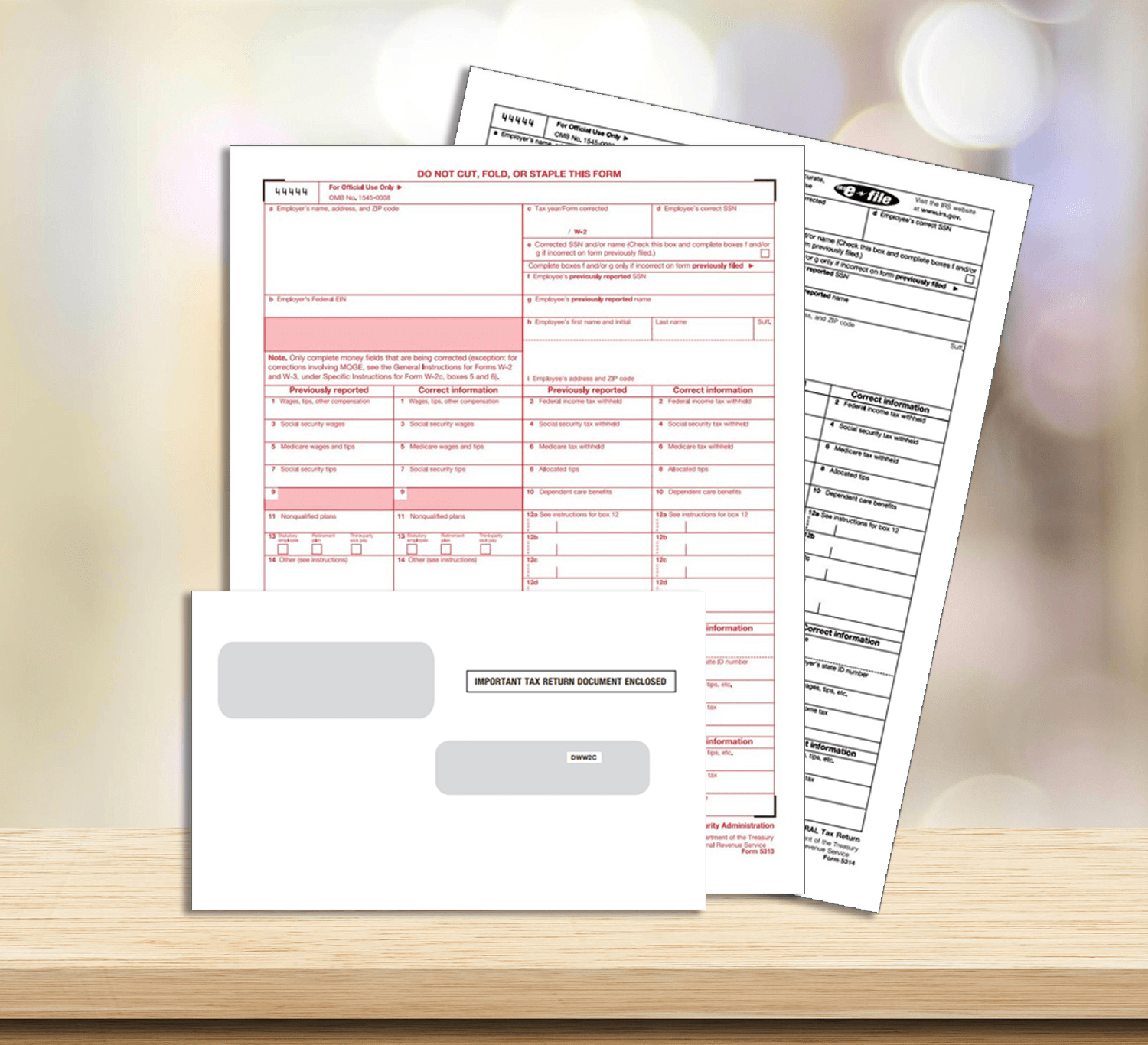

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

A list of official 1099 and W2 due dates for e-filing or mailing paper copies to recipients and the IRS or SSA.

There are various ‘Copies’, or parts, of a W-2 form, each with a different name. Although they will have the same information about the employer and employee, earnings and withholdings, each copy is given to a different entity. This ensures correct reporting during the income tax filing process. W-2 Forms are filled out by the employer and provided to the employee or a government agency.

1099-MISC ‘Copies’, or parts, report income to recipients and government agencies and help ensure accuracy of income tax filing. 1099-MISC Forms are filled out by the payer and provided to the recipient and government agency.

The Deadline to Mail 1099s & W2s to Recipients is January 31. You can get them out the door without having to go to the office store and buy forms.

Simply stated, it’s not efficient. They only have 1 style of form, the Traditional 2up W-2, for employee copies. This is the SLOWEST way to print W-2 forms.

Beginning in January 2016, most employers must file information returns for the Affordable Care Act (ACA) on new 1095 and 1094 Forms. Here is an overview of the requirements.

If you need to correct W2 forms that have already been mailed or e-filed with the SSA, you must file a W-2C Correction Form, with a W-3C form to summarize corrections by a single employer. There is no deadline, simply file the form as soon as you discover the error.