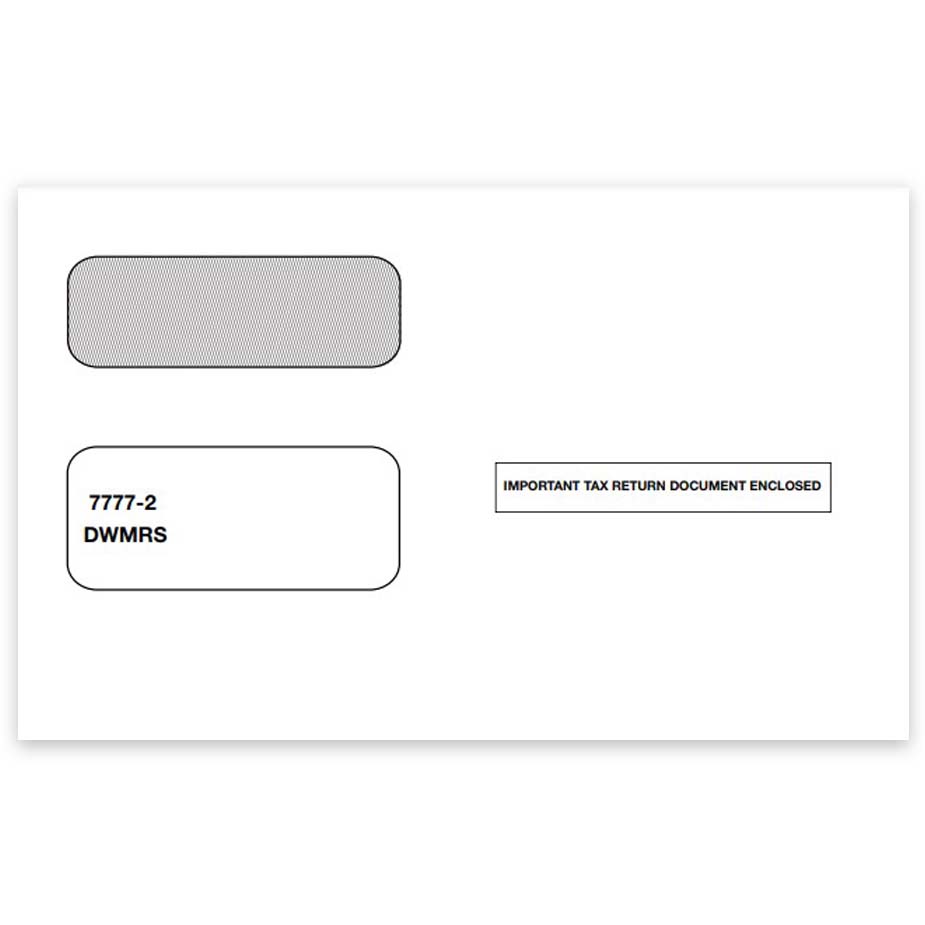

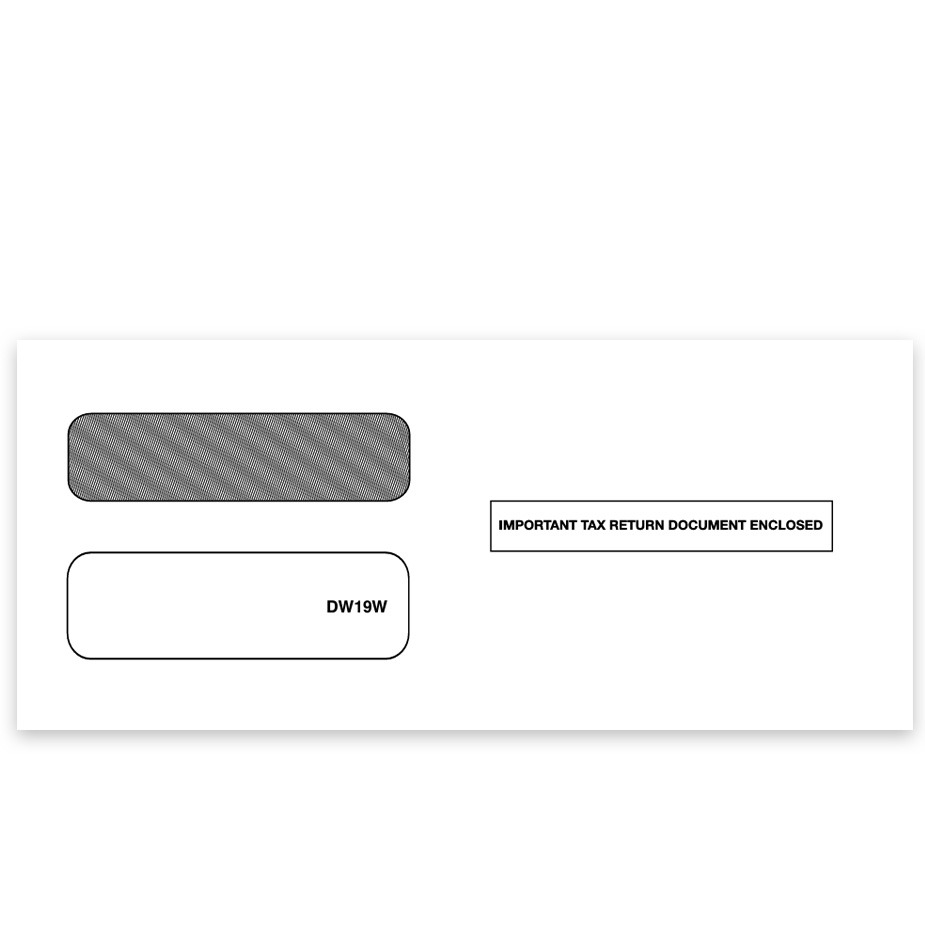

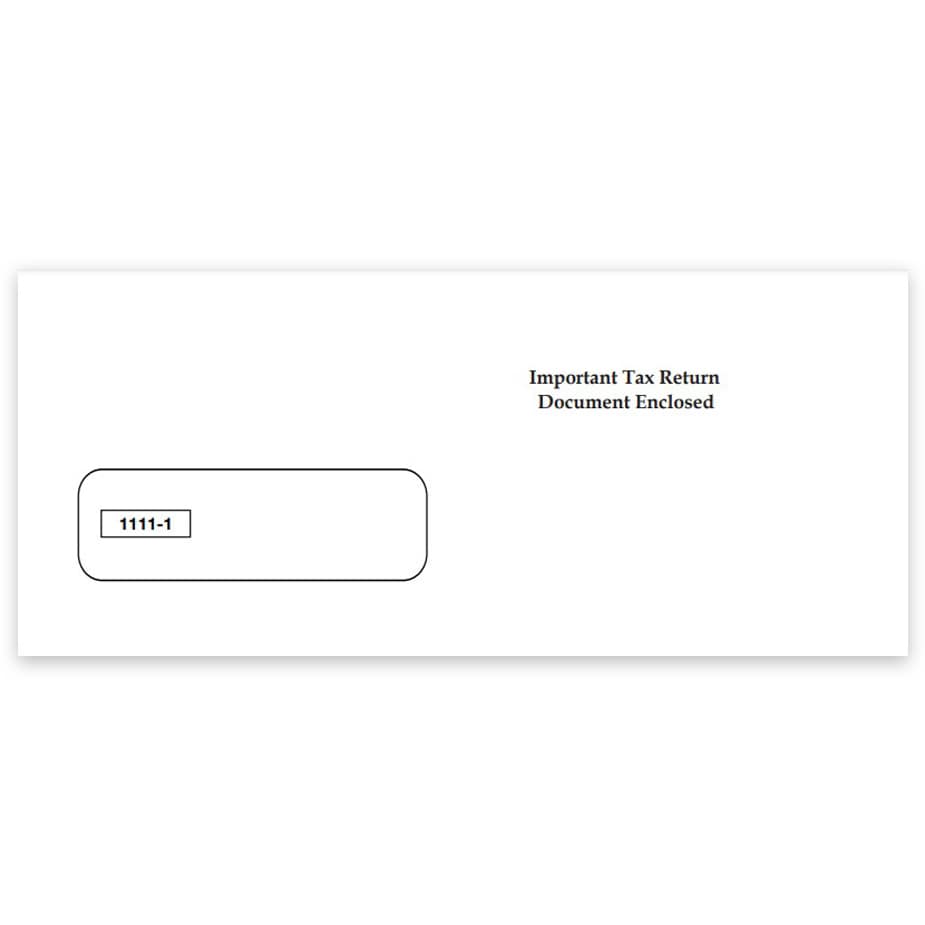

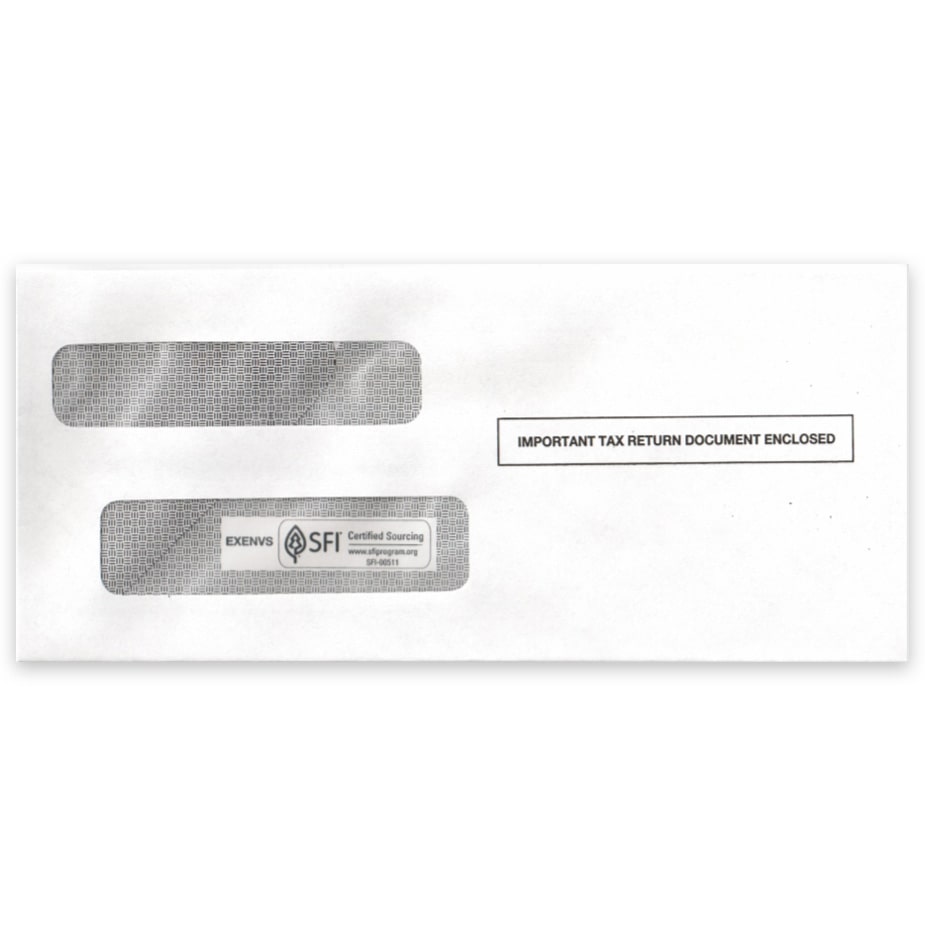

1099 Envelopes

Security 1099 envelopes for easy mailing of all types of 1099 tax forms.

- Big discounts – no coupon needed!

- Envelopes compatible with 2up, 3up and 4up 1099 forms

- Double windows with cellophane

- Security tinted inside

- “Important Tax Return Document Enclosed” printed on front

- Envelopes for 1099NEC, MISC forms and more

- Ships fast and friendly from the Tax Form Gals

Have questions? Just ask!

We’re real people ready to help.

Easily mail all types of 1099 forms with compatible 1099 window envelopes at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

1099 Envelopes – 2up, 3up, 4up & Universal Formats

Insights to Easier 1099 Filing

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…