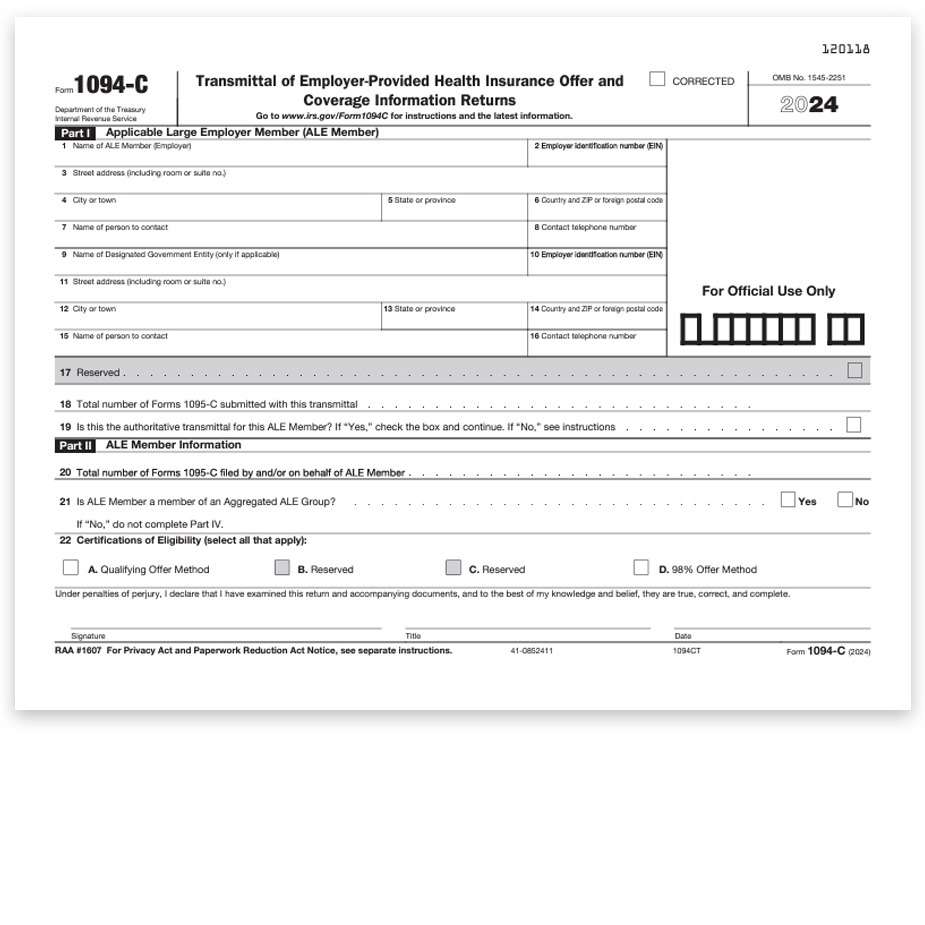

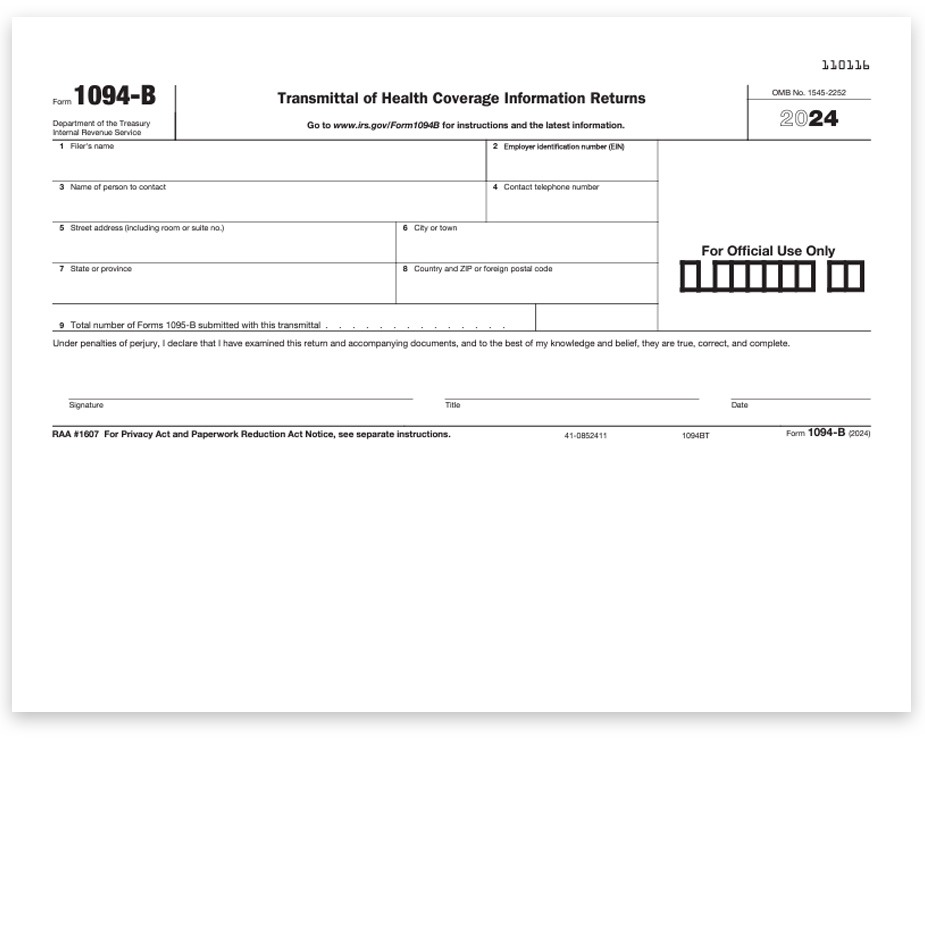

1094-C Transmittal Forms for 1095-C ACA Reporting

Form 1094-C is a transmittal form for 1095-C forms when submitting to the IRS for official ACA health insurance reporting requirements.

You will need 1 form for each employer. If e-filing, this form is not required.