How to File a W2 or 1099 TODAY

The Deadline to Mail 1099s & W2s to Recipients is January 31. You can get them out the door without having to go to the office store and buy forms.

The Deadline to Mail 1099s & W2s to Recipients is January 31. You can get them out the door without having to go to the office store and buy forms.

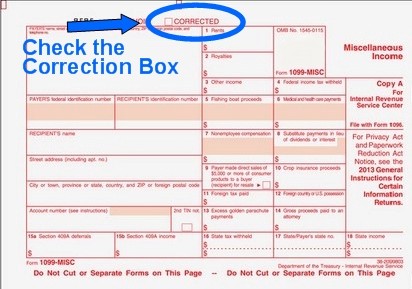

You do not need to correct a 1099 the same way you filed it, so if you mailed a paper copy, you can e-file a correction, or vice versa. However, if you have 250 or more corrections that need to be filed, they MUST be e-filed with the IRS.

As a small business, we’re always looking for ways to save money by doing things ourselves. Many of our colleagues can say the same. One of the ways you can do this is filing 1099 and W2 forms yourself, instead of paying an accountant. It’s easier than you think!!

E-filing 1099 and W2 forms to the Federal Government is not only faster, but you get more time to get it done! It’s enough of a hassle to print and mail recipient copies, you don’t need to spend time repeating the process for the government copies. Here is how to electronically file quickly and easily.

It’s that time of year again. Tax season. And if you’re a business, it starts NOW with 1099 and W-2 form filing. But it doesn’t have to be a hassle. There are ways to make it faster and easier.