Blog

Expert insights to

easy 1099 & W2 filing.

How to Correct 1099 Forms You Already Filed

How correct 1099 Forms if you discover an error after you have already filed with the IRS or mailed to the recipient.

How to Correct a 1099-MISC Form – The Easy Way

You do not need to correct a 1099 the same way you filed it, so if you mailed a paper copy, you can e-file a correction, or vice versa. However, if you have 250 or more corrections that need to be filed, they MUST be e-filed with the IRS.

The easiest way to correct a 1099-MISC form is by using our 1099 Filing Hub >

You simply enter the corrected information and we e-file with the IRS and generate a correction form that you print in your office.

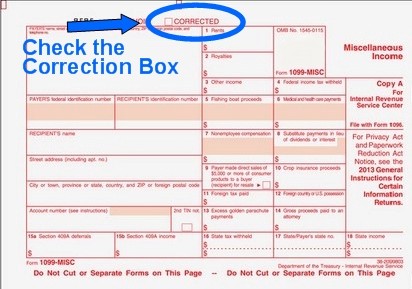

Or, you can Order new 1099-MISC forms to file a correction. Simply check the ‘Corrected’ box at the top and mail it to the IRS and the recipient.

Unlike the W-2C Correction form, there is no such thing as a 1099-MISC Correction form, just use the box at the top of the regular form.

How to Correct Any 1099 Form

All 1099 Forms have a ‘Corrected’ box at the top. To submit a correction to either the IRS or the recipient, you simply create a new form and check that box.

1099 Correction Forms do NOT need to be filed in the same way that the originals were filed. However, if you have 250 or more correction 1099s of a single type (1099-DIV, 1099-INT, etc), you must e-file them with the IRS.

There is no deadline for filing 1099 Corrections, just submit new ones as soon as you discover the error. Order new 1099 forms to file a correction.