1099 Tax Forms

All types of official 1099 forms and envelopes for the 2023 tax year.

Order IRS 1099 forms and envelopes for information and payment reporting.

- Big discounts on 1099 forms – no coupon required!

- Small minimum quantities and fast shipping

- Compatible with most software

- Online e-file options – let us do the work for you!

**NEW** 1099 E-filing requirements — e-file Copy A if you have 10+ W2 and 1099 forms combined for the 2023 tax year

Easily file all types of 1099 tax forms with printing, mailing and e-filing options at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

New E-filing Requirement Changes for 1099 & W2 IRS Filing for the 2023 Tax Year

The new E-file threshold for 2023 is 10 W2 and 1099 forms, combined, per EIN.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

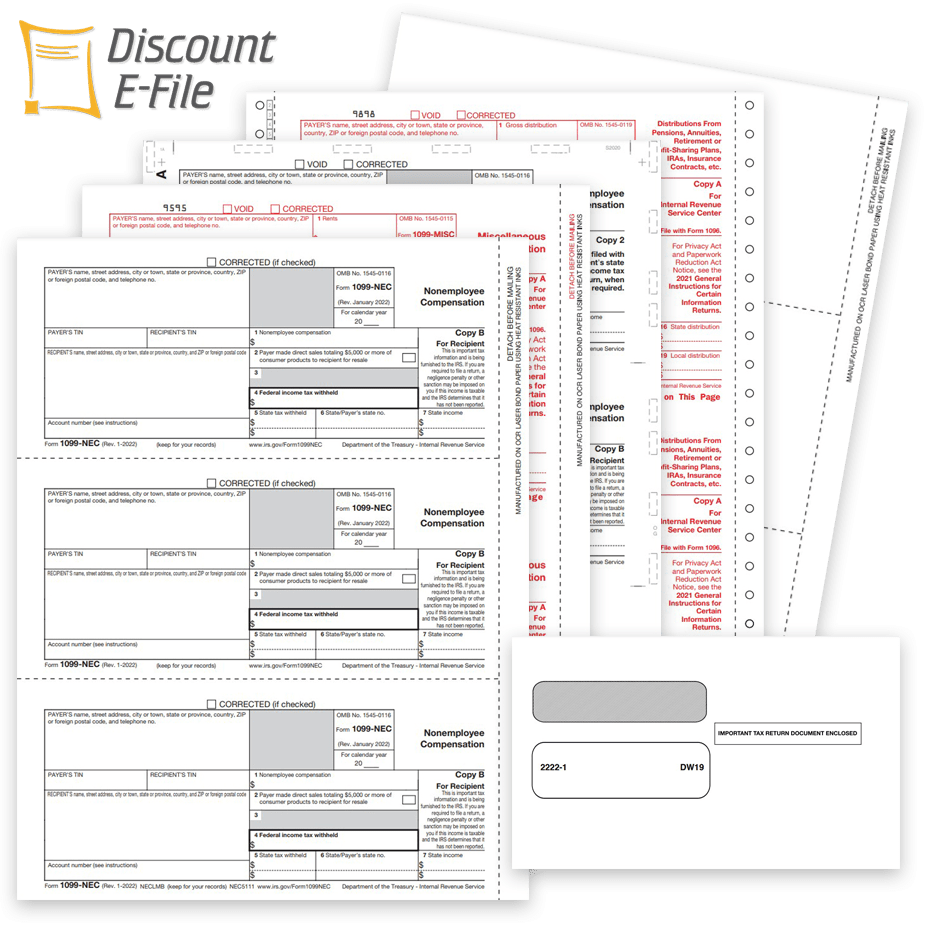

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2023.

Use DiscountEfile.com to enter or upload data and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Pre-Buy Filings on Discountefile.com

Save some money on 1099 & W2 efilings with prebuy bundles at bulk quantity prices!

Normally when using DiscountEfile.com for e-filing and/or print and mail services, you pay for each cart full of form submissions. If you file multiple carts with smaller quantities of forms, that means you don't get the bulk quantity discount pricing.

BUT if you pre-buy a bundle, you'll get the lower prices, even if you only file one form at a time!

These options are great for tax professionals or larger companies with 26 or more forms to file for 2023.

E-File Only Bundle

Get bulk pricing as low as $2.30 each for e-filing 1099 & W2 Copy A forms.

E-File, Print + Mail Bundle

Get bulk pricing as low as $3.25 each for e-filing 1099 & W2 Copy A forms, plus printing and mailing of recipient copies

Order 1099 Tax Forms for 2023

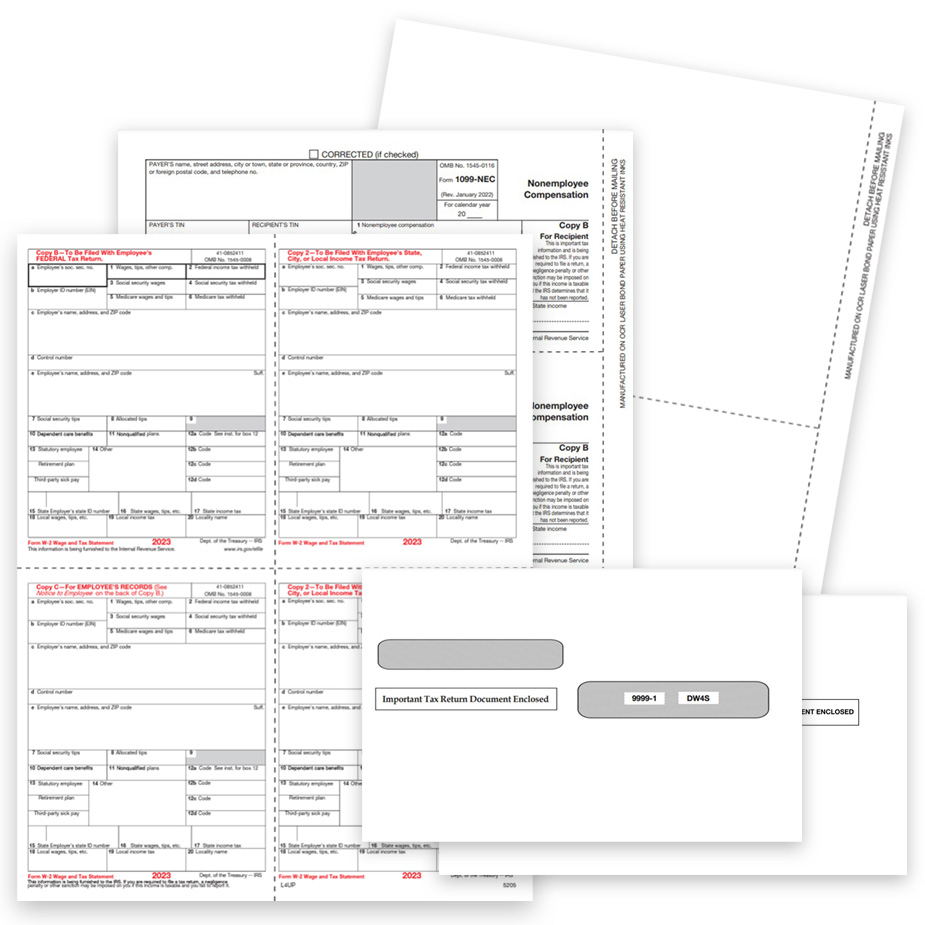

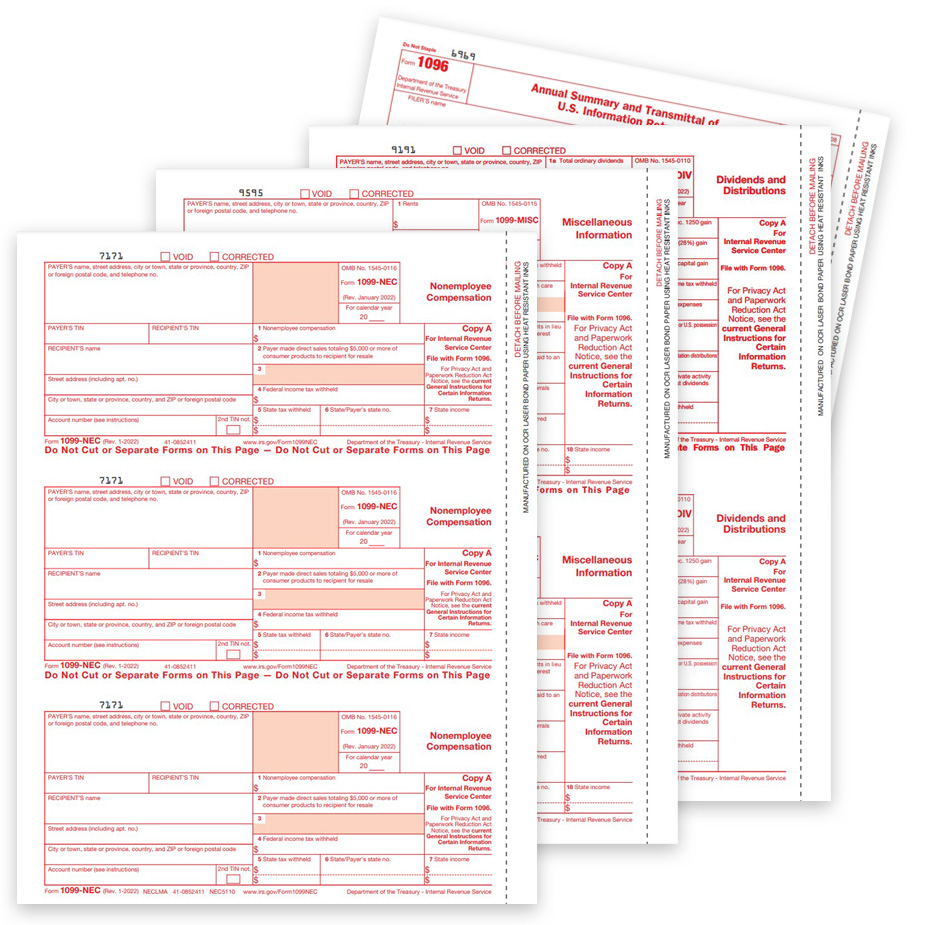

Recipient Only Sets of 1099 & W2 Forms and Envelopes

If you are e-filing in 2023 because of the new requirement changes, and don’t need the red Copy A forms, these sets are for you!

Order 1099 & w2 form sets with only the recipient copies, or with the payer State forms too.

Compatible envelopes can even be included.

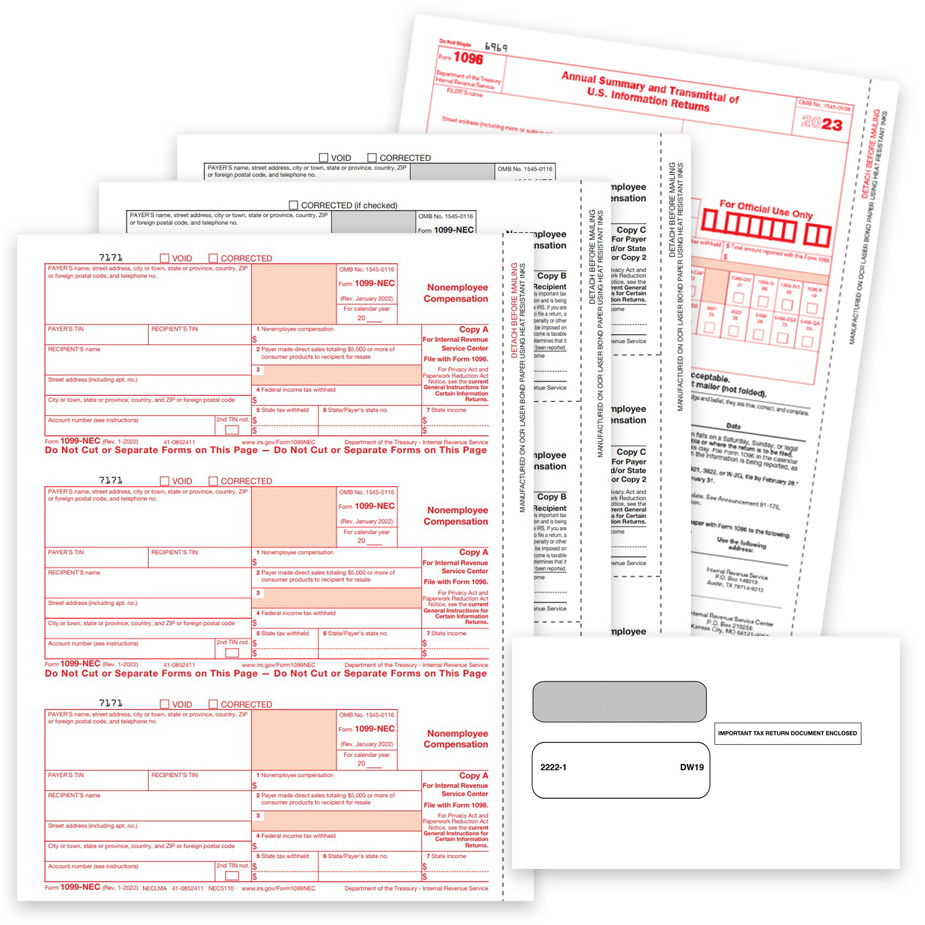

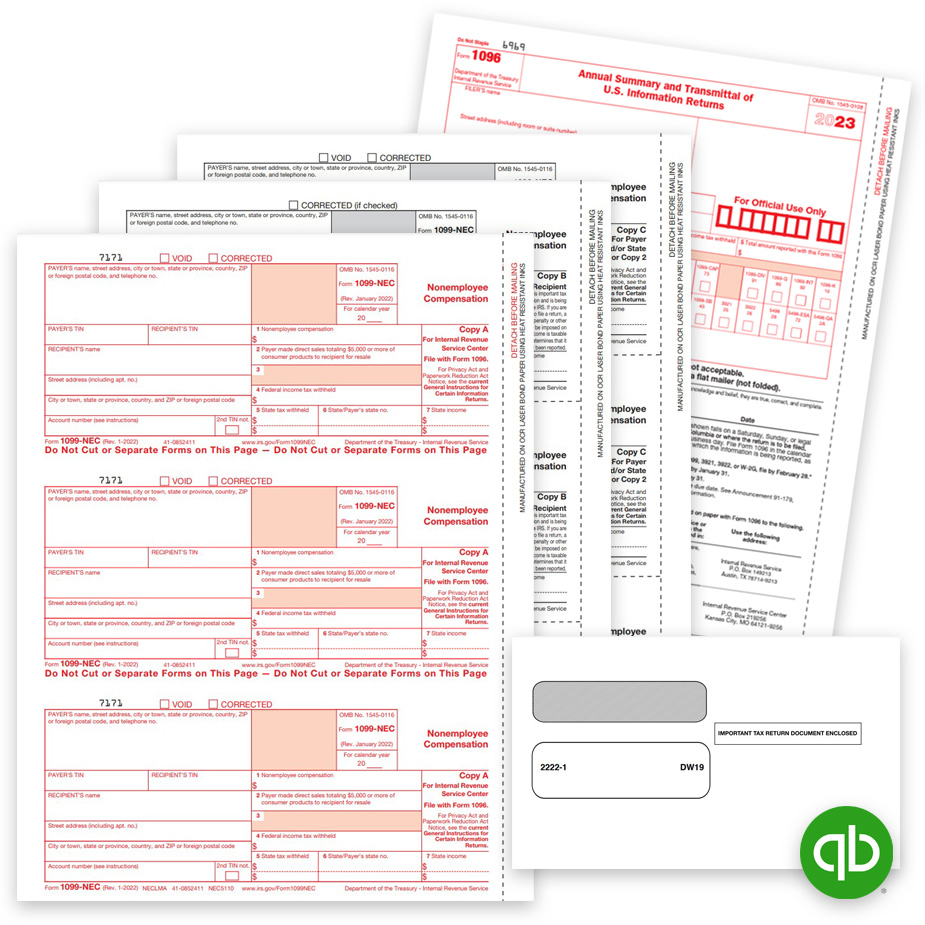

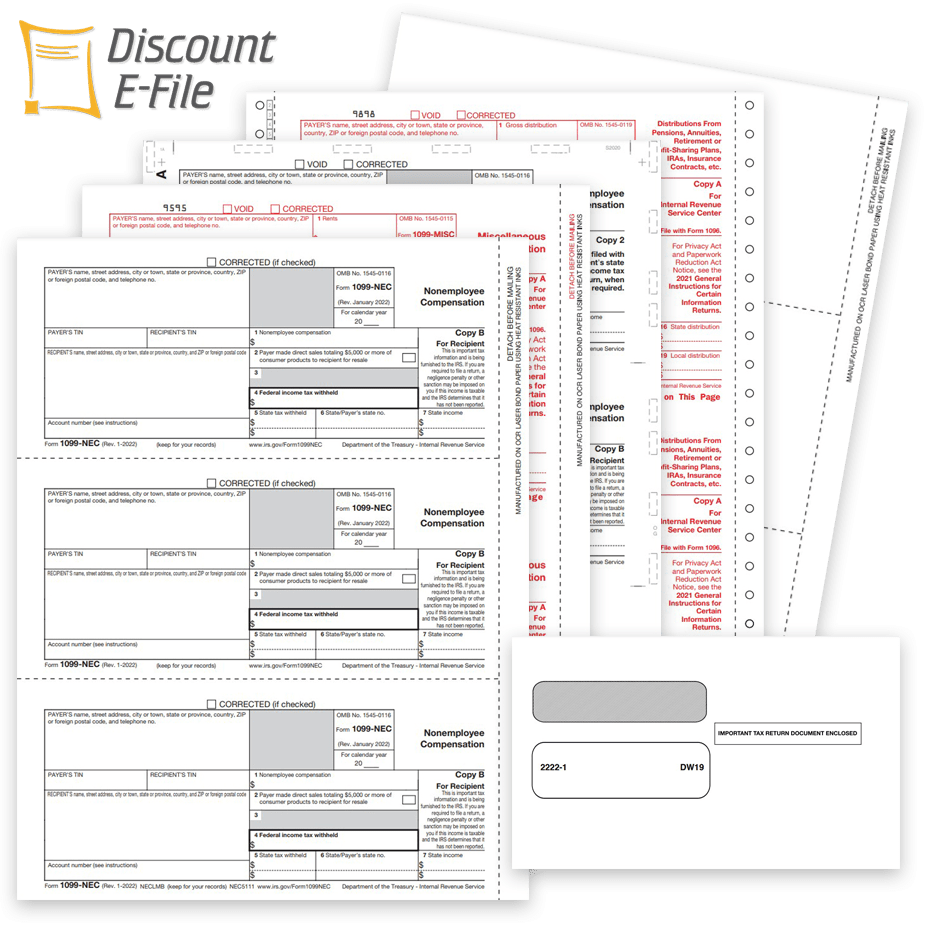

Preprinted 1099 Forms

All types of official 1099 Forms.

Blank 1099 Paper

Perforated 1099 blank forms.

1099 Form Sets

Sets of forms with optional envelopes.

1099 Copy A Forms

All of the red, IRS Copy A forms in one place.

1099 Envelopes

Security-tint, window envelopes.

QuickBooks 1099 Forms

100% Compatible and more affordable!

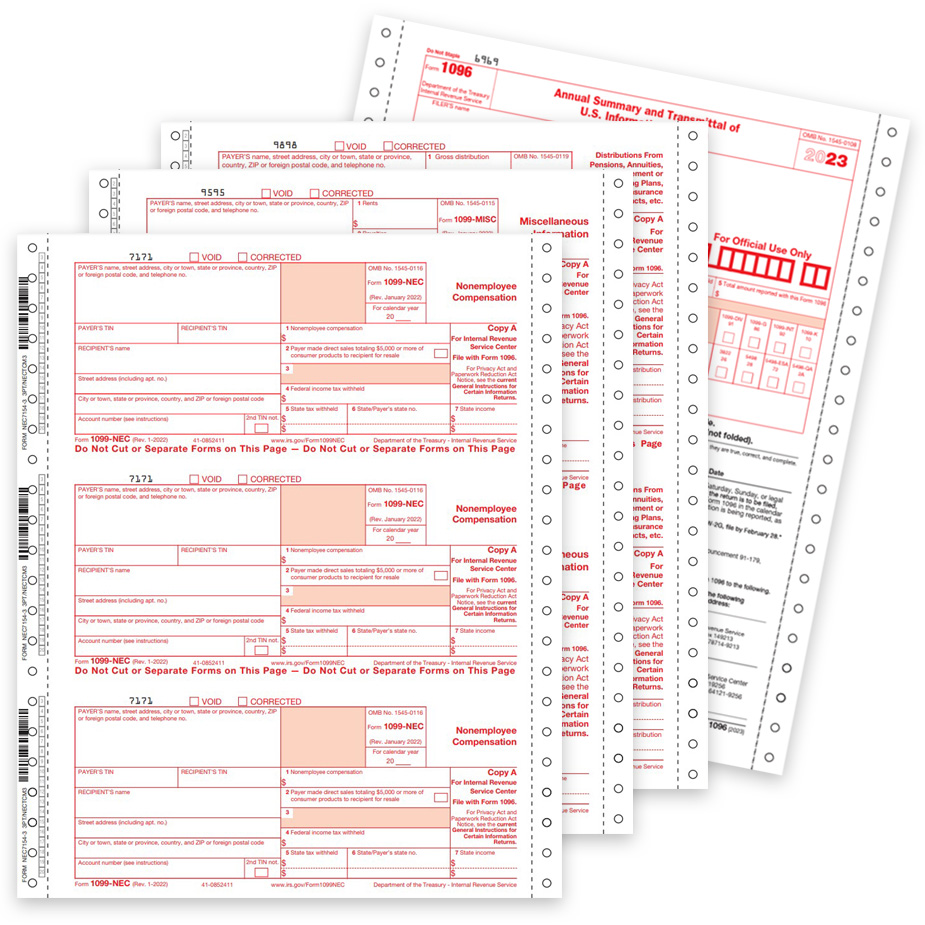

Continuous 1099 Forms

For pin-fed printers & typewriters.

Software Compatible

Forms for accounting software

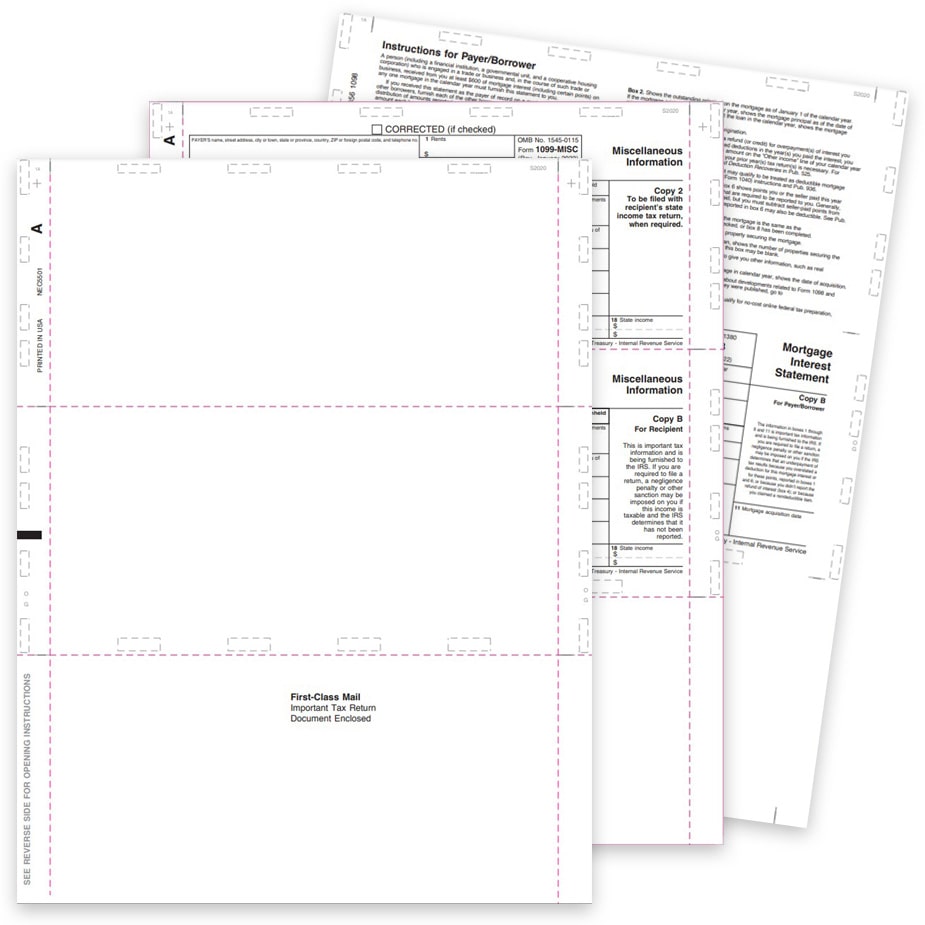

Pressure Seal 1099 Forms

For pressure-seal equipment.

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

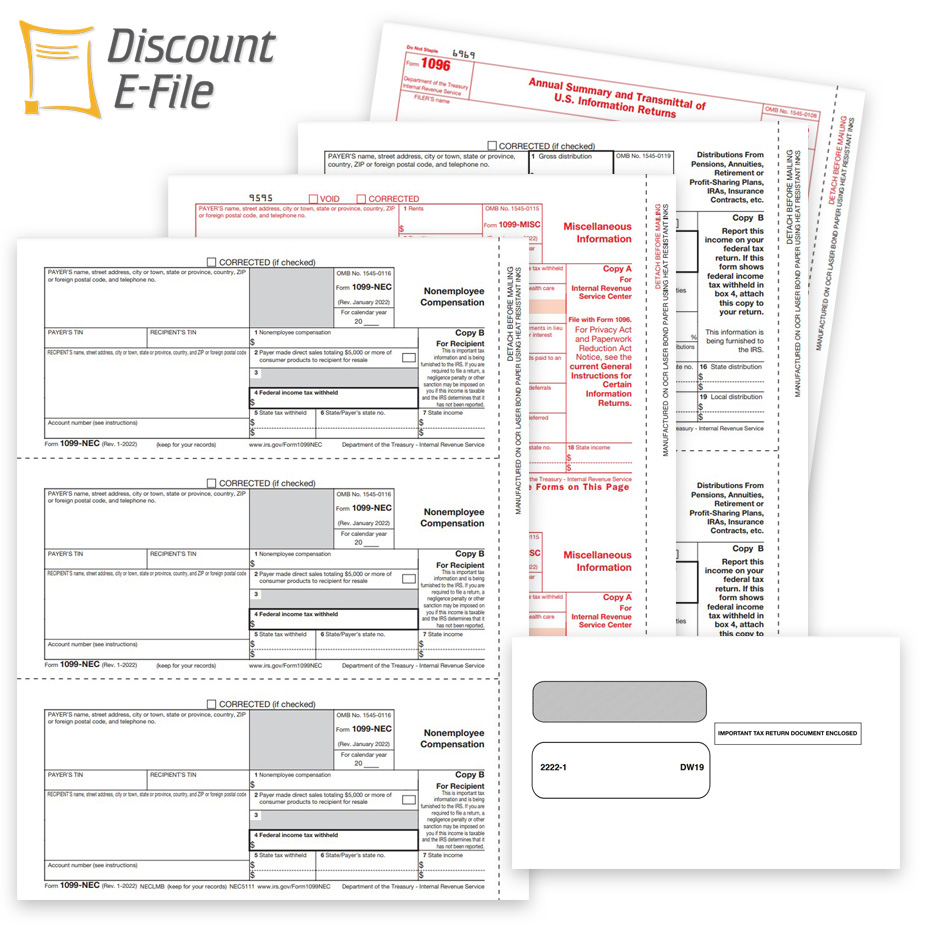

Order Any Type of 1099 Form at Discount Prices!

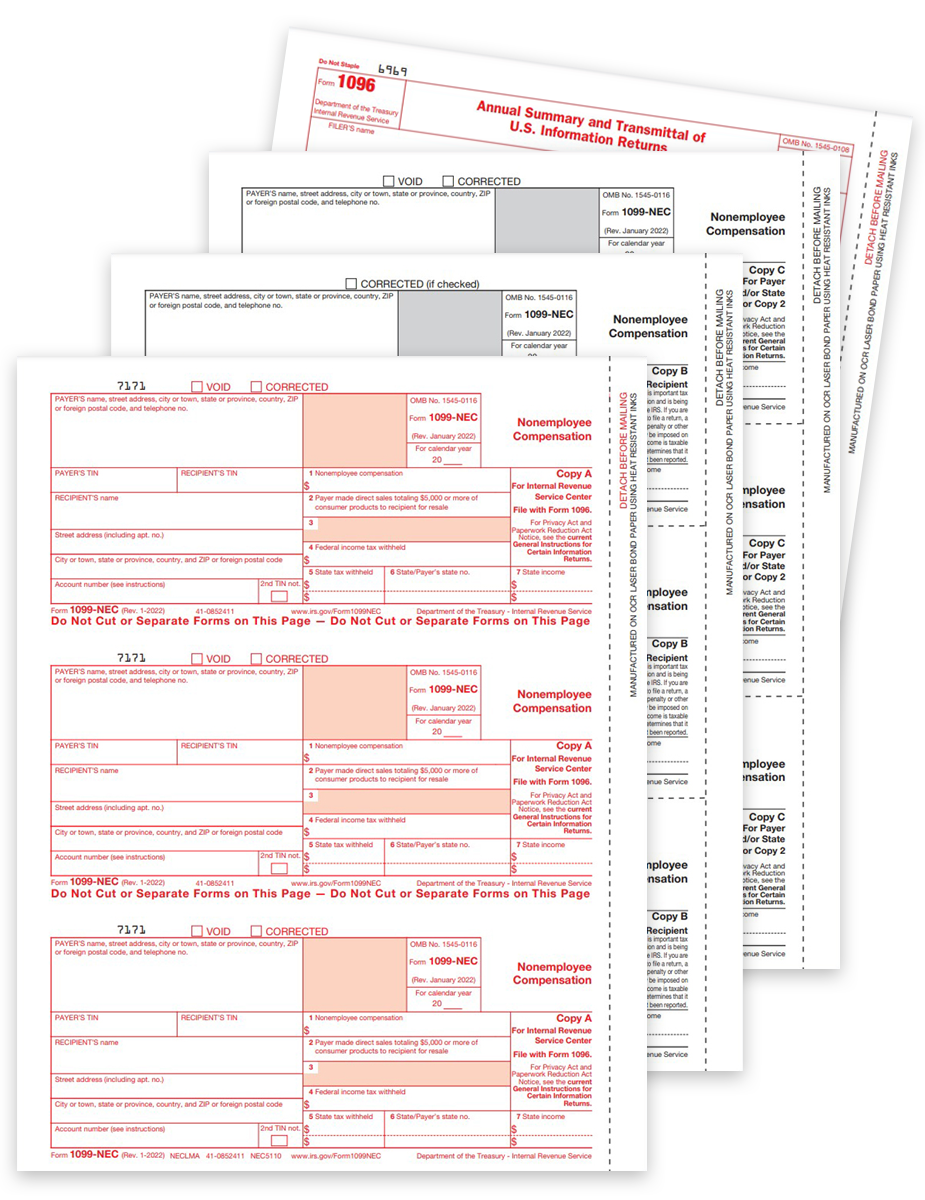

Report nonemployee compensation for contractors, freelancers and more who you have paid over $600.

We offer discounted forms, software and online e-filing and mailing services.

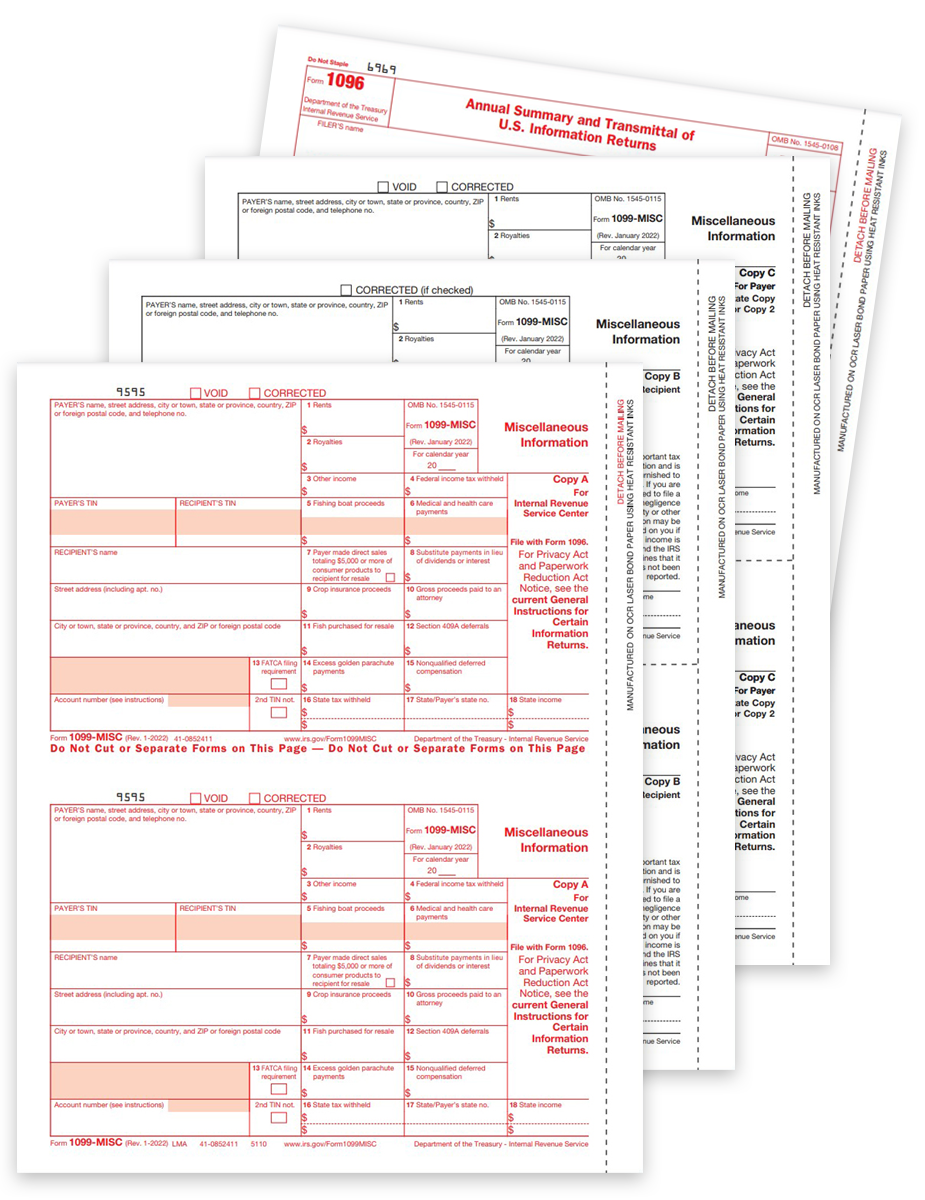

For miscellaneous business expenses over $600 that are NOT nonemployee compensation.

We offer discounted forms, software and online e-filing and mailing services.

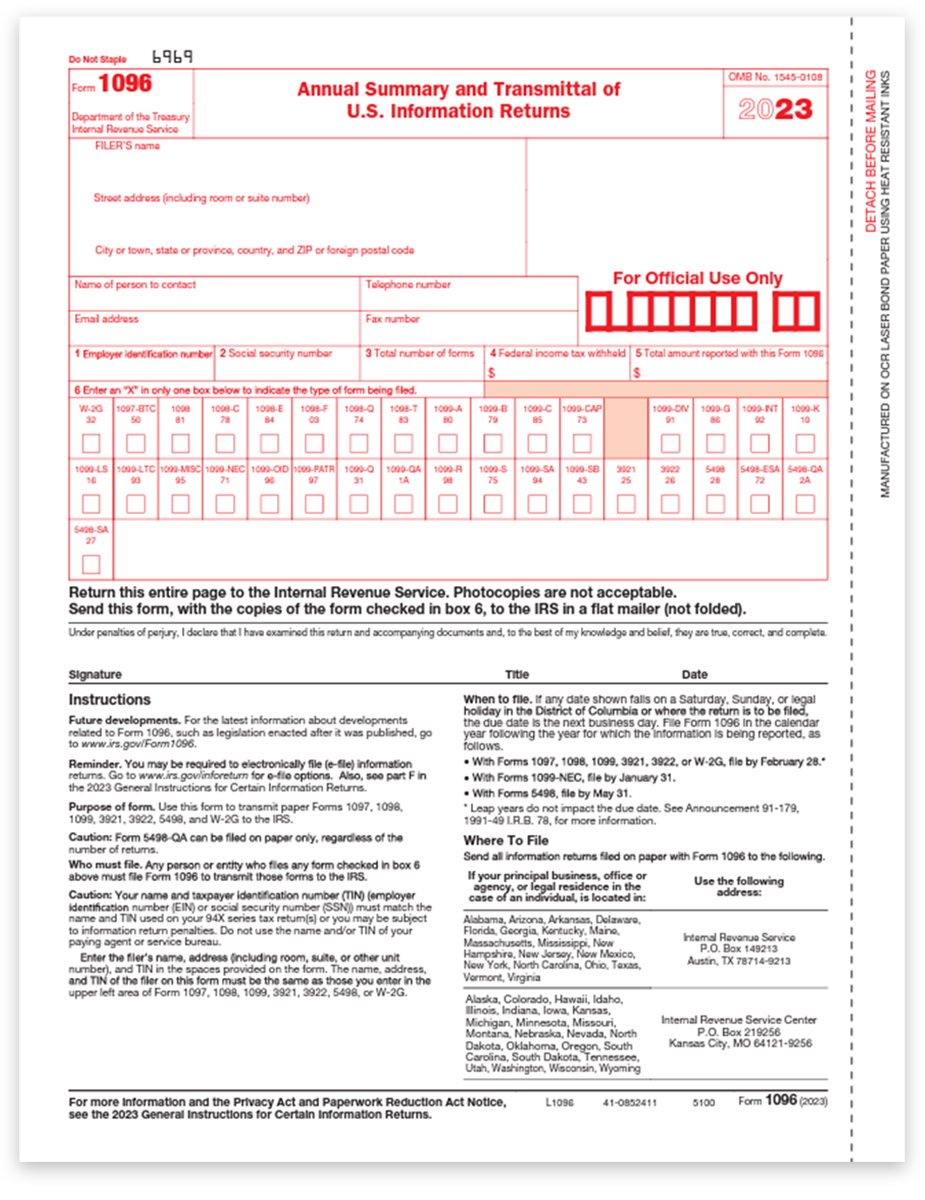

Form 1096 Form summarizes information for a payer’s batch of one type of 1099 forms.

NEW E-filing rules may apply for 2023 and you may not need 1096 forms!

1098

Mortgage Interest

1098-C

Vehicle Donations

1098-E

Student Loan Interest

1098-T

Tuition Payments

1099-B

Proceeds from Broker Transactions

1099-C

Cancellation of Debt

1099-CAP

Corporate or Capital Changes

1099-DIV

Dividends and Distributions

1099-G

Certain Government Payments

1099-INT

Interest income

1099-K

Payment Cards & Transactions

1099-LTC

Long-Term Care & Death Benefits

1099-OID

Original Issue Discount

1099-PATR

Distributions from Cooperatives

1099-R

Real Estate Transaction Proceeds

1099-S

Proceeds from Real Estate

1099-SA

HSA / MSA Distributions

5498

IRA Contributions

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.