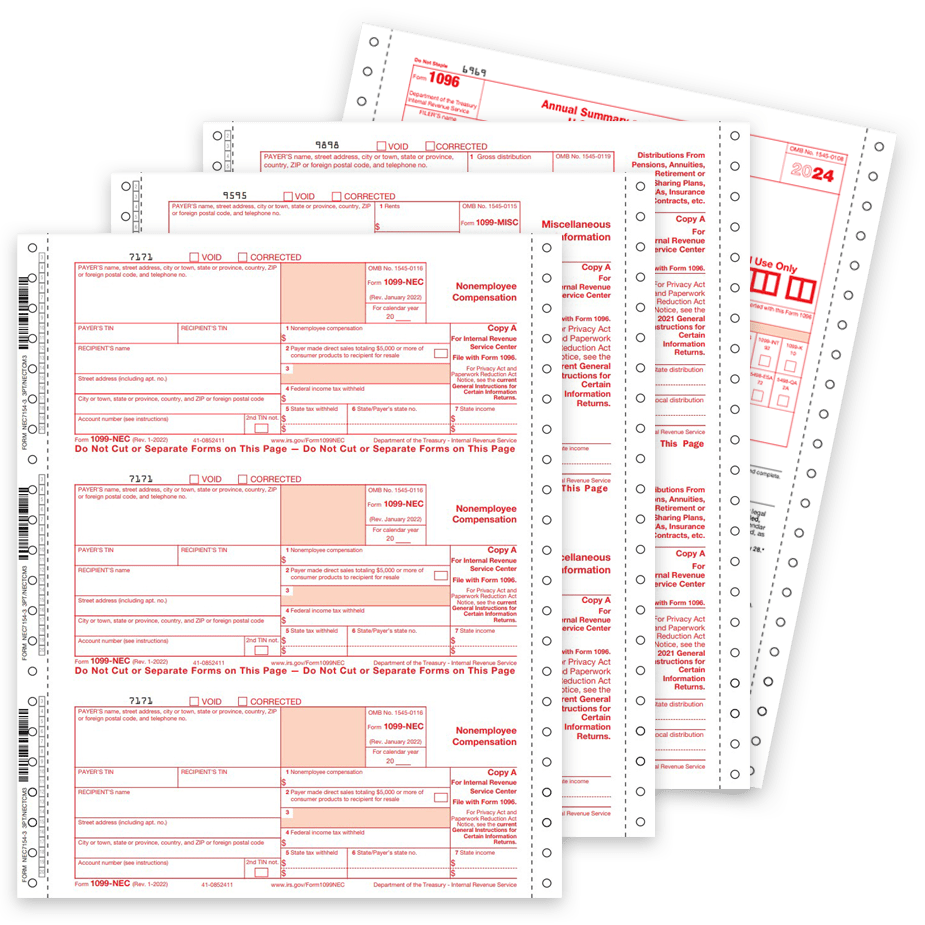

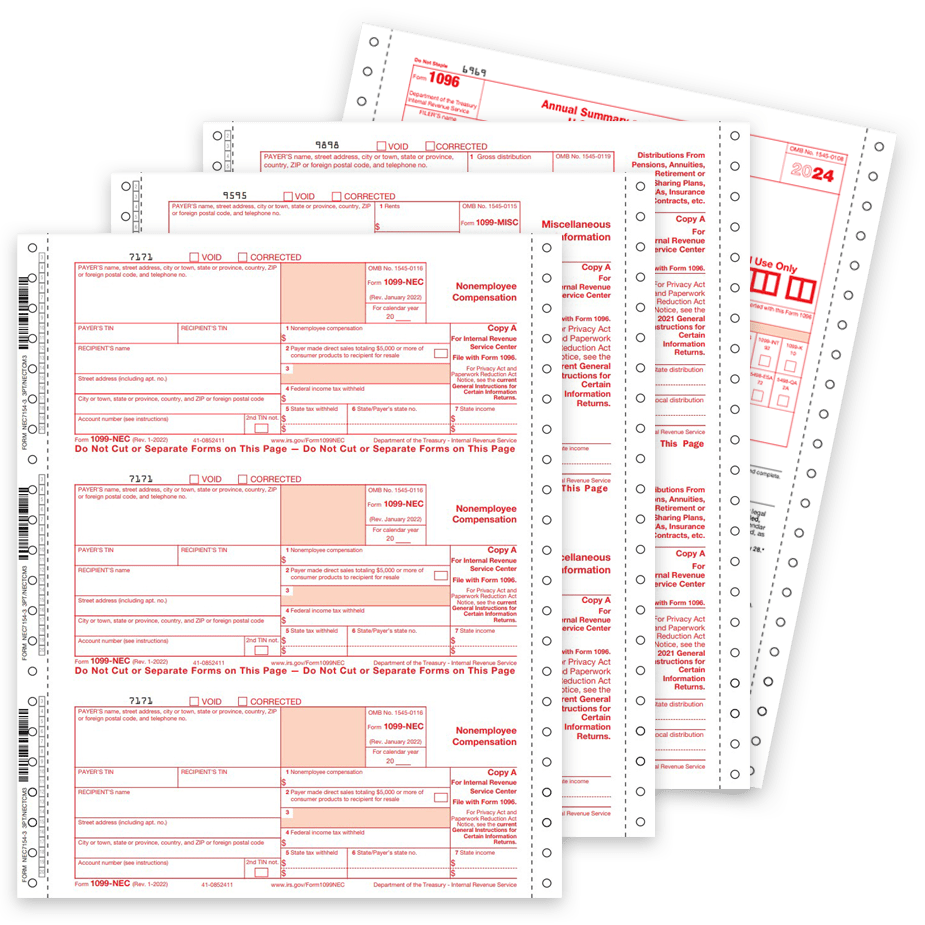

1099 Continuous Forms

Carbonless 1099 forms for pin-fed printers or typewriters.

- Big discounts – no coupon code required!

- Many styles of continuous, multi-part 1099 forms

- Fast, friendly service from The Tax Form Gals

1099 E-filing requirements — e-file Copy A for 10+ 1099 & W2 forms combined. We make 1099 e-filing easy!

1099 carbonless continuous forms for typewriters or dot matrix printers at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

Order 1099 Carbonless Forms for 2024

-

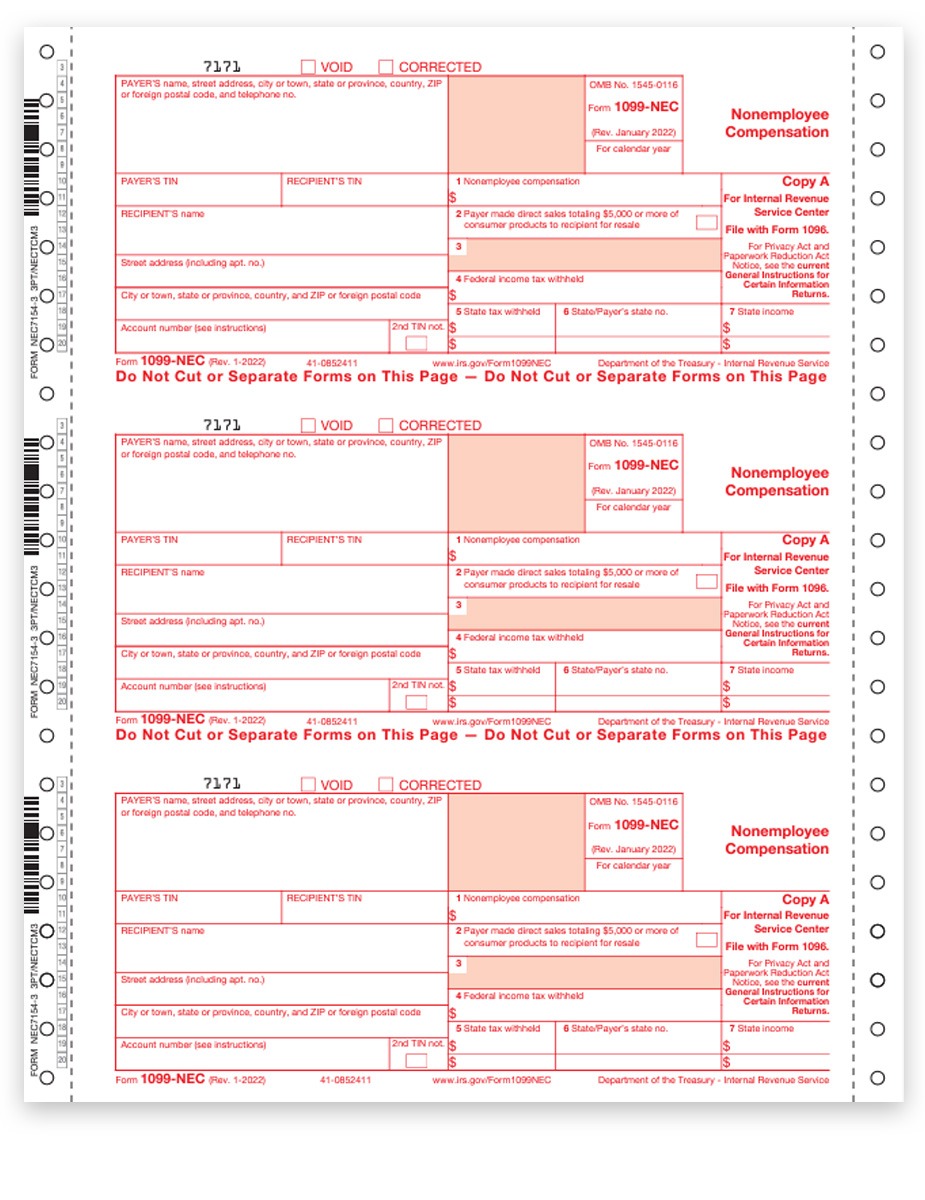

1099-NEC Carbonless Continuous Forms

-

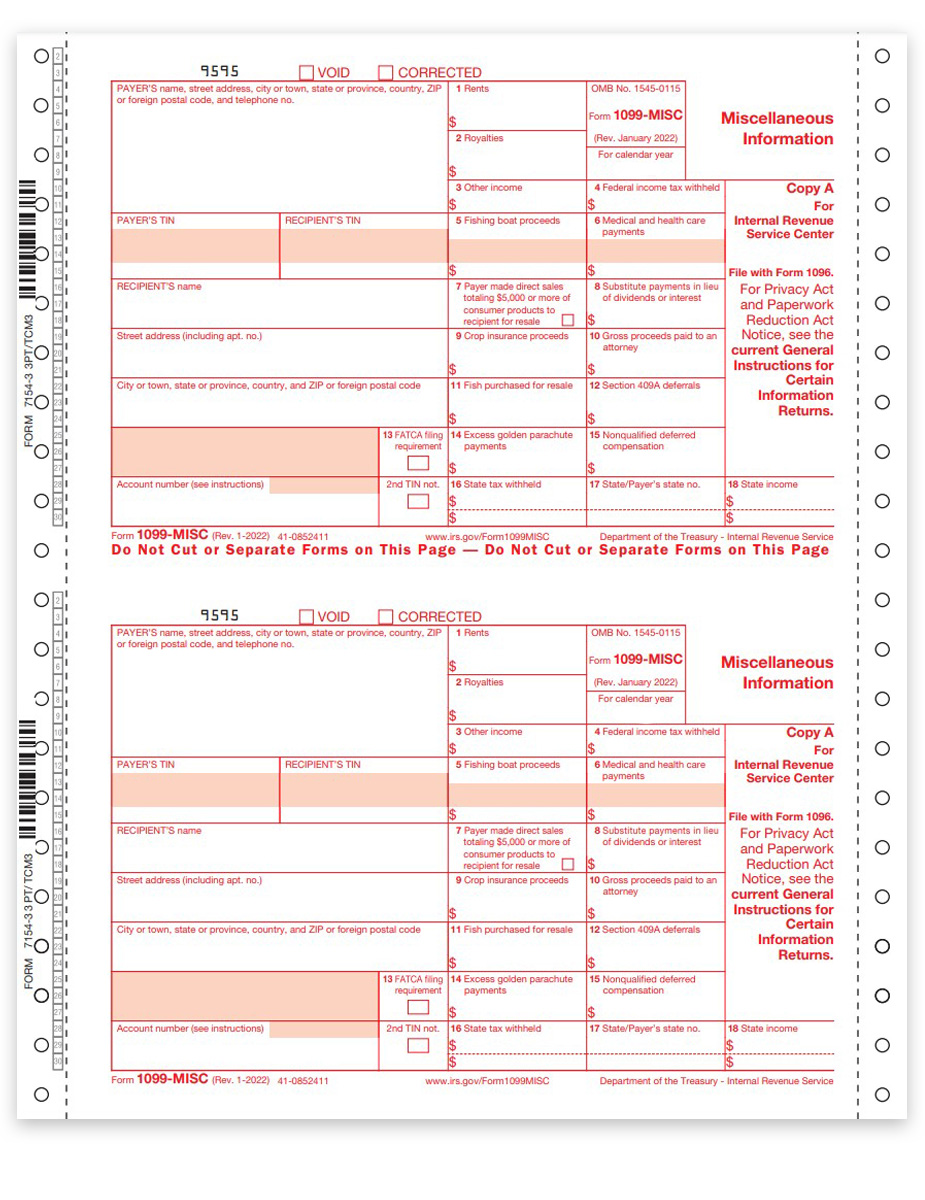

1099-MISC Carbonless Continuous Forms

-

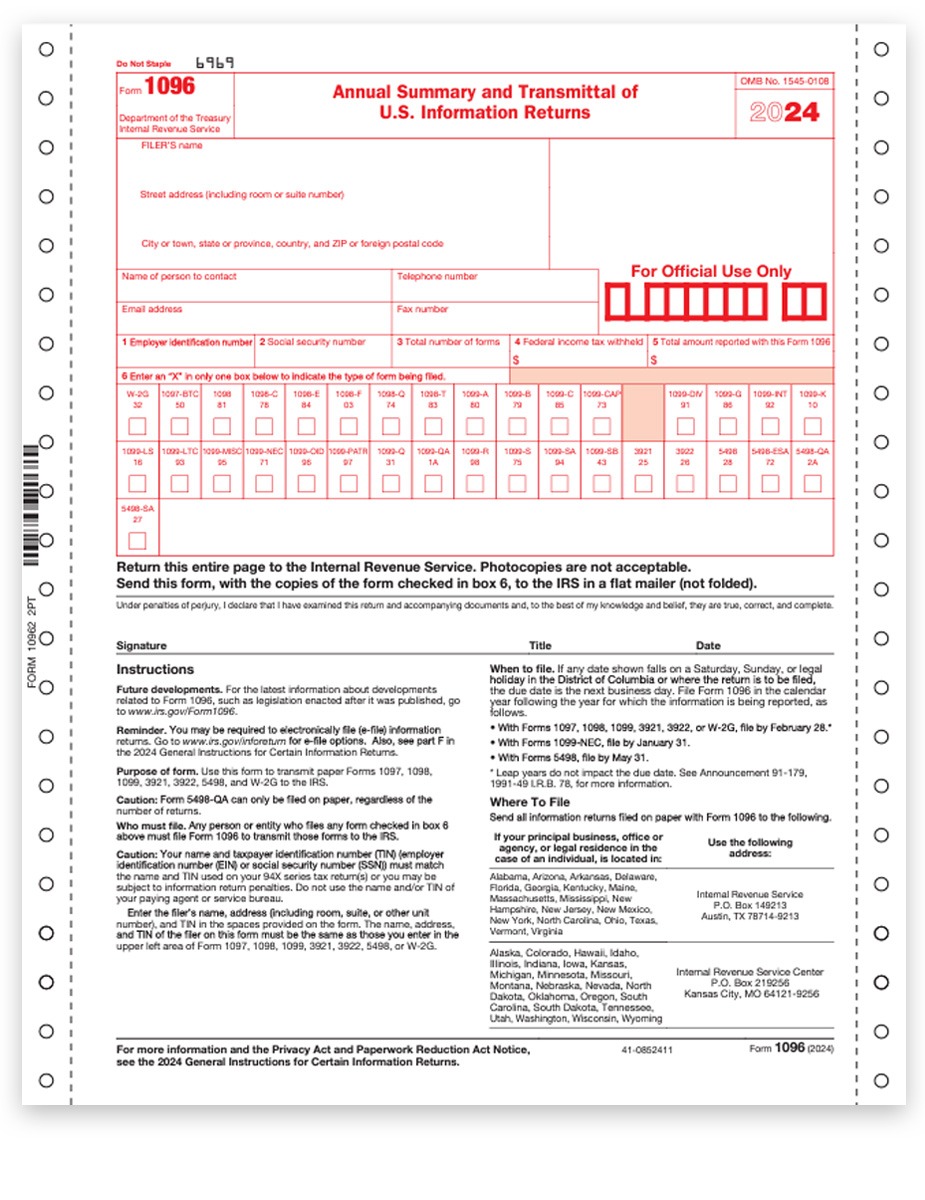

1096 Transmittal Forms – Carbonless Continuous

-

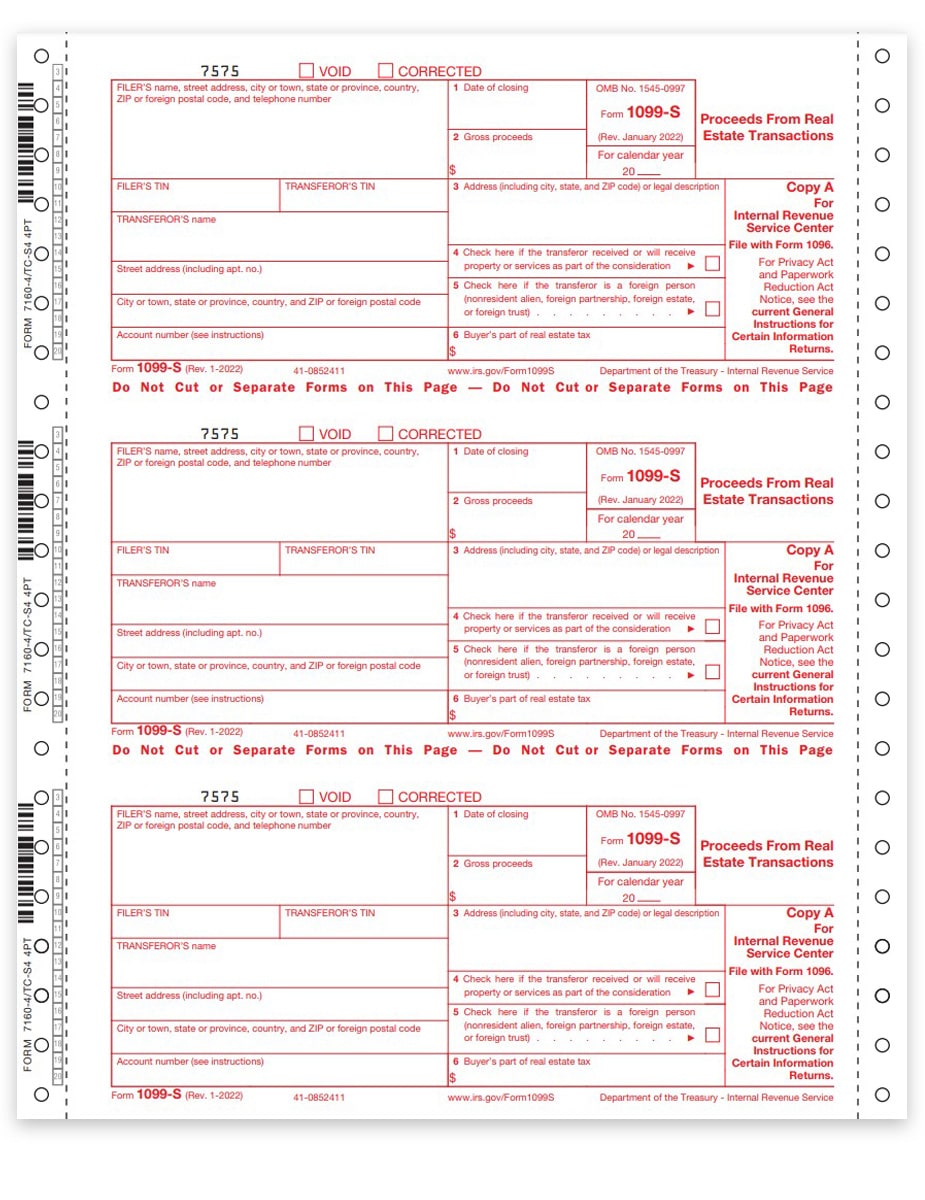

1099-S Carbonless Continuous Forms – 4-part

-

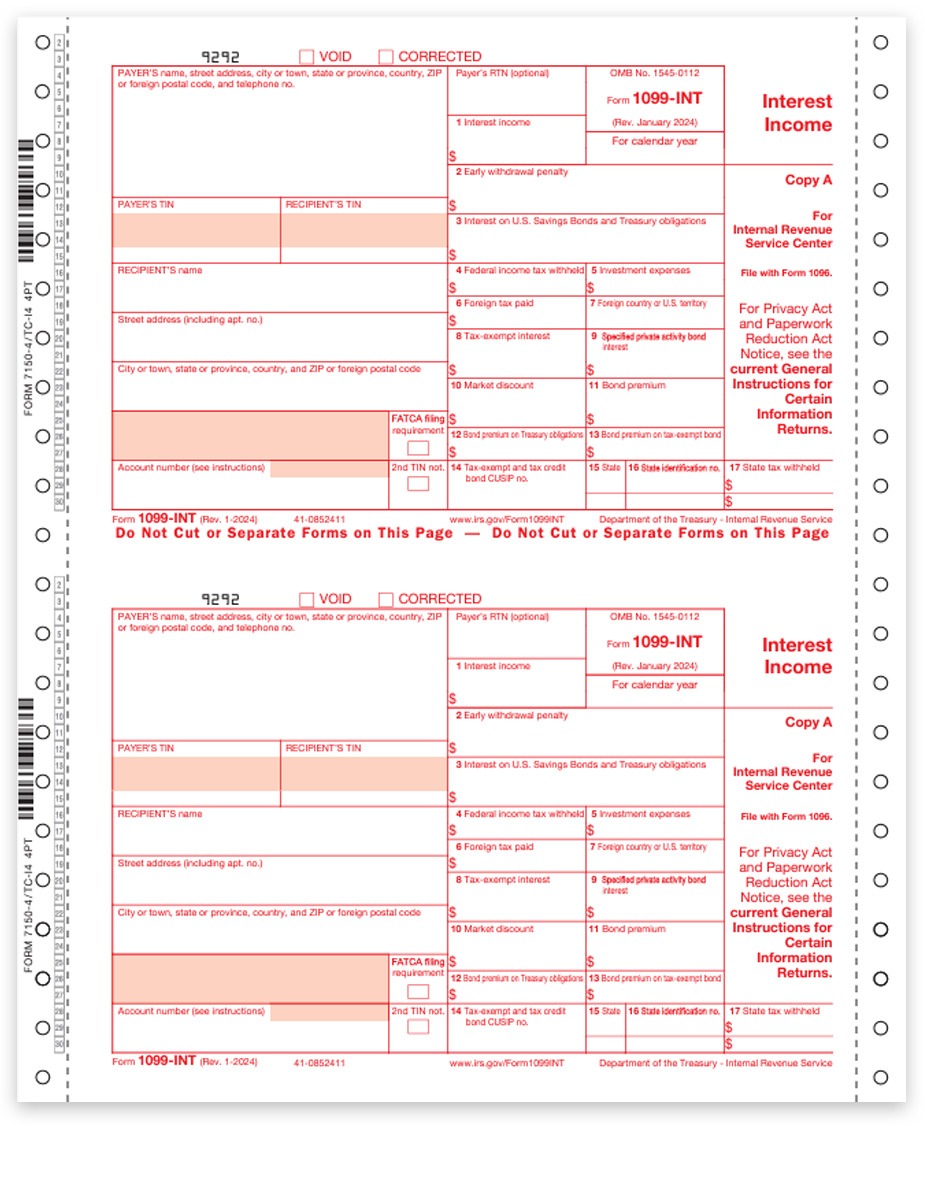

1099-INT Carbonless Continuous Forms

-

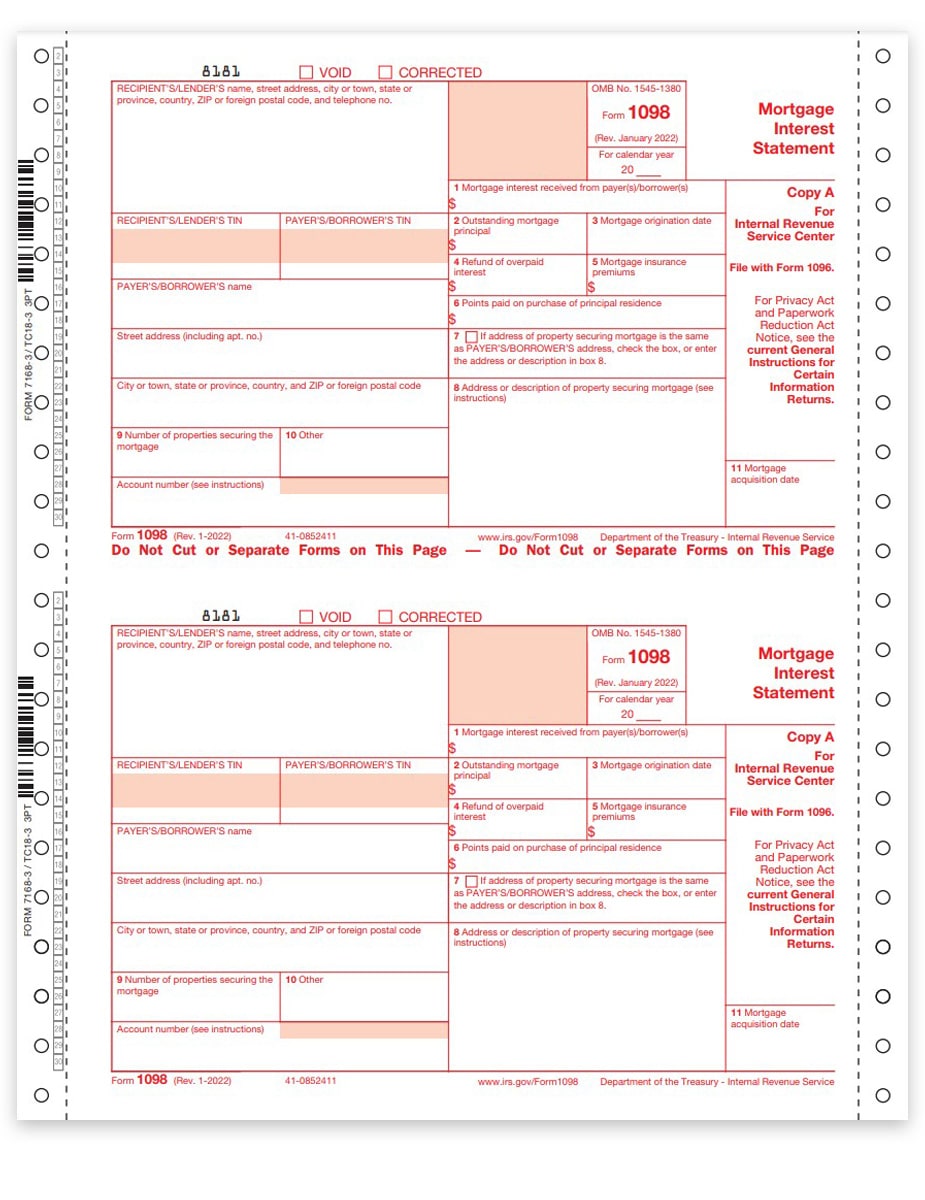

1098 Carbonless Continuous Forms

-

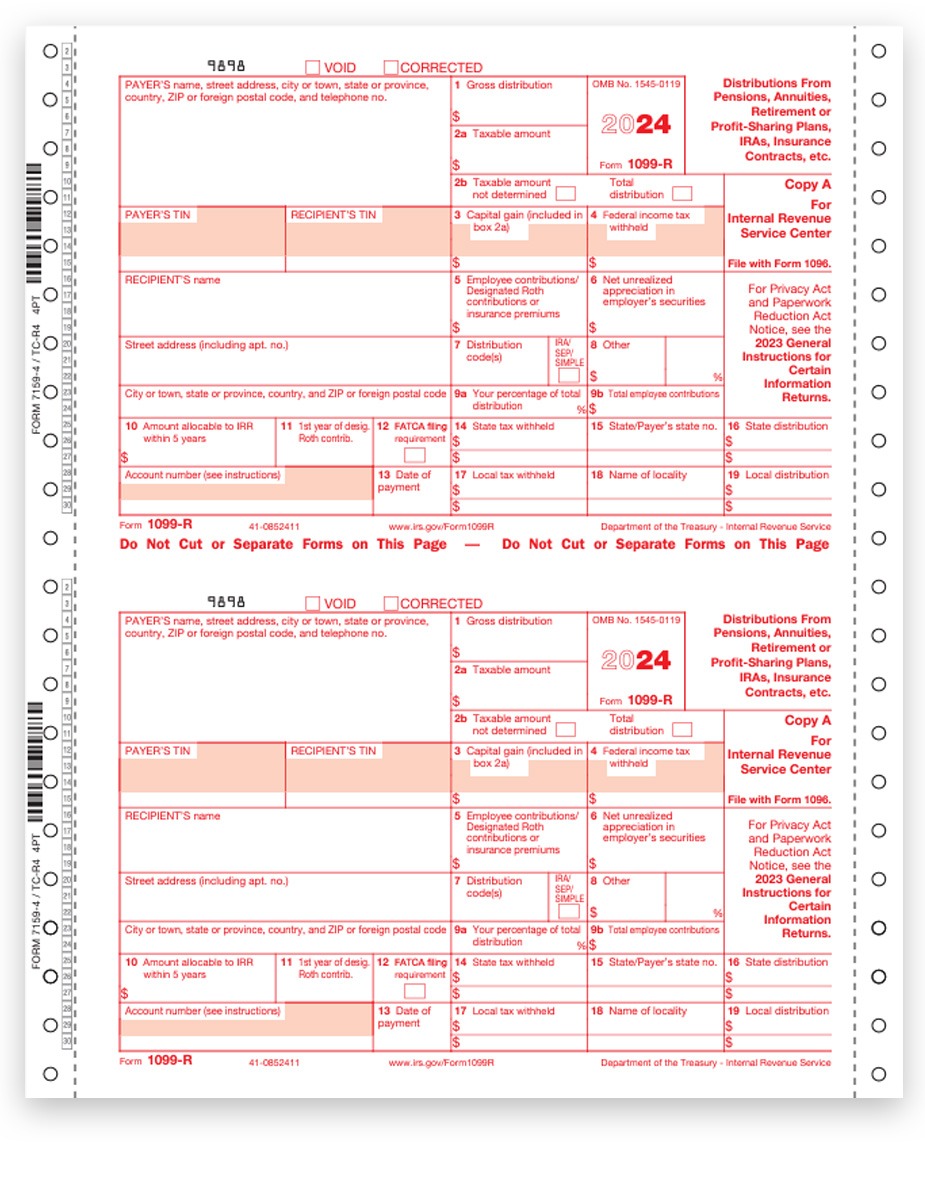

1099-R Carbonless Continuous Forms

-

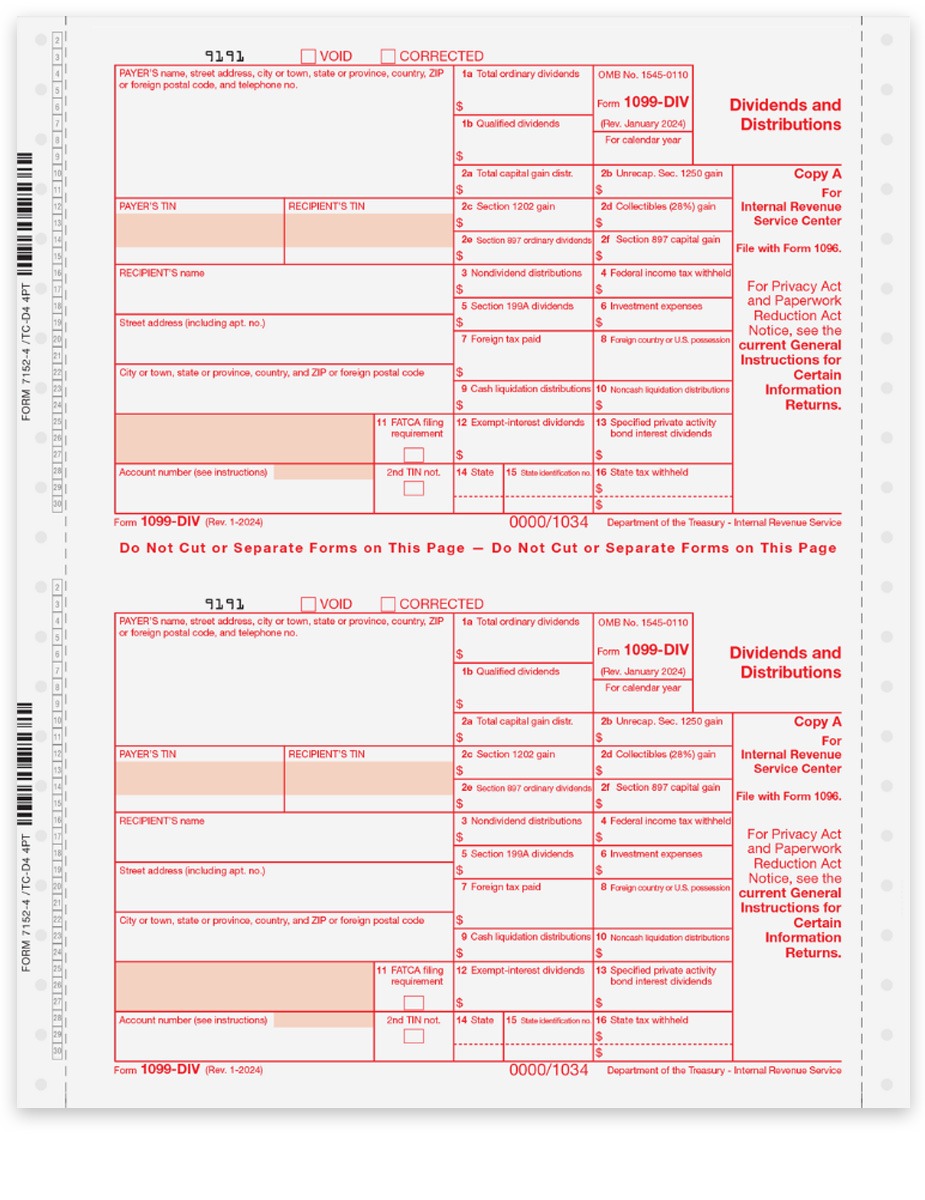

1099-DIV Carbonless Continuous Forms

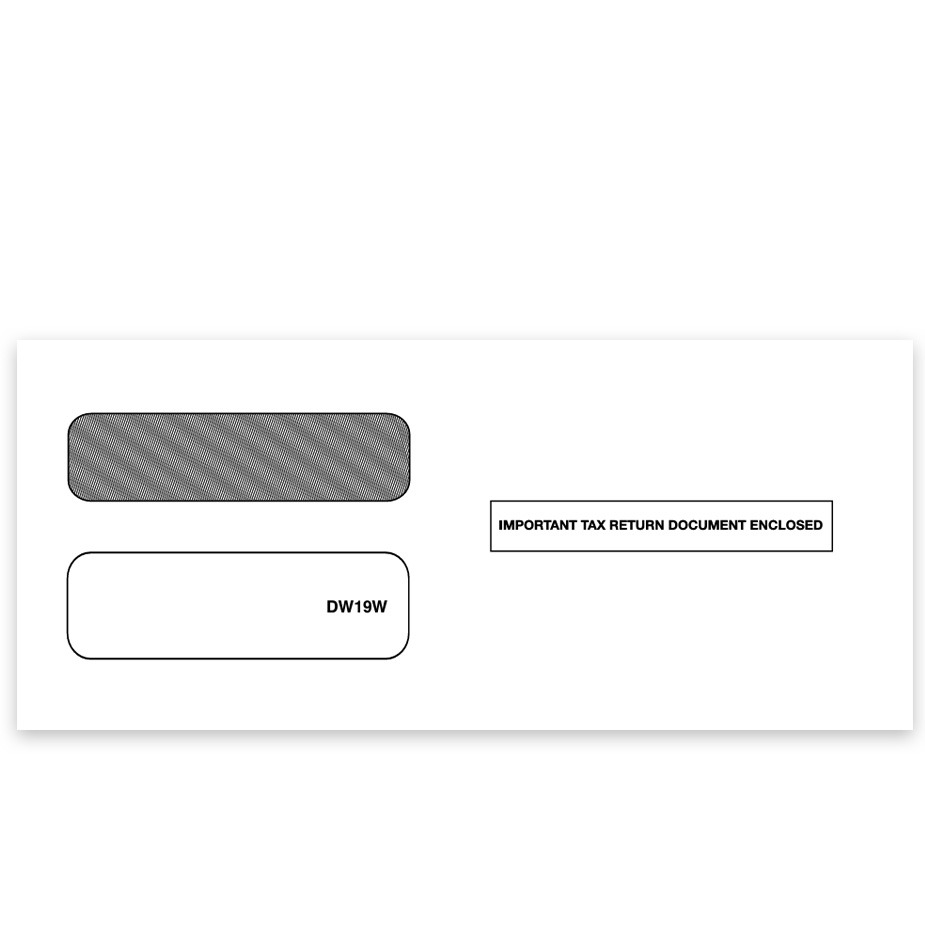

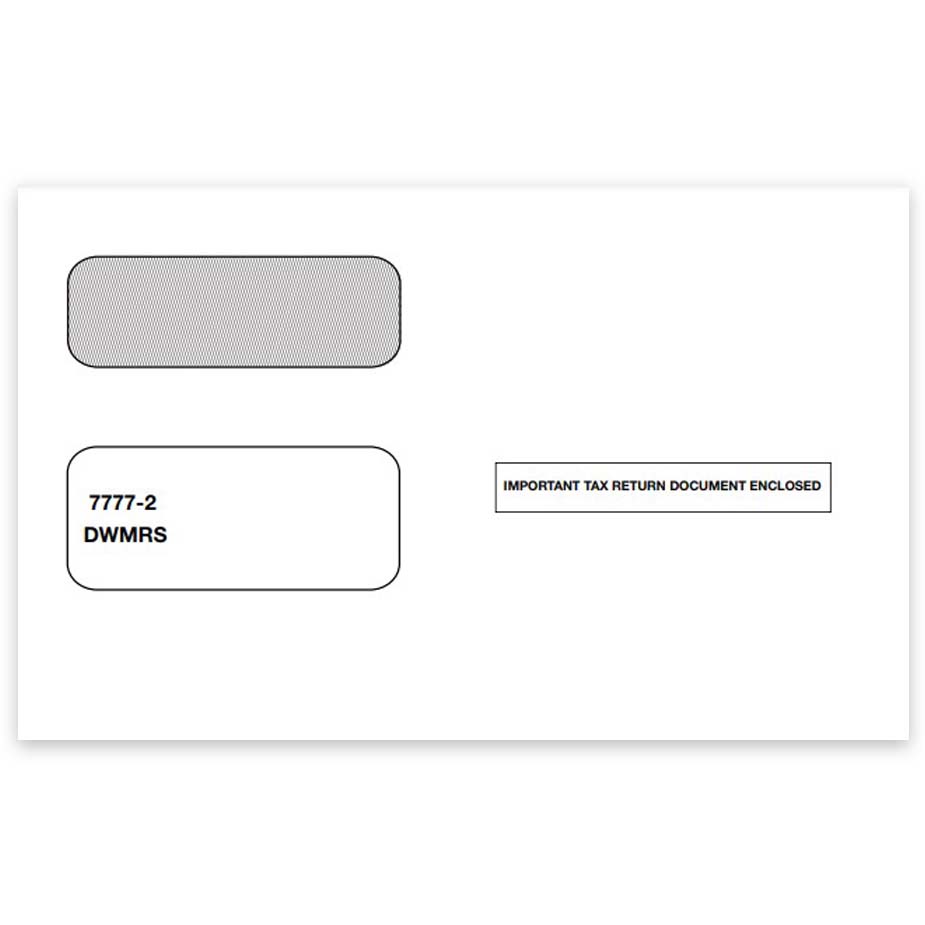

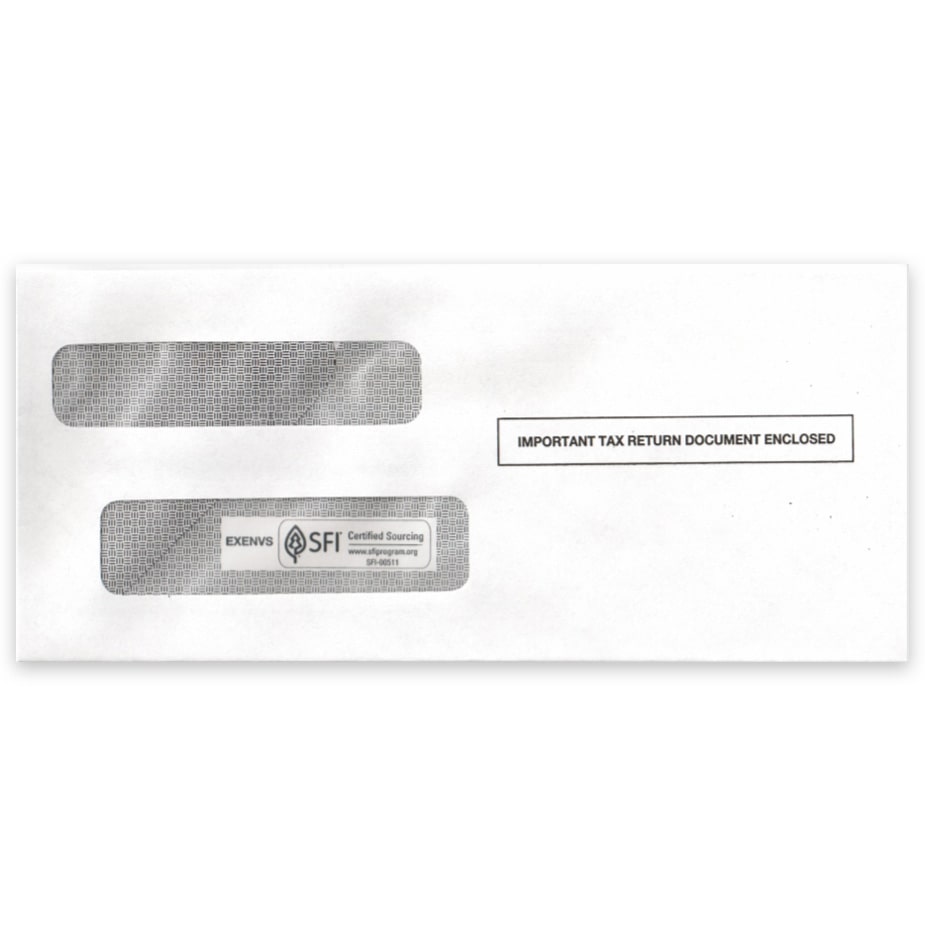

Compatible 1099 Envelopes

Insights to Easier 1099 Filing

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.