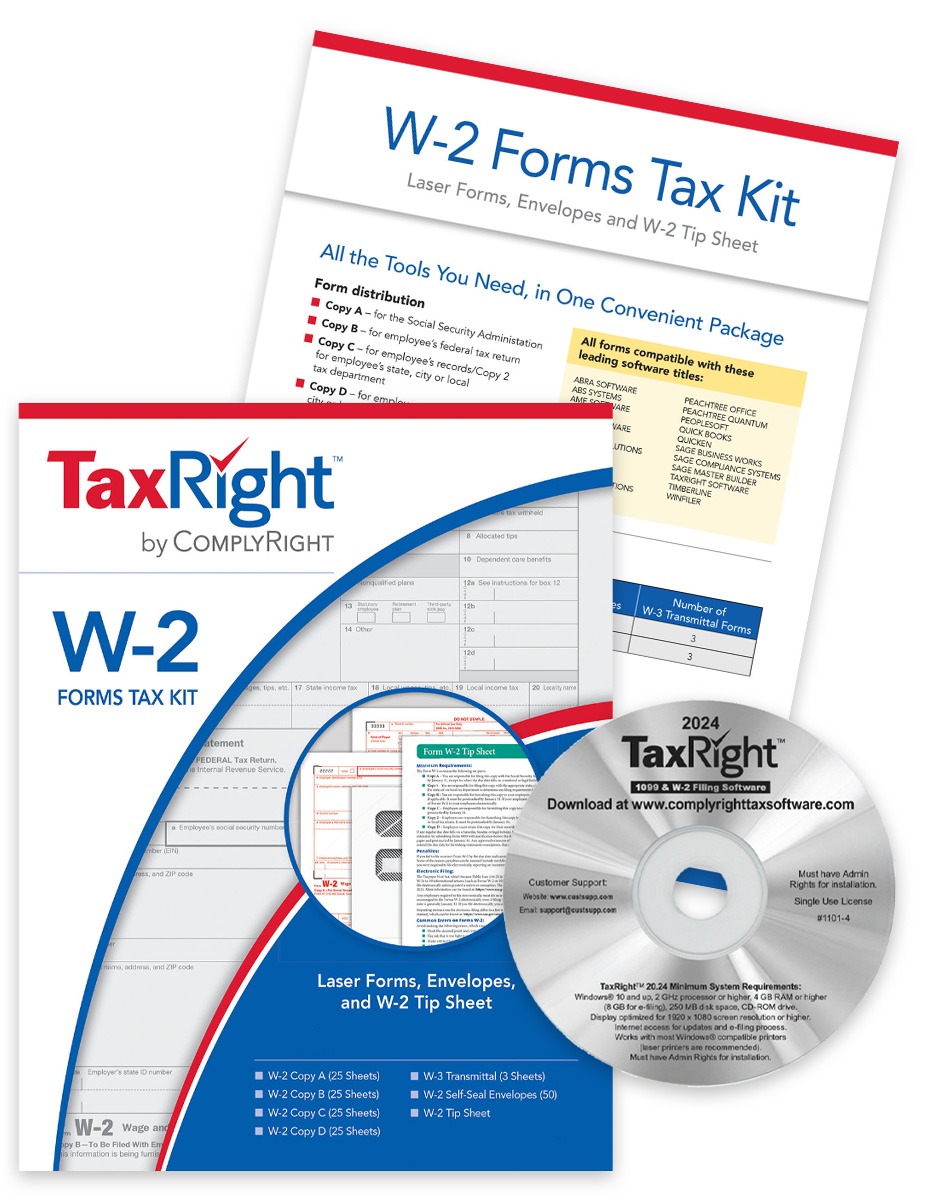

1099 & W2 Software + E-Filing Kit with W2 Forms and Envelopes

A kit with software, W-2 forms, envelopes and efiling for easy filing of W2 and 1099 forms for the 2024 tax year. Plus the capability to easily e-file with the IRS or SSA – required if you file 10+ 1099 and W2 forms combined, per EIN.

W2 Software & Form Kits Make Filing Easy!

TaxRight software will easily print recipient copies on preprinted 1099 and W2 forms.

Simple functionality with step-by-step user guides, templates for importing data from TFP and other systems, plus enhanced reporting to see payer and recipient summary information.

E-Filing is simple, with a quick and easy process to upload files and send to the IRS and/or SSA for just $1.65 per form.

Secure filing with password protection and SSN masking to show only the last 4 digits of recipient SSN.

Official W2 forms and self-sealing envelopes are included in this kit, along with software and a W2 filing tip sheet.

Switching from TFP Software?

An easy conversion integration is available from within Tax Right software! No need to switch to Winfiler® or other expensive 1099 & W2 software, TaxRight does it all at a more affordable price. And the functionality, workflow and printing is so similar, you’ll feel right at home.

W2 & 1099 Efiling Requirements

If your business has 10+ W2 and 1099 forms, combined, pre EIN, you must e-file Copy A forms with the IRS and SSA. This software makes it easy! Learn More About the Requirements >

1099 & W2 Software and Forms Kit Includes:

- TaxRight 1099 & W2 Software

- 4-pt or 6-pt W2 Forms: Copy A – Employer Federal, Copy 1-D – Employer State / File (x2 for 6-pt), Copy B – Employee Federal, Copy C-2 – Employee State / File (x2 for 6-pt)

- Compatible W2 Envelopes: Double cellophane windows, self-seal flaps and security tint; printed with the required text, “Important Tax Return Document Enclosed”

- Three W3 Transmittal Forms

- W2 Filing tip sheet

W2 Software & Form Kit Specs:

- Includes 5 Free e-files (when the software is used for efiling)

- Additional e-filings are $1.65 per form

- Includes 4-part or 6-pt W2 forms and compatible envelopes (choose a pack of 10 or 25; additional forms can be ordered separately)

- Access e-filing information for up to 4 years on our platform

- E-mail communications as forms are filed and accepted

- Software can print the following 1099 & W2 forms:

- 1099-NEC

- 1099-MISC

- 1099-DIV

- 1099-INT

- 1099-B

- 1099-C

- 1099-R

- 1099-S

- 1098

- 1098-T

- W-2

- 1096 and W-3 transmittals

Click to order additional W2 forms and envelopes. These are the form sets included with the software. You can also use most of the other preprinted formats we offer.

Want to skip the software?

You can file everything online at DiscountEfile.com! We take the hassle out of filing 1099 & W2 forms by doing it for you. Simply enter or import your data and we’ll e-file with the IRS or SSA, print recipient copies and provide them electronically, and keep everything on file for you. Learn More >>

Reviews

There are no reviews yet.