Why Spend Money on Tax Return Folders?

Making an investment in a business brand and professional image pays dividends! Here’s why you should invest in client tax return presentation folders.

Making an investment in a business brand and professional image pays dividends! Here’s why you should invest in client tax return presentation folders.

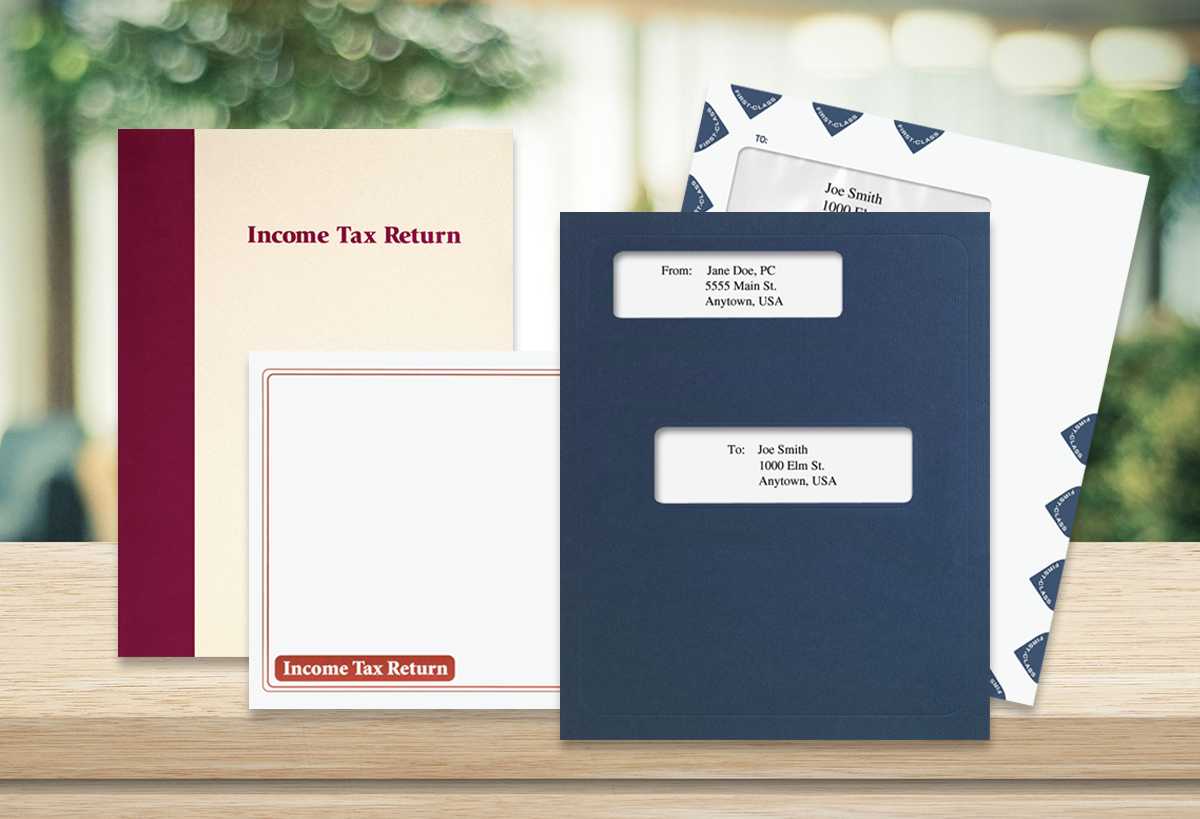

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

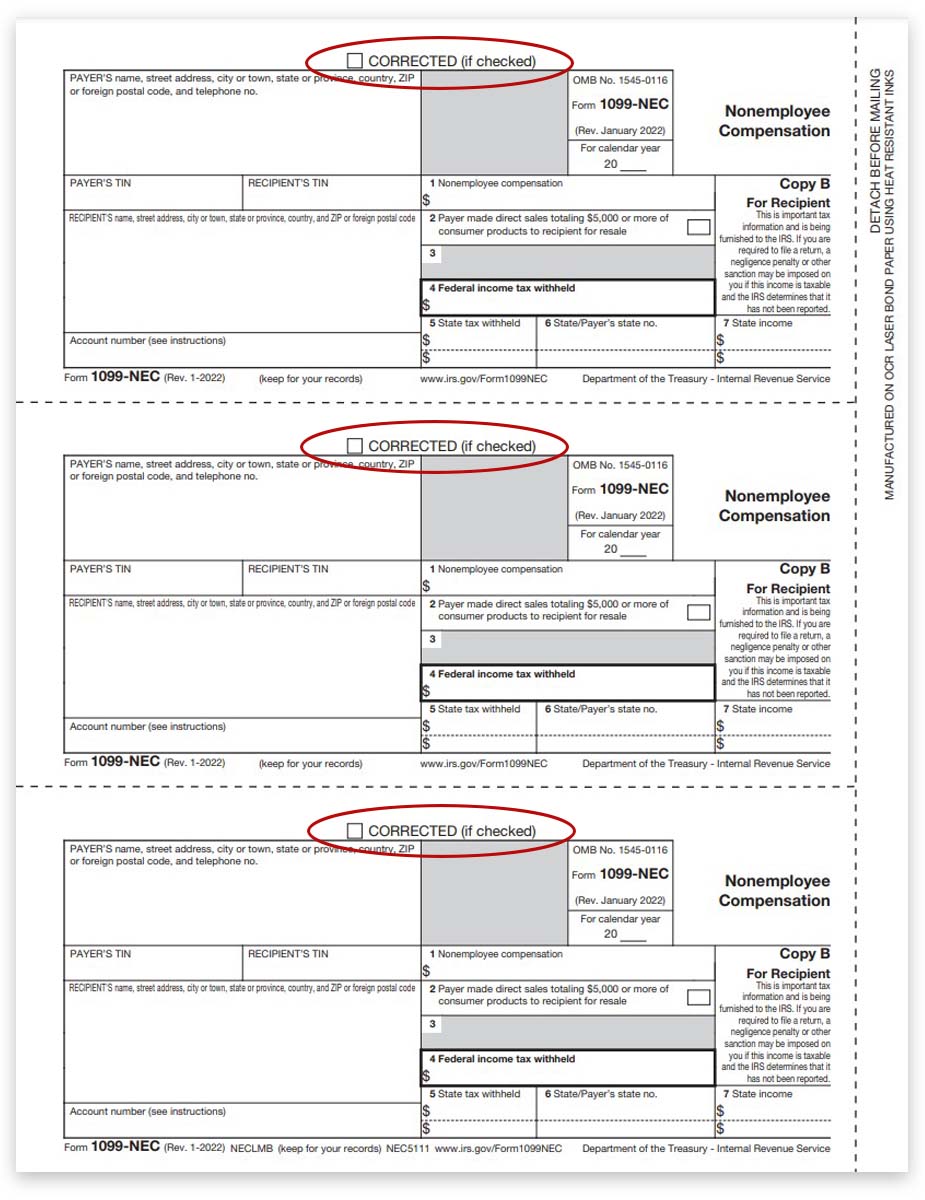

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?

A list of official 1099 and W2 due dates for e-filing or mailing paper copies to recipients and the IRS or SSA.

There are various ‘Copies’, or parts, of a W-2 form, each with a different name. Although they will have the same information about the employer and employee, earnings and withholdings, each copy is given to a different entity. This ensures correct reporting during the income tax filing process. W-2 Forms are filled out by the employer and provided to the employee or a government agency.