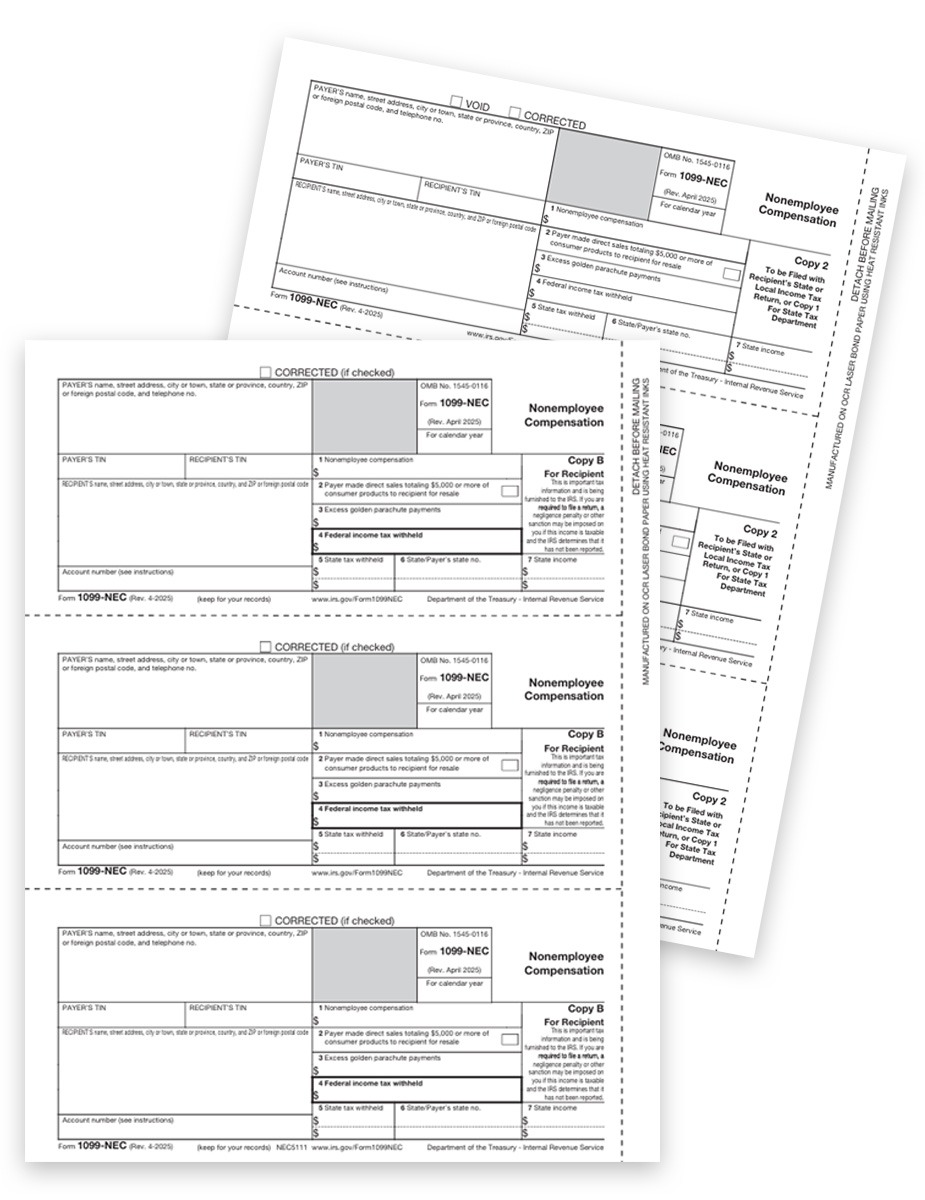

Set of 1099-NEC Tax Forms for Reporting Non-Employee Compensation to Recipients – for Businesses who Efile Copy A

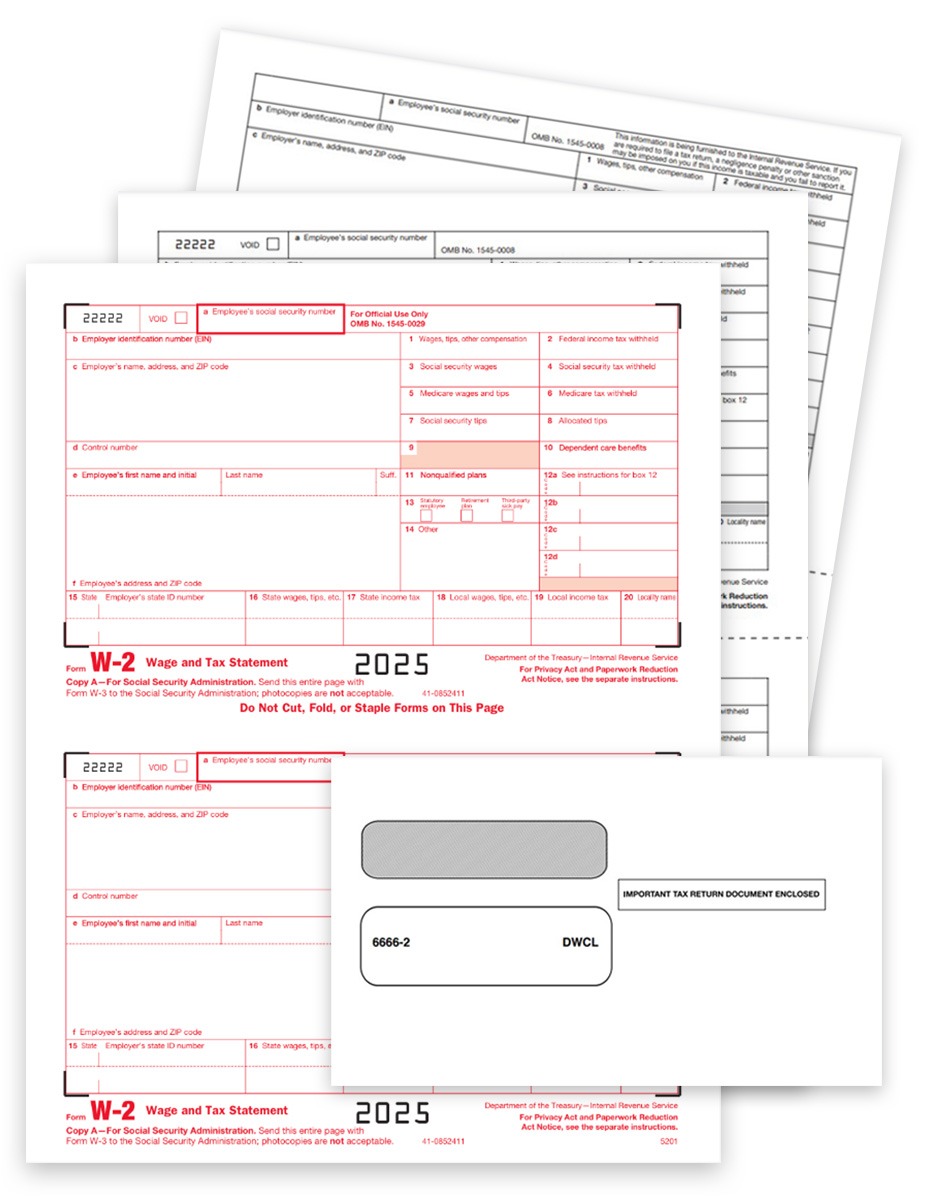

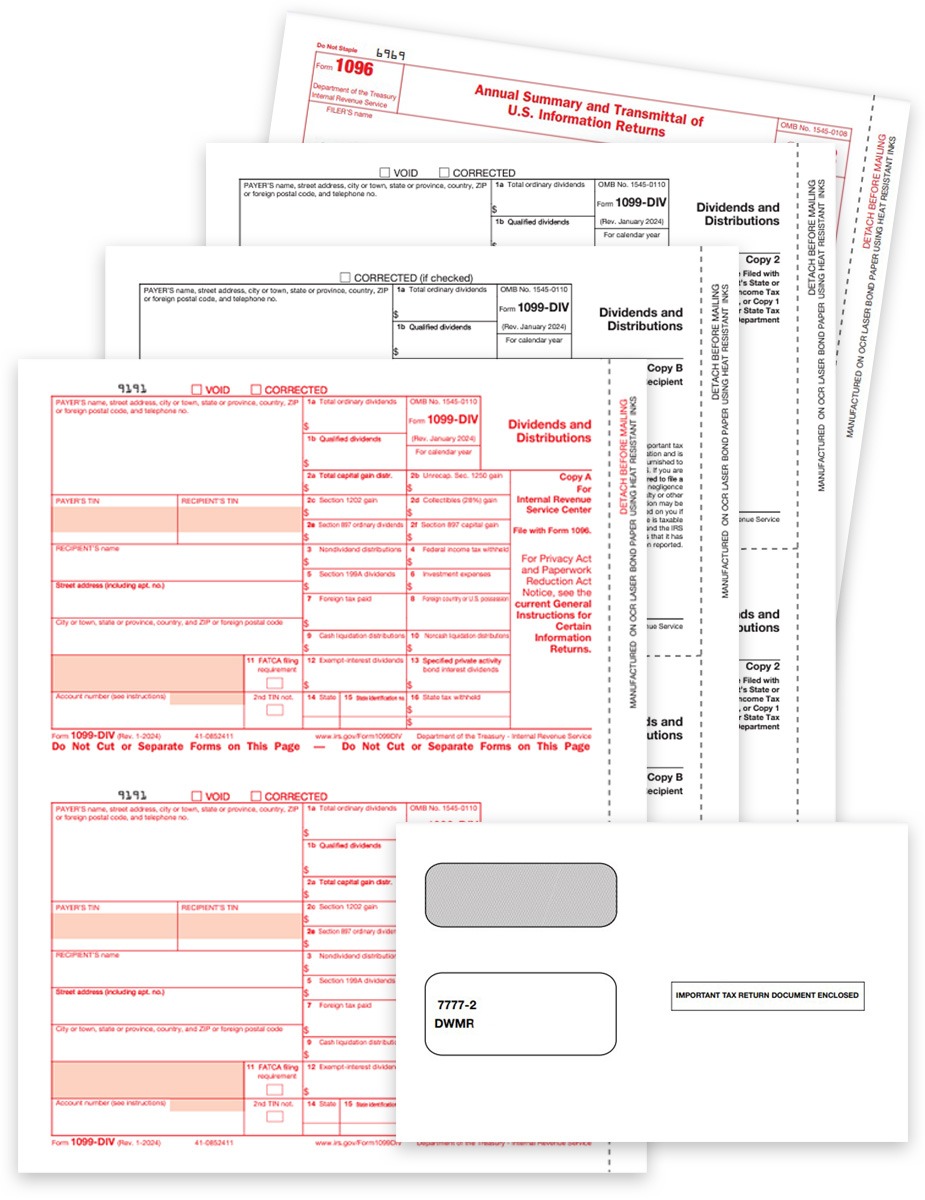

Order 1099-NEC forms for recipients in one simple kit! Includes all the required recipient forms and payer State and File copies. Ideal 1099NEC tax form sets for payers who must efile Copy A forms per the e-filing requirements for 10+ forms.

Low minimum quantities and discount prices – no coupon needed with The Tax Form Gals!

Use 1099NEC Forms to report non-employee compensation of $600+ for contractors, freelancers and more.

Compatible with QuickBooks® software and most accounting software that prints 1099 forms.

1099NEC Form Specs:

- 3-up format with 3 forms per page

- 8.5″ x 11″

- Printed on 20# laser paper

- Dateless format – use your software to fill in the year

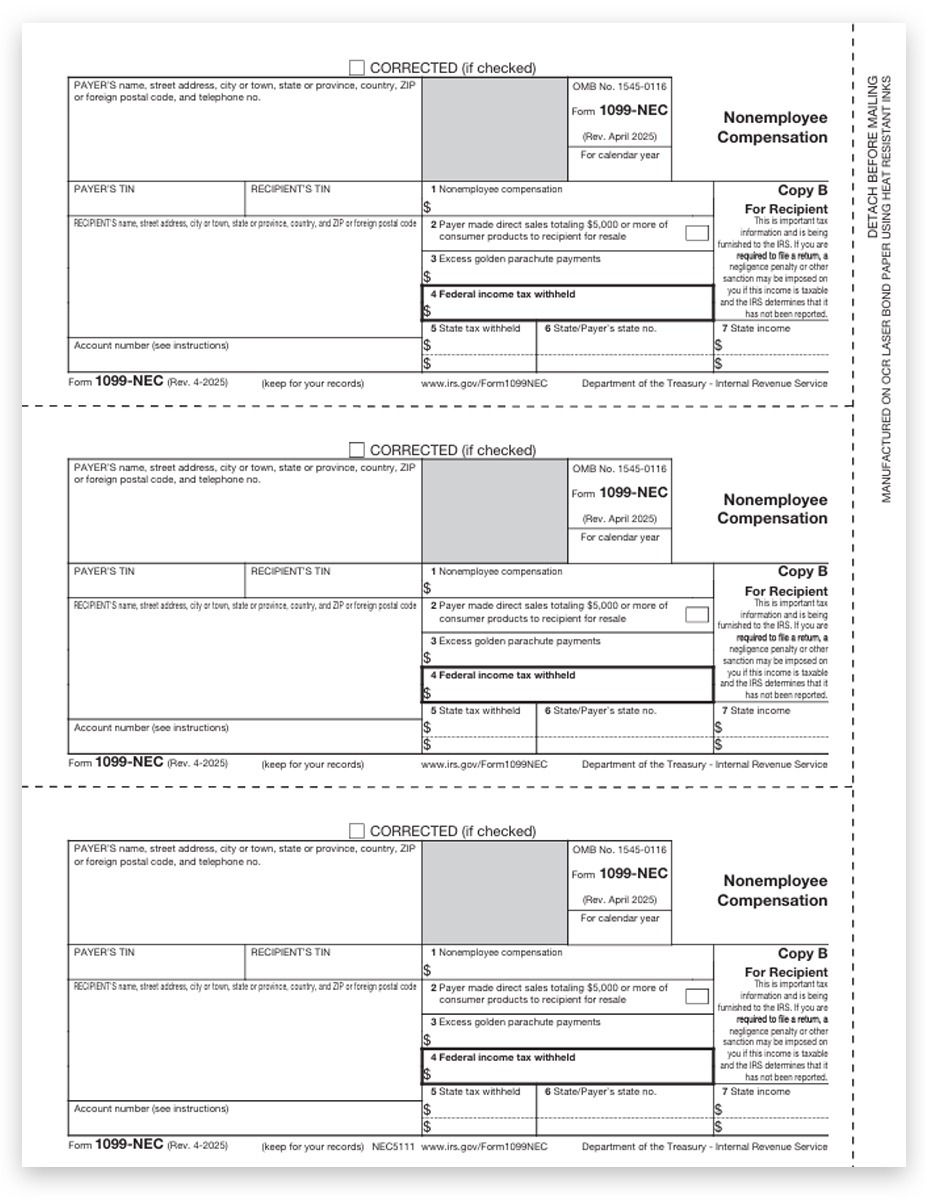

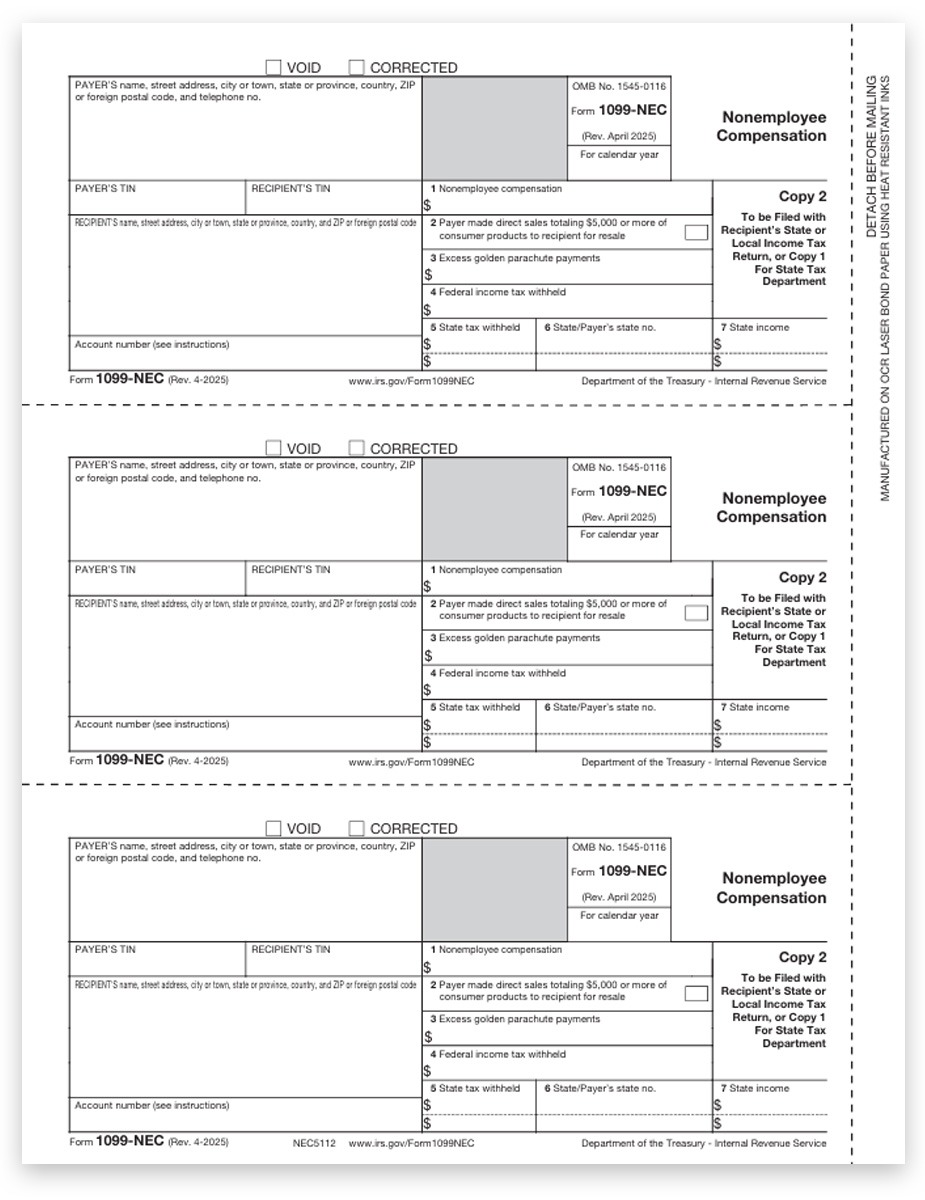

1099-NEC Form Sets include:

- Recipient 3up Federal Copy B (Federal)

- Recipient 3up Copy 2 (File, State, Local)

Compatible Envelopes

E-file Requirements for 1099 & W2 Filing

You must e-file Copy A if you have 10+ 1099 and W2 forms combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms.

We make it easy for businesses to make the change to online e-filing!

Check out DiscountEfile.com … to see how we efile with the IRS or SSA and can even print and mail recipient copies for you. Get it all done in one step in our fully-secure, top-rated online system, Discount Efile 4 Biz.

DiscountEfile.com

Ordering 1099 & W2 Forms

Official preprinted 1099 & W2 forms are sold by the form (not sheets).

Order a quantity equal to the number of recipients you have. For example, if you have 25 recipients, order 25 forms.

- If your W2 or 1099 forms are 2up (2 per page) you will receive 13 sheets

- If your 1099 forms are 3up (3 per page) you will receive 7 sheets

Condensed preprinted W2 forms are sold by the recipient (not the number of forms on it).

Order a quantity equal to the number of employees you have. For example, if you have 50 employees, order a quantity of 50.

Blank 1099 & W2 forms are sold by the sheet (not the number of forms on it).

Order a quantity equal to the number of recipients you have. For example, if you have 100 recipients, order 100 sheets.

Packaging Information

When you receive your order, please open it right away to review the contents and ensure you have exactly what you need. The information below will help you to understand how it’s packaged.

Each shrink-wrapped package may contain several different forms. If there are multiple forms in a package, they will be separated by a colored sheet of paper.

Be sure to open the entire package to determine if items are missing.

Packaging of Kits and Sets

1099 & W2 kits or sets can be packaged in one of two ways.

Example 1: Pre-packaged in specific quantities, which may mean there are multiple shrink-wrapped packs to fulfill your entire order.

Example 2: One shrink-wrapped package, which includes all the forms together.

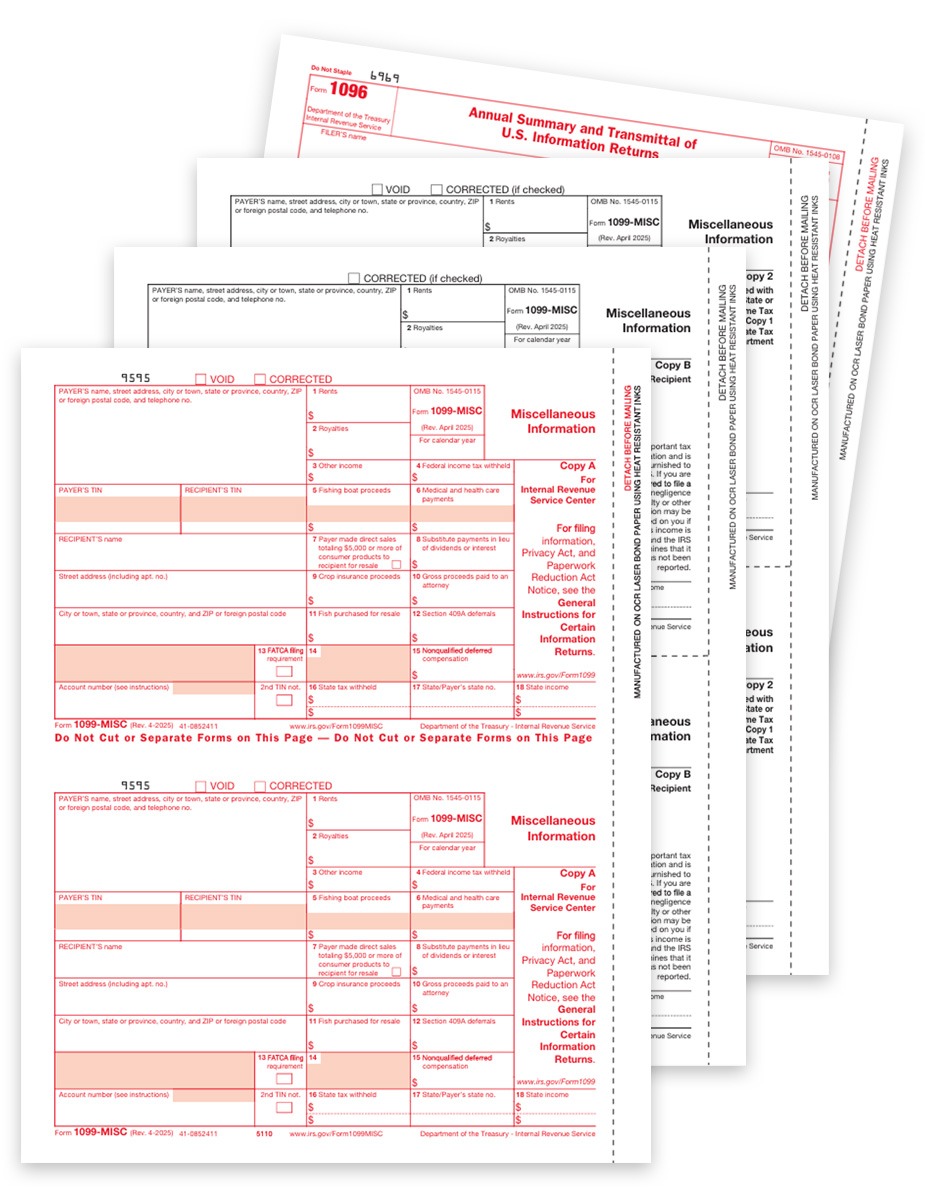

Free Transmittals

Your order was likely shipped with free 1096 or W3 transmittal forms. They will likely be at the bottom of your packs of forms.

Getting Help with Your Order

If you discover a discrepancy, please contact us right away and we’ll make it right.

- Email: hello@taxformgals.com

- Call: 877-824-2458

Our small business appreciates yours!

Need to File Some Forms at the Last Minute?

There’s no need to order additional forms and wait for shipping – file them online at DiscountEfile.com! You enter or import data and we’ll e-file the Copy As, plus print and mail recipient copies. Learn More >>

1099 & W2 E-filing Requirements for 2025

The threshold for e-filing with the IRS is 10+ W2 and 1099 forms, combined, per EIN. This was changed in 2023.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by February 2, 2025.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don’t – $60 per form if you file on time and up to $310 per form if you file late.

Get the Details

1099 & W2 Forms that must be e-filed according to the requirements above: 1042-S, 1094 series, 1095-B, 1095-C, 1097-BTC, 1098, 1098-C, 1098-E, 1098-Q, 1098-T, 1099 series, 3921, 3922, 5498 series, 8027, W-2, and W-2G.

Efile Online with DiscountEfile.com

If your business is required to e-file 1099 & W2 forms, we make it easy! Use our top-rated online filing system, DiscountEfile.com and we’ll e-file with the IRS for you, and can even print and mail recipient copies for you. Get it all done quickly, without purchasing any forms.

Online 1099 & W2 Filing

How to Correct a 1099 Form

Easily File a Correction for Any Type of 1099 Form!

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

The only difference is a simple “Corrected” checkbox at the very top of the 1099.

Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to other types of 1099 forms too.

File 1099 corrections online to save time!

Use our DiscountEfile.com system to file a corrected 1099 form, no matter how you originally filed it. There’s no need to buy more forms and print them yourself. We’ll do it all for you. Learn More >>

More on 1099 Corrections

Reviews

There are no reviews yet.