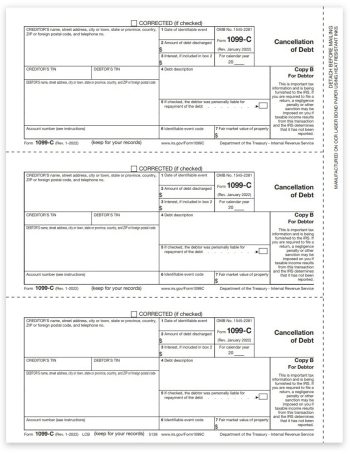

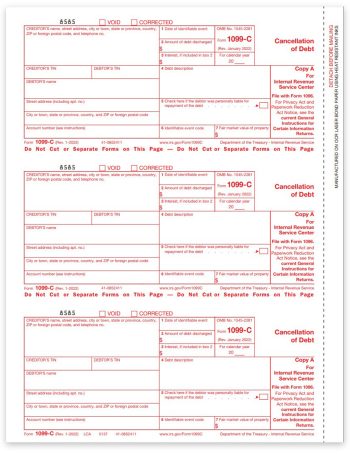

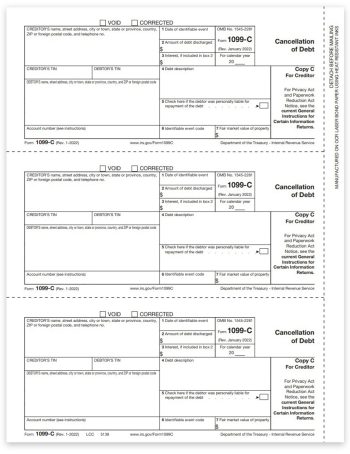

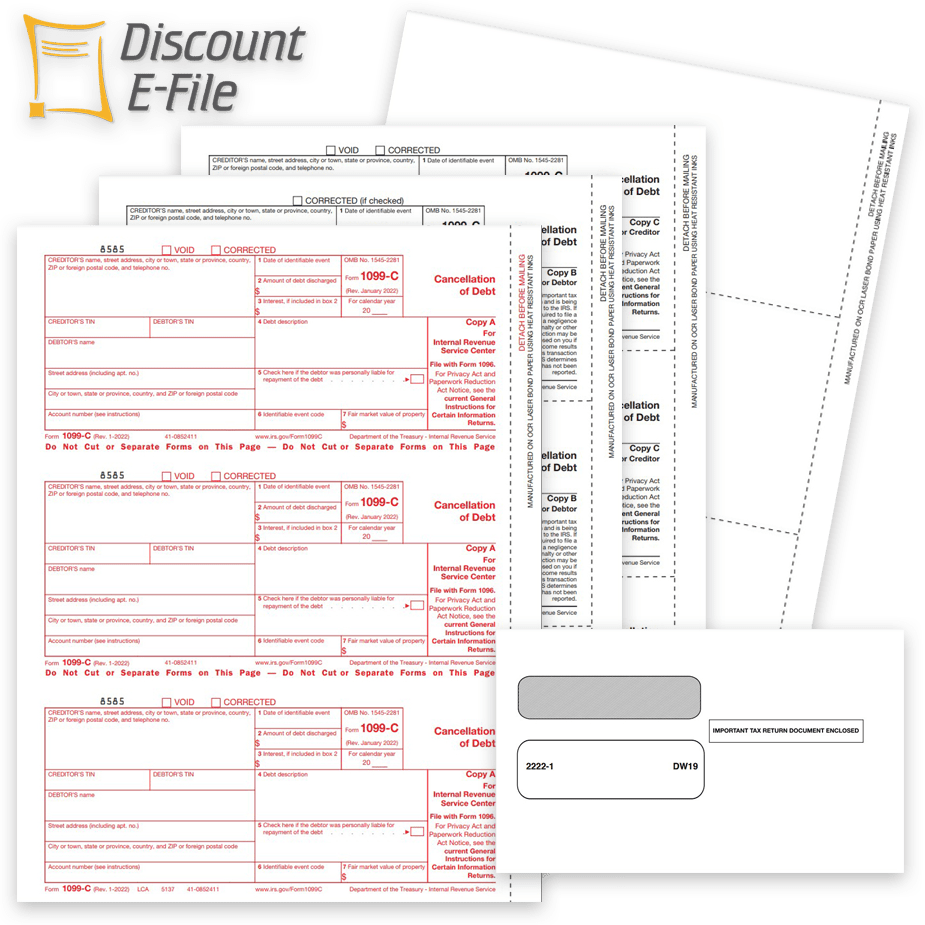

1099-C Tax Forms

1099 Forms for Reporting Cancellation of Debt during 2023.

Order official IRS 1099C forms in various formats compatible with software and more.

- 1099C Forms at discount prices – no coupon needed

- Official IRS forms compatible with software

- Preprinted and blank perforated 1099-C forms

- Compatible 1099 security envelopes

- Easy online 1099 e-filing + print and mail service options

- Dateless format – fill in the year on each form.

Easily print 1099C tax forms to report Cancellation of Debt at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The required threshold for e-filing is 10+ W2 and 1099 forms, combined, per EIN.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2025.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Order 1099C Tax Forms & Envelopes

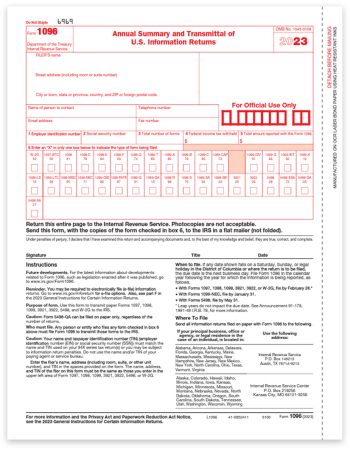

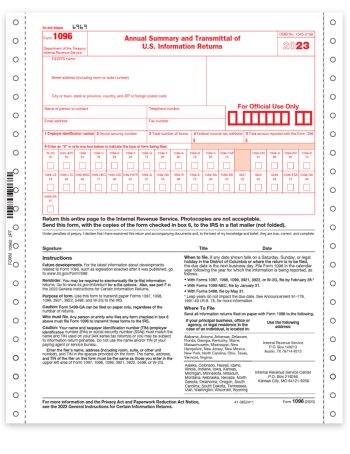

1096 Summary & Transmittal Forms

Submit one 1096 Transmittal Form to summarize the batch of Copy A forms for a single payer.

Laser forms – minimum 25 | Continuous forms – minimum 1

1099 Filing Articles

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.