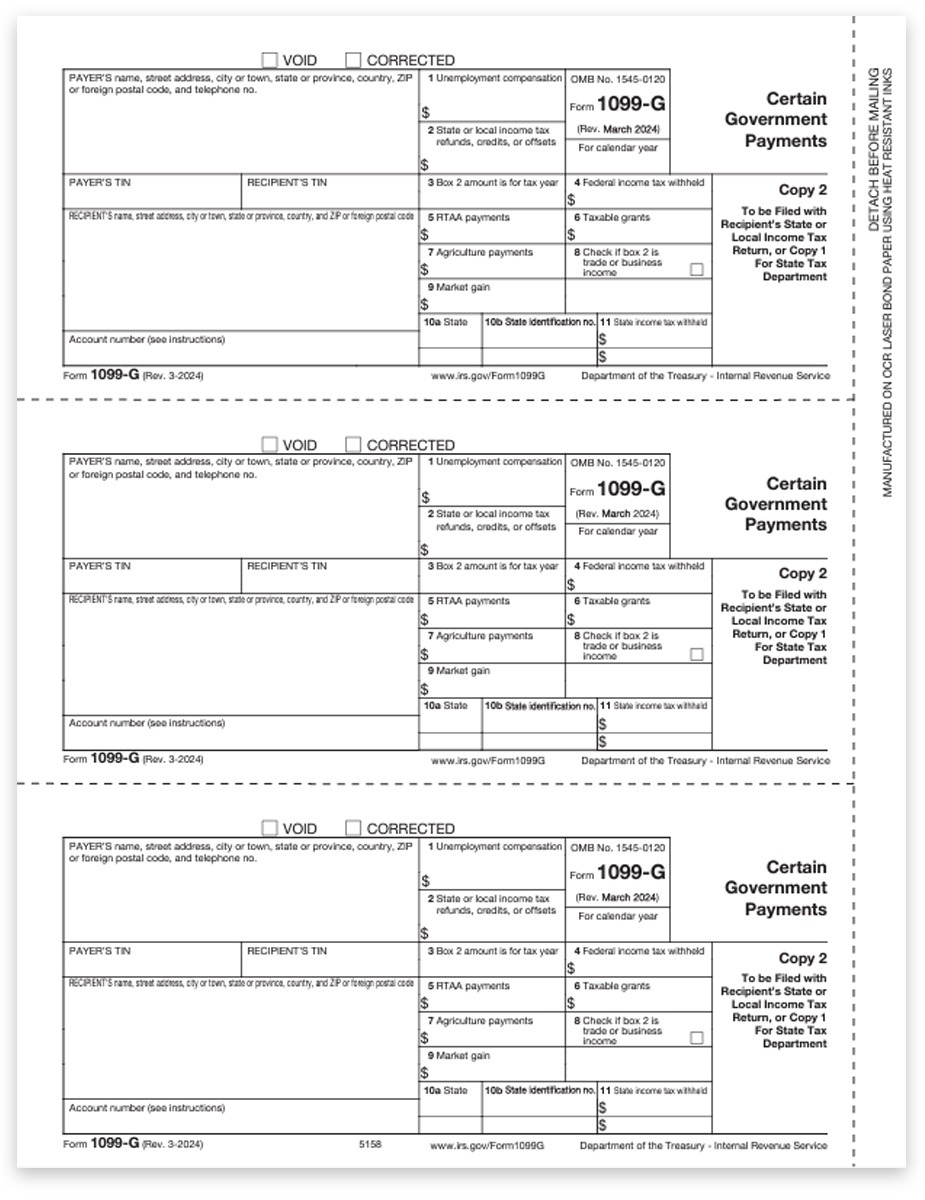

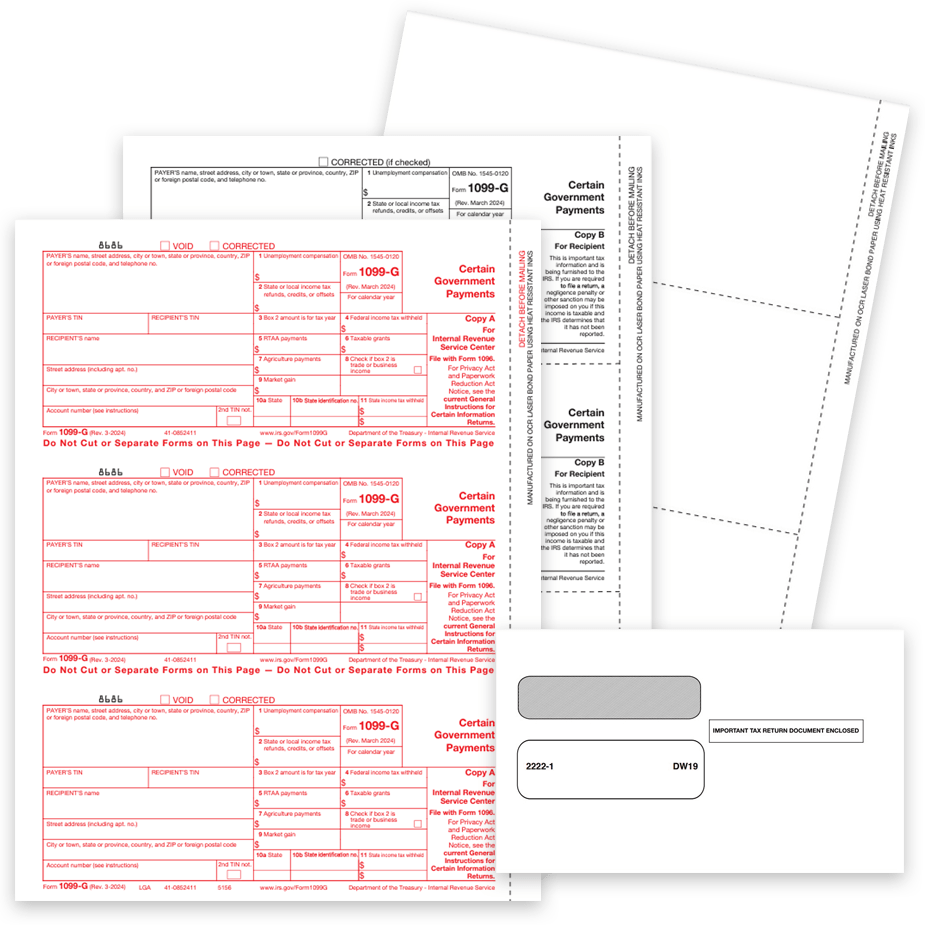

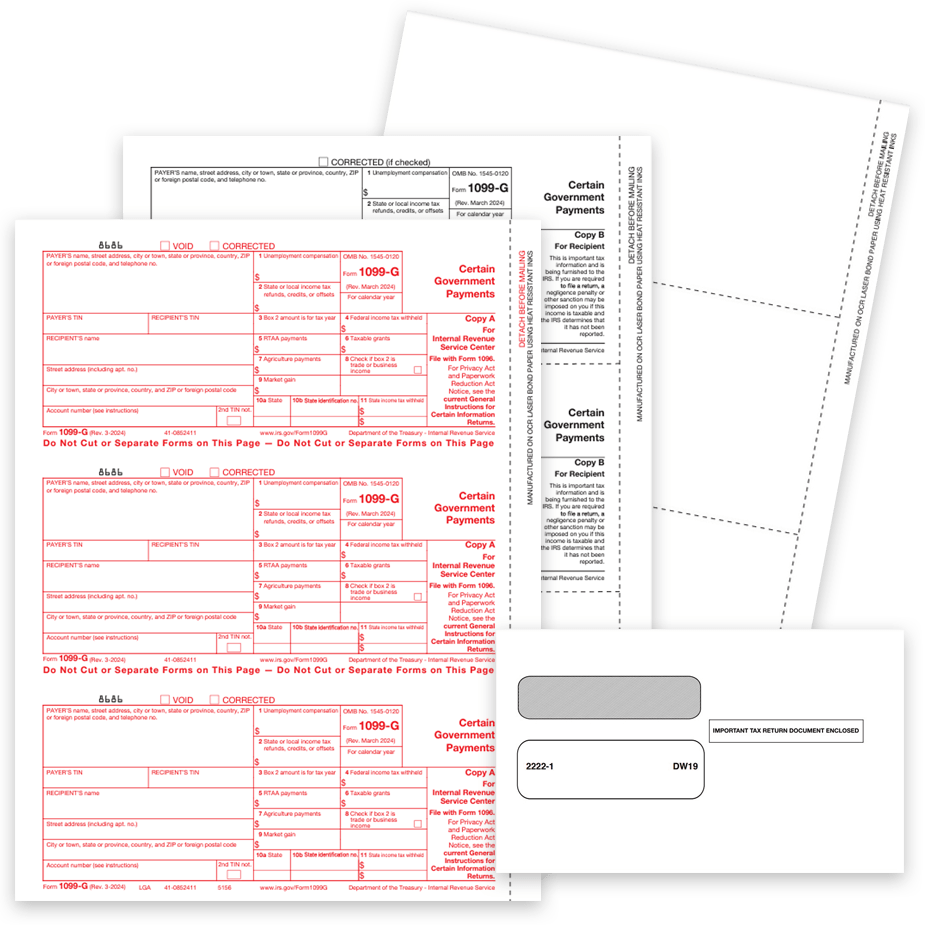

1099-G Tax Forms

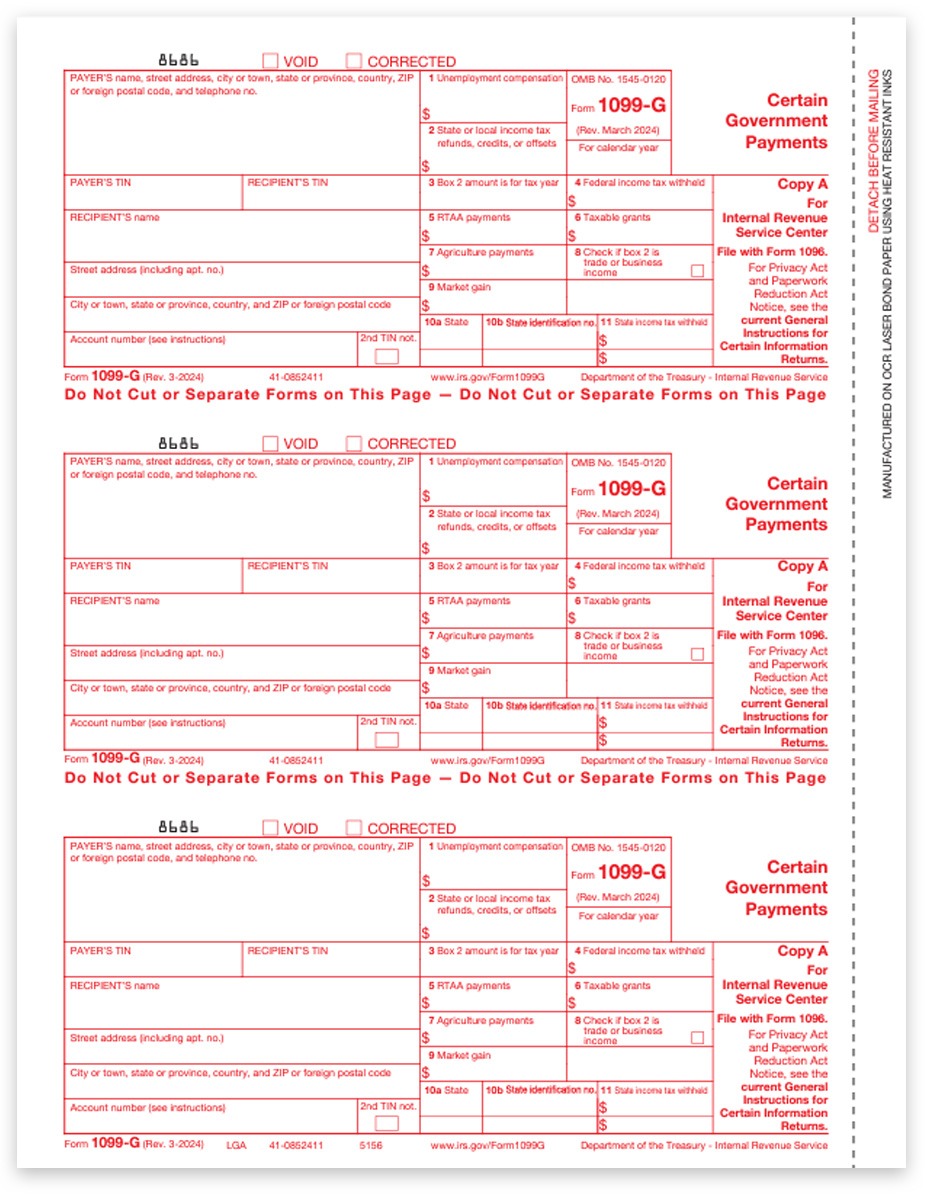

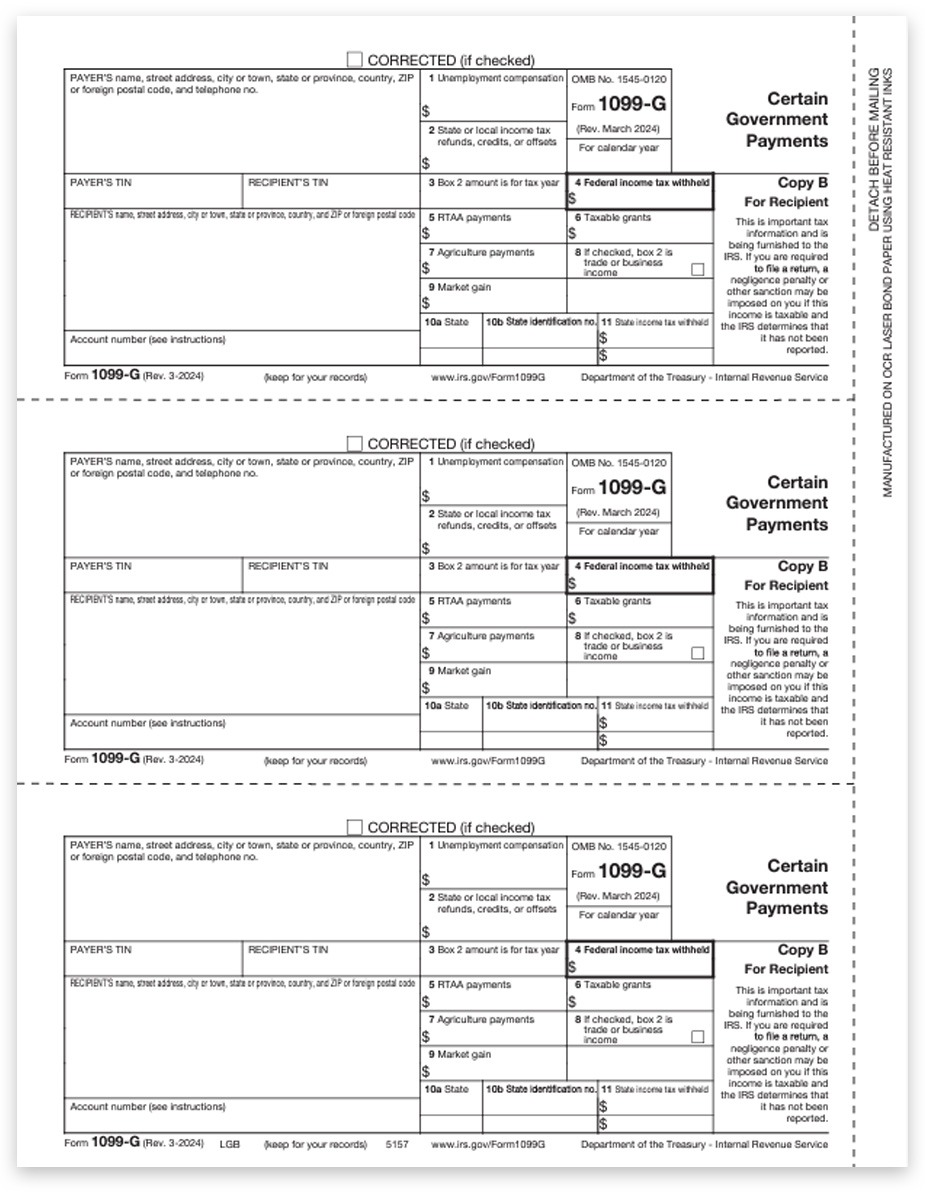

1099 Forms for Reporting Certain Government Payments

Order IRS 1099G forms in various formats compatible with software.

- Discount prices – no coupon needed

- Official IRS forms compatible with software

- Preprinted 1099G forms

- Blank perforated 1099 paper

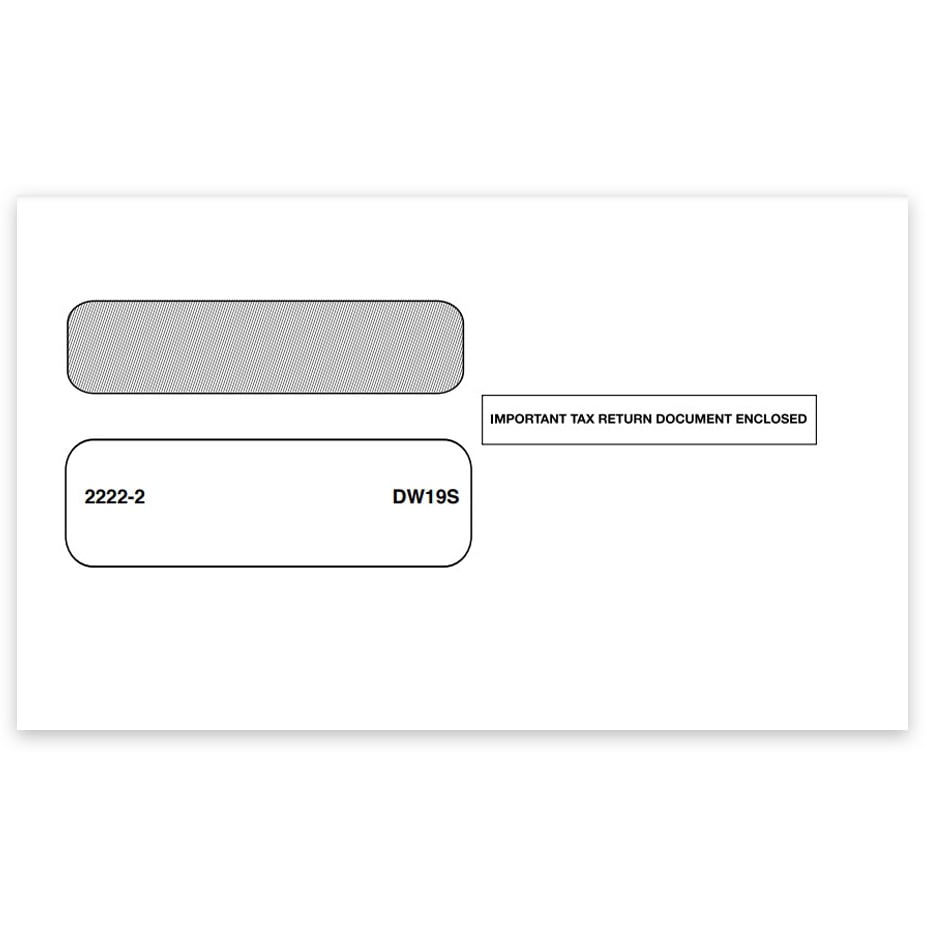

- Compatible security envelopes

- Dateless format – fill in the year on each form

1099 E-filing requirements — e-file Copy A for 10+ 1099 & W2 forms combined.

Easily print 1099-G tax forms to report Certain Government Payments at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Order 1099G Tax Forms & Envelopes

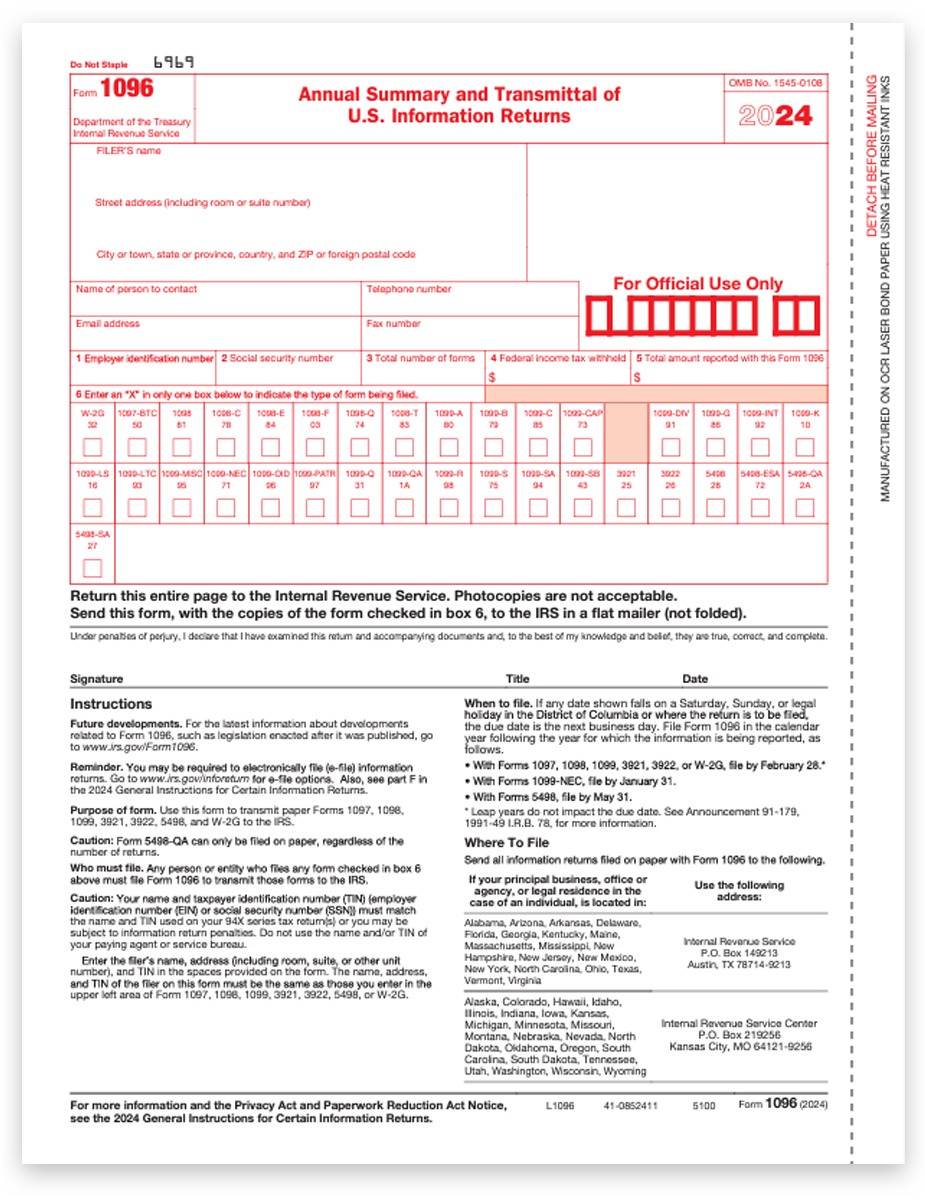

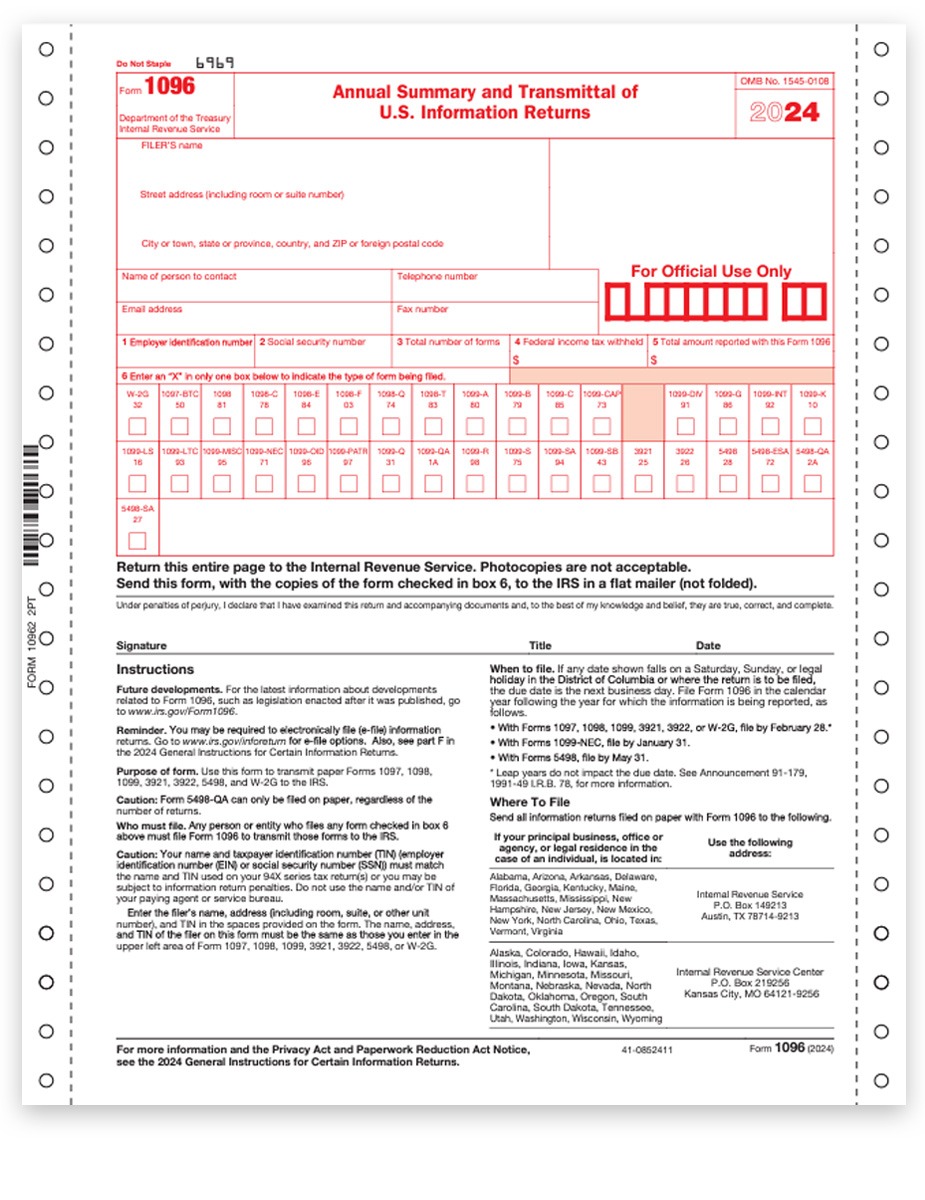

1096 Summary & Transmittal Forms

Submit one 1096 Transmittal Form to summarize the batch of Copy A forms for a single payer.

Laser forms – minimum 25 | Continuous forms – minimum 10

Insights to Easier 1099 Filing

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file with the IRS and SSA in 2023. DiscountEfile.com makes it easy!

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.