Blog

Expert insights to

easy 1099 & W2 filing.

Blog Posts on 1099MISC Forms & Filing

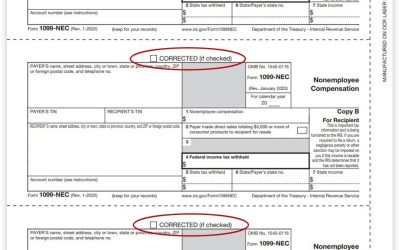

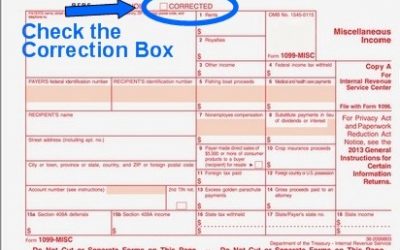

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

Decoding 1099-MISC Copy Requirements

1099-MISC ‘Copies’, or parts, report income to recipients and government agencies and help ensure accuracy of income tax filing. 1099-MISC Forms are filled out by the payer and provided to the recipient and government agency.

How to File a W2 or 1099 TODAY

The Deadline to Mail 1099s & W2s to Recipients is January 31. You can get them out the door without having to go to the office store and buy forms.

Small Business Guide to Filing 1099 & W-2 Forms

An overview of the options for small business 1099 and W2 filing, how to choose the right forms, filing deadlines and more.

How to File1099-MISC Forms with QuickBooks®

Instructions for printing 1099 forms from QuickBooks® software.

How to Correct 1099 Forms You Already Filed

You do not need to correct a 1099 the same way you filed it, so if you mailed a paper copy, you can e-file a correction, or vice versa. However, if you have 250 or more corrections that need to be filed, they MUST be e-filed with the IRS.

How to E-file 1099 & W-2 Forms

E-filing 1099 and W2 forms to the Federal Government is not only faster, but you get more time to get it done! It’s enough of a hassle to print and mail recipient copies, you don’t need to spend time repeating the process for the government copies. Here is how to electronically file quickly and easily.

Don’t Get 1099 & W-2 Forms from the IRS!

Why not? They’re free, right? Sure, they’re free. But this is definitely a case of ‘you get what you pay for’. Here is a list of things that regularly go wrong when you order 1099 and W2 Forms from the IRS.

The Fastest Ways to Get 1099 and W2 Forms Done

It’s that time of year again. Tax season. And if you’re a business, it starts NOW with 1099 and W-2 form filing. But it doesn’t have to be a hassle. There are ways to make it faster and easier.

Online 1099 & W-2 Filing – Efile, Print & Mail Service – DiscountEfile.com

Technology, no doubt, makes filing 1099 and W-2 forms easier – typewriters are almost completely out of business. There are software programs and accounting software will print the forms. As long as you buy the right forms, stock up on printer ink, and are prepared to make a few mistakes and stuff a few envelopes, you’ll get it all done. Eventually. Hopefully by the deadline. But yet again, technology brings you a better way! With online filing systems like DiscountEfile.com, you no longer need to hassle with software, forms or stuffing envelopes.

It’s May. W-2s and 1099s are the Last Thing on Your Mind

Congratulations on finishing up another year-end reporting cycle. Hopefully everything went well, forms mailed on time, taxes paid and now it’s time to relax a little and enjoy the summer. But know that we’re STILL working on 1099 and W-2 filing! No, not because we didn’t send out our forms on time, but because we’re working to make filing easier for you at the end of this year!

Penalties for Business that Don’t File 1099 Forms Correctly

If a business doesn’t file 1099-MISC Forms with the correct information, by the due date, and cannot show reasonable cause, it is subject to penalties from the IRS. This applies to electronic and paper filers. Penalties can be assessed if a business fails to do any of the tasks in this article.

1099 Form Definitions

A simple list of all the 1099 forms and what they are used for. From 1099-MISC to 5498 forms, they’re all covered here.

How to File 1099 & W-2 Forms: Different Filing Methods

From typing forms on a typewriter to printing them using your accounting software or specialized 1099 & W2 software, to filing them online and never touching a form, we help you understand your options and make the most efficient choice for getting this annual talk done quickly and efficiently.