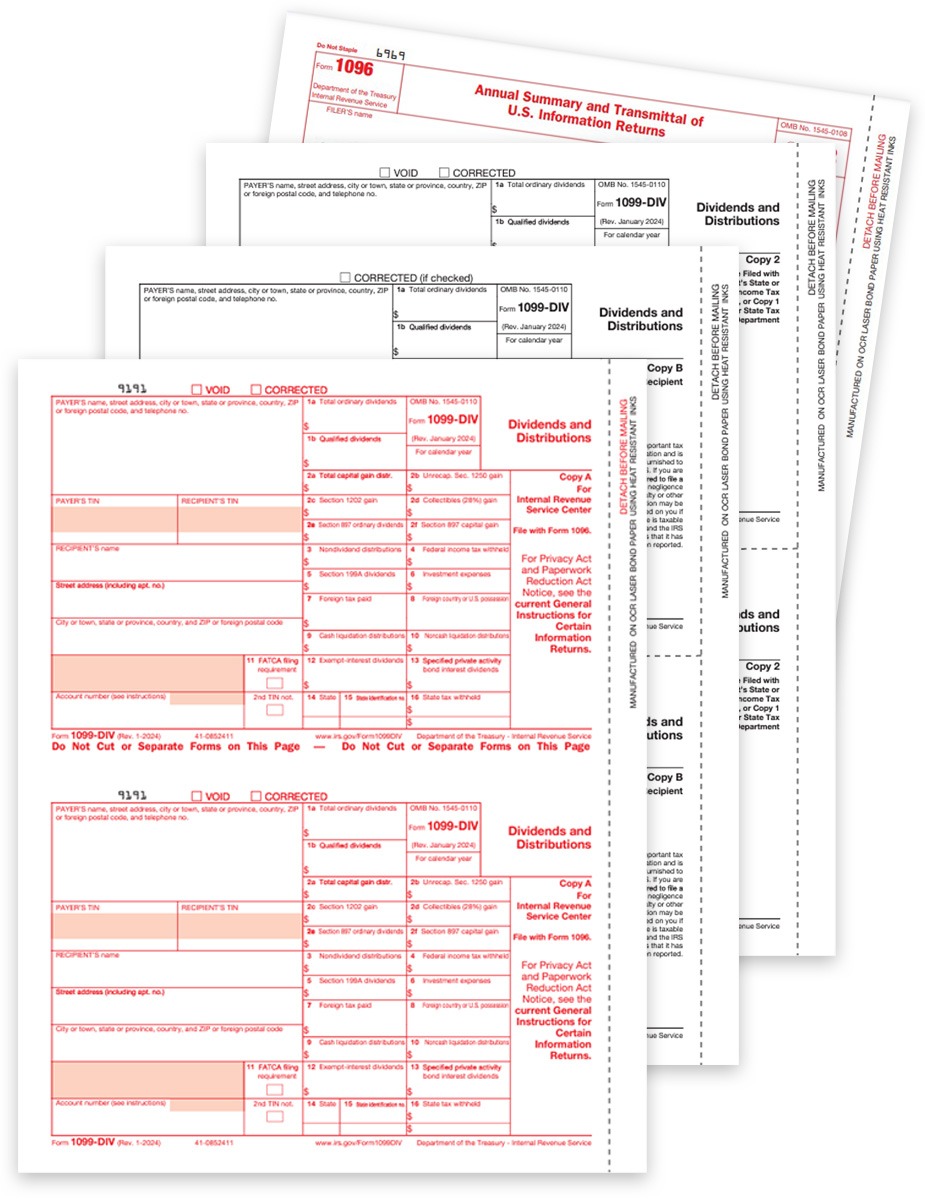

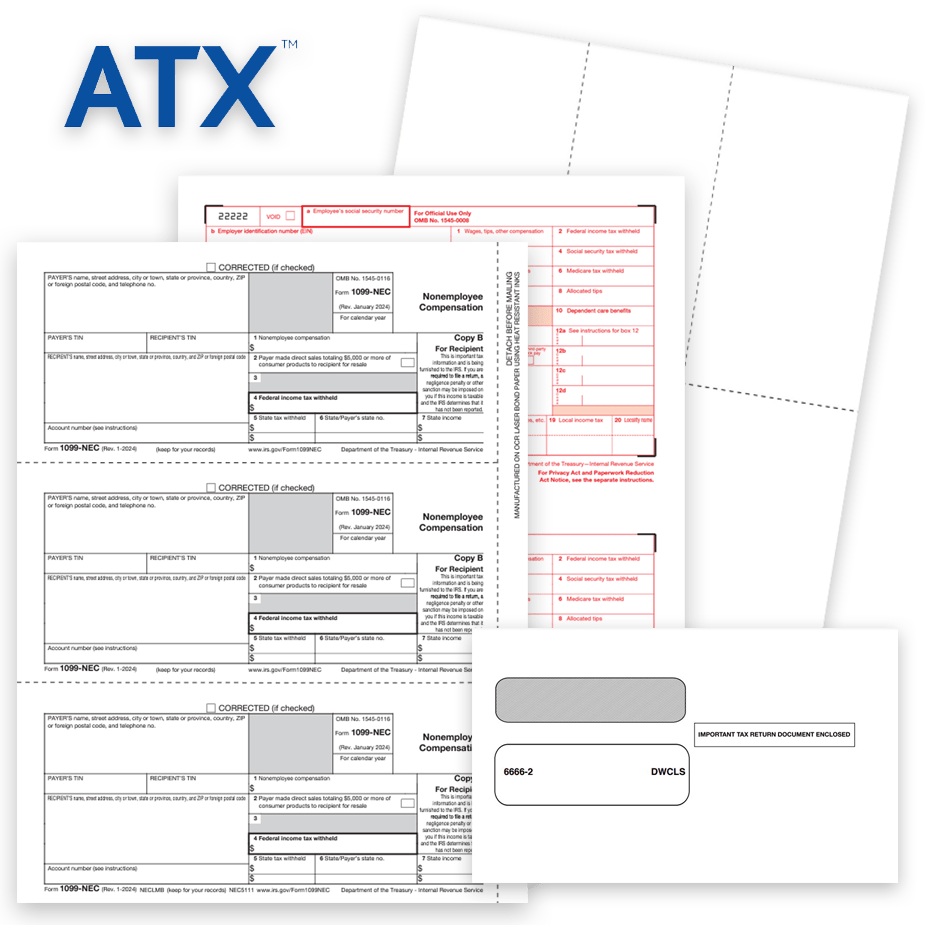

ATX™ Software Compatible Tax Forms

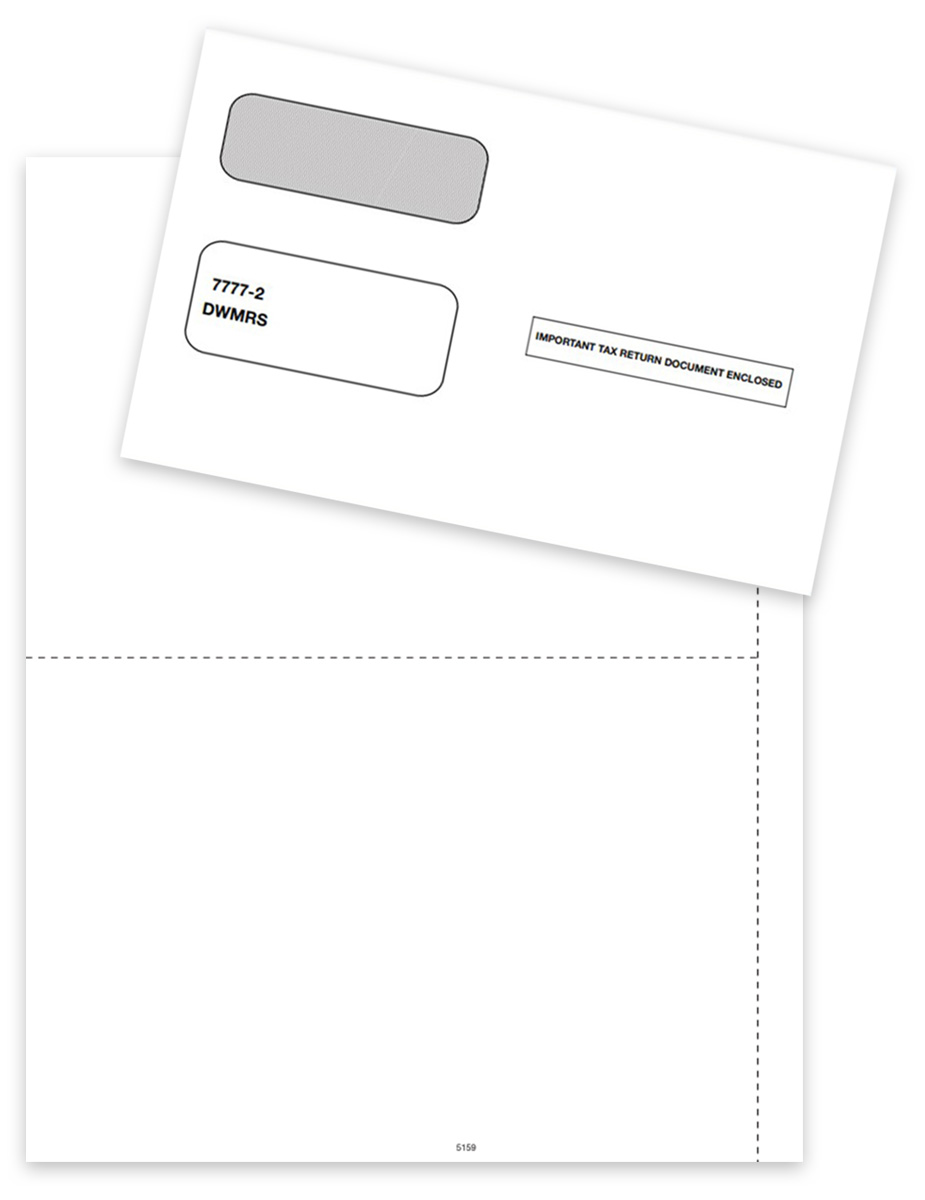

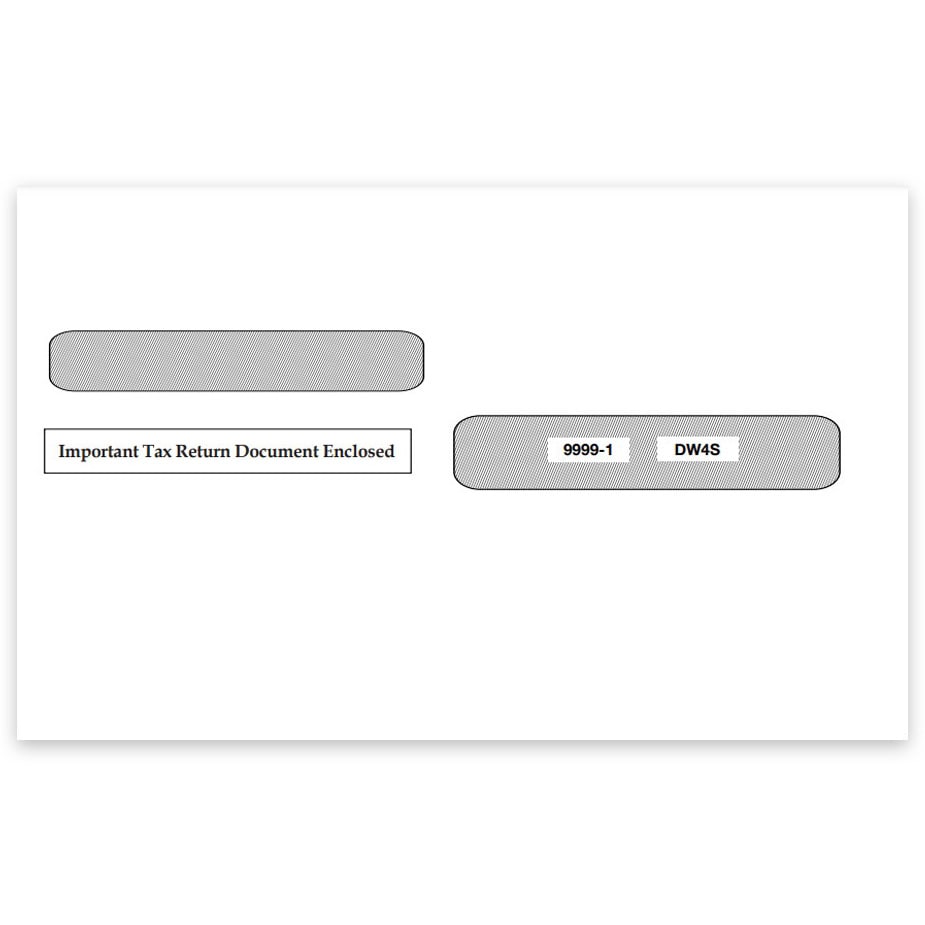

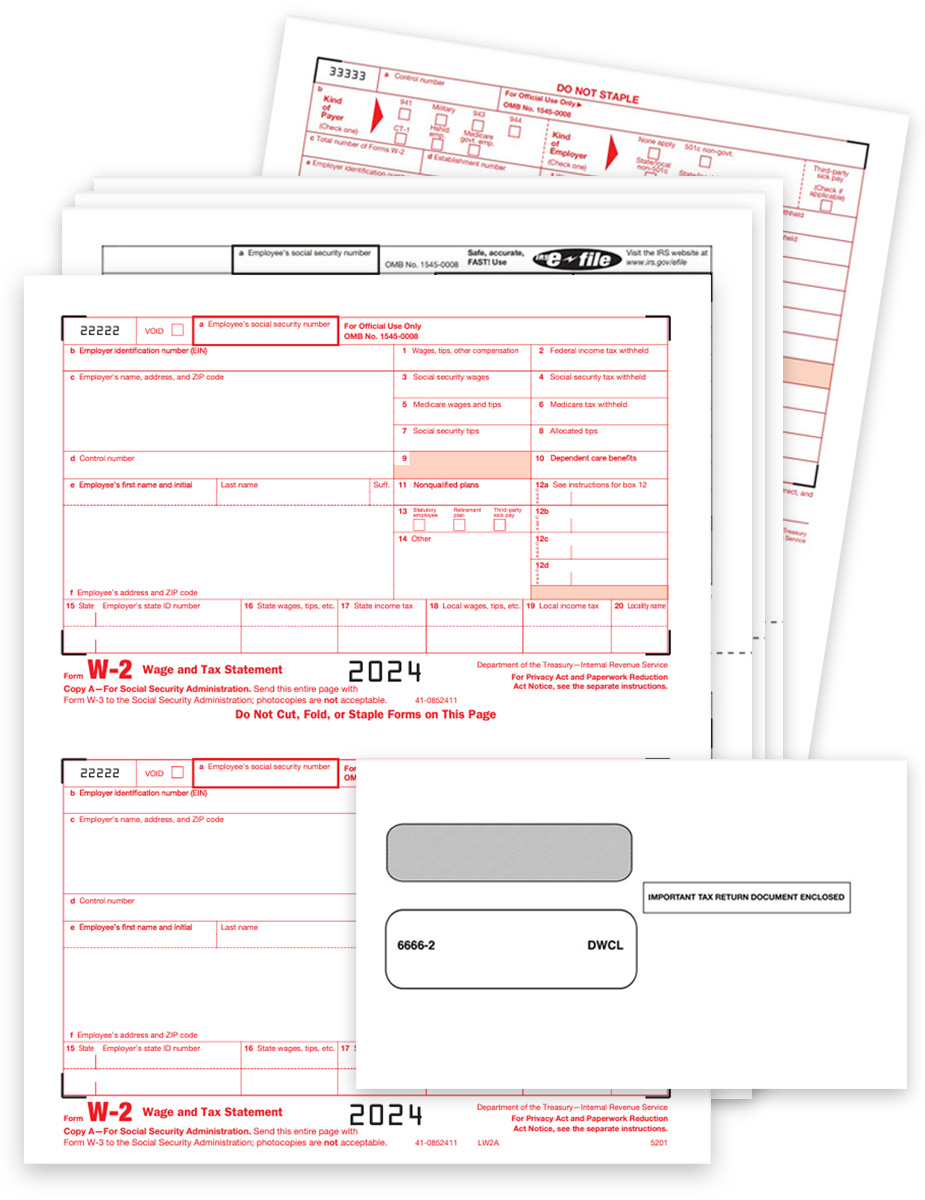

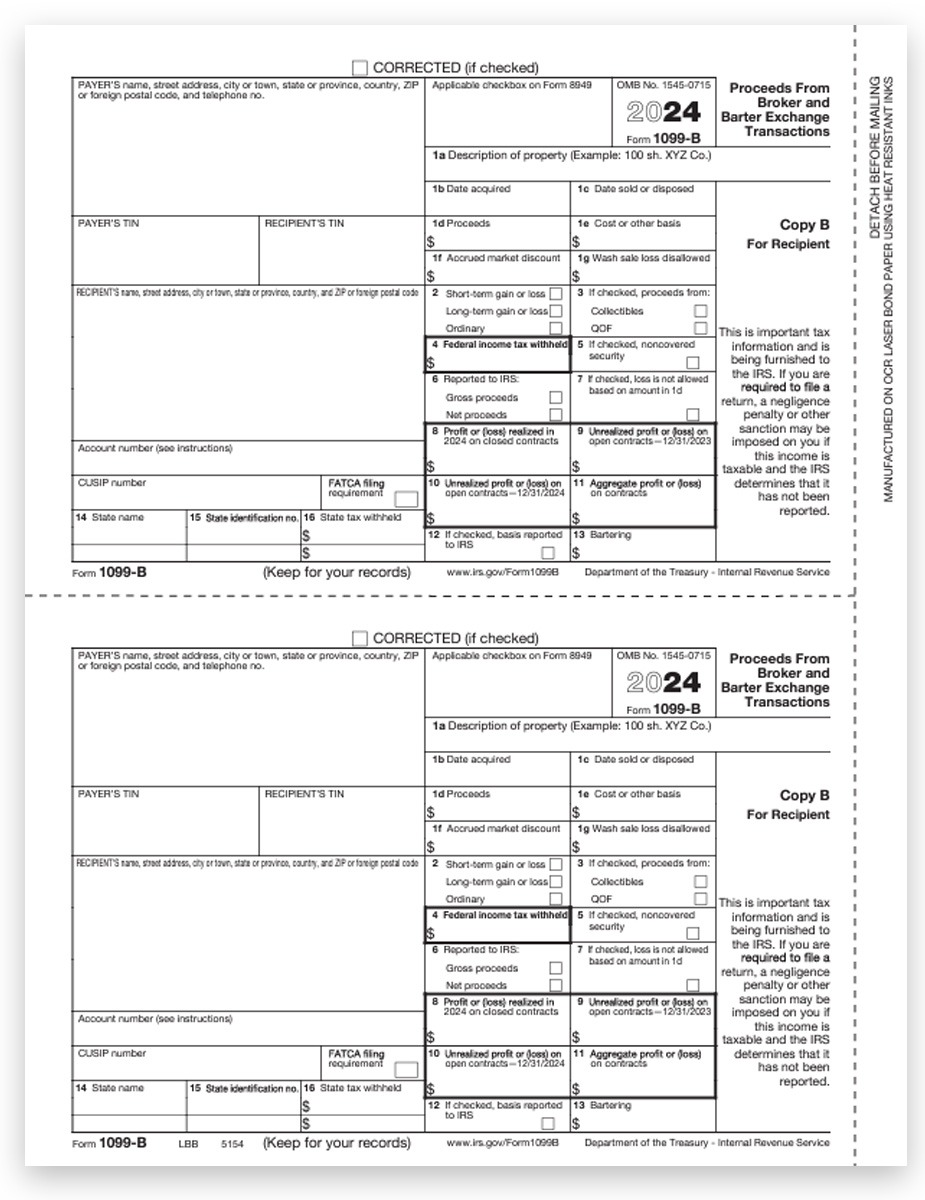

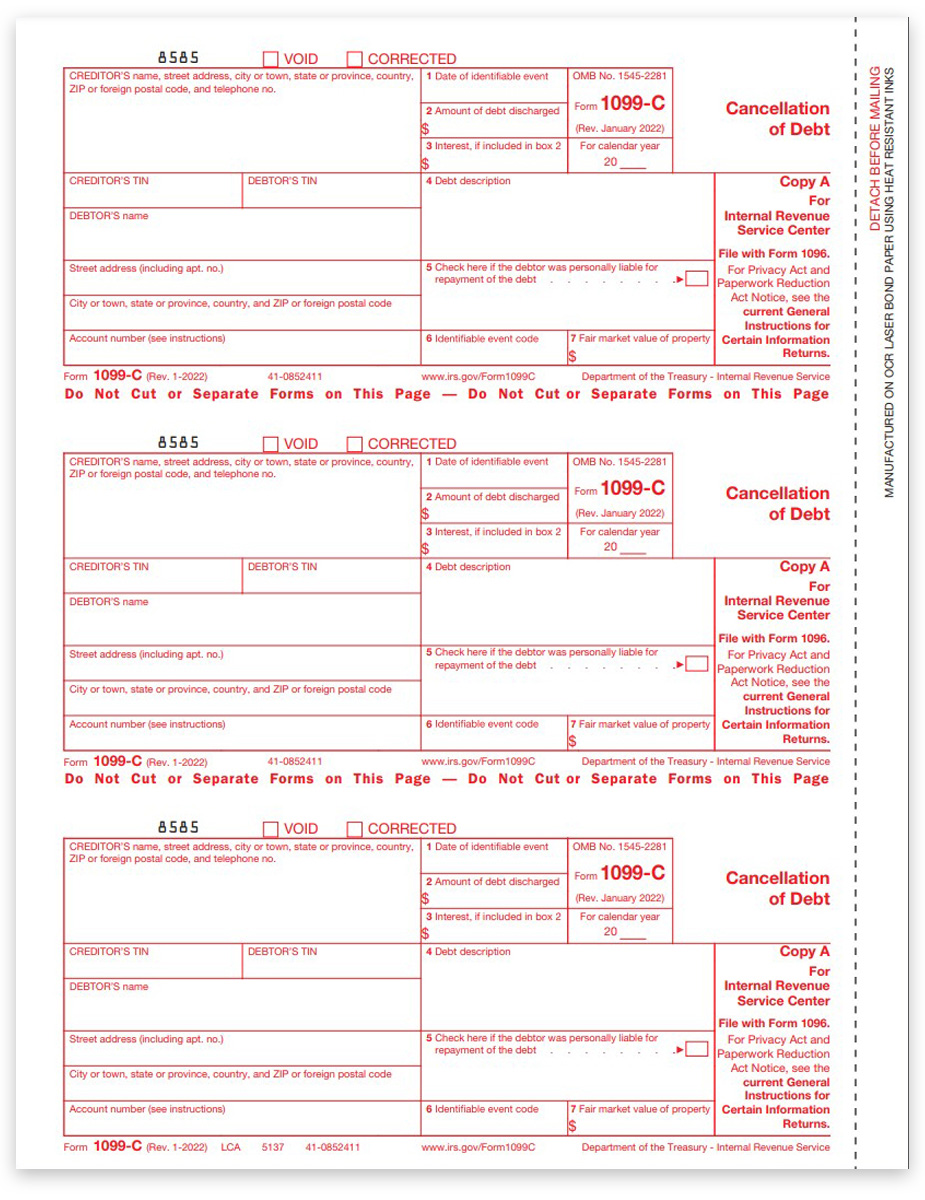

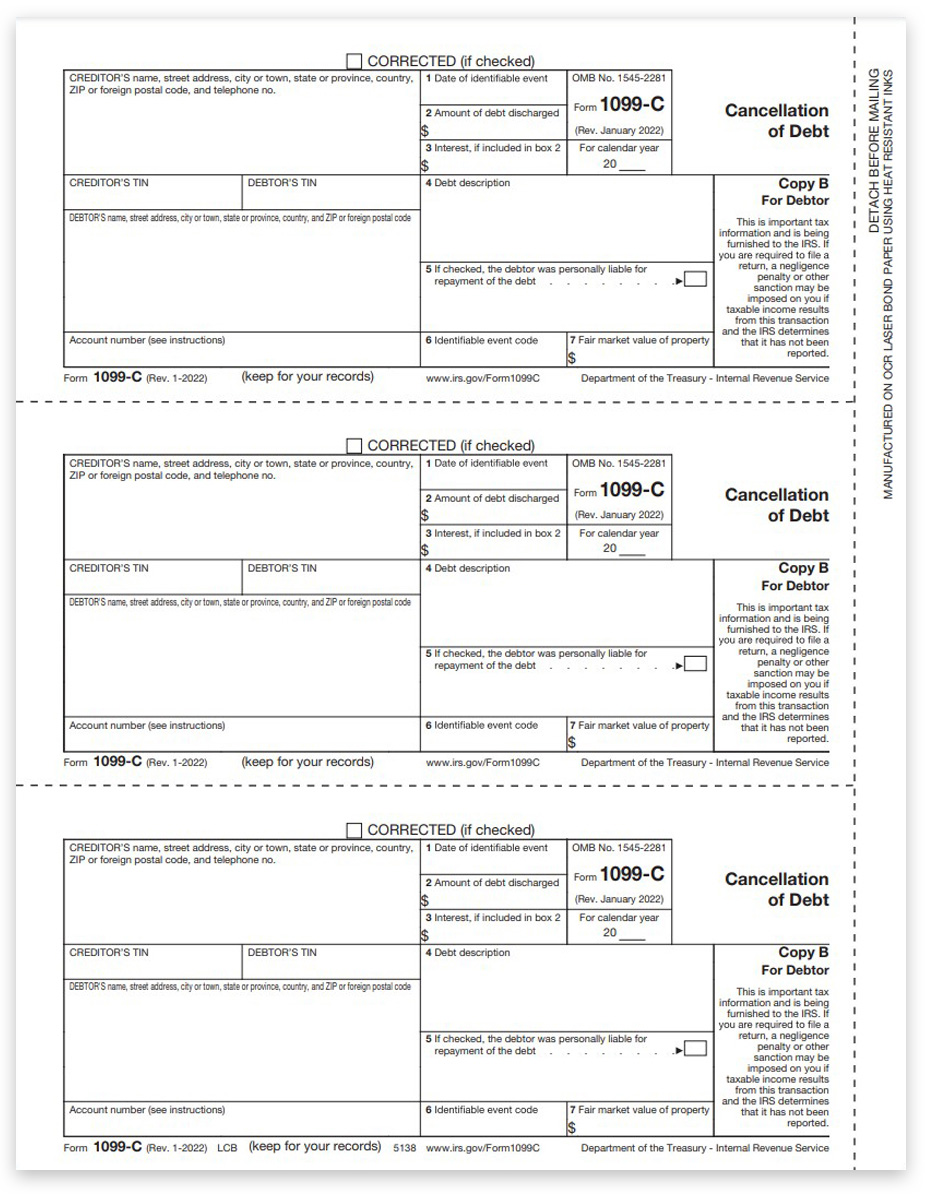

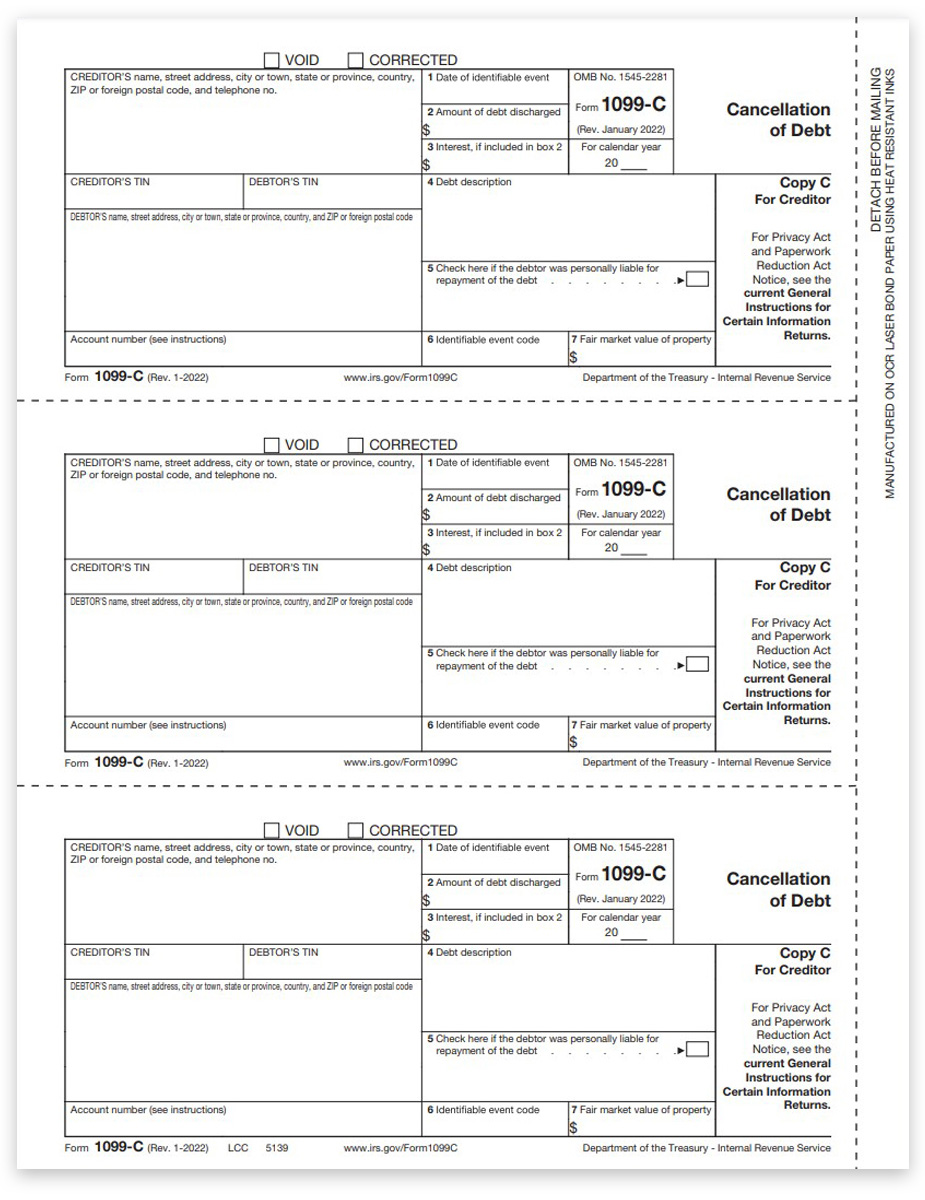

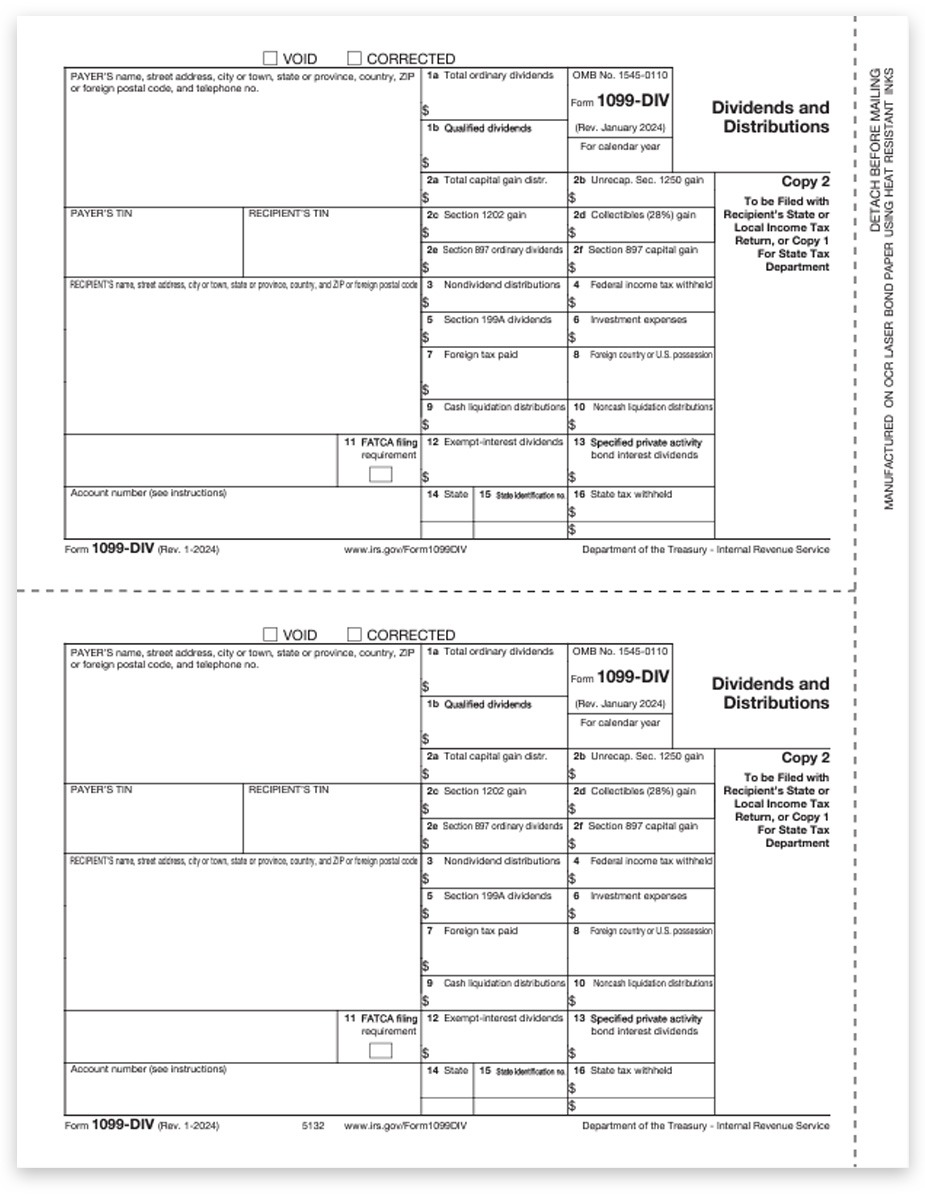

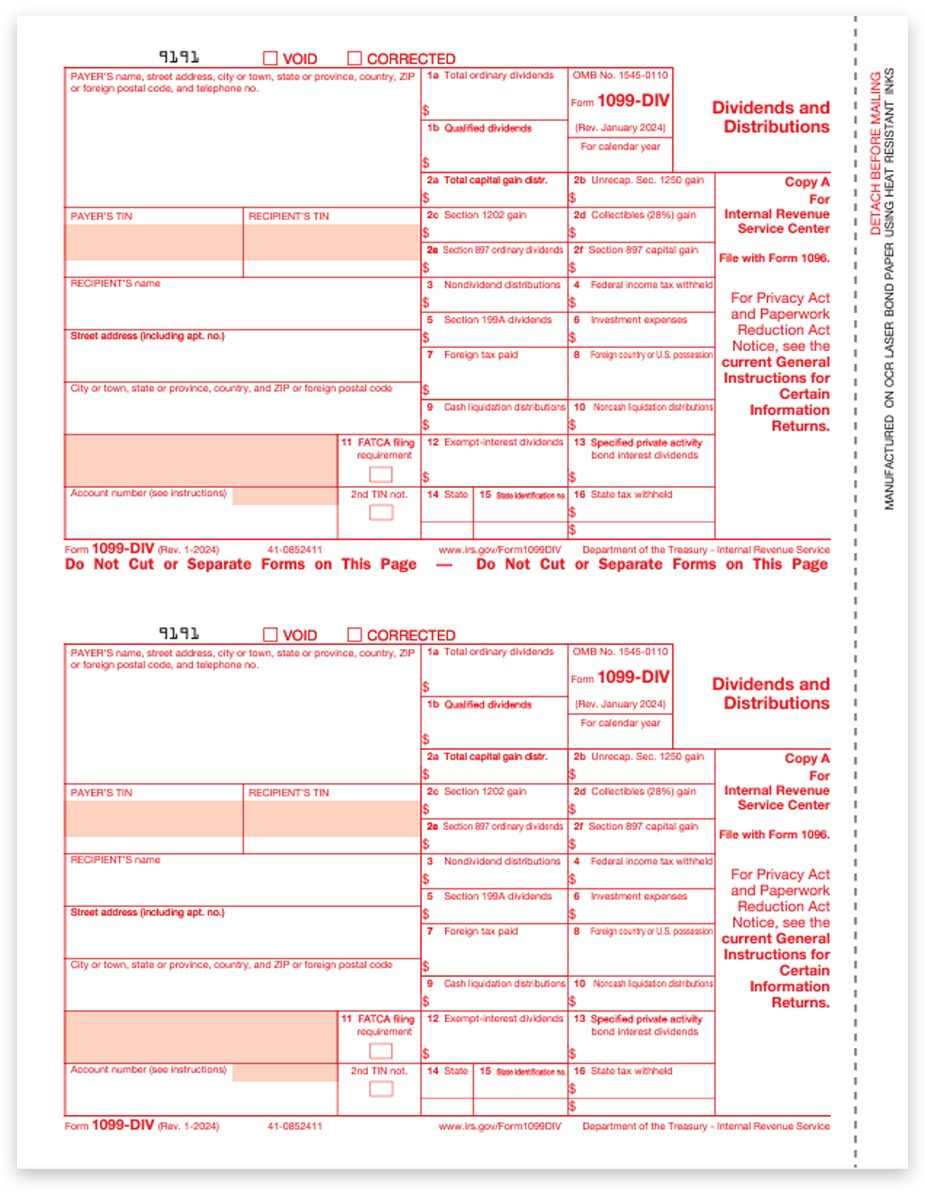

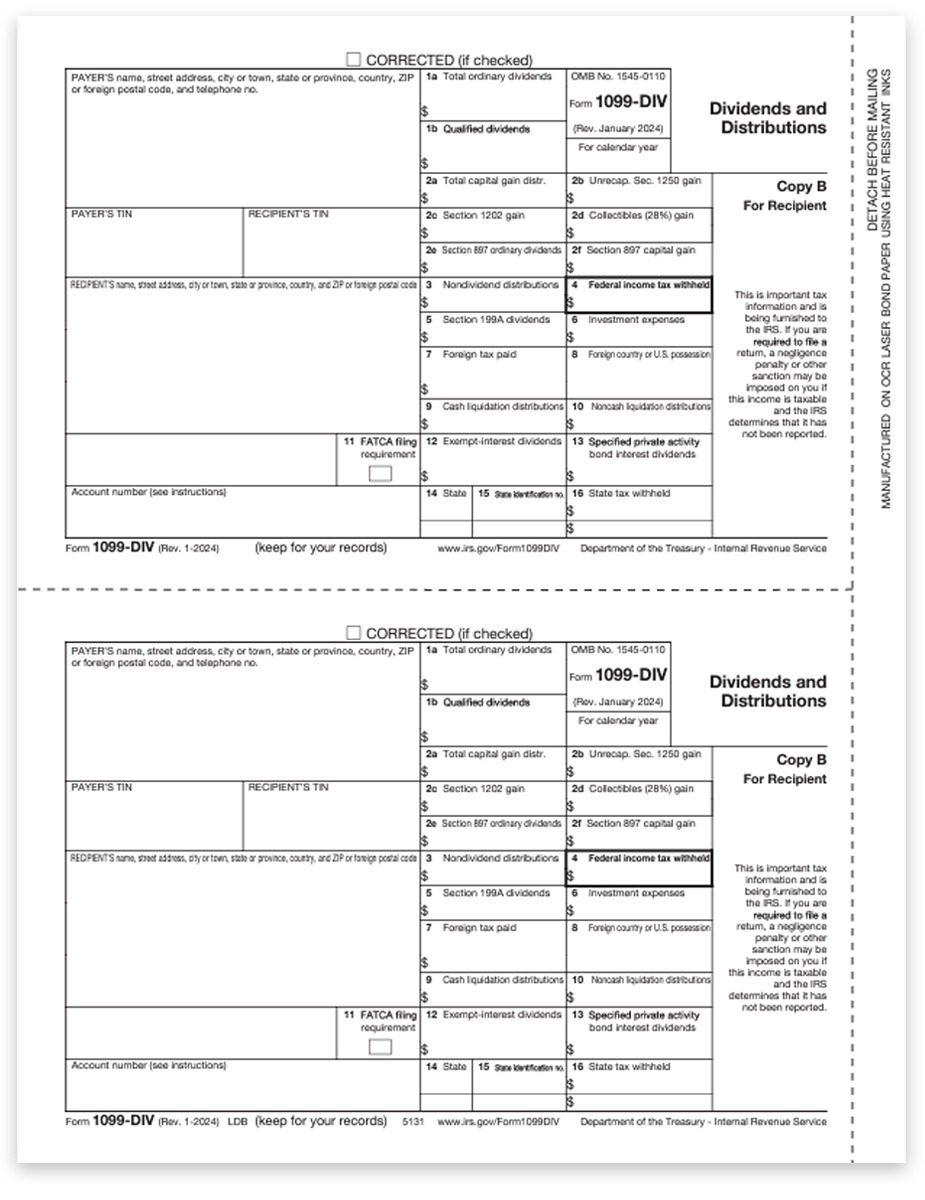

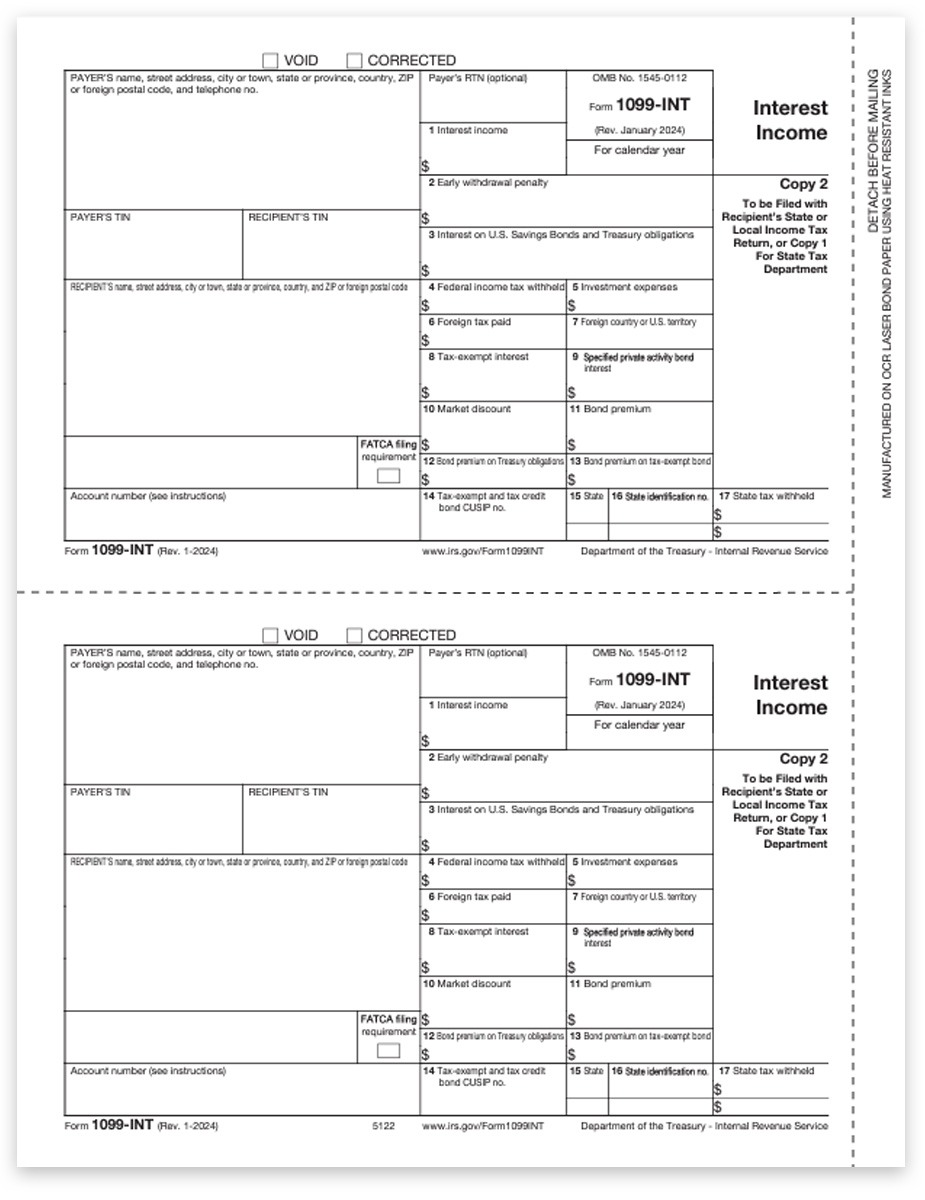

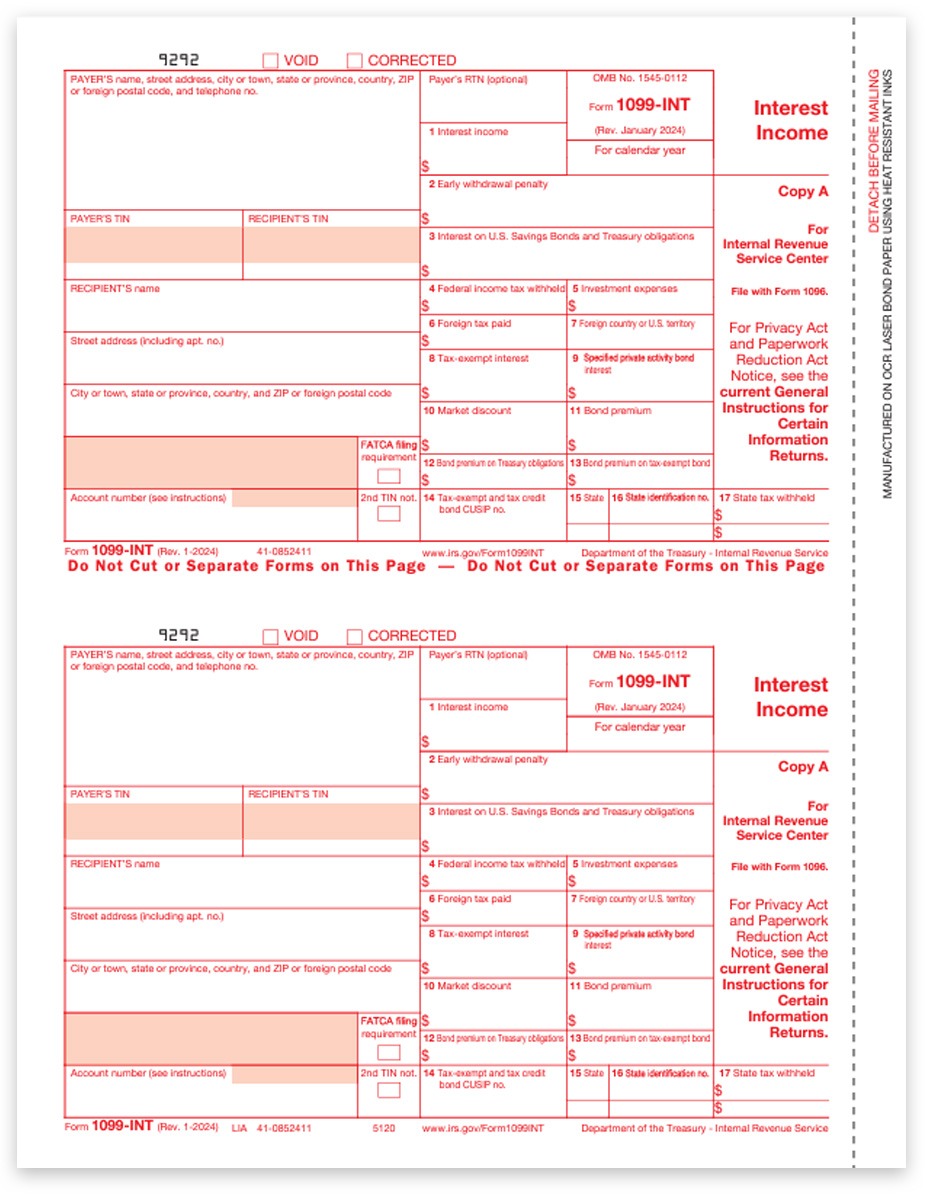

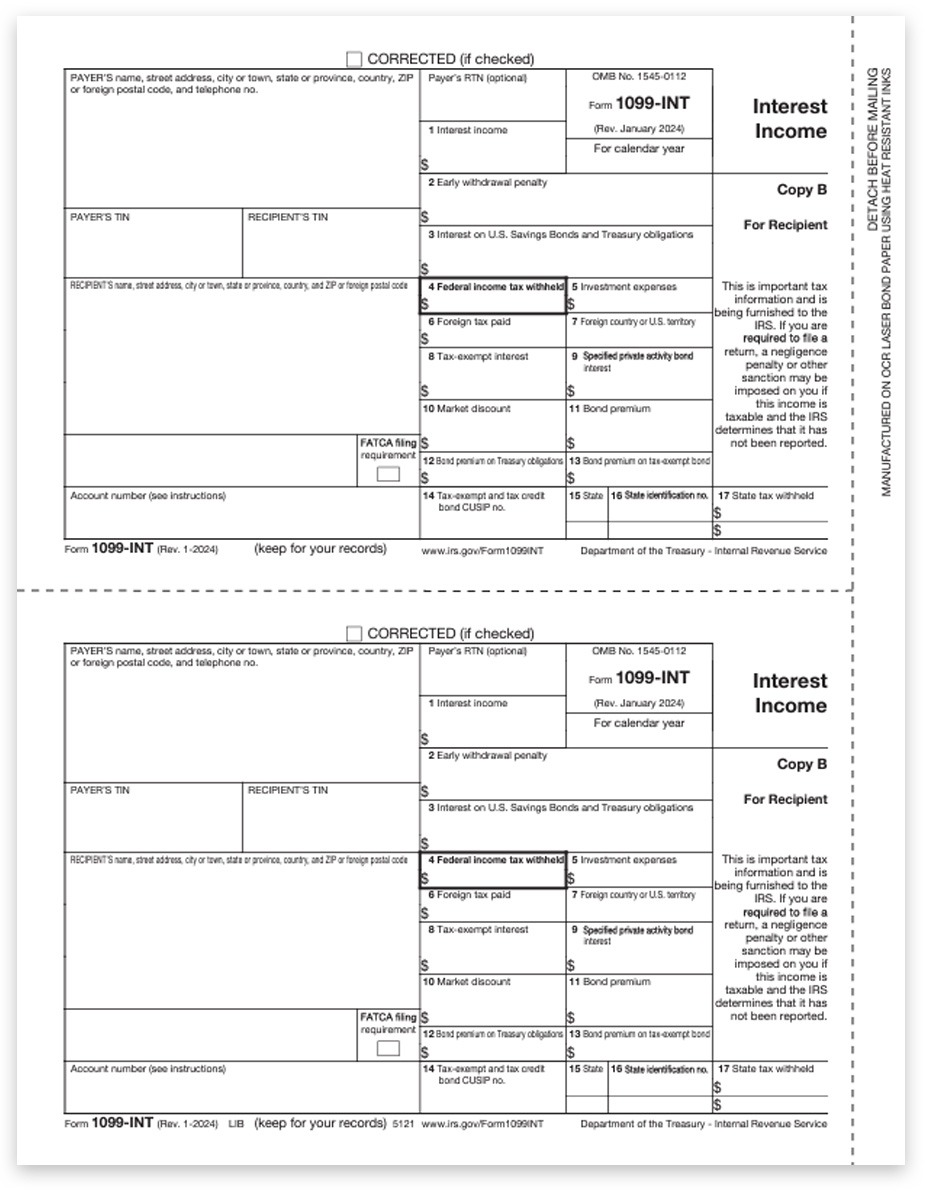

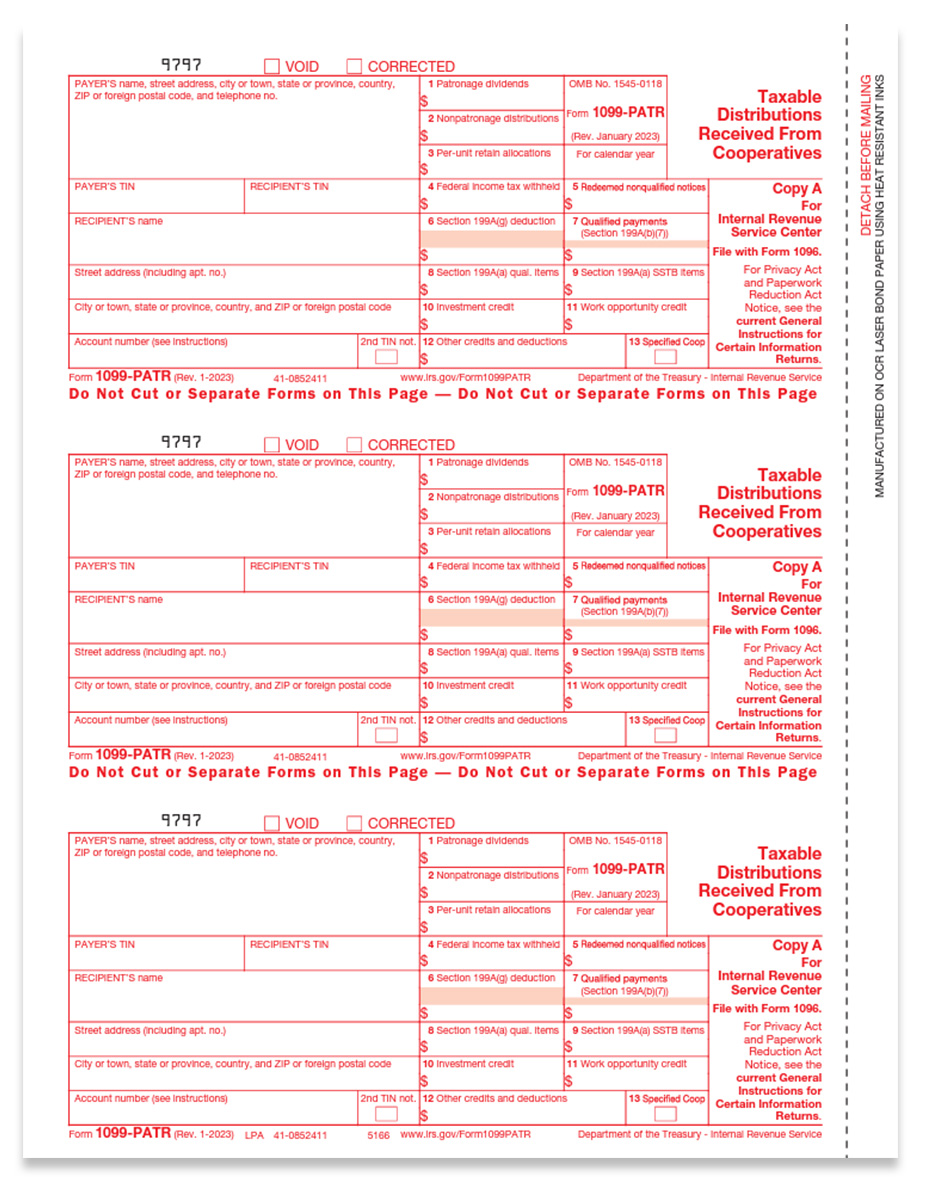

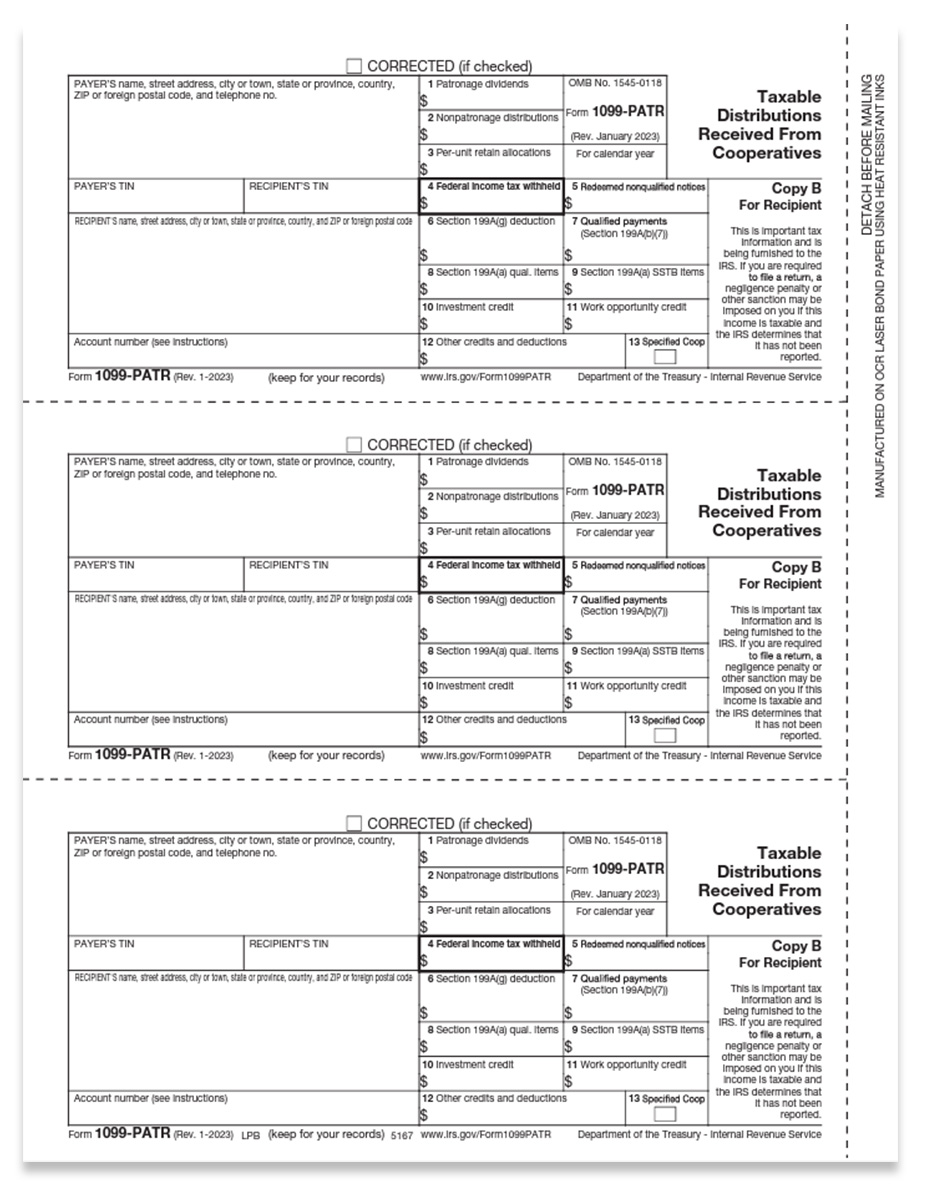

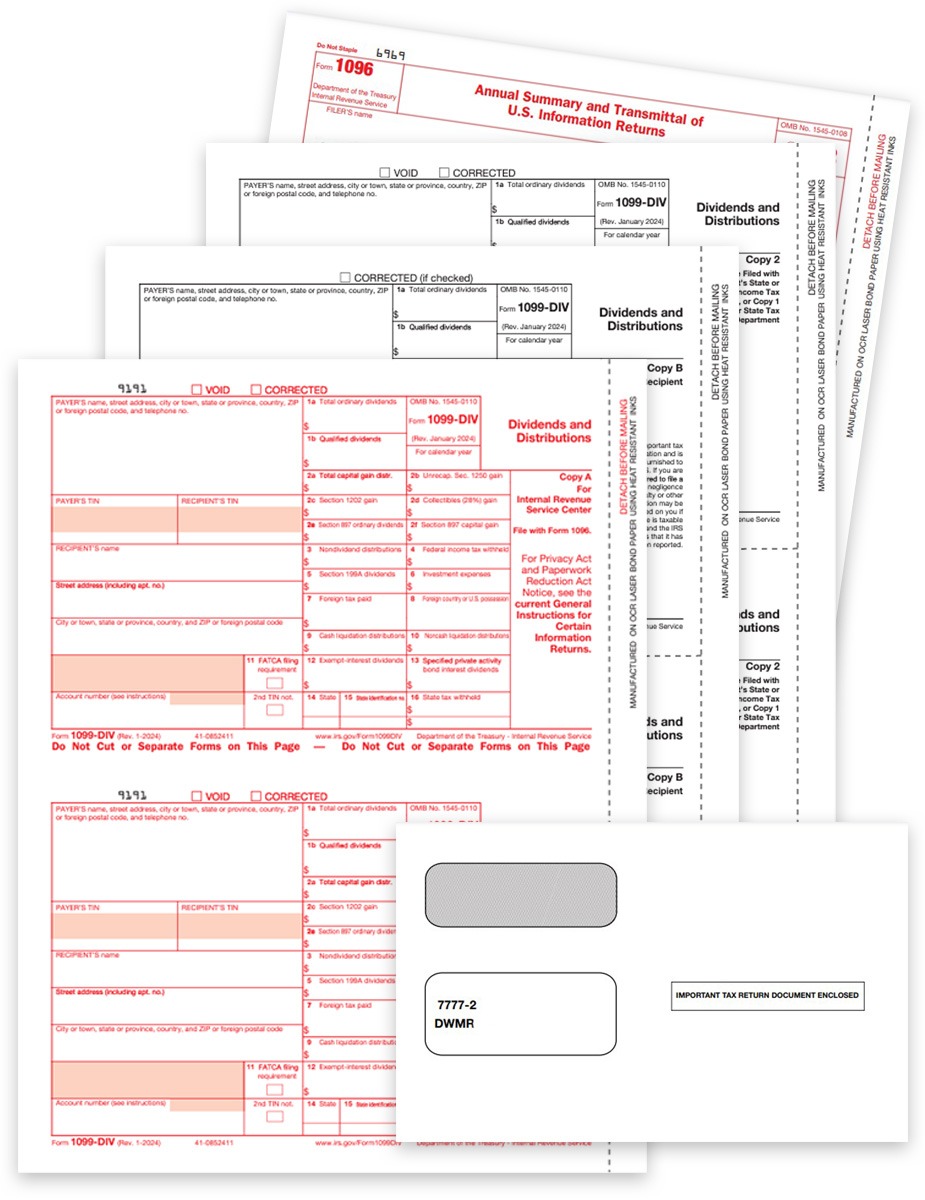

Order compatible 1099 & W2 tax forms and envelopes for ATX software.

Tax forms and security envelopes are guaranteed compatible, at big discounts – no coupon code required with The Tax Form Gals!

Printing year-end 1099 & W2 forms is quicker and easier when forms align perfectly with the data format of your software. We’ve done the research for you.

*Brand names are property of their respective owners

1099 & W-2 Forms for ATX™ Software

Guaranteed Compatible!

If you have any problems, we will replace the product or refund your money.

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

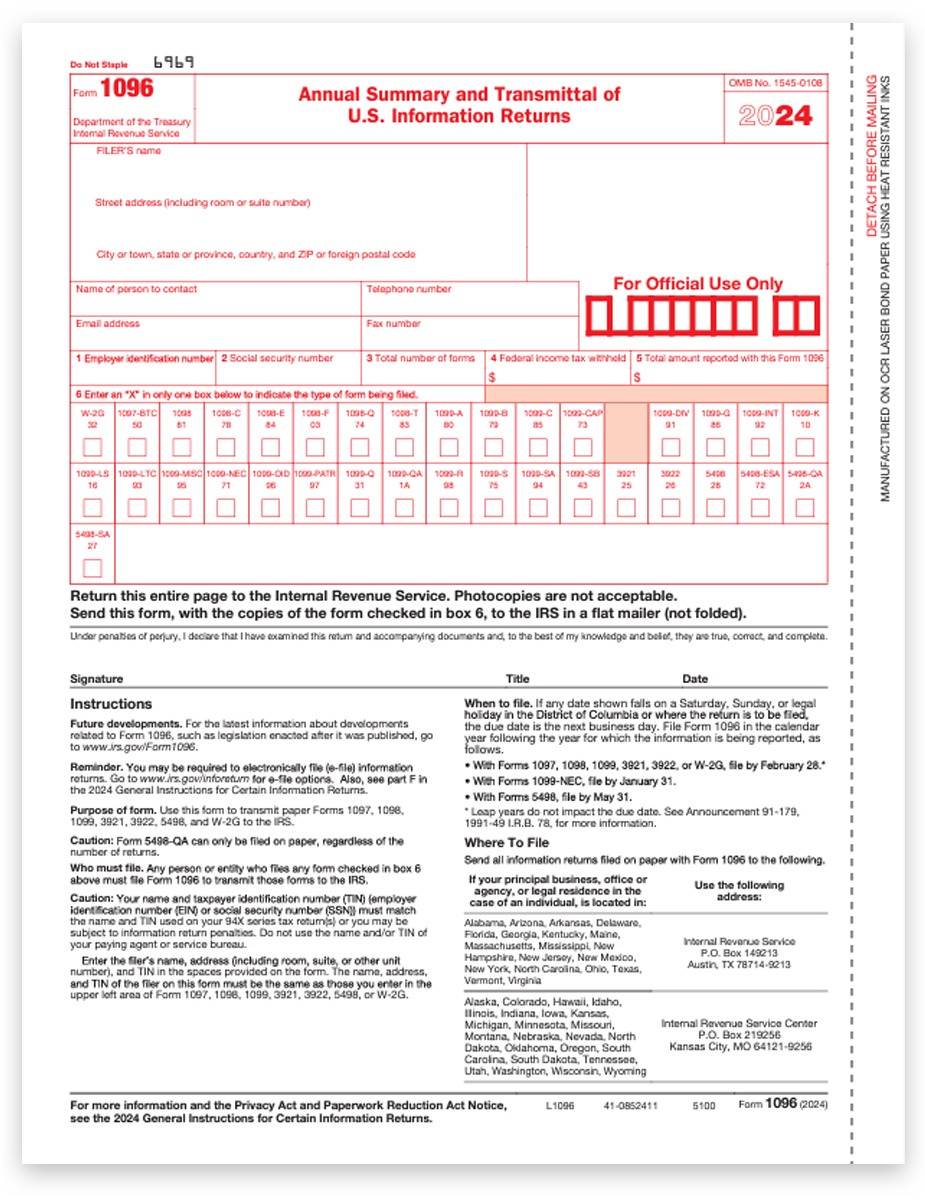

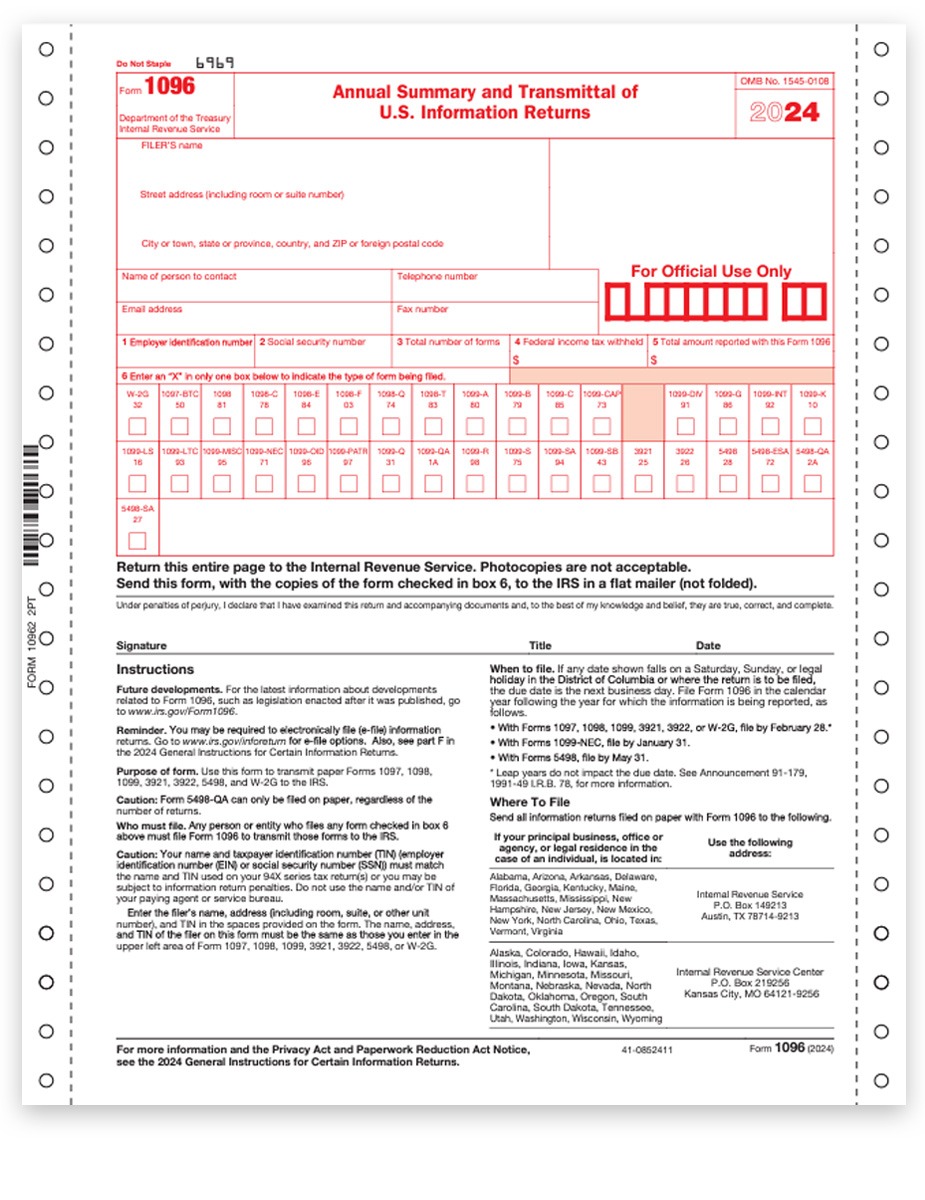

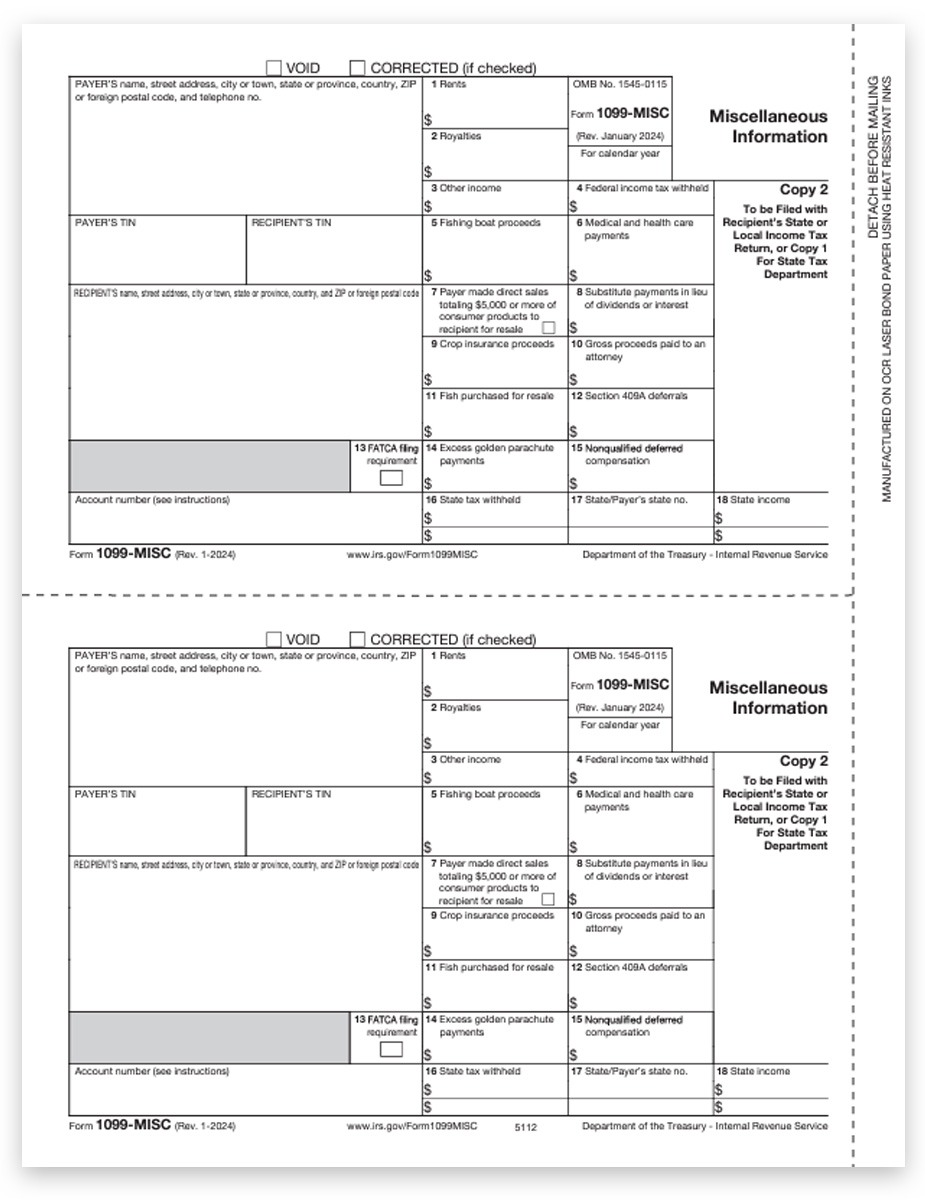

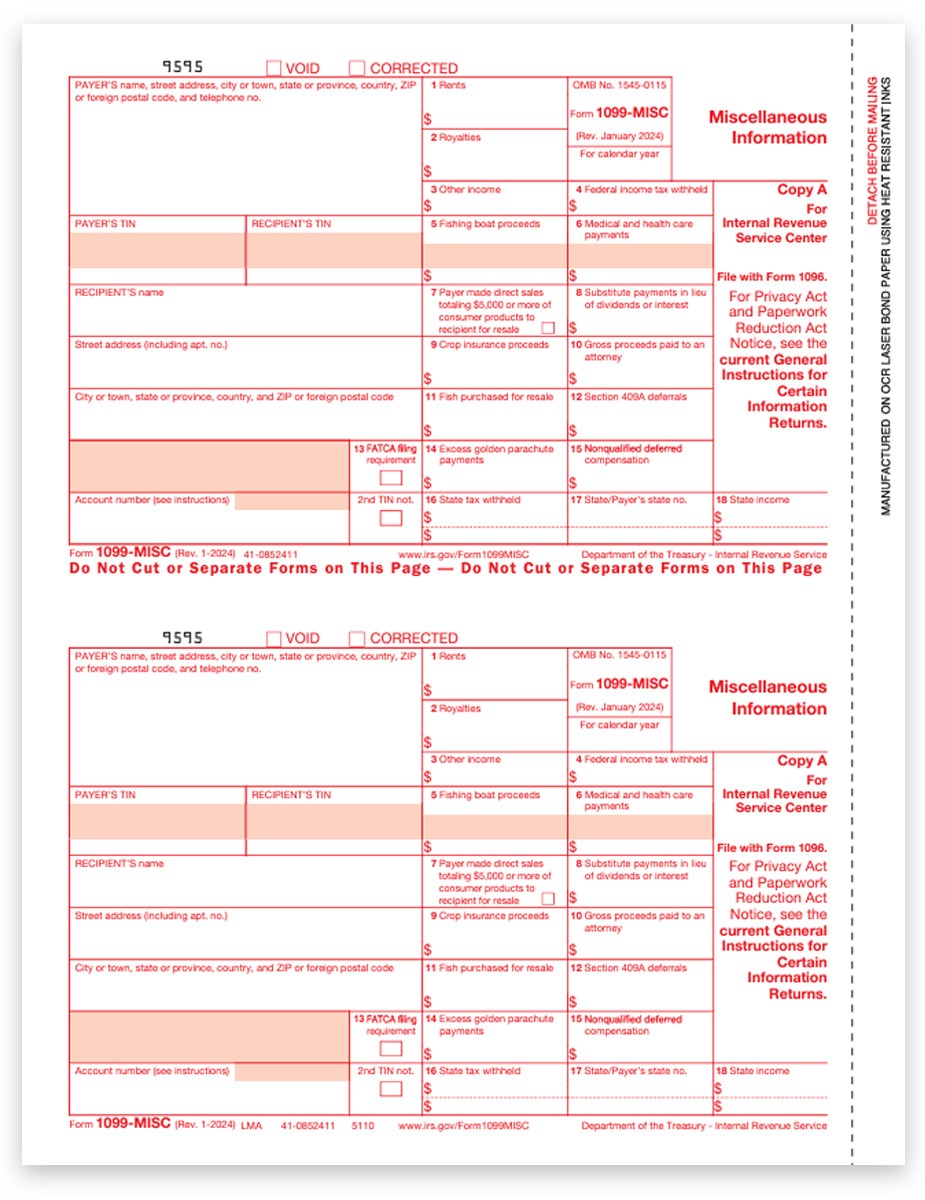

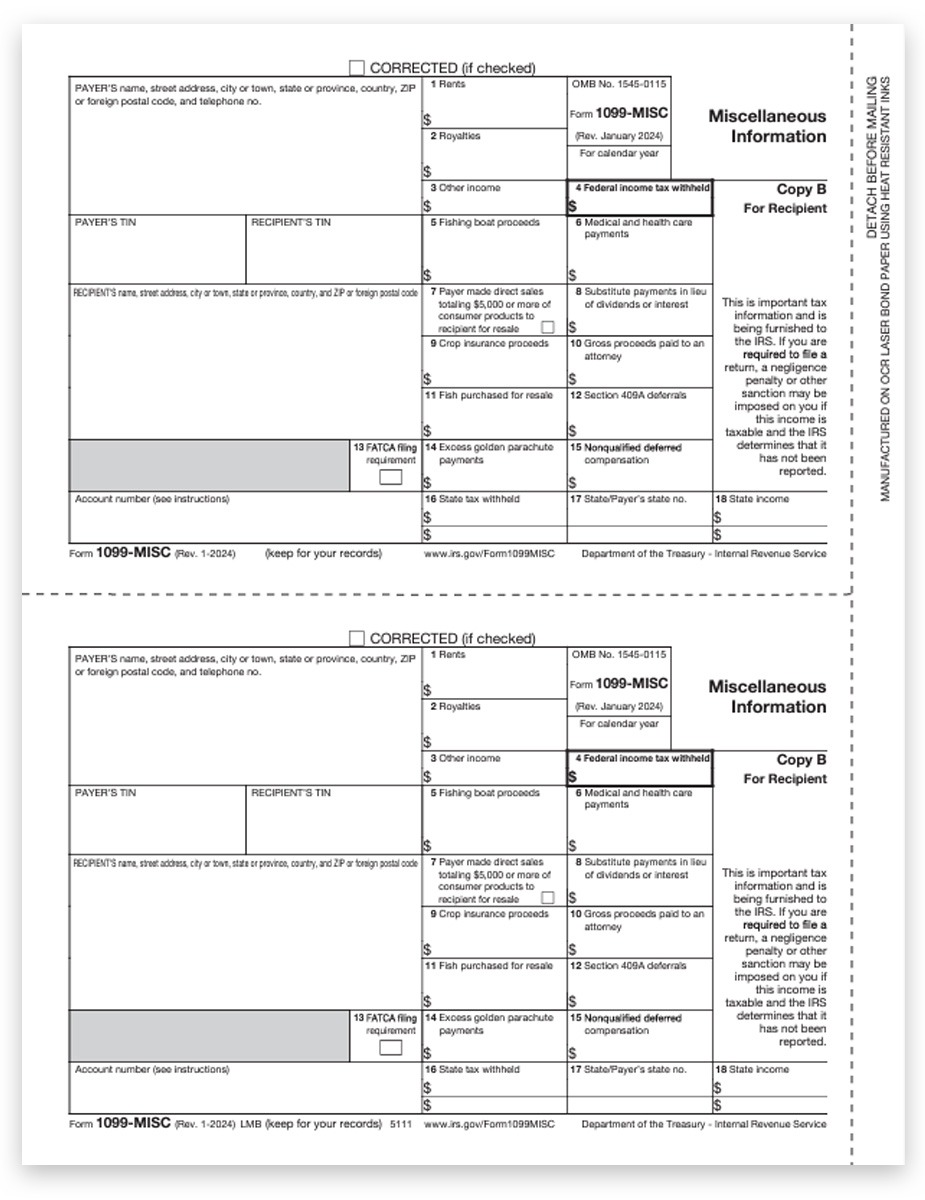

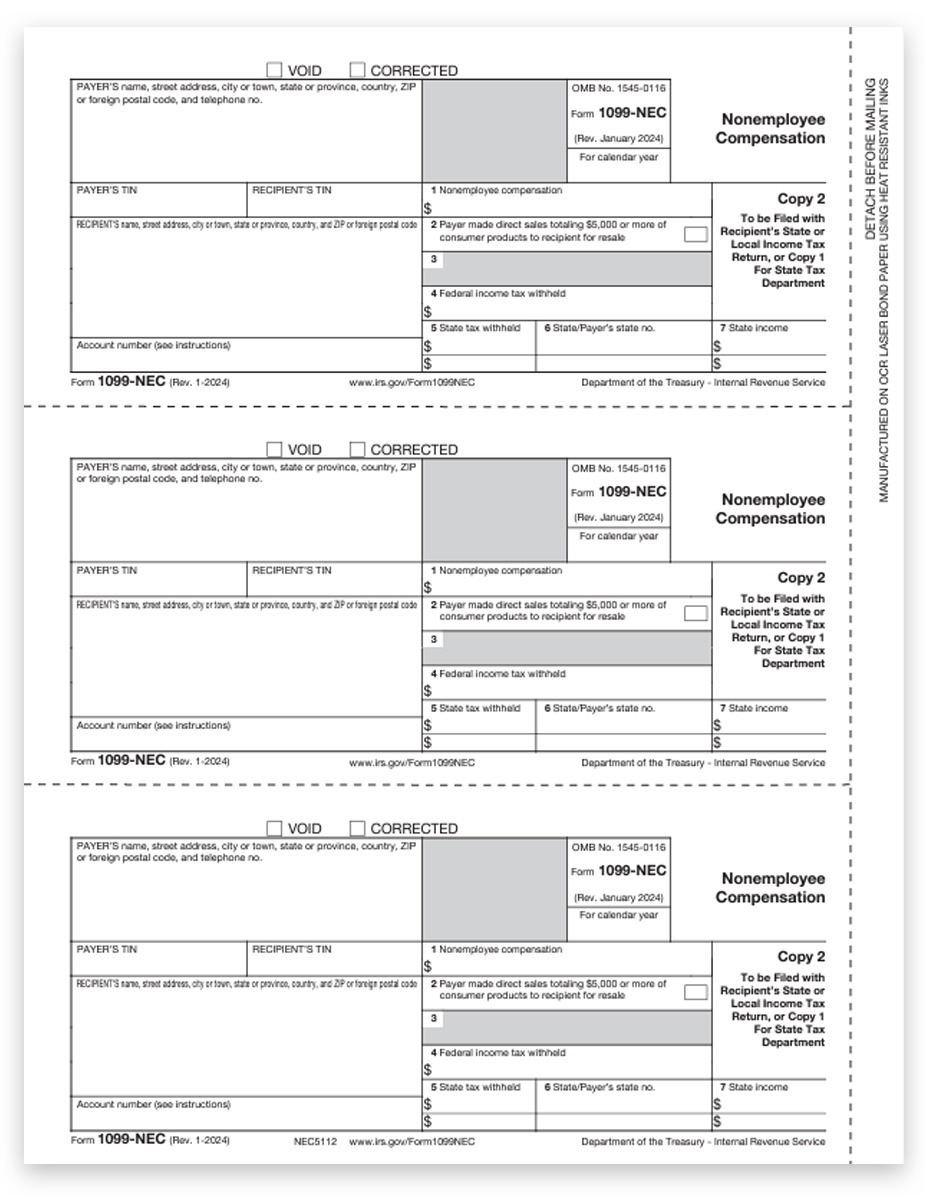

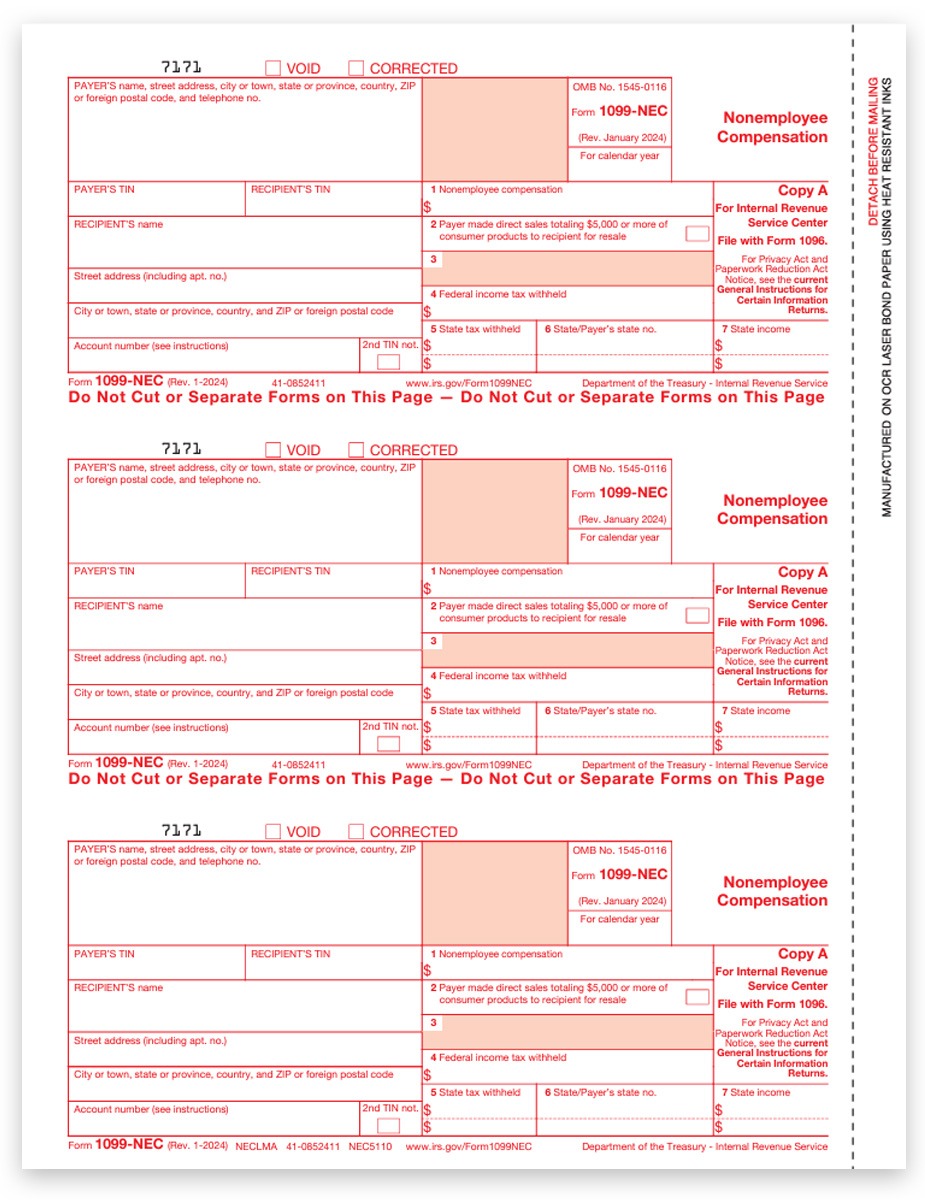

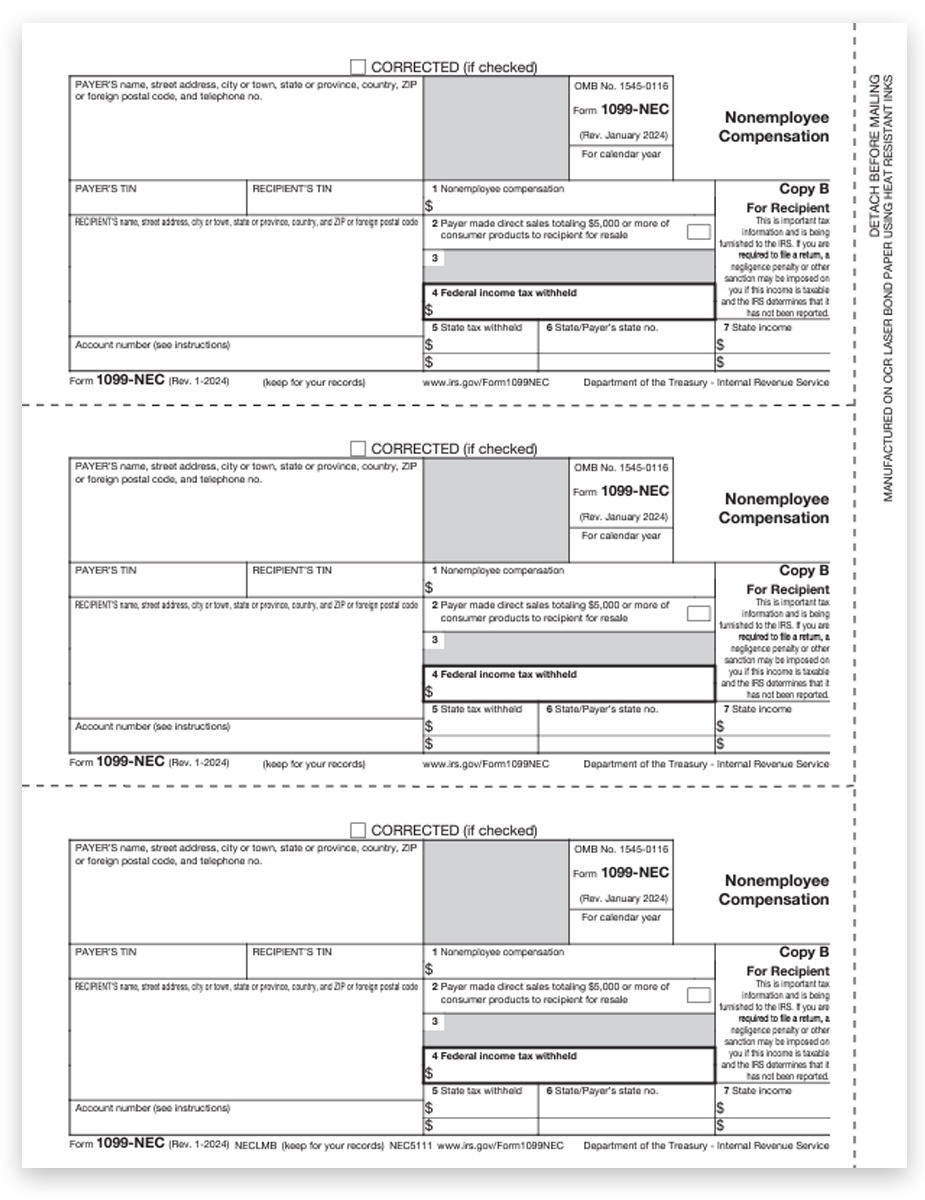

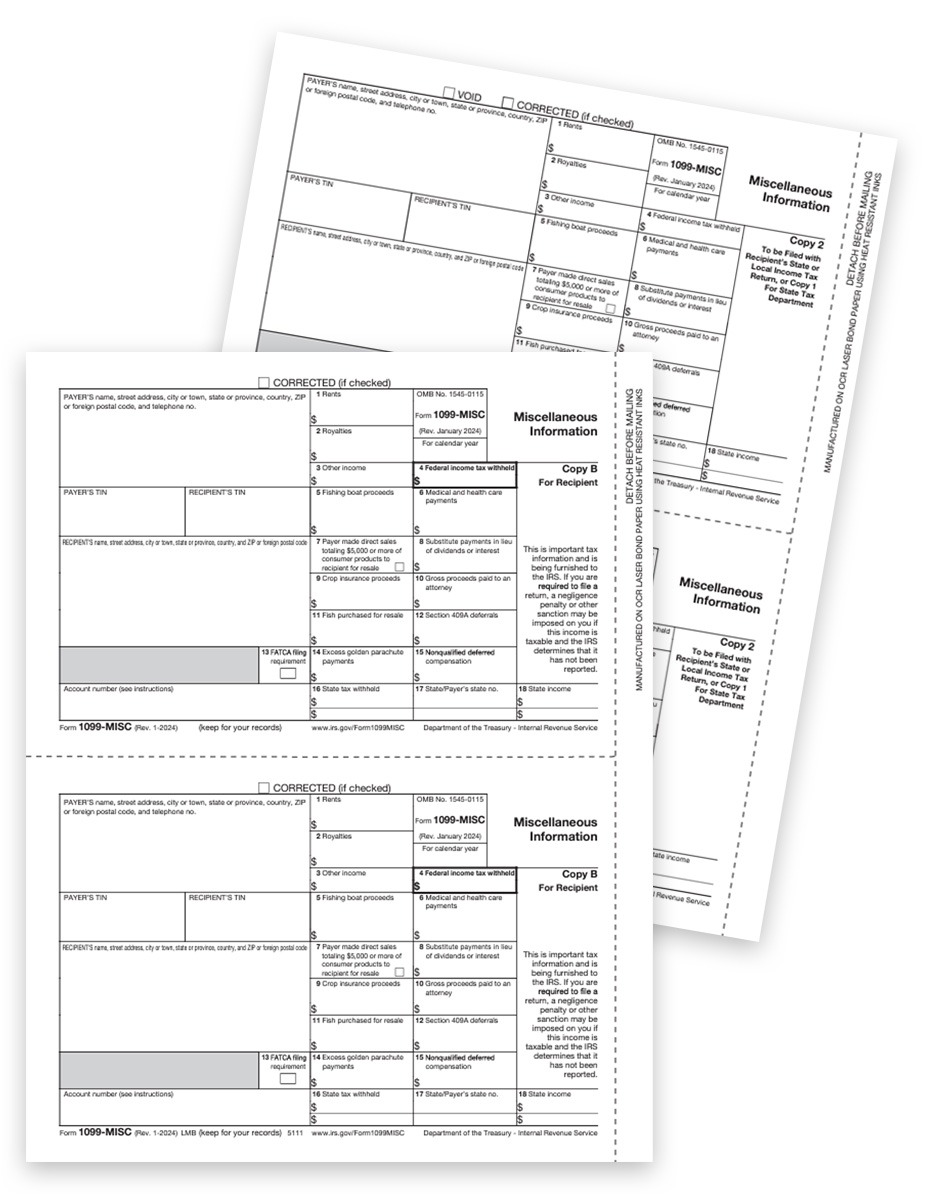

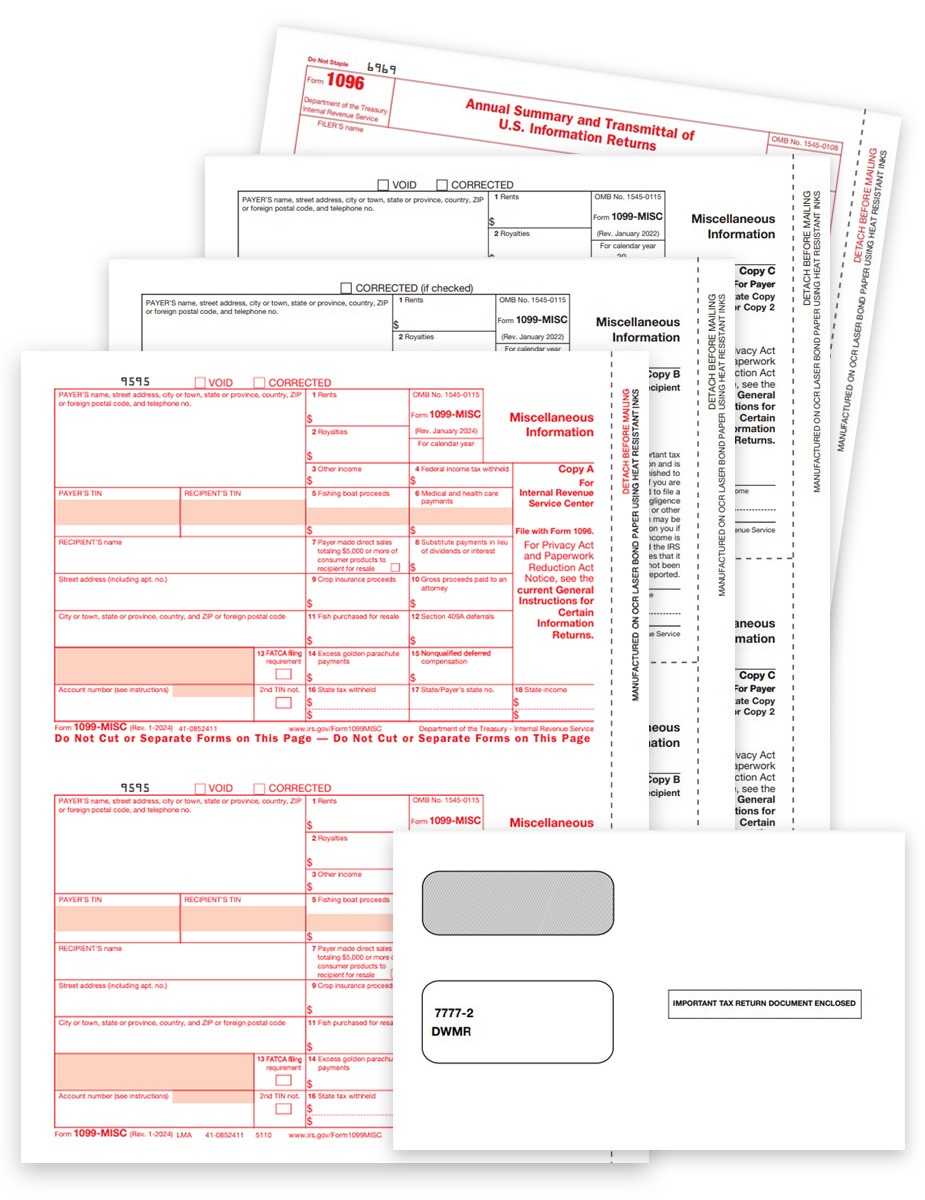

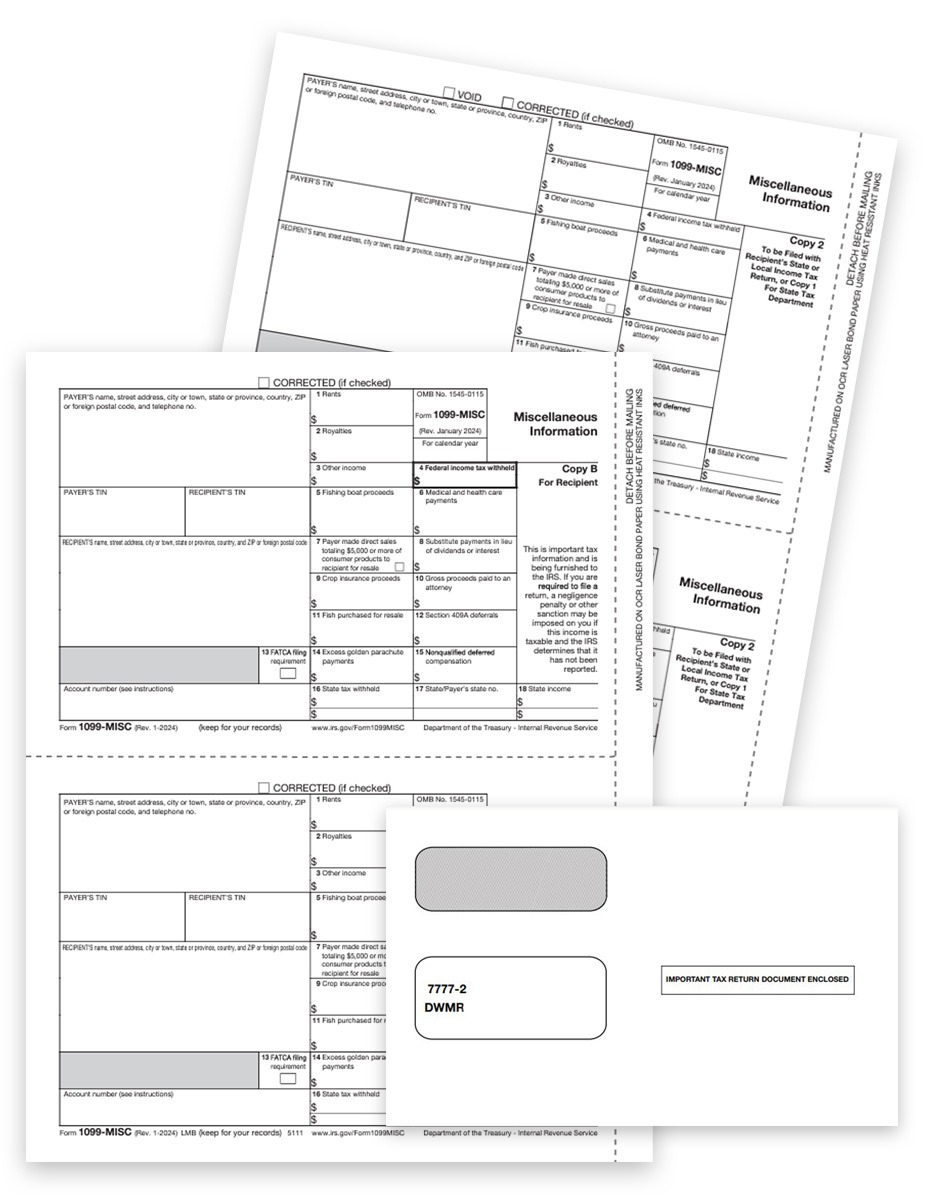

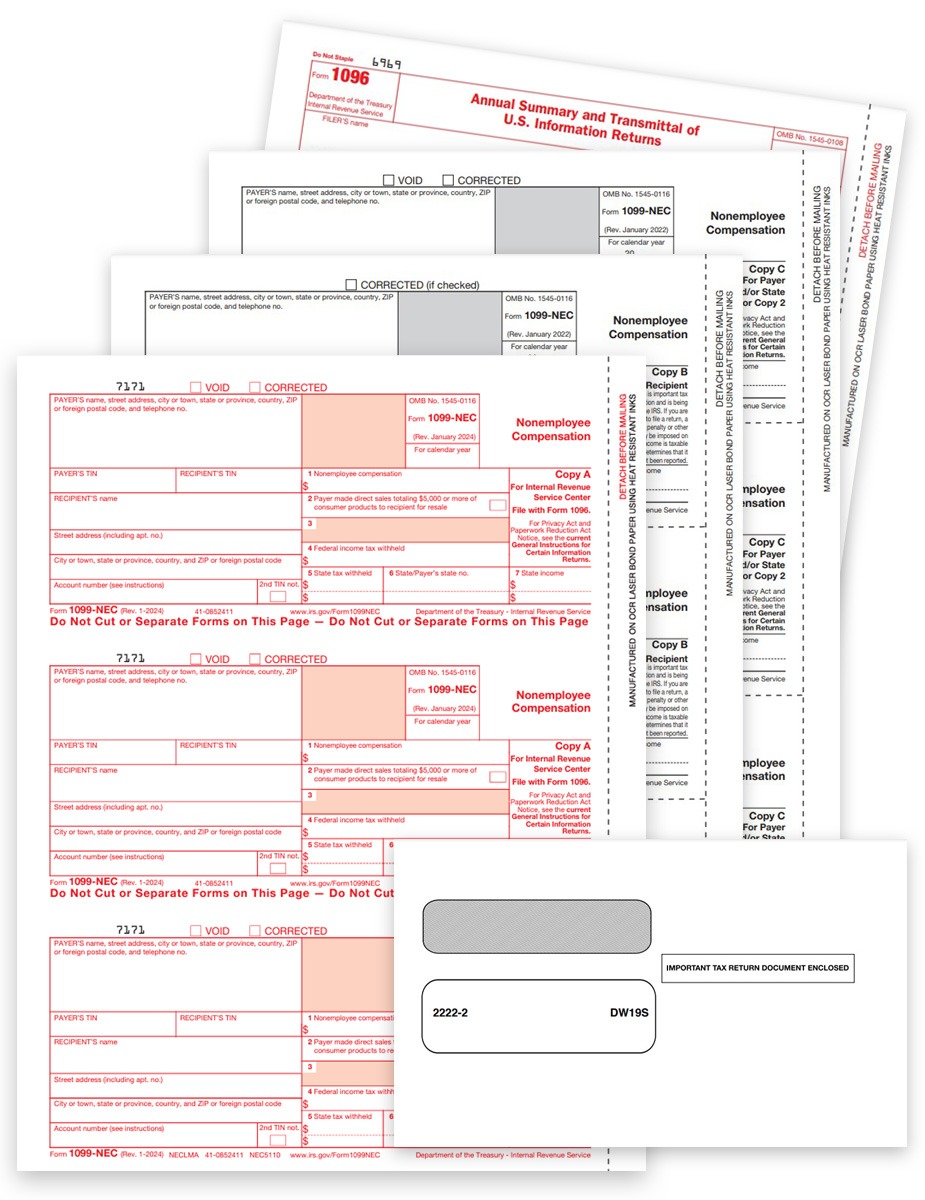

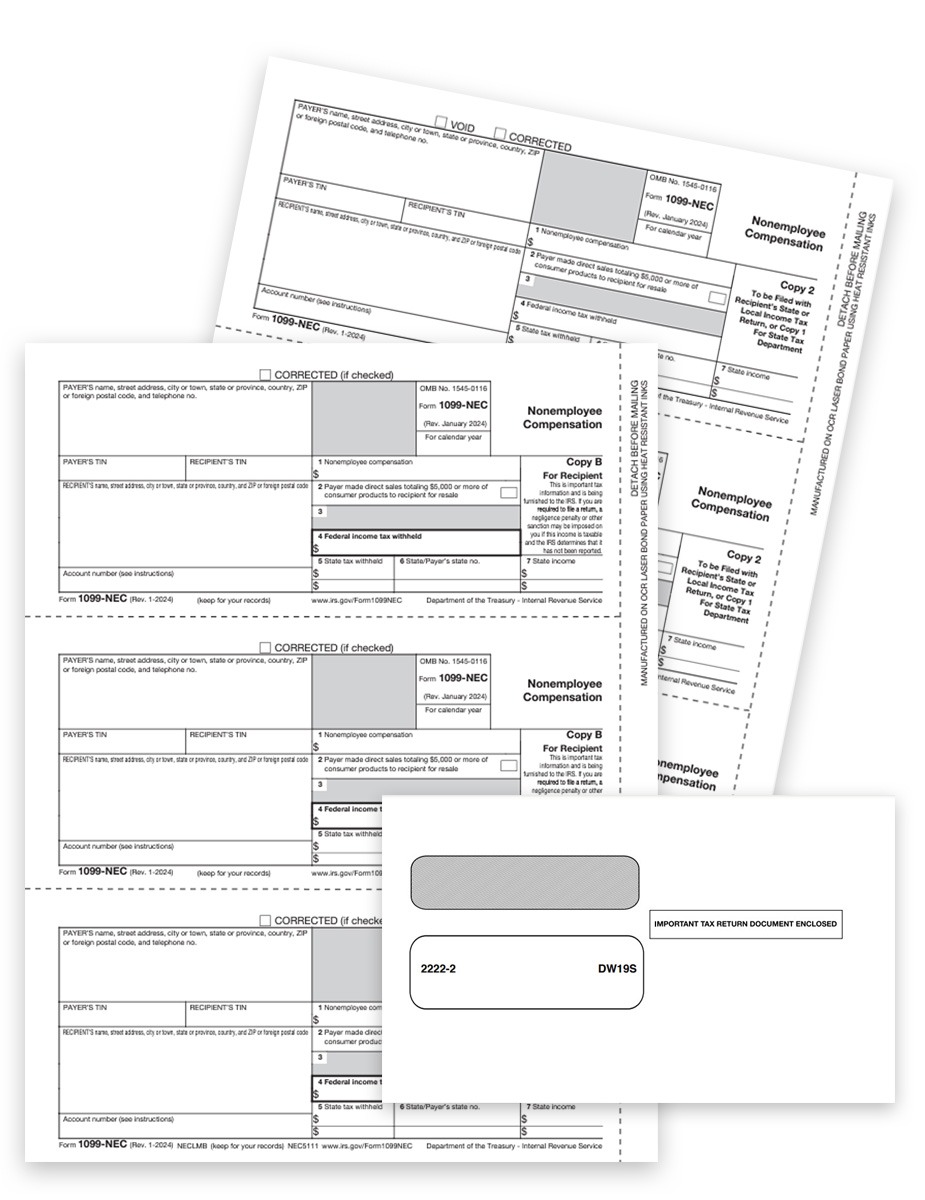

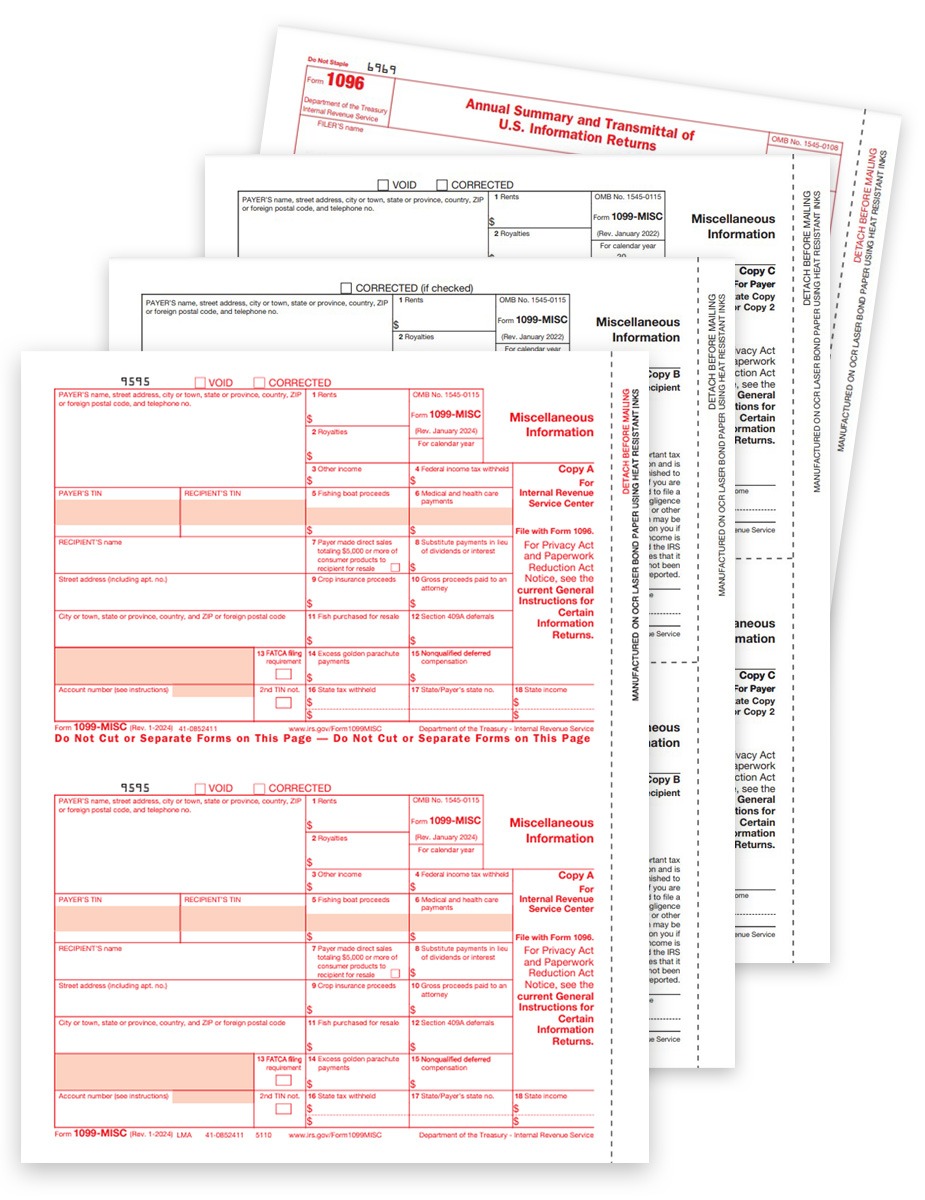

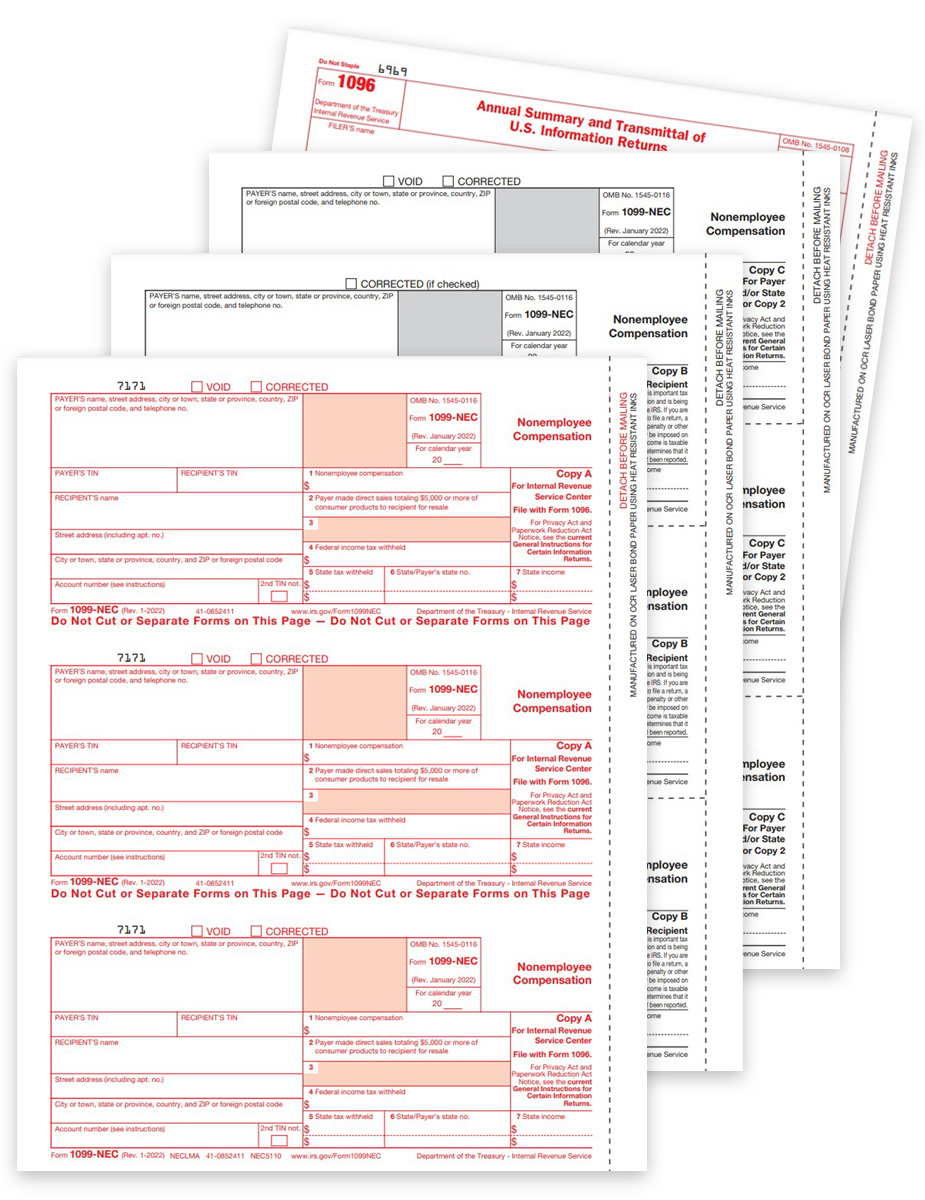

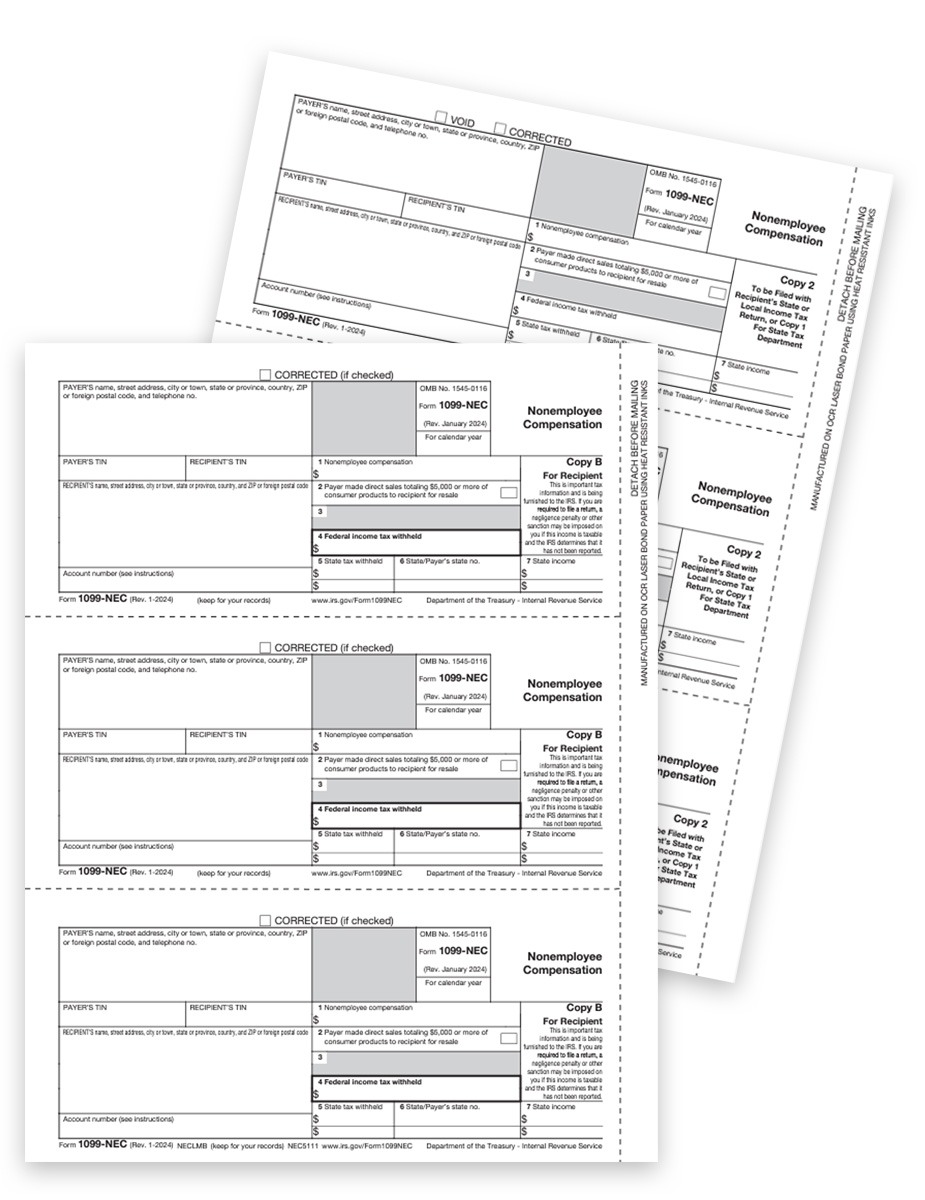

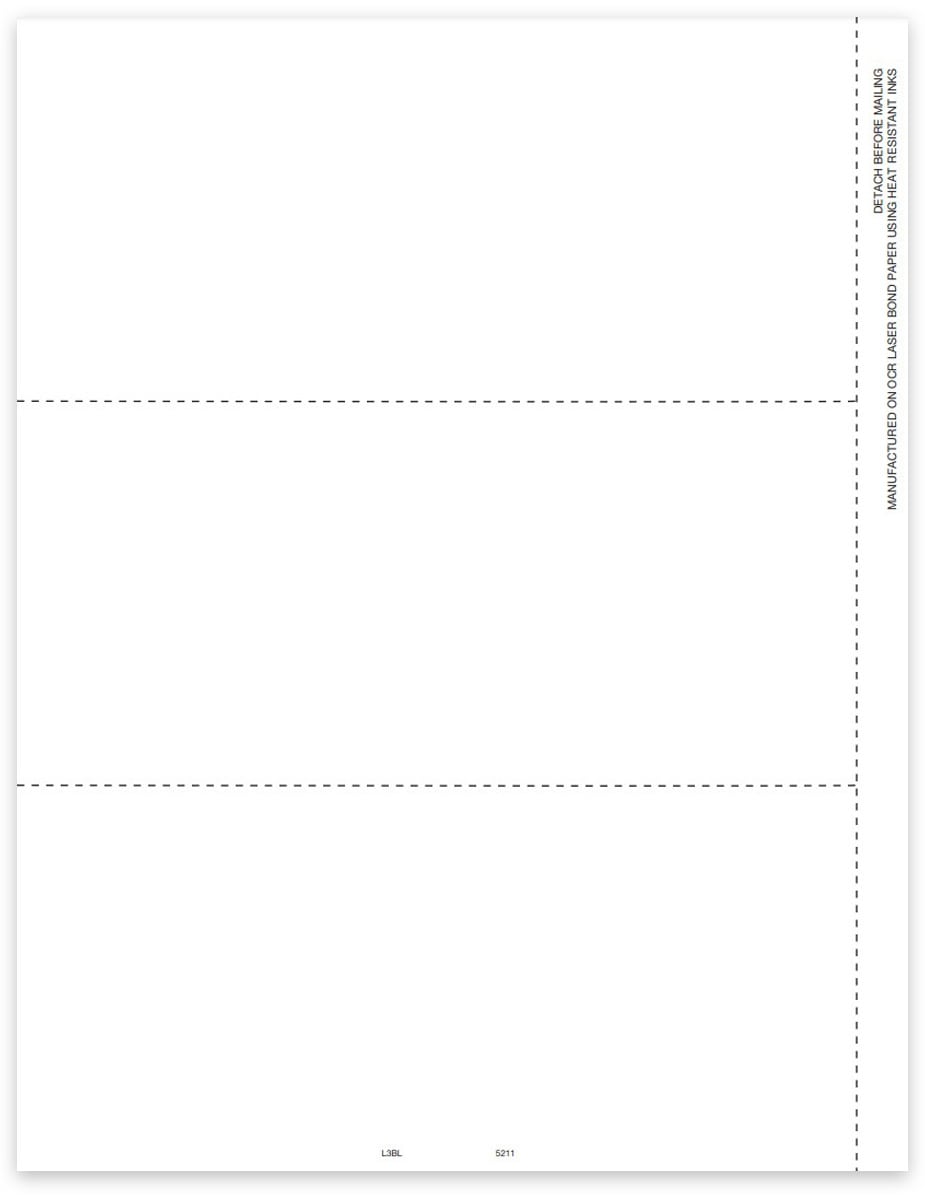

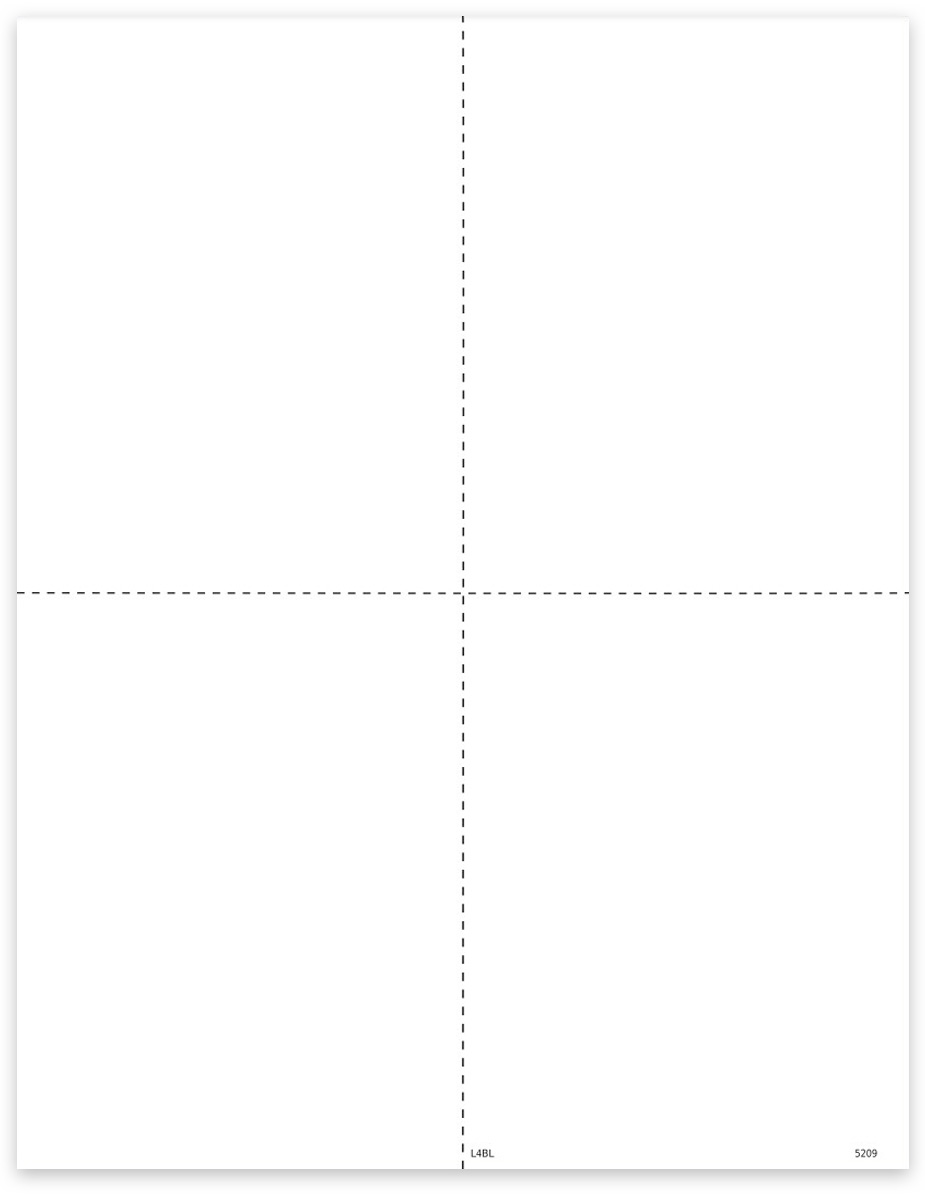

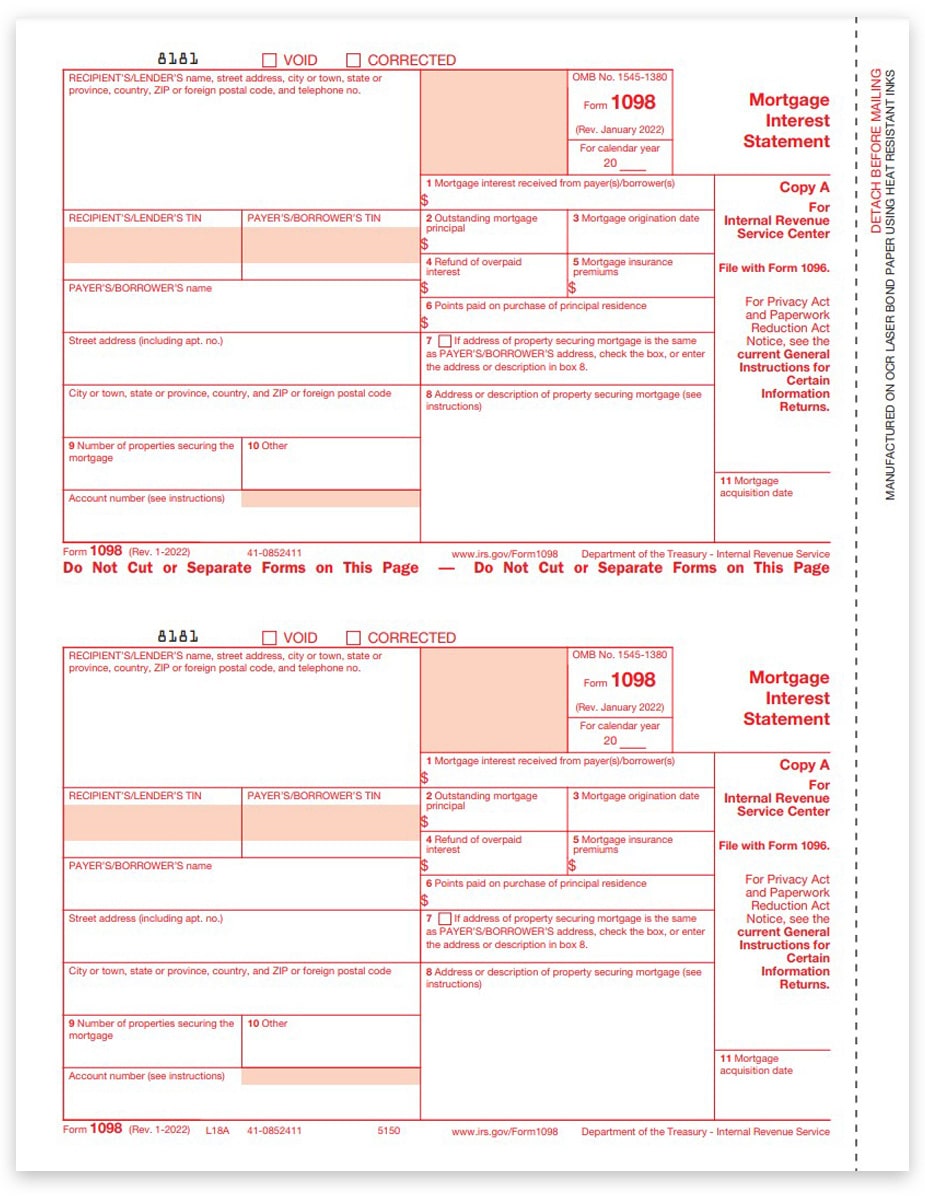

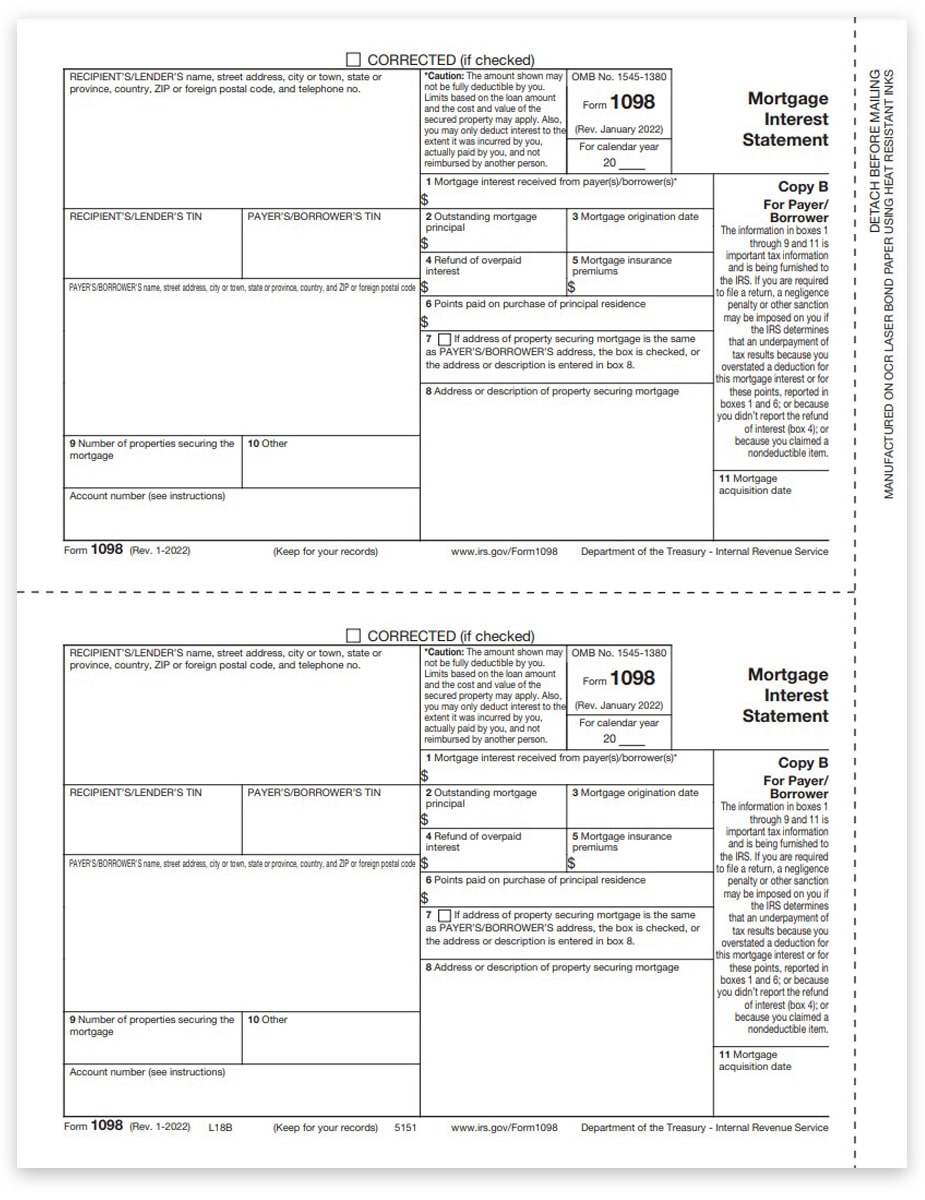

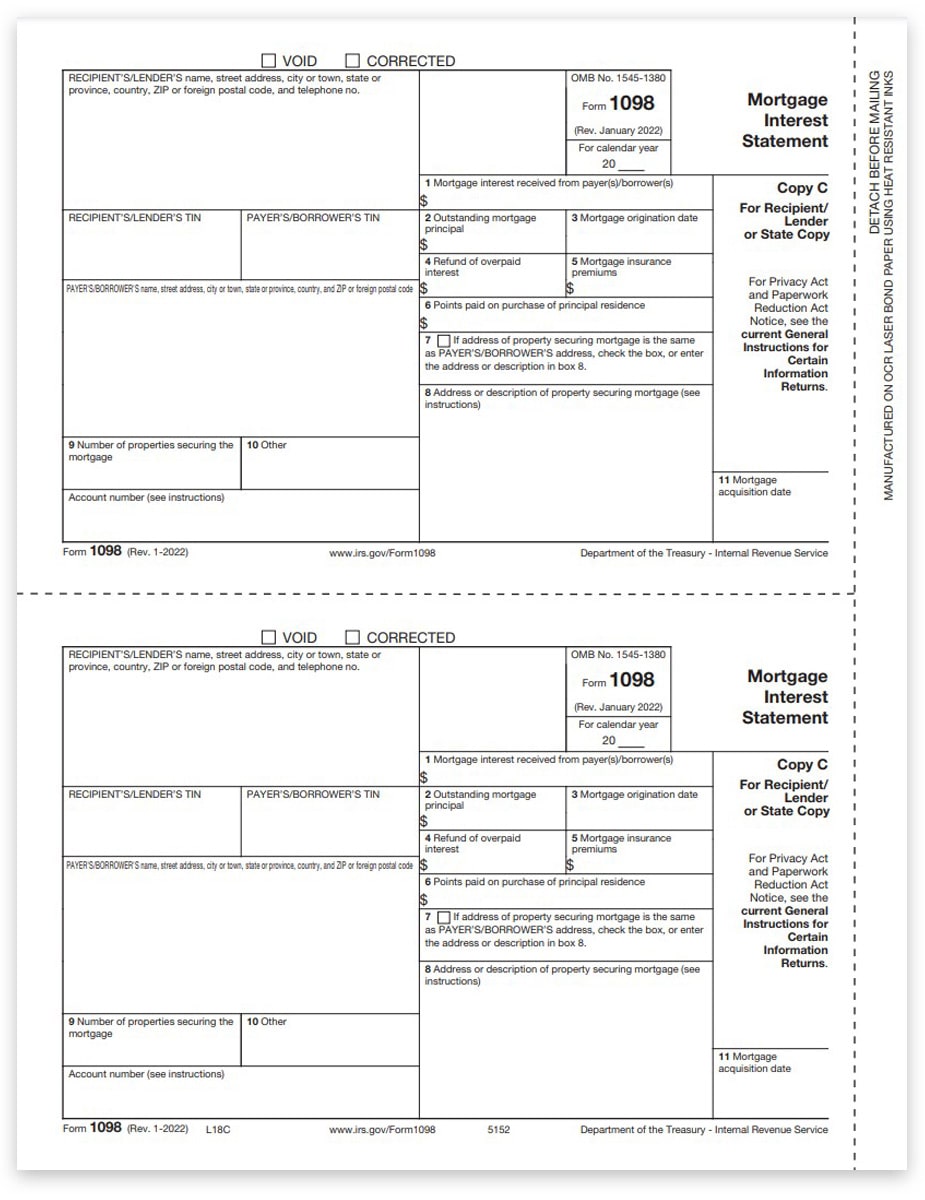

1099MISC & 1099NEC Forms Compatible with ATX Software

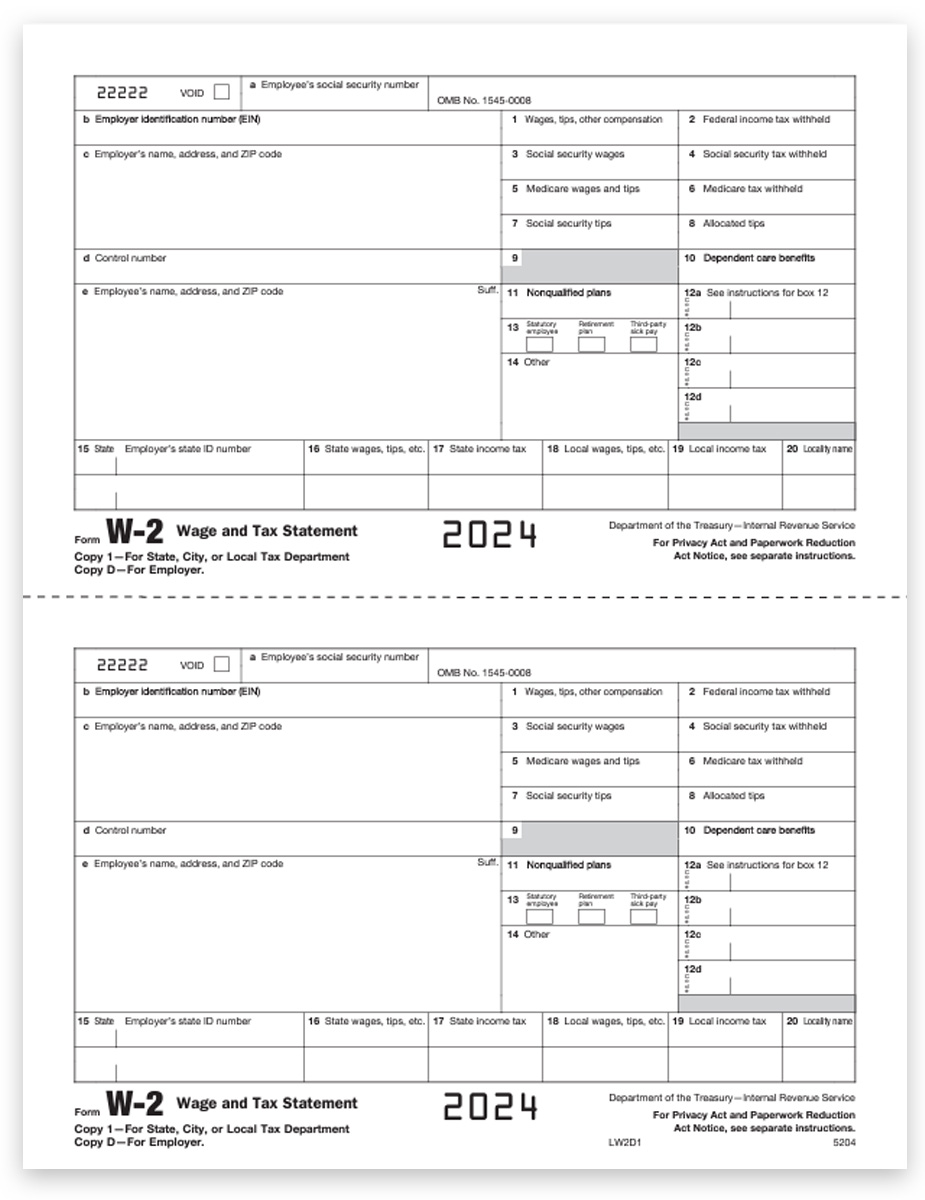

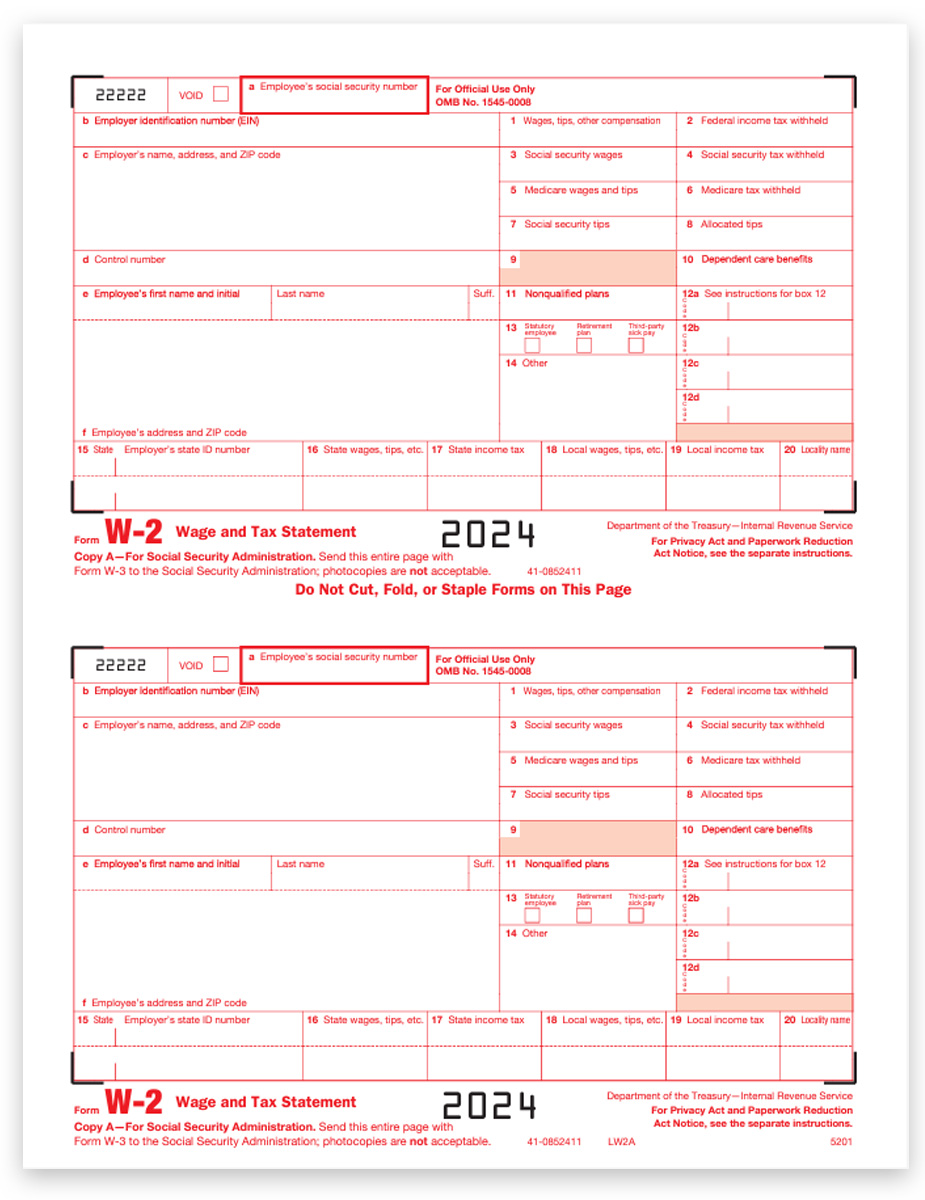

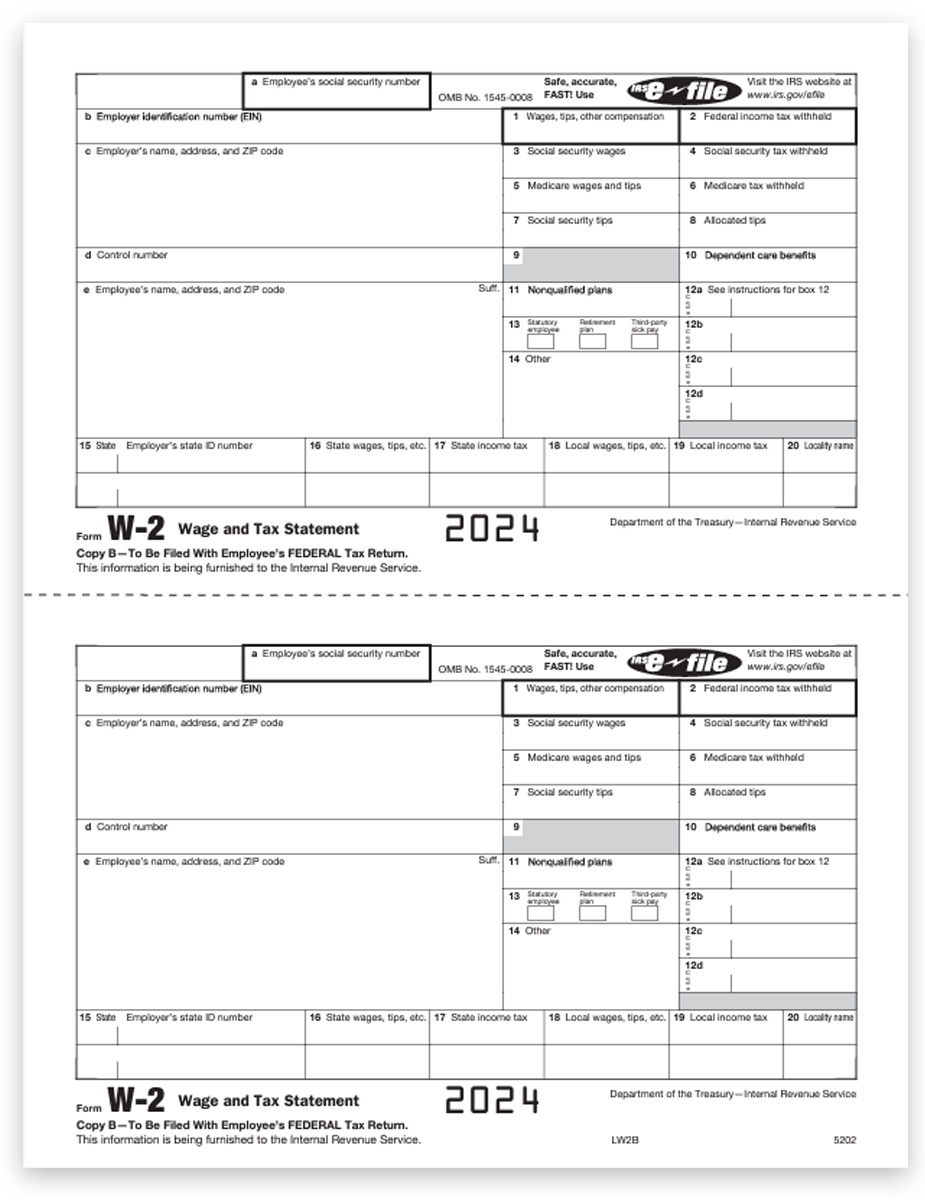

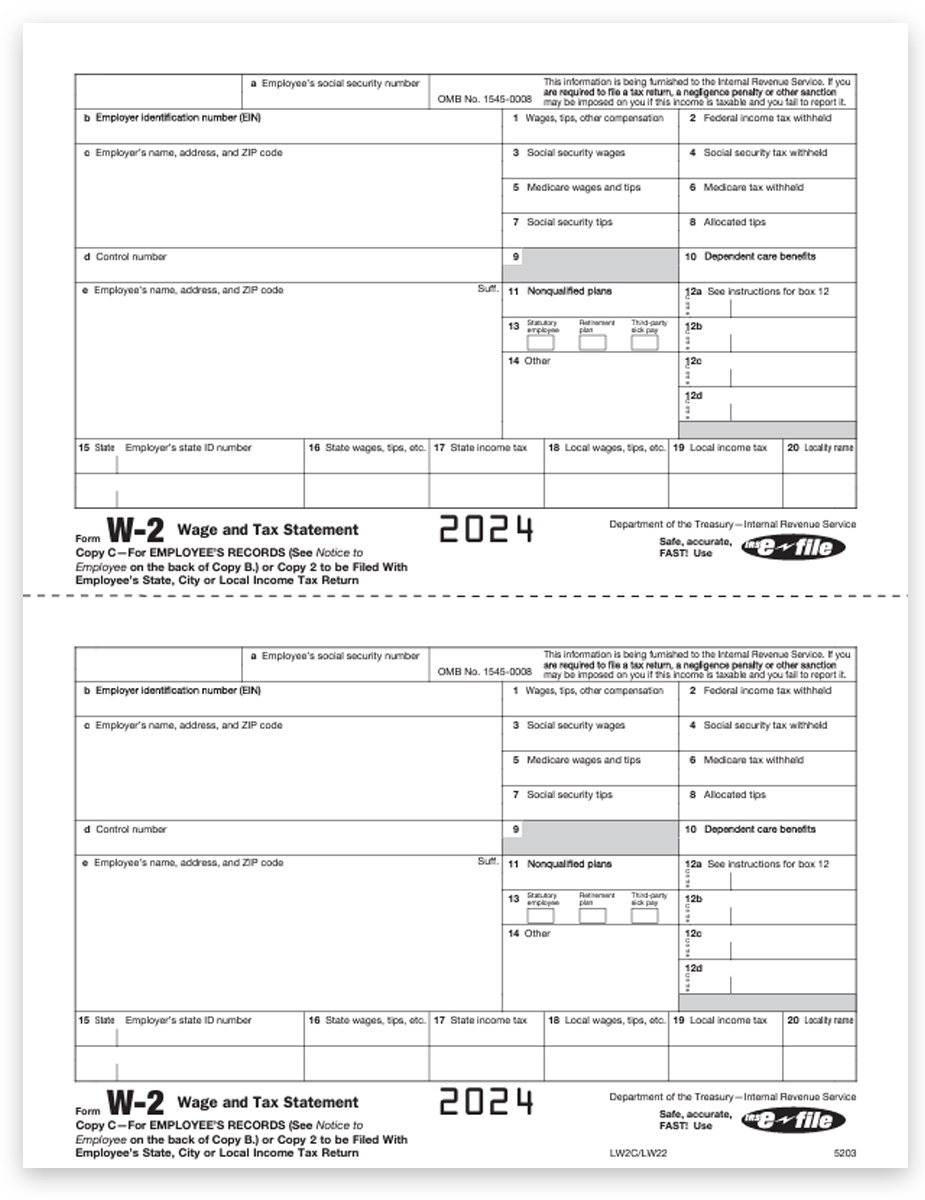

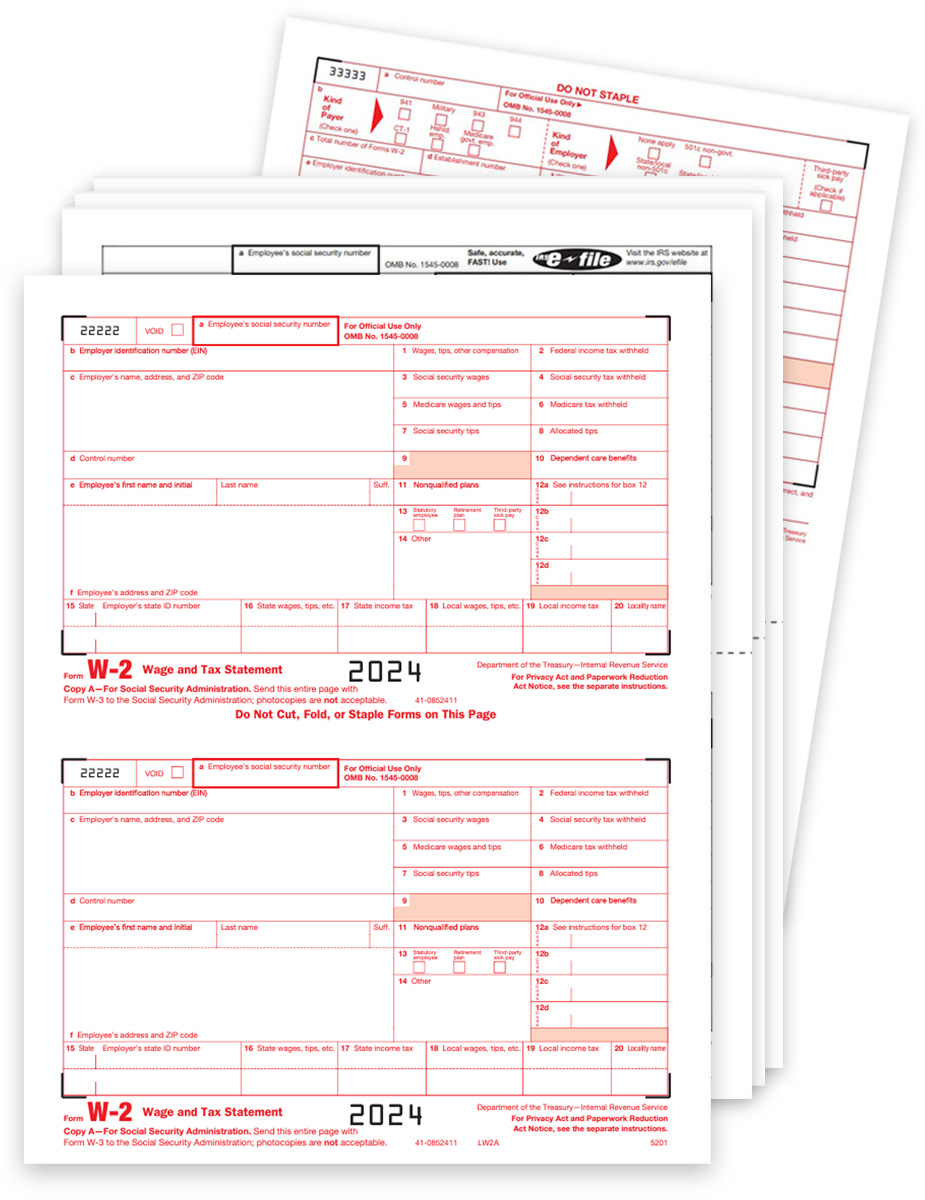

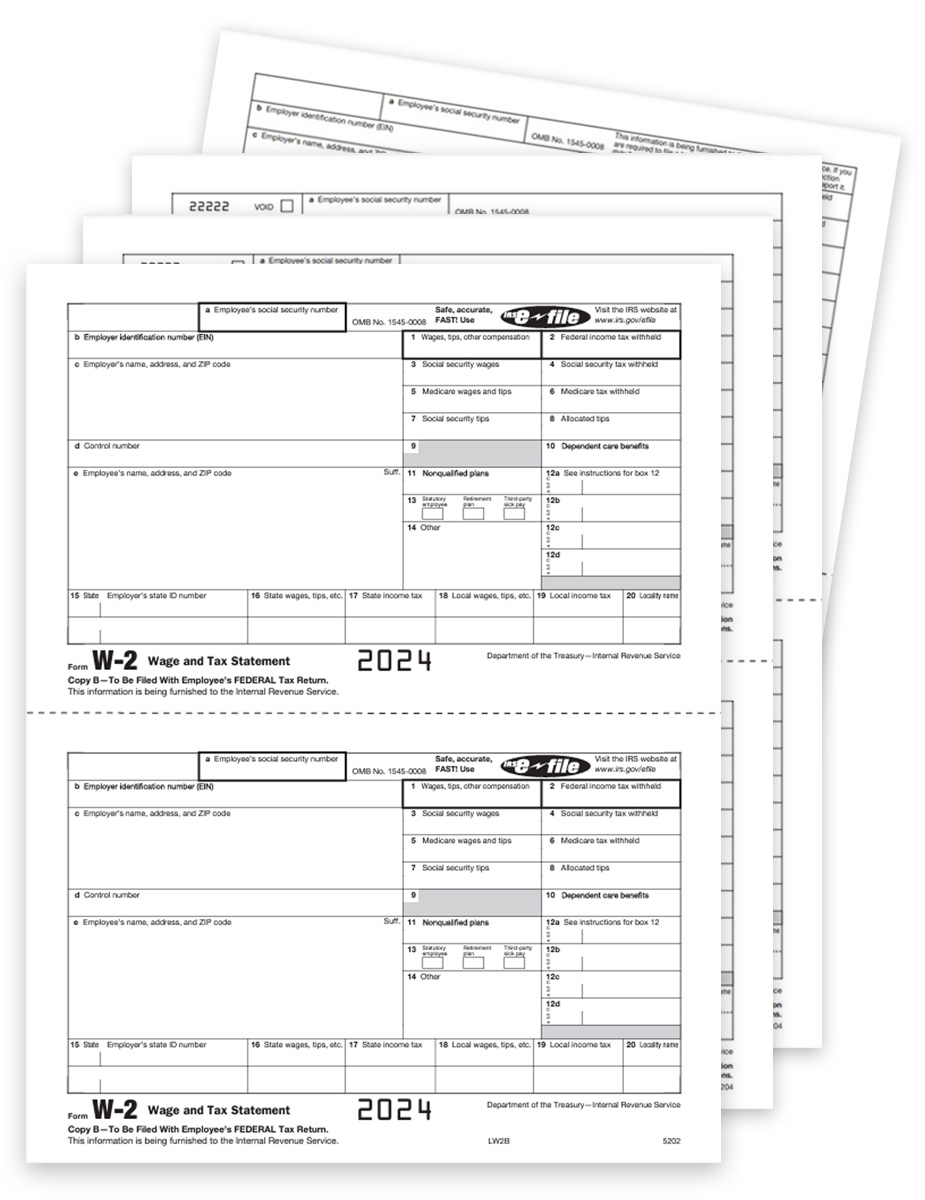

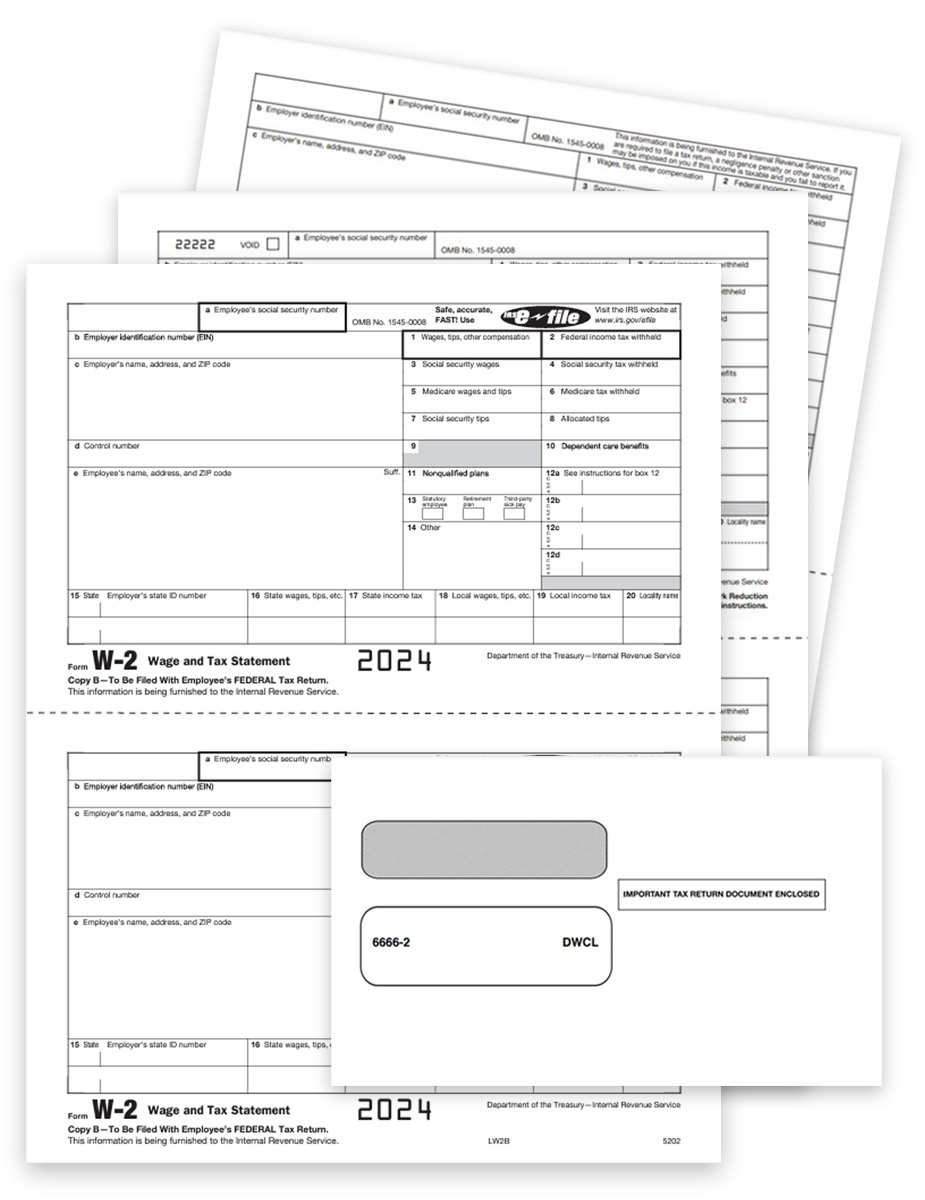

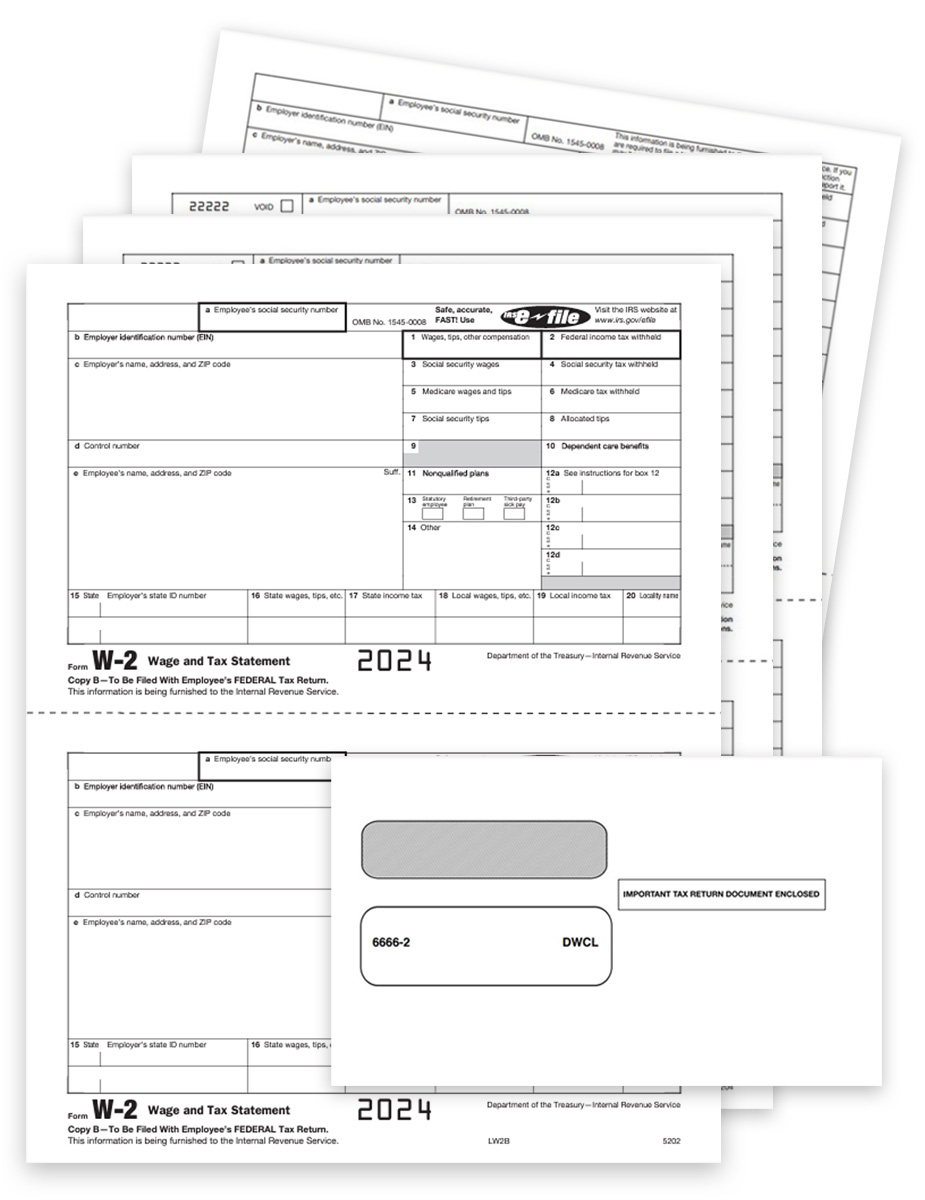

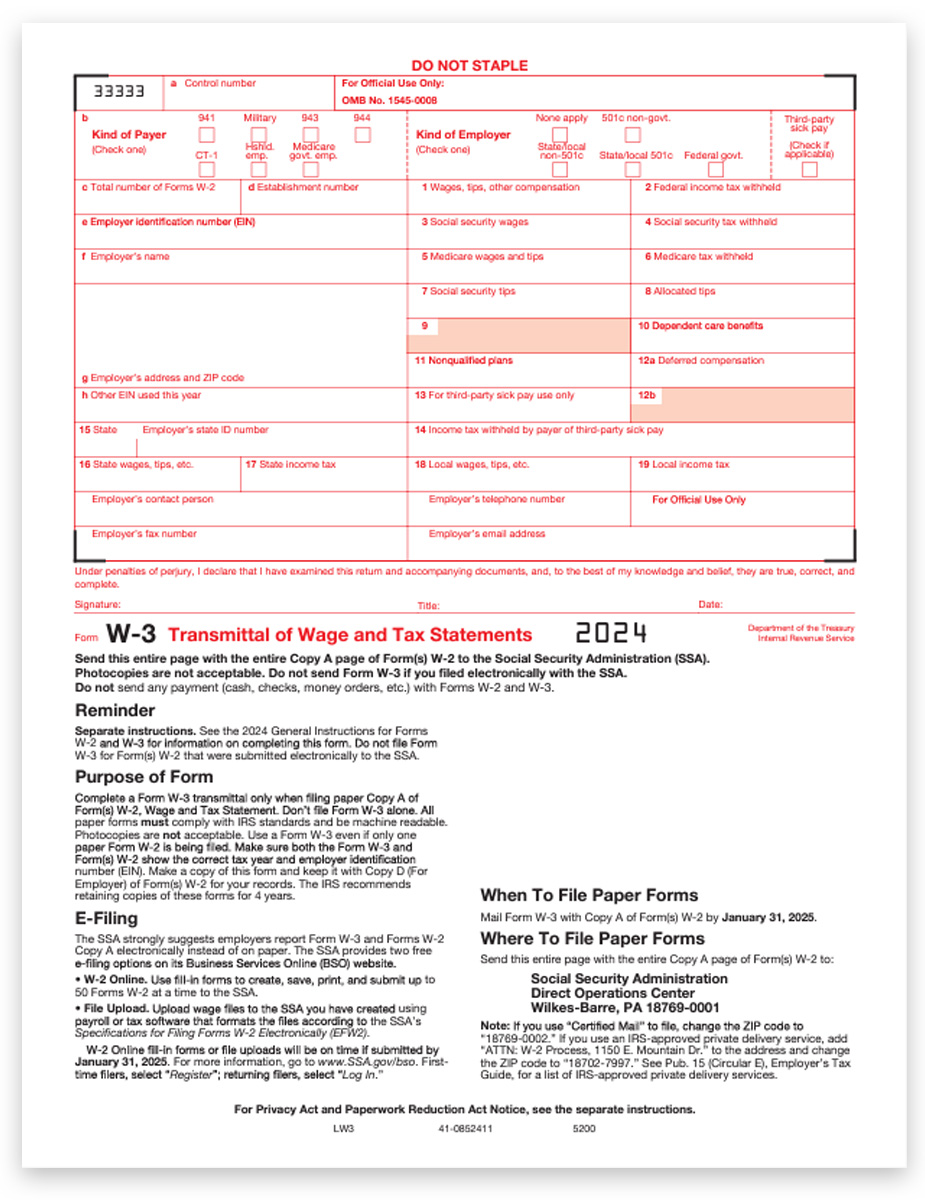

W2 Forms Compatible with ATX

Rely on The Tax Form Gals for personal, friendly service and fast shipping.

As a women-owned and operated business in Michigan, the friendly Tax Form Gals at Discount Tax Forms work hard for you, and have fun every day – even on Mondays!

With the goal of delivering the best value and best service for essential business supplies that you rely on every day to make your small business run like a well oiled machine.

Give us a call at 877.824.2458 or email hello@taxformsgals.com.

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

Insights from our Blog...

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.